Onboarding a new bookkeeping client is a make or break moment for your relationship.

A good onboarding process, supported by an accounting client onboarding checklist, ensures you get all necessary information, set clear expectations, and lay the foundation for efficient and accurate financial management.

This article is a checklist to help you onboard new bookkeeping clients and deliver amazing service from day one.

What are the benefits of effective client onboarding?

Effective client onboarding is crucial to building a strong and lasting client relationship. A well-structured onboarding process can benefit the accounting firm and the client.

Client onboarding is more than just paperwork; it’s a strategic process that benefits both the client and the service provider. Investing time and resources into a proper onboarding process sets the stage for trust, efficiency, and a growing partnership.

Regarding bookkeeping and accounting, where accuracy and trust are key, proper onboarding gives you all the information you need to manage your client’s finances. It increases client satisfaction, reduces risk, and makes you look like a pro.

What are the essential items to include in the onboarding checklist?

Here are the essential items to include when onboarding new clients:

Signed contract and welcome packet for the new client

Basic client information and documentation

Access to previous or existing accounting systems

Financial statements, invoices, and tax returns

Regular communication and feedback

How do you implement the client onboarding process?

The best way to implement the client onboarding process is to review this list and check them off as completed.

1. Engage the client and formalize the relationship

Formalize the relationship with new clients by sending a welcome message and gathering essential information through a client onboarding questionnaire.

Use a client onboarding checklist to ensure a smooth transition and establish a clear understanding of the client’s business operations and financial health.

2. Gather information and documentation

Access the client’s previous or existing accounting systems, including accounting software, manual bookkeeping systems, and bank accounts. Collect necessary documentation, such as financial statements, invoices, and tax returns.

Use this information to assess the client’s current accounting records and ensure a seamless transition.

3. Review documents and add info to your systems

Review documents and add accounting clients' information to your systems, including practice management and accounting software. Ensure accurate and efficient data entry and bookkeeping tasks, set up the client’s account, and establish a regular line of communication with the client.

How do you automate the onboarding process?

Leverage accounting software to automate and streamline the onboarding process for bookkeeping firms. Use tools like client onboarding templates and workflow automation to reduce repetitive tasks and improve efficiency. Select the right software for your firm to ensure a seamless onboarding process.

Bookkeeping client onboarding checklist

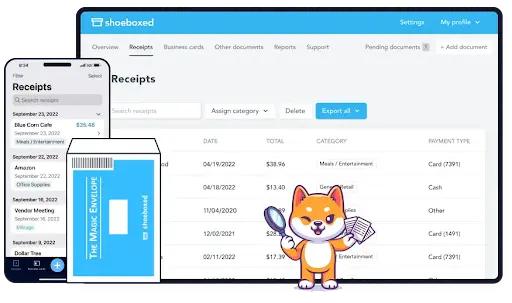

Adding Shoeboxed to your new accounting client onboarding process will boost efficiency, accuracy, and client satisfaction.

Shoeboxed is a powerful tool for digitizing and organizing receipts, invoices, and other financial documents so they are easily accessible and manageable.

Tying Shoeboxed into your checklist will streamline document collection and reduce manual data entry.

How to add Shoeboxed to your bookkeeping client checklist

Here is a checklist with steps to add Shoeboxed to your onboarding process:

1. Initial consultation

At the initial consultation, discuss document management. Introduce Shoeboxed as a way to organize and digitize financial documents, expenses, and receipts.

Explain how Shoeboxed will simplify receipt management by understanding the client's business and keeping all documents safe for the client.

Be sure to mention any additional fees or subscriptions for Shoeboxed if applicable.

2. Business information

Explain how to set up a Shoeboxed account. Get the necessary information to set up a Shoeboxed account for the client or get access if they already have one. Make sure you have the correct contact details for account verification and communication.

3. Financial documents

Digitize existing documents. Use Shoeboxed to scan and upload the client’s existing financial documents, receipts, invoices, and bills.

You can do this by scanning the document with your smartphone and uploading it into the designated account or sending the documents in Shoeboxed's prepaid Magic Envelope to their processing center, where they will scan, human-verify, and upload them for you.

These documents will be automatically organized and categorized in predefined or tax categories for easy access and reference.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today4. Chart of accounts

Ensure the expense categories in Shoeboxed match the client’s chart of accounts.

This will make expense categorization and reporting easier.

5. Client business processes

Discuss how the client can use Shoeboxed in their daily operations and workflows.

6. Compliance and regulations

Discuss the compliance benefits of how Shoeboxed keeps documents in an IRS-accepted format and how easy it is to access records for audits or tax prep.

7. Communication

Document submission guidelines of how and when to submit documents via Shoeboxed and who to contact if you have questions or issues with document submission.

8. Confidentiality and security

Tell the client about Shoeboxed’s security features, including bank-level encryption and cloud storage. Include data protection clauses in your agreement and reference Shoeboxed’s compliance with privacy regulations.

9. Expectations and deliverables

Agree on the frequency of financial reports using data from Shoeboxed. Set deadlines for the client to submit expenses and receipts through Shoeboxed.

10. Training and support

Provide training sessions to the client and their staff on how to use Shoeboxed. Provide user guides, tutorials, or access to Shoeboxed support for ongoing help.

11. Document everything

Use Shoeboxed to store all financial documents and communications. Backup data regularly and keep records up to date.

Why integrate with Shoeboxed

Integrating with Shoeboxed benefits both the firm and its clients.

For your firm:

Time savings: Less time spent on manual data entry and physical document organization.

Accuracy: Fewer errors with automatic data extraction and categorization.

Workflows: Easier to collect and process client documents.

For your clients:

Convenience: Submit receipts and documents via mobile app or mail.

Real-time: Access to digitized documents and expense tracking.

Security: Know their financial documents are stored and backed up securely.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the best practices for a smooth onboarding process?

When onboarding new clients, use an onboarding checklist to ensure a smooth transition. Automate and streamline the onboarding process using practice management software and accounting software and establish a clear understanding of the client’s business operations and financial health.

In conclusion

A well-planned client onboarding process is crucial for setting the tone for the client relationship. Use a client onboarding checklist and automate the onboarding process to ensure a seamless transition. Provide ongoing support and learning to ensure clients get the most out of your services.

Adding Shoeboxed to your new bookkeeping client checklist simplifies onboarding and improves client collaboration and bookkeeping efficiency. By integrating Shoeboxed into your bookkeeping, you win, and your client wins, too, setting you up for a great long-term professional relationship.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!