Are you a small business owner looking to take control of your accounting tasks?

You’re in the right place. This article explores DIY accounting and then goes on to highlight a number of guides tailored specifically for small business owners who are thinking of taking on their own bookkeeping and accounting.

Whether you want to learn about accounting basics, understand the accounting cycle, discover small business accounting tips, transition to digital accounting, or explore accounting practices in specific industries such as real estate, property management, ecommerce, trucking, and more, we’ve got you covered.

But first…

What is DIY accounting?

DIY accounting, which stands for Do-It-Yourself accounting, refers to the practice of individuals being their own small business accountant, without relying on professional accountants or bookkeepers.

It involves taking personal responsibility for tasks such as recording financial transactions, preparing financial statements, managing budgets, staying on top of business transactions and business assets, and filing taxes.

DIY accounting can be done using accounting software, spreadsheets, or other tools that facilitate financial tracking and reporting.

This approach is often adopted by individuals or small businesses to save money on accounting fees and maintain more control over their financial records.

However, it requires a certain level of knowledge and understanding of accounting principles and practices to ensure accuracy and compliance with regulations.

Good news—here at Shoeboxed, we’ve put together a number of guides written by accounting and bookkeeping specialists to help you with DIY accounting!

The following articles and guides cover accounting tools and software options, tax season checklists, and even share some humor with the funniest accounting jokes and memes.

Empower yourself with knowledge and enhance your financial understanding with these practical resources designed to simplify and streamline your accounting processes.

Accounting 101: fundamentals and basics

If you are a new small business owner and you don’t plan on hiring bookkeeping services or other professional services to help you with your accounting, then you’ll want to start here.

1. The Accounting Cycle Explained: 5 Simple Steps

The accounting cycle is a multistep process that helps collect and convert raw financial data into accurate and consistent statements.

Without knowledge of the accounting cycle’s steps and importance, businesses may struggle to collect and organize financial data accurately, resulting in errors, inefficiencies, and non-compliance.

This article explains the importance of the accounting cycle in generating financial statements for businesses.

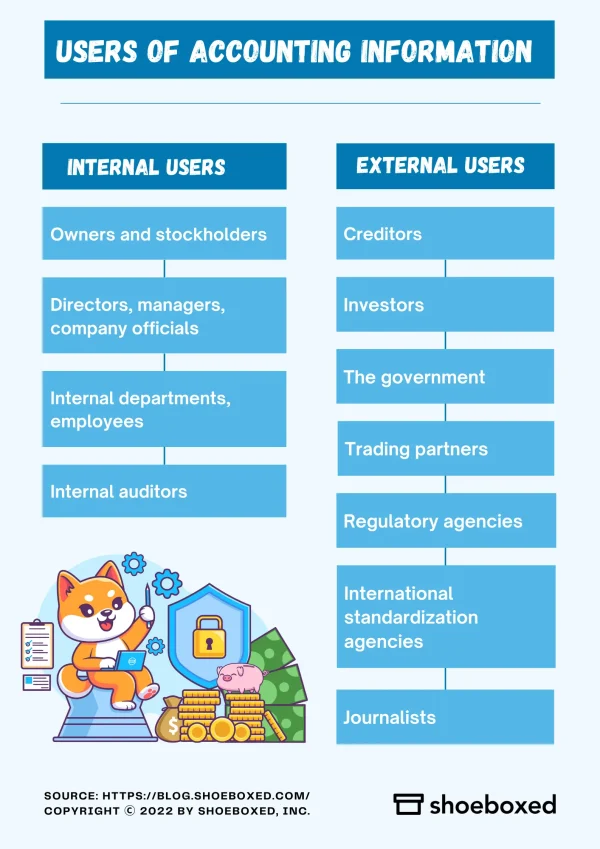

2. Who Uses Accounting Information?

The accounting cycle process produces financial statements that provide valuable information for a wide range of users.

However, not all business owners are aware of who uses these statements. This article explores the users of accounting information, both internal and external.

Users of accounting information graphic

3. 7 Small Business Accounting Tips: Simplicity Is The Key To Success

Caryl Ramsey, a knowledgeable expert with years of experience in bookkeeping, taxes, and setting up businesses, offers valuable insights and practical tips on small business accounting practices that can significantly simplify and streamline your accounting.

She shares tips on topics such as how to effectively separate one’s business bank account and business expenses from personal expenses, create and maintain budgets, automate accounting processes, improve cash flow through timely invoicing and accounts receivable management, track and store receipts, and more.

4. Digital Accounting: What It Is, Benefits & How to Do It

Many business owners have yet to fully benefit from automating tedious aspects of their accounting.

The article emphasizes the importance of digital accounting in the era of digital transformation in finance and outlines a step-by-step guide for transitioning to digital accounting software, including how to prepare for the transition, using OCR scanning services, implementing storage solutions, and discarding paper copies.

5. The Small Business Accounting Checklist [Infographic]

At the end of the year, businesses must “close the books,” which involves reviewing, reconciling, and verifying all financial transactions and elements of the business’s ledgers from the previous fiscal year.

To make this process easier, we suggest using a small business accounting checklist that helps you stay organized throughout the year. It covers tasks like reviewing cash status, recording transactions, keeping track of documents and receipts, preparing and sending invoices, analyzing inventory, reviewing financial statements, and more.

By following this checklist, you can ensure a smooth year-end close and maintain accurate financial records for your business.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started Today6. Accounting Errors: Types, Examples, and How to Fix Them

To prevent accounting errors, it’s important to understand the accounting cycle and be aware of potential mistakes.

This article offers the small business owner the steps to detect and prevent accounting errors, such as checking the trial balance, comparing data from books, reviewing the balance of accounts, conducting year-to-year comparisons, and checking the overall balance of books.

7. 17+ Ways Accounting Helps in Business Decision Making

This article by accounting specialist Agata Kaczmarek discusses how accounting helps in decision-making in various ways.

It includes following best practices, providing statistical knowledge of the company’s financial health, analyzing resource utilization, aiding lending and capital investing decisions, informing shareholders, facilitating auditing and budgeting processes, ensuring control and management efficiency, supporting incremental decision-making and cost analysis, promoting fairness and transparency, assisting in marketing decisions, enabling constraint and trend analysis, and aiding valuation.

Accounting guides for small business owners

What type of business model should your business use? What’s the best way to separate personal finances from business finances? What business plan or business structure provide the greatest tax savings?

These guides provide tailored help for a number of popular industries.

8. Accounting for Real Estate: +13 Best Practices

Real estate involves large sums of money and numerous transactions, making accurate record-keeping essential. Maintaining an effective accounting system helps monitor financial health, track profitability, and compare performance over time.

This article discusses compliance with tax regulations and accounting standards. Best practices include choosing an accounting method, implementing double-entry bookkeeping, separating personal and business finances, establishing a chart of accounts, tracking income and expenses, anticipating operating costs, reconciling accounts, keeping books updated, generating accurate financial reports, digitizing supporting documents, using cloud-based accounting software, outsourcing tasks if needed, and preparing for tax season in advance.

9. Accounting for Property Managers: A 6-Step Guide

The article discusses the importance of property management accounting and provides steps to set up an efficient accounting system for rental properties.

Property owners need to treat their rental properties like any other business and keep personal finances separate from their business bank accounts. They also need to choose an accounting method, such as accrual accounting or cash basis accounting, and create a chart of accounts to categorize transactions.

Keeping a journal to track transactions, generating financial statements, and tracking deductible expenses are essential steps in property management accounting. Using accounting software, like Shoeboxed, can help streamline the process by organizing receipts and expenses.

10. Accounting for Ecommerce: Tips, Resources, FAQs

Accounting is crucial for tracking financial transactions, managing expenses, and staying on top of taxes for e-commerce businesses.

This article discusses key tasks, including categorizing transactions, maintaining a business budget, staying on top of taxes, and reconciling bank statements.

Best practices include setting aside money for taxes, forecasting major expenses, and supervising inventory management. Regularly reviewing financial statements and keeping proper records are also essential for ecommerce accounting.

11. Accounting for Truckers: Steps, FAQs, Resources

This article covers how trucking companies that are starting out need to choose the right entity structure, decide on an accounting basis (cash or accrual), track and document all income and expenses, and fulfill tax obligations.

Best practices include using software programs, sticking to a schedule, using fuel cards, and consulting with an accounting expert.

12. Accounting for Farms: Best Practices and FAQs

Farming businesses need to consider accounting methods to comply with rules and regulations.

The article covers generally accepted accounting principles (GAAP) and factors specific to farm accounting, such as land as an asset, government subsidies, inventory management, land-use changes, government schedules, stock management, asset depreciation, recording losses, assessing profitability, and utilizing technology.

13. Accounting for Contractor: A Beginner’s Guide

Construction accounting is different from regular accounting due to the unique nature of the construction industry. Construction accounting focuses on managing the costs and profitability of individual construction projects.

This accounting guide for contractors covers job costing, contract retainage, revenue recognition methods, and handling frequent change orders. The article provides an in-depth guide to construction accounting, including its challenges, concepts, and best practices. It emphasizes the importance of accurate job costing, choosing the appropriate revenue recognition method, understanding contract billing methods, and managing construction payroll. Additionally, it offers tips for construction accounting best practices and highlights common errors to avoid.

14. Accounting for LLC: Best Practices, Steps, Resources, FAQs

The article discusses the steps to set up accounting for a limited liability company (LLC) when starting a business. It emphasizes the importance of separate business accounts to maintain financial separation between personal and business finances.

The article also explains the two popular accounting methods for LLCs: cash accounting and accrual accounting. It highlights the significance of recording earnings and expenses in a general ledger to ensure proper financial management.

The decision on whether to outsource bookkeeping or keep it in-house depends on various factors. The article advises tracking business expenses and provides options for receiving payments, such as online payments and automated invoicing.

15. Accounting for Retail: Best Practices, How-Tos, FAQs

Retail accounting is a method that helps businesses track inventory without physically counting all the items. It converts current inventory to its estimated retail price and subtracts the sales to determine the inventory on hand.

The article explains three inventory valuation methods: first in, first out (FIFO), last in, first out (LIFO), and weighted average. It highlights the advantages of retail accounting, such as avoiding physical inventory counts and providing tax benefits. However, it also mentions some disadvantages, such as potential inconsistencies in estimates.

The article outlines the steps involved in using retail accounting for a retail business, including determining the cost-to-retail percentage, tracking inventory cost, and calculating the final inventory. It suggests using automated tracking methods, such as a point-of-sale (POS) system, and discusses the accounting cycle for retail stores, including recording transactions, generating statements, and reconciling financial records.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Try Free for 30 DaysSmall business accounting software guides

Even if you’re intent on going it alone, you might still benefit from business tools and small business accounting software that will help you automate the more tedious aspects of bookkeeping and accounting.

16. 10 Accounting Tools for Every Type of Business and Industry

Accounting tools help track and record financial activities, including transactions, bank reconciliation, invoicing, and generating statements.

The article highlights eight reasons why accounting tools are important, such as saving time, reducing costs, minimizing human errors, and simplifying tax filing. It discusses considerations for choosing accounting tools, including features, ease of use, accessibility, scalability, cost, and integration capabilities.

The article also presents a list of the top 10 accounting tools for businesses, including Shoeboxed, Oracle NetSuite, Xero, AccountEdge, FreshBooks, QuickBooks, Kashoo, Wave Accounting, Gusto, and TSheets.

17. 9 Trucker Accounting Software Options and How to Choose One

Are you a trucker looking for the best accounting software for your business? Look no further!

This article provides a list of the top 9 accounting & bookkeeping software options specifically tailored for trucking companies. From receipt tracking systems to all-in-one solutions, these software options offer features like fleet management, mileage tracking, billing, dispatch management, and IFTA reporting.

Each software is described briefly, highlighting its pros and cons, and the prices are provided where available. Don’t miss out on finding the perfect accounting software to streamline your trucking business and manage your finances effectively.

18. Realtor Accounting Software: Top 10 Picks in 2024

This article covers various benefits and features of different software options, including Realtyzam, Shoeboxed, Zoho, Buildium, FreshBooks, Wave Accounting, Xero, Quicken, Lone Wolf Back Office, and QuickBooks Online.

We summarize each software’s key features, pricing, and suitability for different business sizes and requirements. Whether you need specialized real estate accounting features, mobile apps, property management tools, or budget-friendly options, this article has got you covered.

19. 7 Best Engineering Accounting Software Picks and Total Guide

In this article, we explore the importance of engineering accounting software and its benefits.

Engineering software helps organize and integrate data, enables working on the go, simplifies communication with clients and collaboration with team members, streamlines financial management, and boosts overall productivity.

We evaluated various accounting software options and highlighted the top picks for engineers.

20. 9 Top Retail Accounting Software Picks for Shop Finances

Running a successful retail business requires meticulous record-keeping, and that’s where retail accounting software comes in. Retail accounting software helps manage inventory, track sales taxes, sync sales across multiple channels, automate accounting processes, accept online payments, provide key metrics for sales performance, aid in tax management and financial planning, and generate reports.

In this article we evaluated various software options and highlighted the top picks for 2024 for retailers.

Tax season guides

Here, we share our best guides to help you navigate tax season with less stress. From tips on what receipts to keep for tax purposes, to understanding your tax obligations, these guides will have you covered.

21. Tax Checklist 2024: What to Know, Do & Prepare for Tax Filing Day

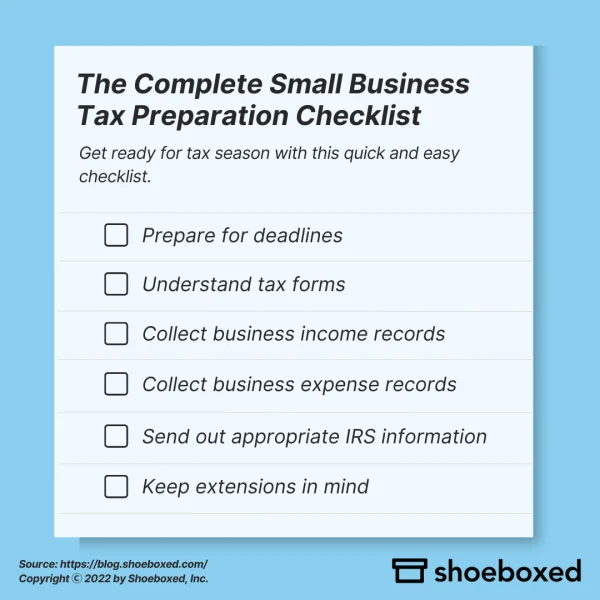

This article provides a complete small business tax preparation checklist to guide business owners through the process.

The checklist includes preparing for deadlines, understanding tax forms, collecting business income and expense records, sending out the appropriate IRS information, and considering extensions if needed.

Each item is explained in detail, providing valuable insights and tips to ensure a smooth tax filing experience. By following this comprehensive checklist, business owners can alleviate stress and confidently complete their taxes, maximizing efficiency and accuracy.

Tax Prep Checklist

22. What Is a Tax Receipt? A Complete Guide to Tax Receipts

Receipts play an important role in tax reporting, serving as proof of expenses claimed on state and federal income tax returns.

Business tax receipts are crucial for claiming deductions related to expenses such as office rent, payroll, supplies, and travel.

It is recommended to keep receipts, whether paper or digital, for at least 3 years or 7 years in cases of loss claims. Understanding and retaining receipts is essential for accurate tax reporting and deductions.

23. Small Business Tax Strategies: A Step-by-Step Guide for 2024

In this article, we provide a straightforward guide to help business owners navigate tax strategies.

We cover topics such as choosing the right business entity when starting a business, maximizing tax write-offs, using small business accounting software, and working with tax professionals.

By following these strategies, you can save money on taxes and ensure your business remains organized and compliant.

24. Tax Audit Prep: The Absolutely Non-Scary Guide

Understanding the audit process can help alleviate fears associated with being selected for an audit by the IRS.

An audit involves a review of your tax return to ensure accuracy, and in many cases, the IRS simply needs more information to support the numbers on your return.

This comprehensive guide provides tips for a painless tax season and outlines the different types of audits, how to prepare for an audit, and top tips for a successful audit.

25. Does The IRS Accept Receipt Scan for Tax Deductions?

Tax season can be stressful for business owners, but digitizing your receipts can streamline the process. If you’re worried about whether the IRS will accept receipt scans, here’s some good news: scanned receipts are 100% legitimate and approved by the IRS since 1997. Read the article!

26. Filing Duplicate Tax Returns? Here’s What to Know and Do

If you’ve ever wondered what to do if you accidentally file your tax return twice, we’ve got you covered with some helpful tips.

Filing duplicate tax returns can happen when the same social security number is submitted twice in a year, either by mistake or due to identity theft.

The first important thing to know is that there is never a situation that calls for filing duplicate tax returns.

If you do file twice, the IRS will accept the first return and reject the subsequent one. Find out how to resolve the issue with this guide.

27. How to Organize for Taxes: 9 Quick & Easy Tips

Tax season can be overwhelming, but with the right organization strategies, you can tackle it with confidence. Here, we’ve covered our favorite tips for getting organized for tax season!

Other DIY accounting resources

Here are articles and lists, ranging from general business news to more specific information that will help your new business succeed.

28. 18 Accounting Blogs to Improve Your Financial Understanding

Accounting blogs offer updated information on bookkeeping and accounting practices, industry insights, and helpful tips. This article reviews some of the best accounting blogs that professionals should have in their arsenal.

The chosen blogs cover a wide range of topics, including accounting technology, business management, tax news, and career advice.

With their expertise and variety of topics, accounting blogs are worth exploring to enhance your accounting skills and stay informed about the latest trends in the field.

29. 16 Intriguing Accounting Podcasts to Listen to on the Go

Accounting podcasts offer valuable insights and information for accounting professionals, students, independent contractors, and business owners.

The featured podcasts cover topics such as accounting best practices, CFO insights, growing accounting practices, cloud accounting, and interviews with accounting influencers.

Whether you want to stay updated on industry trends or gain valuable business and accounting skills, these podcasts offer valuable content in an engaging and accessible format.

30. 39 of the Funniest Accounting Jokes and Memes From Reddit

Need a good laugh to brighten up your day in the world of accounting?

This article has compiled the best accounting jokes from Reddit to tickle your funny bone. From auditors crossing the road to accountants valuing Santa’s sleigh, these jokes cover a range of humorous situations that only those in the accounting field can appreciate.

Frequently asked questions

What is DIY accounting?

DIY accounting means doing your own accounting tasks instead of hiring a professional. It includes things like keeping track of money coming in and going out, making financial statements, managing budgets, and doing taxes. You can use software or spreadsheets to help you. People do DIY accounting to save money and have more control, but you need to know some accounting rules to do it right.

How can I do accounting by myself?

To do accounting by yourself, follow these steps:

1. Keep track of all your income and expenses.

2. Prepare financial statements.

3. Manage budgets.

4. Handle tax obligations.

5. Use accounting tools.

6. Educate yourself.

7. Seek professional help if needed.

In closing

In conclusion, while DIY accounting allows individuals and small businesses to handle their financial management independently, it is important to approach it with the necessary knowledge and understanding of accounting principles.

Follow the advice linked to in the guides above so you can effectively manage your income, expenses, budgets, and tax obligations.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!