Are you a small business owner overwhelmed by trying to handle all aspects of your business while trying to maintain legal compliance? If so, you’re not alone. It has become increasingly popular for small business owners to outsource their bookkeeping and accounting.

According to Capterra, 71% of business owners contract finance and bookkeeping services to third parties. Out of all the outsourcing options, businesses outsource bookkeeping and accounting services the most.

By outsourcing, business owners can focus more on customers and strategies for business growth.

What is accounting outsourcing?

Outsourced accounting is when a business hires a third party or someone outside the company to perform its accounting functions. These financial functions may include payroll, bookkeeping, accounts payable, accounts receivable, taxes, financial reporting, and legal financial compliance. These external professionals may perform a combination or all of these functions.

What is Outsourced Accounting? by Chris Hervochon, CPA, CVA, LLC

Who should outsource accounting?

It used to be that large companies were the only ones that outsourced accounting services. In our experience, it has become practical for a wide range of business types to seek third parties to perform certain business functions.

1. Small businesses

Smaller businesses are now relying heavily on outsourcing financial services, especially companies that need more advanced skills, knowledge, and expertise than the internal accounting department or bookkeeping.

2. A company struggling to hire

A company struggling to hire someone capable of fulfilling the needed skill sets and a company that can’t afford to hire an internal full-time employee to handle all the financial functions should consider outsourced accounting services.

3. Businesses that need temporary help

Outsourcing accounting functions is a practical solution for companies that only need certain financial services for a certain period during the year. For example, you may run a seasonal business or only need tax help.

4. Growing businesses

When companies are experiencing growth, they have financial needs that are often more complex. By outsourcing financial functions to accounting firms or other accounting professionals, you are gaining access to someone with more expertise to handle the more complex functions. These professionals also are trained to offer financial advice and financial management tips.

5. Not for profits and charities

Managing donations and handling tax-deductible receipts is another ballgame from your typical for-profit business. Not-for-profits are subject to strict control by government regulations and taxes. It takes someone professionally trained to maintain legal compliance with these regulatory agencies. Companies need this expertise to avoid steep penalties and fines.

What business functions are typically outsourced to financial professionals?

Many core business tasks are outsourced to a third party. When it comes to accounting, these functions include the following:

Bookkeeping services

Payroll

Preparation and management of financial statements

Management accounting

Accounts payable/receivable

Taxes

Back office support

Reconciling bank accounts

Financial planning and advice

Expense management

What is an example of an outsourced accounting service?

Expense management is an accounting function often overlooked by enterprises looking to outsource financial functions. Tracking the money a business spends can be an overwhelming task when managing receipts for various employees. Still, it is a necessary evil when monitoring your budget and at tax time when claiming deductions.

Shoeboxed

That’s why over one million businesses outsource receipt management to Shoeboxed.

Businesses use Shoeboxed for outsourcing accounting functions like expense management.

Shoeboxed scans and organizes receipts, categorizes expenses, creates expense reports, and tracks business mileage, all while saving the company time and money.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFeatures

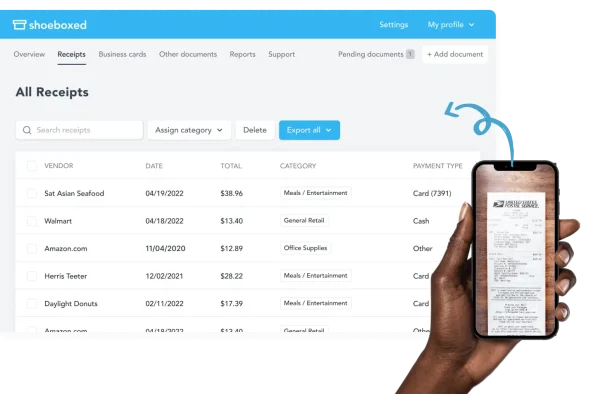

With Shoeboxed, you can take pictures of your receipts and directly upload them into your account from their phone app, automatically import digital receipts from your Gmail, or mail your paper receipts to Shoeboxed, where they will scan and upload them into your account.

Shoeboxed photographs and uploads receipts into an account where expenses are categorized.

Shoeboxed automatically categorizes receipts into 15 different tax categories. These receipts are later searchable by payment type, vendor, category, or date.

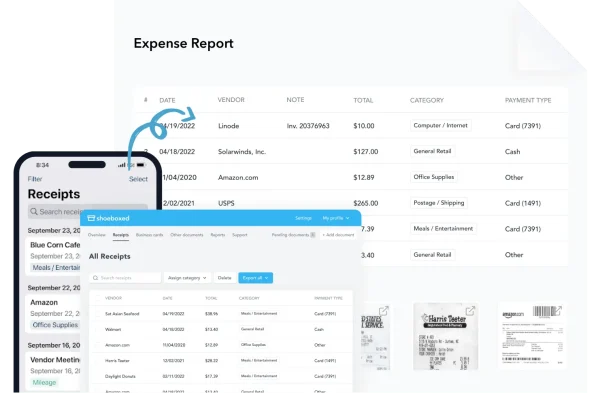

Shoeboxed creates expense reports with receipt images.

Shoeboxed then creates detailed PDF or CSV expense reports with receipts attached so you have all your receipts easily accessible for filing taxes or in case of an audit. You can also add an unlimited number of free sub-users to the account.

You can even use your phone’s built-in GPS for easy, accurate mileage tracking.

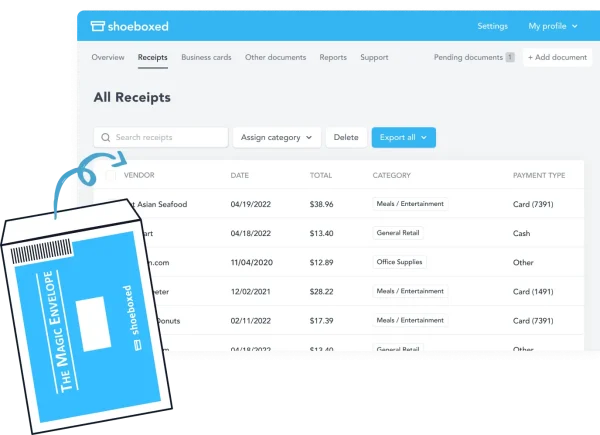

Magic Envelope

Shoeboxed also offers a receipt scanning service with their Magic Envelope.

You can even outsource scanning the receipts to Shoeboxed by sending your paper receipts in their Magic Envelope.

When you sign up for the Magic Envelope plan, Shoeboxed sends you a monthly postage-prepaid envelope. Simply fill the envelope with your receipts and mail it back to them.

They will then scan, verify, and upload the receipts into your account, where the expenses are categorized.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhen should you outsource accounting?

It’s best to outsource accounting when you need services beyond general bookkeeping or when the business owner can no longer be involved in all aspects of the business.

Bookkeepers typically only have basic financial knowledge of day-to-day financial dealings. Most bookkeepers can handle payroll, deposits, billing, collections, bank account reconciliation, sales tax, and basic financial statements.

As their business grows, owners find it more valuable to focus their time on building their company instead of on day-to-day activities. This shift is when business needs begin to change. Businesses need management accounting to experience growth and to run a successful business. Bookkeepers don’t have the training or expertise to offer this kind of advice.

Bookkeepers can handle basic financial needs such as keeping the books up-to-date and generating basic financial statements. Management reporting involves taking the data from the bookkeepers and making crucial business decisions using real-time data to pinpoint critical performance indicators.

We have found that small business owners should start considering an outsourced accounting team when they encounter the following:

Business owner no longer has the time to be involved in every aspect of the business

Business begins to experience growth

Sophisticated financial reports are needed to make business decisions based on real-time data

Businesses accept outside investor capital

Need financial tips and advice to make critical financial decisions

What should a business owner do before hiring an outsourced accounting firm?

Now that you have decided to outsource your accounting needs, there are several things that business owners should do before hiring an outsourced accountant to avoid some of the most common mistakes.

Step 1: Make a list of needed services

First, business owners should list all the services they need to run their business. Then, decide which services the business can effectively manage and which services could be handled better by someone outside the firm. Now, the business owner has a complete list of services better served by a third party.

Step 2: Make a list of business goals

Once you have made a list of the services needed for your business, it’s time to consider your business goals. With the required services and business goals list, an outsourced accounting firm can create a tailored solution to meet your business’s unique needs based on your company’s objectives.

Step 3: Look for an accounting firm whose values align with yours

Be sure to research all of your potential options. Narrow these options by establishing which accounting firms’ values align with yours. If you share the same values, you will better understand each other, communicate more effectively, and approach your goals similarly.

Step 4: Look for an accounting firm that understands your business needs

Even if an accounting firm comes highly recommended, there may be better choices for your business. Look for an accounting outsourcing option that understands your business. Ensure that this outsourced accounting team has experience handling and managing finances for other companies in the same industry with similar needs.

Why should you consider outsourced accounting?

Before you outsource accounting services, think about what challenges you encounter daily and your goals. The status of these challenges and goals will indicate when it’s time to consider an outsourced accounting team.

1. Save money

Hiring a full-time bookkeeper, staff accountant, or in-house accounting team or department is expensive, especially for small businesses and start-ups. The cost of the employees’ base salaries and benefits can add up. Outsourced accounting services are more cost-effective since small businesses receive professional help and quality work for a fraction of the price.

2. Saves time

Most business owners don’t have time to be involved in every aspect of their business. Processing payroll, performing reconciliations, budgeting, and handling accounts payable and receivable are time-consuming. Outsourced accounting services will free up time for business owners to concentrate on other aspects of their business, including growth and customer satisfaction.

3. Access to expertise

By outsourcing accounting services, businesses benefit from well-trained financial professionals who perform quality work. These professionals also provide an objective point of view when analyzing financials and assessing a company’s financial health.

4. Get instant access to customized solutions

Not only do you gain access to financial professionals, but the access is available when making crucial business decisions. Access to updated and accurate financials gives the business owner complete company visibility. This results in the business owner being able to make sound business decisions and manage risk, which is more likely to lead to business growth and a successful business.

The Top 6 Benefits of Outsourced Accounting by SVA Certified Public Accountants

Frequently asked questions

Who benefits the most from outsourced accounting services?

Business owners previously thought that only large enterprises benefited from outsourcing accounting services. Today, outsourcing is a more common practice for all types of business. These types include small businesses, those finding it challenging to hire an employee with the desired experience, businesses needing only temporary help, growing companies, not-for-profit corporations, and charities.

What is an example of outsourcing accounting tasks?

Outsourcing expense management to Shoeboxed is an example of outsourcing accounting tasks. The business owner scans the receipts or sends the receipts to Shoeboxed in a Magic Envelope. The receipts are uploaded into an account where Shoeboxed automatically categorizes them into 15 editable or customized tax categories. Then financial reports can easily be generated. This is a service that handles receipt management for business owners.

In conclusion

One of the best accounting solutions for a business struggling to keep up with its core business functions or working towards business growth is to consider an outsourced accounting service. It’s difficult for business owners to establish accounting systems to keep pace with all the regulations and changes a business experiences. An outsourced team will drive profits, improve cash flow, and grow your business.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!