Effective financial management, a cornerstone of business growth and stability, hinges on meticulous payment tracking. This involves vigilant monitoring of invoices, payments, and their impact on maintaining a healthy cash flow.

To achieve this, businesses have access to a variety of tools, ranging from sophisticated accounting software to straightforward Excel templates. These resources help ensure that finances are handled efficiently, paving the way for a business to thrive.

How to choose the right tool for payment tracking

While accounting software has many features, Excel is popular because of its flexibility, ease of use, and cost effectiveness. Microsoft Excel is also popular for payment tracking because of its flexibility and customization. Google Sheets is another good option, especially if you need collaboration features.

What are the components of a payment tracking template?

An efficient payment tracking Excel template should have the following:

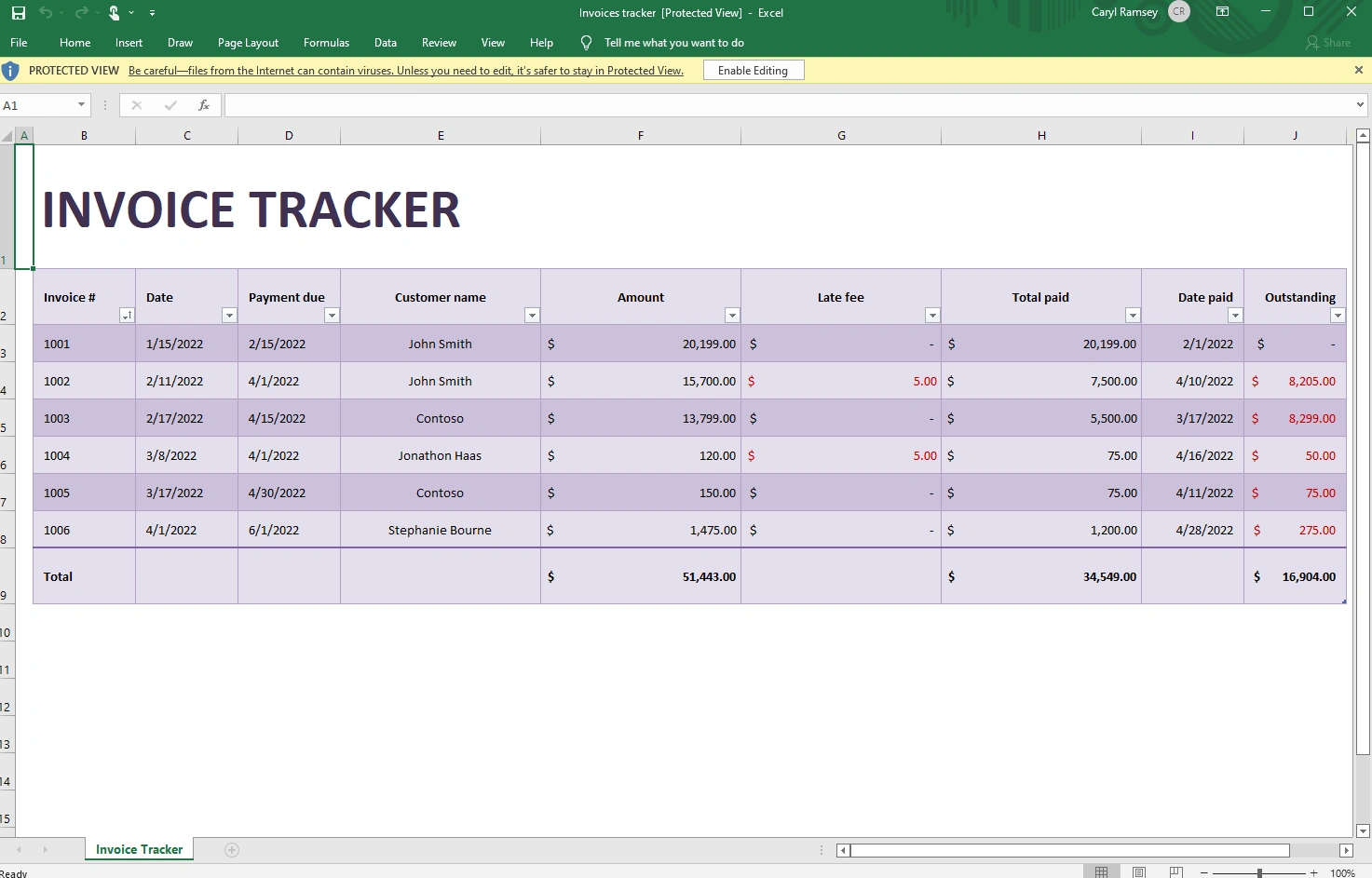

Invoice tracker: a table to track invoices, including invoice number, date, due date, and payment status.

Payment history: a table to track payments, including payment date, method, and amount.

Payment schedule: a table to track upcoming payments and due dates.

Payment terms: a section to outline payment terms and conditions.

How to set up your payment tracking template?

Here are the steps to follow when setting up your payment tracking template:

1. To monitor each transaction's life cycle, create columns for invoice number, date, due date, and payment status.

2. Add more columns to keep detailed records of financial transactions, such as payment date, payment method, and payment amount.

3. Integrate payment schedules within the template to track upcoming payments for accounts and their due dates so you never miss a payment deadline.

4. You can customize the template to your business needs. For example, you may add columns for discounts, tax details, or customer contact information.

Customizing it this way makes it a tool that fits your business operations and financial management.

How to customize for bill management?

Here’s how to customize for bill management:

1. Add columns to keep track of monthly bills and overdue invoices.

2. Use Excel formulas to automatically calculate payment amounts and due dates so you don’t have to do manual calculations.

3. Highlight overdue invoices and payments with conditional formatting rules so they stand out in different colors.

4. Add filters to quickly search and sort through specific invoices or payments, allowing you to manage and update your financial status quickly and easily.

These customizations save time and keep your financial tracking accurate and clear.

Cash flow management with payment schedules

Cash flow management is key to any business's financial health, and using a payment schedule is part of that strategy process. Setting up a payment schedule allows you to track upcoming payments and their due dates so that all financial obligations are met on time.

Prioritize these payments based on due dates and amounts so you can manage cash outflow and avoid late fees or service disruption. Regular payment tracking can also reveal cost reduction and operational optimization opportunities by highlighting areas where you can reduce expenses.

In the end, these will help you make informed financial decisions that support business growth and stability.

How to get started with a free payment tracking template

Here's how to get started:

1. Download a free payment tracking template.

2. Customize the template to your business needs.

3. Add columns for invoice number, date, due date, and payment status.

4. Add columns for payment date, payment method, and payment amount.

What’s the best alternative to a payment tracking Excel template?

Shoeboxed is a great alternative to traditional payment tracking methods like Excel templates, especially if you want to automate and streamline your financial document management.

Shoeboxed

Here’s why Shoeboxed is the best alternative:

1. Automation of data entry

Shoeboxed's mobile app offers a convenient solution for on-the-go financial tracking. Simply take a photo of your receipt or invoice with your smartphone, and the app will scan and upload the data directly to your Shoeboxed account, relieving you of the stress of manual data entry.

This is perfect for business travelers or those who incur many expenses outside the office. While Excel has mobile versions, they don’t have the same ease of use or integration with device-specific features like camera scanning.

You can also use Shoeboxed’s Magic Envelope service to mail your payment receipts. Send your documents to Shoeboxed in their prepaid envelope, and they will scan, digitize, human-verify, upload, and store them in your Shoeboxed account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Automatic organization

Shoeboxed's Optical Character Recognition (OCR) technology scans and extracts key information from payment receipts and invoices, which means less time spent on manual data entry and less chance of human error, a common pitfall in spreadsheet management. Shoeboxed automatically categorizes payments in 15 tax or custom categories.

3. Accessibility

Shoeboxed stores all your financial data in the cloud, so you can access them anywhere. This is better than Excel, where files are stored on a local device or require manual upload to cloud services for shared access.

Shoeboxed has powerful search capabilities to find specific payments or documents based on various criteria, such as date, amount, vendor, or even specific keywords in the receipts.

4. Simplified expense reporting

Shoeboxed has built-in reporting features that automatically generate expense reports and tax documents. The platform allows you to export these to PDF or CSV or send them directly to your accountant or financial advisor.

5. Regulatory compliance

Shoeboxed ensures that all digitized receipts are IRS-compliant and accepted by tax authorities. Maintaining compliance is more complicated with Excel, and you need to manually organize and update it to ensure you’re compliant with the latest regulatory standards.

6. Accounting software integration

Shoeboxed integrates with major accounting software like QuickBooks, Xero, and more. This integration allows real-time updates and no manual entry between Shoeboxed and data across your financial platforms, keeping all your financial data consistent.

While Excel templates are flexible and widely used, Shoeboxed is a more efficient, organized, and compliant way to manage your business expenses, payments, and receipts. With its automation features, mobile accessibility, and robust document management, Shoeboxed is the best solution for businesses to modernize their expense tracking and streamline their financial workflows.

Shoeboxed saves time and money and makes financial data more accurate and reliable, enabling better business decisions that lead to financial health and business growth.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhy track payments for your business?

Tracking payments is important for having an accurate view of your financial situation, which can help you make better business decisions.

Tracking payments helps with the following:

Cash flow management: Monitoring incoming and outgoing payments to have enough funds for business operations.

Reduces financial risks: Efficient tracking reduces the risk of missed or late payments and helps manage debt better.

Strategic planning: With a clear view of your financial situation, you can make strategic decisions on investments, expansions, and other financial commitments.

Frequently asked questions

How do I customize my Excel payment tracking template?

Customize your template by adding columns specific to your business needs, such as discounts, tax rates, or customer name and contact information. Use Excel’s conditional formatting to highlight overdue payments and formulas to calculate totals and due dates automatically.

What is the best alternative to tracking payments with an Excel template?

While Excel templates are flexible and widely used, Shoeboxed is a more efficient, organized, and compliant way to manage your business expenses and receipts. With its automation features, mobile accessibility, and robust document management, Shoeboxed is the best solution for businesses to modernize their expense tracking and streamline their financial workflows.

In conclusion

Efficient financial management requires payment tracking, which is important for cash flow management. A free payment tracking Excel template is an excellent tool for businesses to manage their finances without extra cost.

Integrating solutions like Shoeboxed will simplify it, making all financial data accurate, organized, and accessible. Implement these tools and habits, and you’ll reduce your administrative workload and make better financial decisions to grow your business stronger and healthier.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!