Keeping track of your expenses is crucial, whether you're managing household finances, running a small business, or tracking freelance work.

While many opt for digital tools, printable expense trackers are a popular choice for those who prefer a more tactile approach or a less tech-heavy method.

Let's explore some of the top free printable expense trackers and free budgeting printables available online and then introduce Shoeboxed, a digital alternative that offers significant advantages.

What categories should I include in my expense tracker?

Create categories that reflect your typical spending.

Common categories include:

Groceries

Dining Out

Transportation (fuel, public transit)

Entertainment

Health (pharmacy, doctor visits)

Utilities

Rent or Mortgage

Savings

Miscellaneous

What data should I include when recording expenses?

Write down every purchase and expense and include the following:

Date: The day the expense occurred.

Category: The category the expense falls under.

Amount: The cost of the expense.

Method of payment: Cash, credit, debit, or digital wallet.

Notes: Any relevant details (e.g., who you were with, the purpose of the expense, whether it was planned or impromptu).

What are the top free printable expense trackers?

A personal expense tracker is all about keeping track of where your money is going.

A daily, weekly, or monthly expense tracker is a great tool to measure and manage your money to see spending patterns and make informed financial decisions.

1. Daily expense tracker by The Savvy Mama

With the daily expense tracker, you'll write down what you spend daily. Out of all the free printable expense trackers, this one quickly becomes a genuine eye-opener by giving you a daily play-by-play of how much and where your money is going.

The advantage of tracking expenses daily is that you’ll keep a running total of every expense daily and quickly see the red flags if you spend too much versus waiting a week or month. This gives you more time to turn your spending around and pace your spending.

In my experience, the daily tracker is the most effective tool for helping spenders stick to a budget and reach their financial goals.

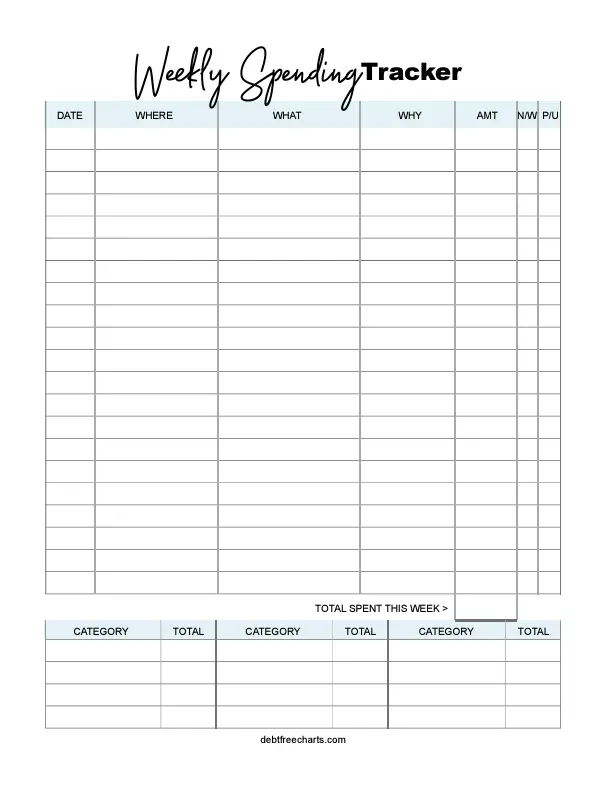

2. Weekly expense tracker by Debt Free Charts

The great thing about this weekly spending tracker is that it includes columns for 'why,' 'need vs. want,' and 'planned vs. unplanned.' This allows you to analyze your spending more deeply.

The 'why' column gives you a better idea of what prompts you to overspend. The 'need vs want' column makes you think more about the necessity of your purchase. If your spending is leaning towards more 'wants' than 'needs,' it's time to rethink your weekly spending patterns. If you have more 'unplanned' expenses than 'planned,' then it's time to rethink and adjust your budget.

This weekly expense tracker is my favorite of all the free printable expense trackers because it has the long-lasting potential to change your whole perspective on spending.

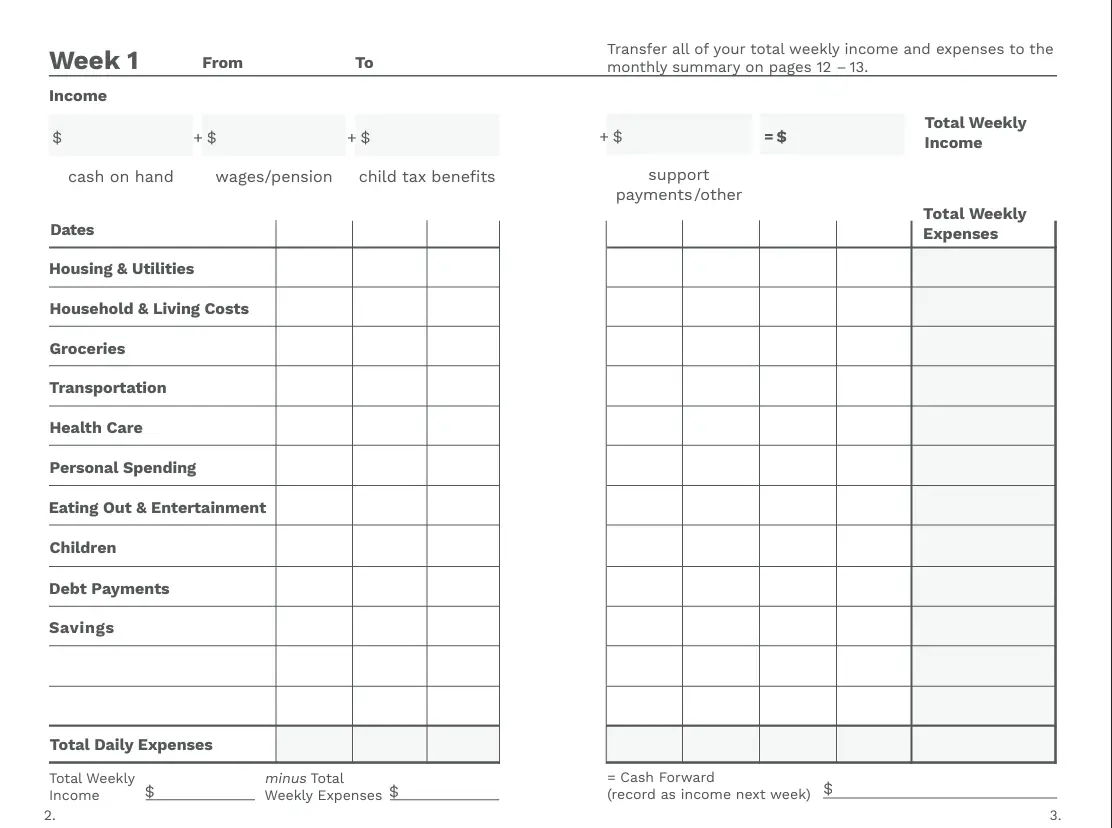

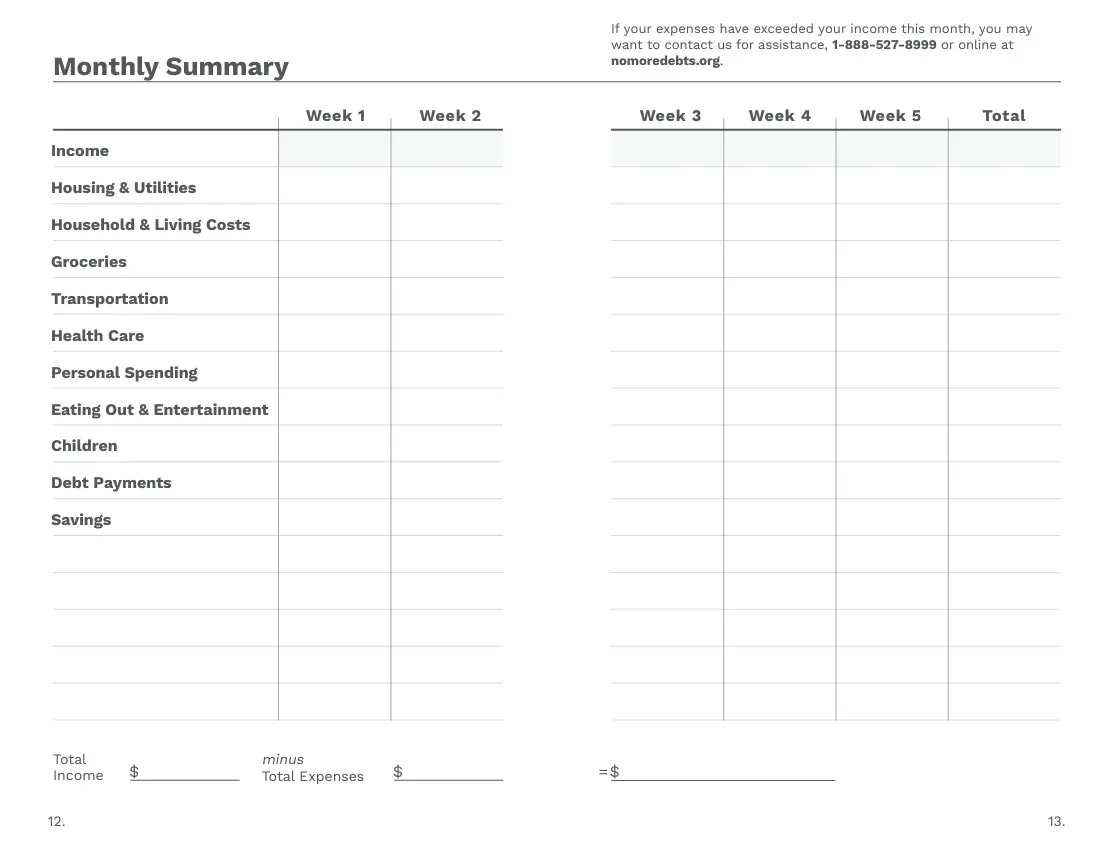

3. Monthly printable expense tracker by No More Debts

This particular monthly printable expense tracker initially has you recording and totaling your income and expenses every week.

The sums for each week are then transferred to the monthly summary. This free printable expense tracker offers the best of both worlds in more ways than one. First, you get a clear picture of your spending habits weekly and monthly, and second, you get a clear picture of your income and monthly expenses.

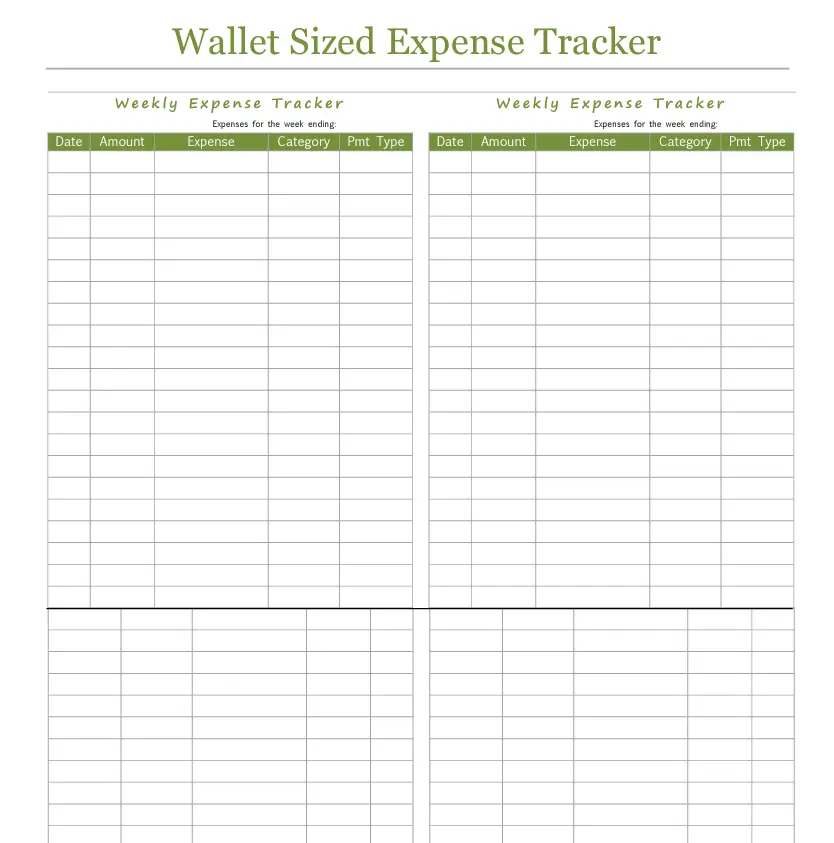

4. Wallet-sized printable expense tracker by Frugal and Thriving

This is one of my favorite free printable expense trackers for on-the-go use. The compact PDF format, which is wallet-sized, allows you to enter expenditures as they occur, making it easier to maintain accurate financial records and prevent you from getting backlogged when recording your expenses. There are four trackers per page, so just cut, fold, and stick it in your wallet.

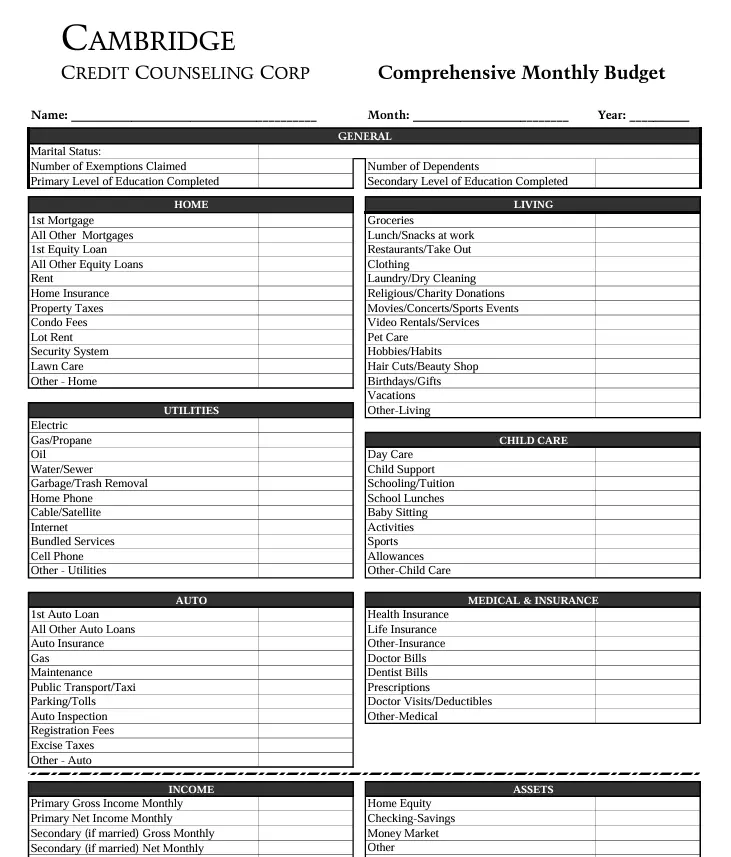

5. Printable budgeting worksheets by Cambridge Credit Counseling Corporation

Printable expense trackers aren't beneficial unless you take the time to fill out printable budgeting worksheets. A monthly budget will keep you on track when paying off debt, saving money, and achieving financial goals. The printable budgeting worksheets give you something to compare your actual expenses to see if you're overspending in any area and have enough money to make it through your pay period.

6. BONUS: Shoeboxed—the best alternative to a printable expense tracker

Using free printable expense trackers and free budgeting printables is the first step in taking control of your business or personal finances. While these printable trackers are helpful, they require manual input and maintenance, which can be time-consuming and prone to errors.

Fortunately, there is a digital alternative.

For those seeking a more efficient and effective way to manage expenses, Shoeboxed presents a robust alternative to printable expense trackers.

Here’s why Shoeboxed stands out:

Digital receipt management

Shoeboxed transforms the way you manage receipts and expenses. It turns receipts into digital data.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayAccessibility and security

Instead of having to keep up with a wallet-sized printable expense tracker and manually filling it out while on the go, Shoeboxed has a mobile app that will conveniently scan receipts, automatically extract the data, and categorize expenses for you.

You can also access your expense data from anywhere, at any time. Shoeboxed uses secure cloud storage to ensure your financial data is safe and always accessible.

Integration

Seamlessly integrate Shoeboxed with accounting software like QuickBooks, making it easy to synchronize your expense data for accounting and tax purposes.

IRS compliance

Shoeboxed ensures that all digital copies of receipts are legible and categorized following IRS guidelines, which is crucial for tax preparation and audit protection.

An overview of Shoeboxed

While a free printable expense tracker can be a good option for those who prefer paper-based methods, the time and effort required to maintain one can be considerable.

Shoeboxed offers a powerful and efficient alternative. It automates the expense tracking process and provides added benefits such as secure storage, easy integration, and compliance with tax regulations. For modern professionals and businesses looking for a streamlined approach to finance management, Shoeboxed is undoubtedly the best choice.

Lighten the Load✨

Learn How a Multi-Campus Church Reclaims 20 Hours a Month with the Shoeboxed App

Read the case studyWhat are some tips for effective budgeting?

Here are some bonus tips for creating an effective budget:

Be realistic: Underestimating expenses can lead to budget failure. Be honest about what you spend.

Prioritize savings: Treat savings like a fixed expense. Pay yourself first to build a financial cushion.

Plan for surprises: Set aside some of your income for an emergency fund to cover unexpected expenses.

Stay flexible: As your financial situation changes, adjust your budget. Regular updates can help you stay on top of your financial goals.

What are some strategies to manage overspending?

Keep the following in mind to avoid overspending:

Budgeting: Create a detailed monthly budget that outlines how much you can spend in each category based on your income and financial goals. Stick to this budget to control spending.

Track spending: Keep a log of all purchases. Reviewing where your money goes can help identify areas where you might be overspending. Check monthly bank statements for spending patterns.

Prioritize spending: Focus on essential expenses first and allocate remaining funds to savings and discretionary spending. This can help prevent financial overreach.

Set financial goals: Define clear short-term and long-term financial goals. This can motivate you to adjust your spending habits.

Use tools and resources: To manage your finances more effectively, consider using budgeting and expense management apps, free budgeting printables, free expense trackers, financial planning tools, or consulting with a financial advisor.

Can I use Excel or Google Sheets to track my expenses?

Both Excel and Google Sheets are tools for tracking expenses and can be customized to suit your personal or business finance needs.

Here’s how you can use each of these platforms to create and maintain an expense tracker:

Using Excel to track expenses

Excel is spreadsheet software that offers data manipulation and visualization capabilities.

Here’s how to start tracking expenses with Excel:

Create a new spreadsheet: Open Excel and create a new workbook.

Design your layout: Set up columns for Date, Description, Category, Amount, and any other pertinent details, such as Payment Method or Notes.

Categorize expenses: Make categories relevant to your spending patterns, such as groceries, transportation, rent, utilities, and entertainment.

Input data: Start entering your expenses as they occur. Each row can represent a different transaction.

Formulas: Use Excel formulas to sum up totals, calculate averages, or compare spending across different months or categories. For example, =SUM(D2:D100) to total an amount column.

Pivot tables: For more advanced analysis, use Pivot Tables to segment and break down your expenses dynamically by category or date.

Graphs and charts: Excel’s charting features can help visualize spending trends and patterns.

See also: Home Expenses Template: Top 3 Free Templates + Bonus Service

Using Google Sheets to track expenses

Google Sheets is a cloud-based alternative to Excel with collaborative features. It is accessible from any device with internet access.

Here’s how to use Google Sheets for expense tracking:

Create a new Google Sheet: Open Google Sheets in your browser and start a new document.

Setup columns: Like with Excel, create columns for Date, Description, Category, Amount, etc.

Use drop-down lists: To make data entry easier and consistent, use data validation to create drop-down lists for categories. Go to Data > Data validation, and set the criteria to ‘List of items.’

Enter expenses: Regularly input your expenses. Each entry should be a new row.

Sum and analyze: Use built-in functions to summarize your data, such as =SUM(), =AVERAGE(), or =COUNTIF() for specific analyses.

Visualization: Use Google Sheets' charting tools to create graphs directly from your data, which will help you visualize your spending habits over time.

Sharing and collaboration: Share your Google Sheet with family or team members to allow them to enter their expenses.

Frequently asked questions

Are free budgeting printables and expense tracker spreadsheets as efficient as Shoeboxed?

While these printable budgeting worksheets and expense trackers are helpful, they require manual input and maintenance, which can be time-consuming and prone to errors.

For those seeking a more efficient and effective way to manage expenses, Shoeboxed presents a robust alternative to printable expense trackers.

In what ways is Shoeboxed more efficient than free budgeting printables and expense trackers?

Shoeboxed turns physical receipts into digital data. The platform has a mobile app that conveniently scans receipts, automatically extracts the data, and categorizes expenses for you instead of manually doing these steps. You can also access your expense data from anywhere, at any time.

Shoeboxed integrates with accounting software, making it easy to synchronize your expense data for accounting and tax purposes instead of transferring and synchronizing the data manually. Shoeboxed also ensures that all digital copies of receipts are legible and categorized, following IRS guidelines.

In conclusion

Understanding and controlling spending is crucial to maintaining financial health and achieving stability. Recognizing the signs of overspending and addressing them can ensure that your financial actions align with your overall life goals.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!