A printable truck driver expense worksheet tailored for owner-operators provides a helpful guide when tax season comes around.

This organizational tool helps truckers list the totals of all their truck driver tax deductions, simplifying the process of identifying eligible tax write-offs.

These worksheets go into great detail, listing the many items that owner-operators can claim, which ensures that all potential deductions are explored and appropriately claimed.

We've compiled our favorite printable truck driver tax deduction worksheets for owner-operators + 1 service that will help owner-operators stay on top of business expenses throughout the year.

Best free printable truck driver expense owner-operator tax deductions worksheets

Truck drivers and owner-operators often incur a wide range of expenses. To simplify tax season, they can use worksheets to tally up their total deductible expenses ahead of the tax deadline.

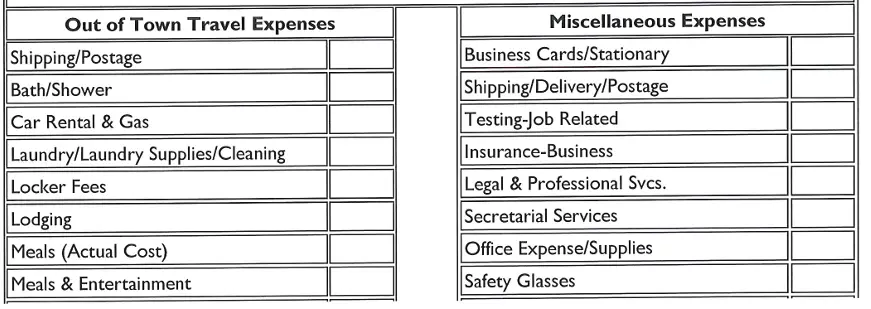

1. Long haul trucker/OTR driver deductible expenses worksheet

This is a trucker tax deduction worksheet for the owner-operator truck driver and includes a comprehensive list of expenses that you can use as a guide for getting ready for tax season. Available as a PDF for easy printing.

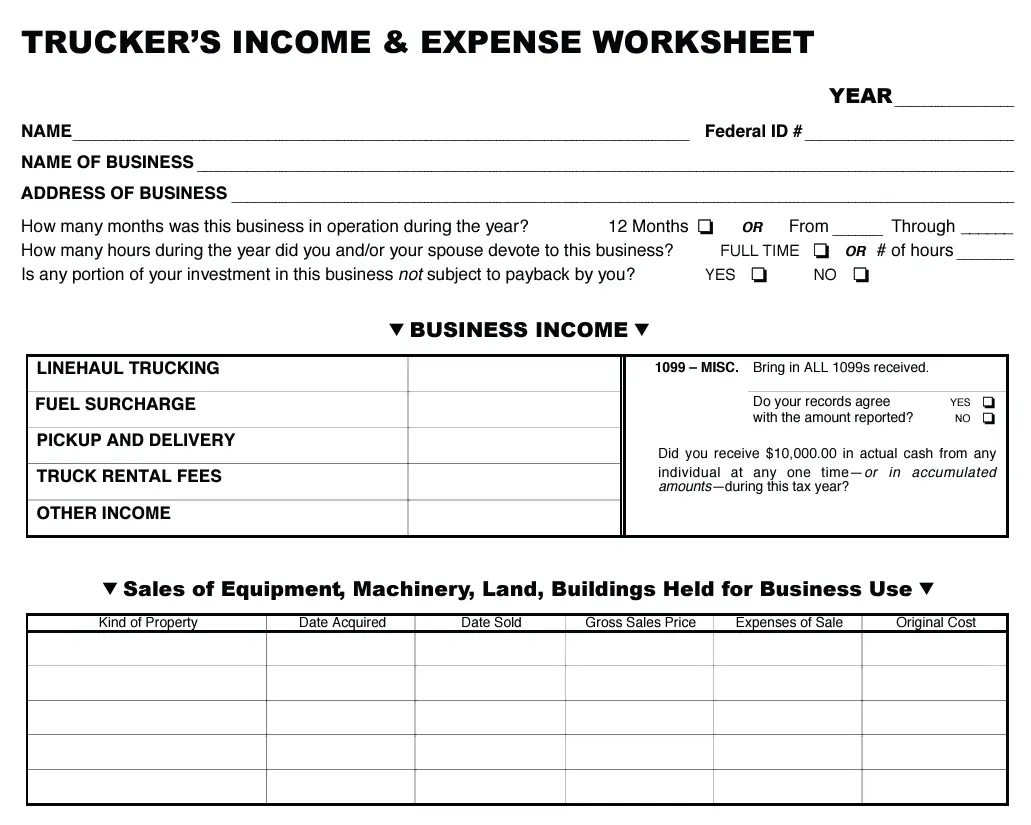

2. Trucker's income and expense worksheet

This truck driver tax deductions worksheet can be used to help you tally up trucking business income along with car and truck expenses. Available as a 3-page PDF, you can print this out and use it to guide you as you find totals for all your expenses for the past year.

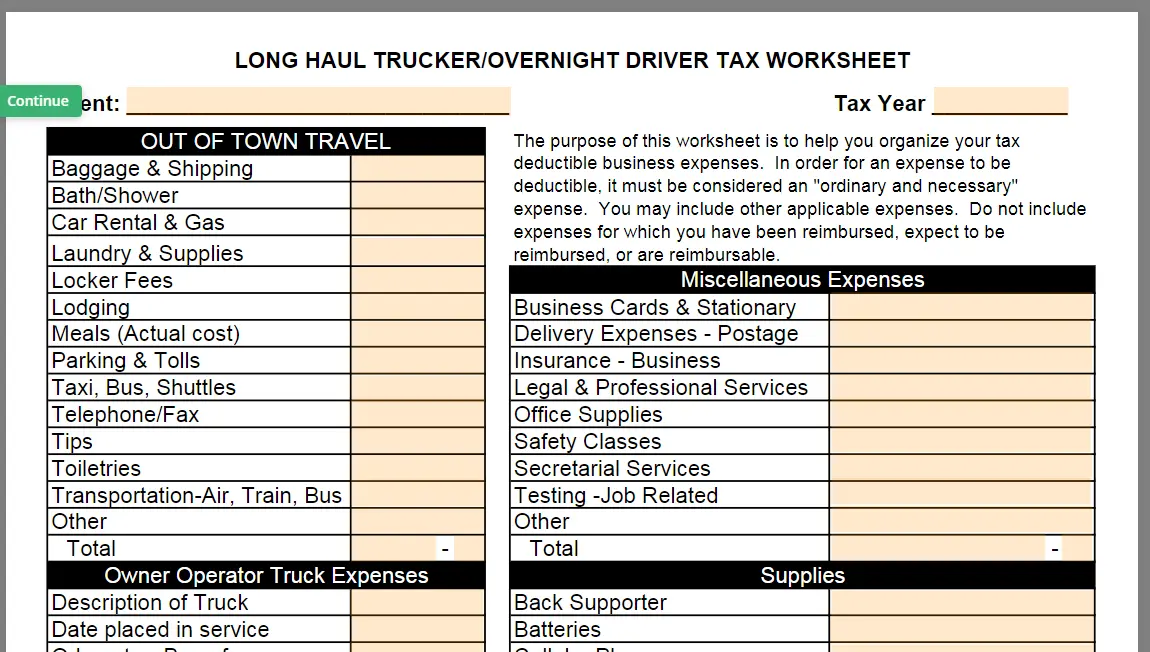

3. Long haul trucker/overnight driver tax worksheet

This worksheet is beneficial for owner-operators who need to organize their business expenses so they can claim them on their tax return.

The worksheet lists common deductible business expenses, ensuring owner-operators don't miss out on any potential deductions.

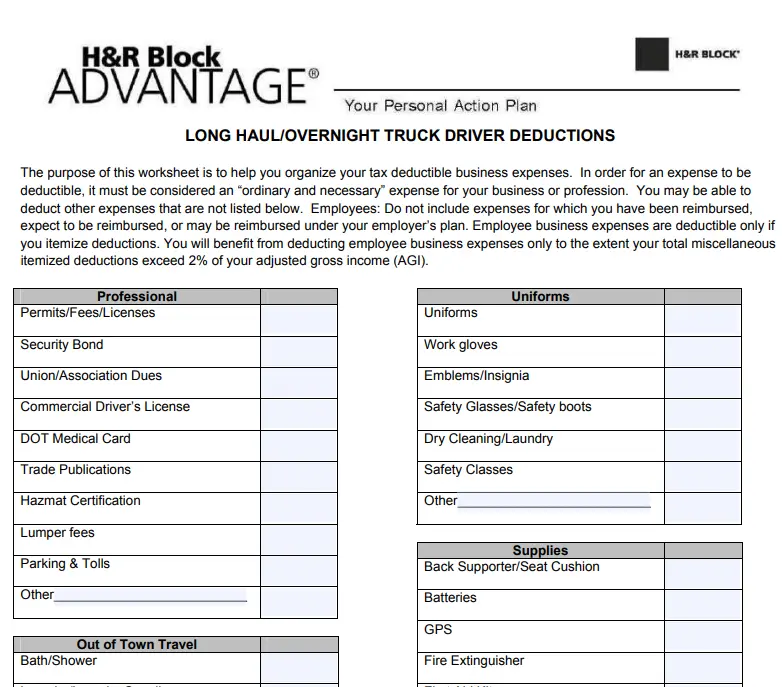

4. Simple truck driver expenses worksheet

Created by H&R Block, this trucker driver expenses worksheet is a 1-page PDF that can be downloaded and printed. While it isn't as comprehensive as the other options listed in this list, it covers the main categories that trucker drivers incur.

Bonus: Shoeboxed's receipt scanning service for truckers

Want a headstart on next tax season? Start today by implementing an award-winning strategy for staying on top of your expenses all year round!

Consider this scenario:

You’ve been on the road for two weeks. In your cabin, you have dozens of loose receipts from gas stations and fast food joints that you have to bring back to the office at the end of your route. You can’t help but lose a few to the wind when you climb in your truck after a 10-hour haul. What’s a guy (or gal) supposed to do?

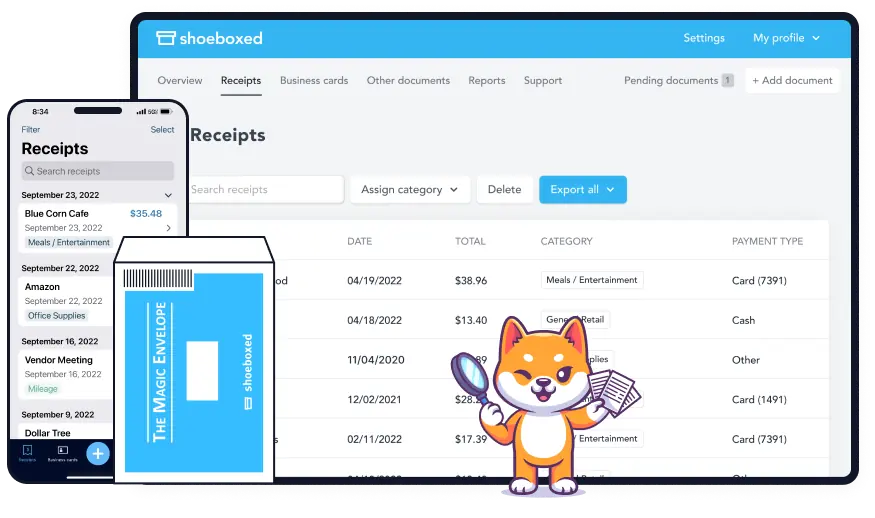

With Shoeboxed, you can capture receipts from your phone or mail receipts to be scanned and uploaded to your account.

Shoeboxed is the #1 app for receipt management and expense reporting and lets you capture photos of, categorize, and create expense reports for receipts on the go.

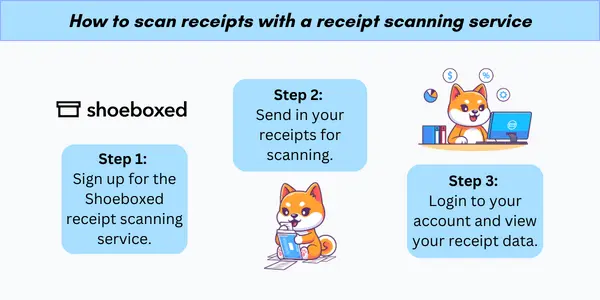

Shoeboxed also offers a mail-in receipt-scanning service, the Magic Envelope, which allows you to send your receipts to a scanning facility and have them uploaded to your account for expense organizing and reports. All without you lifting a finger!

Quite notably, truck drivers in the States are prominent among Shoeboxed’s happy customers; and they recommend keeping a Magic Envelope on the seat next to them on their long hauls. Whenever they stop for gas or for a bite to eat, they stuff the receipt in the Magic Envelope.

Then at the end of the month, they send the postage pre-paid Magic Envelope off to Shoeboxed’s scanning facility and they get notified when the receipts are processed and viewable in their account.

Pros

“Set and forget” expense reporting—use the Magic Envelope to store your receipts, ship at the end of your route, and get them scanned and uploaded to your account.

Accurate mileage tracking that can be included in expense reports.

Add multiple users to a single account for FREE.

Store digital copies of related documents for loads, including invoices, warranties, contracts, etc.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Integrate with other software, such as QuickBooks, for tax reporting and accounting purposes.

Get each business expense automatically categorized

Used and trusted by truckers.

Cons

Plans that include the Magic Envelope cannot be purchased through the mobile app.

Price

Plans that include the Magic Envelope start at $18/month, up to $54/month.

30-day free trial for monthly plans.

All annual plans are charged upon sign-up and come with a full money-back guarantee if the plan is terminated at any point within the first 30 days.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Hit the road with Shoeboxed ⛟

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

There are many ways to upload receipts to Shoeboxed.

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account from your phone.

Shoeboxed also has a user-friendly web dashboard so you can drag and drop receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a couple of clicks.

Shoeboxed integrates with 12+ apps, including QuickBooks, Xero, and Wave Accounting, to automate tedious life tasks.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Shoeboxed's mileage tracker

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayTax deductible business expenses checklist for truck owner-operators

Owner-operators in the trucking industry should be well-versed in tax deductions to maximize their savings and effectively manage their taxable income. Being aware of the essential truck driver tax deductions helps in efficiently managing finances and reducing tax liability.

1. Truck maintenance and repairs

Maintenance and repairs are inevitable when operating a truck. They should keep meticulous records since expenses for new tires, oil changes, and engine repairs are tax-deductible.

2. Fuel costs

One of the largest expenses for owner-operators is fuel. They can offset this cost significantly as fuel purchases are fully deductible. This includes diesel, gas, and other fuels necessary for operation.

3. Insurance premiums

Insurance is a necessity for truckers, protecting against medical expenses, accidents, and other road incidents. Truck insurance premiums for liability, cargo, and accident insurance are often deductible expenses.

4. Meals and lodging

While on the road, truckers incur costs for meal expenses and overnight hotel expenses. The IRS offers a special per diem rate for meals, and lodging expenses can be deducted when provided with valid receipts. Parking fees can also be counted as trucking expenses.

5. Tolls and weigh stations

Passing through tolls and weigh stations is part of the job. Owner-operators can deduct these costs, which, while seemingly small individually, can accumulate significantly over time.

6. Load boards and broker fees

Connecting with freight is often done through load boards and brokers, for which fees are charged. These fees can be deducted, reducing overall tax liability.

7. Utilities

Utilities related to the business, such as mobile phone bills and internet required for operations, can be written off as long as they're strictly business-related.

8. Operational expenses

Day-to-day operational expenses, such as office supplies and employee business expenses are deductible. This includes small expenses like pens and logbooks that add up over the year.

9. Rent or mortgage interest

If they rent space for their business or have a loan on a property, part of the rent or the mortgage interest may be considered a deductible expense.

10. Office supplies

Office supplies necessary for running a trucking business, like printers, scanners for truck drivers, paper, and software, are tax-deductible as long as they serve a business purpose.

11. Accounting and bookkeeping

The cost for services that help manage their finances, including accounting and bookkeeping, are deductible, encouraging the use of professionals to ensure accuracy in record-keeping.

12. Legal fees

Legal fees incurred in the operation of their business, such as for contract disputes or business formation, are deductible.

13. Home office deductions

For those who conduct business from a home office, a portion of their home expenses—proportional to the size of the office space—can be deductible.

14. Professional services

Consultation fees for professional services, like logistics consultants, are deductible expenses and are crucial for some owner-operators' operations.

15. Health insurance

If the owner operator truck driver is self-employed and pay for their health insurance, this cost is often deductible, which can be a significant saving given the high cost of insurance.

16. Retirement contributions

Contributions to retirement plans, such as a SEP-IRA, specifically set up for their business are deductible, providing a savings incentive for the future.

17. Miscellaneous deductions

Other expenses incurred that are ordinary and necessary for the operation of a trucking business, including uniforms and safety gear, can also be deducted.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

What are common tax deductions for truck drivers?

An owner-operator truck driver can typically deduct costs related to their work, such as a portion of their meal expenses on the road, vehicle expenses, such as maintenance and repair costs, miscellaneous expenses for business purposes, and license fees.

Can a truck driver deduct their meal expenses?

An owner-operator truck driver can deduct meal expenses while on the road. According to current IRS rules, they can claim a certain percentage of their actual meal expenses or opt for a per diem rate.

What is a truck driver expenses worksheet?

A truck driver expenses worksheet is a tool that helps drivers organize and tally their deductible work-related expenses, simplifying the tax preparation process.

Is there a specific tax rate for self-employed truck drivers?

Owner-operators, as self-employed individuals, pay their Social Security and Medicare taxes directly, with the combined rate substantially similar to the sum paid by employees and their employers.

How can owner-operators keep track of expenses?

Owner-operators should maintain accurate and detailed records of all business-related expenses. Some owner-operators use a truck driver deductions spreadsheet or a truck driver expenses worksheet for trucking expenses. Other owner-operators who prefer to automate expense management turn to Shoeboxed and outsource expense data entry tasks to Shoeboxed's professional team.

In closing

Tracking expenses is critical for owner-operators in the trucking industry. Detailed records help keep finances in check and maximize tax deductions.

A printable truck driver expense worksheet is helpful for organizing expense totals during tax time. And for those who want to get a head start on next year's tax season, consider switching to Shoeboxed to simplify tax season prep once and for all!

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!