Tired of tedious time-consuming manual data entry and human errors? Or stuck with a financial technology platform that doesn’t meet your business needs?

Ramp alternatives are the answer, addressing human error, time waste, and lack of real-time financial visibility that comes with manual expense management.

Ramp is a financial technology platform that offers expense management software and accounting automation. But companies may look for alternatives due to specific needs, features, or pricing. This article will help you choose the Ramp alternative that best suits your needs.

What are the key features of a spend management solution?

Spend management solutions help businesses control, track, and optimize their expenses.

Here are the key features we've found that should be included in a spend management solution:

1. Expense tracking and reporting

Real-time expense tracking: Allows businesses to track expenses as they happen for real-time visibility into spending.

Detailed reporting: Create expense reports that break expenses down by category, department, project, and more.

2. Automated expense management

Receipt scanning and OCR: Automates expense capture and categorization through optical character recognition (OCR) technology.

Automated approval workflows: Streamlines the expense approval process with customizable workflows for compliance and efficiency.

3. Budgeting and forecasting

Real-time budget monitoring: This feature allows businesses to create and monitor budgets in real-time to stay within budget.

Forecasting accounting tools: Predicts future spending based on historical data.

4. Integration with financial systems

Accounting software integration: It syncs financial data with popular accounting platforms like QuickBooks, Xero, etc.

Bank integration: Connects to bank accounts to import and categorize transactions.

5. Corporate card management

Physical and virtual cards: Issues corporate cards that can be managed and controlled through the spend management platform.

Spending controls: Allows businesses to set spending limits and controls for individual cards so expenses stay within budget.

6. Compliance and risk management

Policy enforcement: Ensures all expenses comply with internal and external regulations.

Audit trails: Keeps detailed records of all transactions and approvals for audits and compliance checks.

7. Vendor and contract management

Vendor management: Tracks and manages vendor relationships and payments so payments are on time and accurate.

Contract management: Manages contracts with suppliers and ensures compliance with contract terms.

8. Mobile accessibility

Mobile apps: Provides mobile apps for employees to capture receipts, submit expenses, and approve reports on the go.

Real-time notifications: Sends notifications and alerts for pending approvals and policy violations.

9. Advanced analytics

Spend analysis: Analyzes spending patterns and finds cost savings opportunities.

Customizable dashboards: Customizable dashboards on expense management software to show key financial metrics.

What is Ramp software?

Ramp is a financial technology platform designed to help businesses manage their corporate spending and expenses more efficiently. It offers a range of features focused on expense management, corporate card issuance, and accounting automation.

Here’s an overview of Ramp software and its key features:

Corporate cards

Virtual and physical cards: Ramp provides both virtual and physical corporate cards to facilitate business transactions. These cards have built-in controls that allow businesses to set spending limits, restrict purchases to specific categories, and monitor usage in real-time.

Card issuance: Cards can be issued to employees quickly, with customizable spending controls to ensure compliance with company policies.

Expense management

Expense report: Ramp automates expense reporting by capturing transaction data directly from corporate cards and categorizing expenses. This reduces the need for manual entry and ensures accurate record-keeping.

Receipt matching: Users can upload receipts via mobile app or email, which are then automatically matched with corresponding transactions.

Accounting integration

Integration: Ramp integrates with popular accounting software such as QuickBooks, Xero, etc. This ensures that all financial data flows smoothly between systems, enhancing accuracy and efficiency in financial reporting.

Syncing: Financial data is synced in real-time, providing real-time visibility into company spending.

Spend controls

Policies: Businesses can set custom spending policies to enforce compliance and prevent unauthorized expenses. These controls can be applied to individual cards or across the entire organization.

Approval workflows: Ramp allows customizable approval workflows to ensure all expenses are reviewed and approved according to company policy.

Analytics and reporting

Reporting: Ramp provides detailed reports and dashboards that offer insights into spending patterns, budget utilization, and potential cost-saving opportunities.

Analytics: The platform offers real-time analytics to help businesses make informed decisions based on current financial data.

Vendor management

Subscription management: Ramp helps businesses manage their subscriptions and recurring expenses, providing visibility into renewals and potential savings.

Vendor tracking: The platform tracks vendor performance and spending, helping businesses negotiate better terms and manage supplier relationships effectively.

What are the best Ramp alternatives?

While Ramp is a powerful tool, businesses might find that alternatives such as Shoeboxed, Brex, Divvy, Expensify, Airbase, or others better meet their specific needs, preferences, or limitations.

Here are what we've found to be the best Ramp alternatives:

1. Shoeboxed - ideal for small businesses looking for a comprehensive receipt management platform

Here's a detailed look at why Shoeboxed excels:

Comprehensive receipt management

Shoeboxed allows users to scan, digitize, and organize receipts. This helps businesses keep accurate and organized financial records which is key to expense tracking and tax compliance.

The platform’s ability to handle physical and digital receipts makes it unique and highly versatile.

Digital receipts

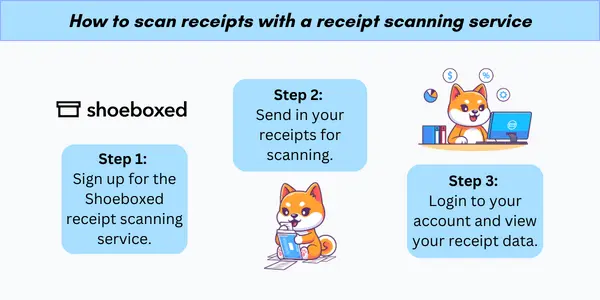

To scan receipts using a mobile device and Shoeboxed’s app, snap a photo of the receipt with your mobile device’s camera and upload it to your Shoeboxed account through the app.

Physical receipts

Shoeboxed offers a mail-in service for businesses that want to outsource the digitization process. You can send your receipts in a pre-paid Magic Envelope, and Shoeboxed will scan and digitize them for you.

This is especially helpful for businesses with a high volume of physical receipts that don’t have time to do their own scanning.

Shoeboxed is the only receipt scanner app that handles both paper and digital receipts, saving customers up to 9.2 hours per week from manual data entry!

Advanced OCR technology for organizing receipts

Shoeboxed’s advanced Optical Character Recognition (OCR) technology extracts data from scanned receipts and automatically categorizes them. This reduces errors and makes expense tracking more efficient.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayAutomatic expense reporting

Shoeboxed generates detailed expense reports with one click, which is perfect for financial analysis, reimbursements, and tax prep.

Seamless integration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and many more. This integration syncs digitized receipts with financial records, reduces manual data entry, and makes accounting easier.

Ease of use and accessibility

Shoeboxed has a simple interface and mobile app, so users can capture and manage receipts on the go. Cloud storage means all receipts are stored securely and can be accessed anywhere.

Cost-effective solution

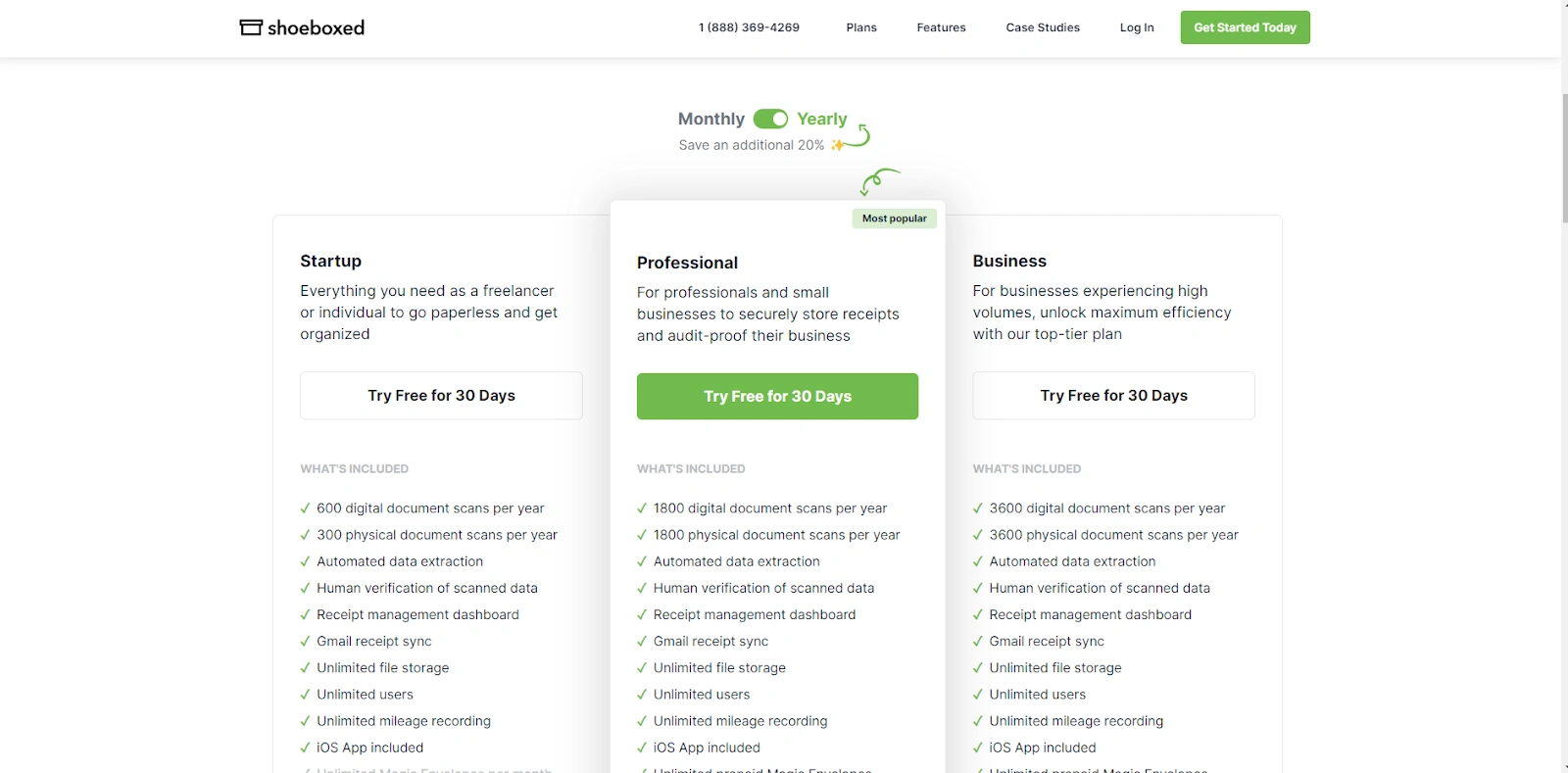

Compared to Ramp, Shoeboxed is an affordable solution for small to medium-sized businesses. With plans starting at $18/month, it has all the receipt management features without the big price tag.

Pros

Easy to use and highly efficient.

Protects receipts from physical degradation by digitizing them.

Enhances tax preparation and audit readiness.

Cons

Scanning backlog receipts during the initial setup can be time-consuming, but you could outsource the scanning to Shoeboxed.

Pricing

Plans start at $18 per month, with higher tiers available based on volume and features.

Shoeboxed is the best alternative to Ramp because of its receipt and expense management functionality, accounting software integration, advanced OCR, user-friendly design, and affordability. All of this gives businesses a complete solution to streamline their expense management and keep financial records accurate.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today2. Brex - ideal for startups who don't have a long credit history

Brex is a financial technology company that offers a range of services tailored to modern businesses, particularly startups and rapidly growing companies. Its core product is a corporate credit card that provides higher credit limits based on business performance rather than personal credit scores, eliminating the need for personal guarantees.

Credit limits based on business performance

Unlike traditional credit cards that base limits on personal credit scores, Brex bases limits on the business’s financial performance and cash flow.

Expense management tools

Brex has expense management tools, including expense tracking, real-time spend visibility, and integration with popular accounting software like QuickBooks and Xero.

Rewards program for business expenses

Brex has a customizable rewards program where businesses can earn points on categories most relevant to their spending, such as travel, dining, software, and more.

No personal guarantee required

Brex doesn’t require a personal guarantee, so business owners are not personally liable for the debt.

Integrations

Integrates with accounting tools and enterprise resource planning systems. Brex integrates with various financial tools and platforms including accounting software (QuickBooks, Xero), travel booking platforms and financial management tools.

Pros

No personal guarantee is required.

Comprehensive expense management tools.

Higher credit limits.

Cons

Available only to C-Corps, S-Corps, LLCs, and LLPs.

It may not be suitable for small businesses or startups without significant funding.

Pricing

Free for the core platform, additional costs may apply for premium features.

Brex is a good alternative to Ramp because of its flexible credit, expense management, customizable rewards program, no personal guarantees, and integrations with financial tools.

3. Bill (formerly Divvy) - ideal for businesses looking for a free financial management platform

Bill, formerly known as Divvy, is a financial management platform designed to streamline expense management and budgeting for businesses. The platform's user-friendly interface and features make it a valuable tool for managing corporate finances efficiently.

Here’s why Bill is a practical choice for businesses looking for spend management solutions:

Budgeting and expense management

Bill has budgeting tools that allow businesses to create, track, and manage budgets in real-time. The platform has expense tracking, approval workflows, and reporting to streamline financials and keep spending within budget.

Real-time expense tracking

Bill has real-time expense tracking so businesses can monitor and control spending as it happens.

Free to use

One of the best features of Bill is that it’s free to use. Unlike other financial management platforms that charge subscription fees, Bill offers its core features for free. The company makes money from interchange fees from merchants, which makes it affordable for businesses of all sizes.

Corporate cards

Bill has physical and virtual corporate cards integrated with its expense management platform. These virtual cards have built-in controls to set spending limits, track real-time transactions, and ensure company policies are followed.

Pros

Free to use.

Real-time expense tracking.

Strong budgeting tools.

Cons

Customer support can be slow.

Some users report issues with the mobile app.

Pricing

Free for all features, including corporate cards and expense management tools.

Bill is a reasonable alternative to Ramp. It has budgeting and expense management tools, real-time expense tracking and zero cost pricing. Its corporate cards, simple-to-use interface, and financial and spending controls make it a good choice for businesses to streamline financials and control spending.

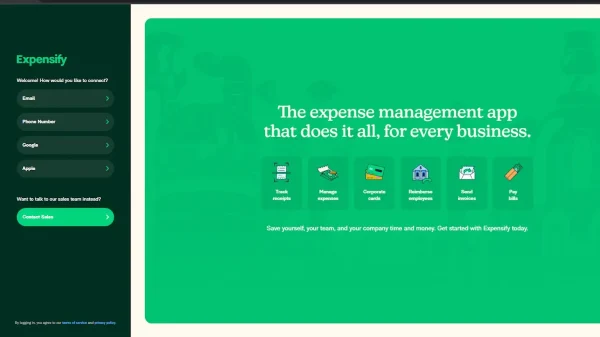

4. Expensify - ideal for businesses looking for a user-friendly interface

Expensify is an expense report and management tool with features to simplify and automate expense reporting and management.

Here’s why Expensify is a good alternative to Ramp:

Receipt scanning and expense categorization

Expensify’s receipt scanning uses OCR technology to capture and categorize expenses.

Expense reports

Expensify has expense reporting tools to track and analyze business expenses.

Accounting software integration

Expensify integrates with various accounting software including QuickBooks, Xero, NetSuite etc.

Corporate cards

Expensify has corporate cards integrated with its expense management platform. These cards have built-in controls to set spending limits, manage payments, track transactions in real time and ensure company policies are followed.

Simple to use

Expensify is simple to use so employees and administrators can easily navigate and use it. The mobile app makes it so that users can manage expenses, capture receipts and approve reports.

Pros

User-friendly interface.

Strong integration capabilities.

Advanced expense reporting features.

Cons

It can be expensive for larger teams.

Some users find the setup process complex.

Pricing

Plans with basic features start at $5 per user per month. Advanced plans cost more based on additional features and the number of users.

Expensify is a good alternative to Ramp, with features like receipt scanning, expense reporting, accounting software integration, and corporate cards.

5. Airbase - ideal for businesses looking for an all-in-one platform

Airbase is a spend management platform designed to streamline financial operations for businesses. Airbase's features are particularly beneficial for mid-sized to large enterprises seeking to optimize their financial management processes.

Here’s why Airbase is a good alternative to Ramp:

All-in-one spend management

Airbase has expense management, corporate card management, and accounts payable in one platform.

Real-time expense tracking and controls

Airbase has real-time expense tracking so businesses can see spending as it occurs. The platform has controls to set spending limits, expense approvals, approval workflows, and policy enforcement.

Accounting workflows

Airbase automates accounting tasks like expense categorization, invoice processing, and reconciliation.

Financial tool integration

Airbase integrates with accounting software like QuickBooks, Xero, etc.

Pros

All-in-one spend management platform.

Accounting automation.

Customizable approval workflows.

Cons

Higher pricing tiers.

It has a steeper learning curve.

Pricing

Contact Airbase for customized pricing based on your business needs.

Airbase is a good alternative to Ramp. It has spend management features, real-time expense tracking, automated accounting workflows, and integrations.

How well does spend management work with the right tools?

Having the right spend management tools significantly benefits businesses.

Here’s how spend management works with the right tools:

1. Cost savings and financial efficiency

Effective spend management tools allow organizations to track and control spending in real-time. Businesses reduce overall spending by identifying and eliminating unnecessary expenses.

2. Visibility and control

Spend management tools give visibility into spending across departments and projects. This allows finance teams to make informed decisions, manage cash flow, and ensure spending is aligned to goals.

3. Compliance and risk reduction

Automated workflows and policy enforcement ensures all expenses comply with internal and external regulations. This reduces fraud, errors, and non-compliance penalties.

4. Time savings and productivity

Automating expense tracking, reporting, and approval saves employees and finance teams a lot of time. Staff can focus on more strategic tasks than manual data entry and reconciliation.

5. Data and decision-making

Advanced analytics and reporting of spend management tools give actionable insights into spending trends and cost savings opportunities. These data-driven insights help businesses optimize their financial strategy and perform better financially.

Frequently asked questions

1. How does Brex compare to Ramp in terms of credit limits?

Brex offers higher credit limits based on the business’s financial performance, not the personal credit scores of the business owners. This is good for startups and fast-growing companies.

2. Can Shoeboxed integrate with my existing accounting software?

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and many more.

In conclusion

Choosing the right financial management tool and expense processes depends on your business needs, size, and budget. While Ramp is a good option, alternatives like Shoeboxed, Brex, Bill, Expensify, and Airbase have unique features and pricing that may fit your requirements.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!