Real estate agents often manage a complex array of expenses. These can range from marketing costs to travel expenditures.

Given the nature of the real estate business, tracking these and other expenses is crucial for financial planning and claiming tax deductions as a real estate professional.

An Excel expense sheet designed as a real estate expense tracker can be a helpful tool for realtors. Such trackers allow meticulous record-keeping and analysis of where money is being spent and help agents identify potential areas for cost savings.

Some templates are free, providing a good starting point for agents to manage their finances.

Here are the top four Excel spreadsheets that realtors can use to manage their finances, plus one nifty service that realtors won't want to miss.

Top 5 free Excel spreadsheets for realtors

A robust system is essential for efficiency and financial tracking when managing real estate transactions and expenses.

The following templates often include various categories specific to real estate operations, enabling agents to adapt the spreadsheet to reflect their unique business model and the types of expenses they regularly incur.

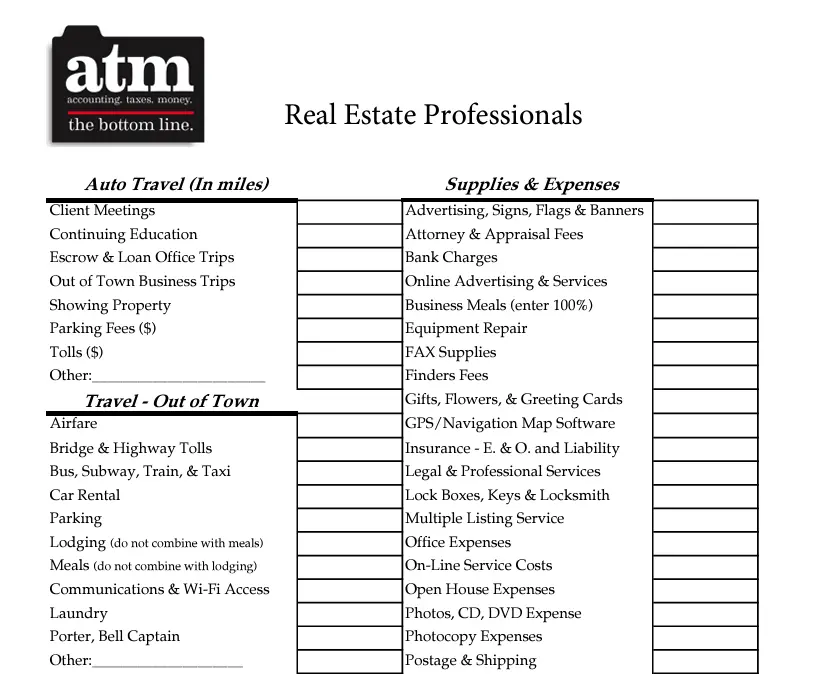

1. Real Estate Expense Worksheet from ATM

ATM offers a real estate expense worksheet that focuses on helping real estate professionals calculate totals from their business-related expenses.

This tool enables users to categorize expenses into common tax-deductible buckets, including auto-related travel expenses, travel out of town, supplies and expenses, and more.

The worksheet aims to simplify expense management and support end-of-year and tax return preparation with its structured layout.

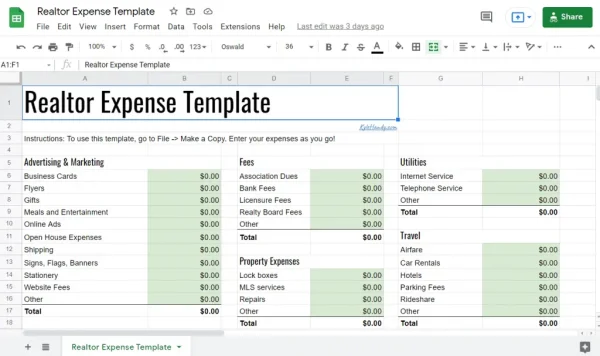

2. Realtor Expense Spreadsheet by Kyle Handy

Kyle Handy's realtor expense spreadsheet assists agents in maintaining their financial records efficiently.

It combines expense management with real estate sales tracking in one easy-to-use template. Agents can enter their expenses under pre-defined categories, and the spreadsheet totals them accordingly, helping realtors make informed business decisions.

To use this spreadsheet in Excel, download the file from Google Sheets in .csv or .xlsx format and then open the file in Excel.

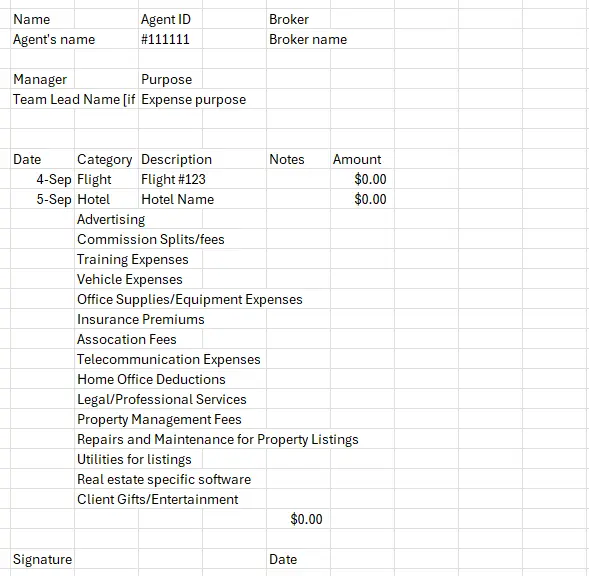

3. KS Realty Agent Templates

KS Realty Agent provides an expenses spreadsheet tailored for real estate agents who need a detailed method for tracking their spending.

This template categorizes expenses, making it simple for agents to see where they allocate their funds.

Users can input expenses as they occur, automatically totaled to see monthly and yearly expenditures.

4. US Legal Forms Real Estate Spreadsheet

This comprehensive spreadsheet from US Legal Forms is designed to record expenses and assist with legal documents and tax filings for realtors.

It integrates expense tracking with key forms and provides guidelines to help ensure that realtors remain compliant with regulations. The focus on legal compliance makes it a valuable tool for those wanting to ensure due diligence in their financial management.

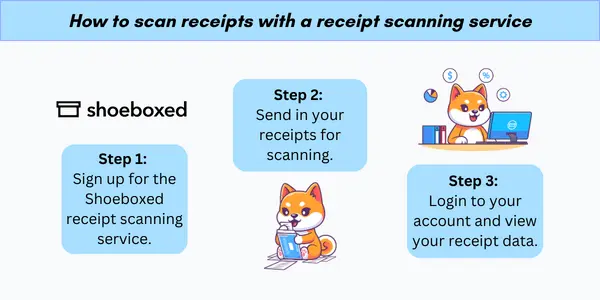

Bonus: Shoeboxed’s receipt scanning service

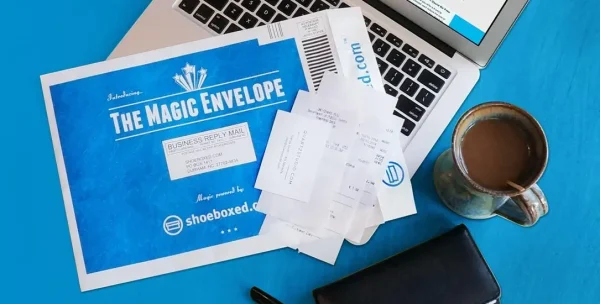

For real estate agents who are always on the go, a notable option is to use Shoeboxed’s Magic Envelope service to outsource manual receipt and expense entry.

Starting from $18 per month, you receive a postage-prepaid Magic Envelope that you can keep on your car’s dashboard. Simply stuff receipts into the envelope as you pay for gas, meet clients for lunch, and purchase supplies.

At the end of the month, send the Magic Envelope to Shoeboxed’s scanning facility in Durham, NC, and get all your data scanned and categorized into 15 common tax categories. Easy peasy.

Voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk, Shoeboxed's award-winning features include the following:

“Set and forget” expense reporting—use the Magic Envelope to store your receipts, ship them at the end of the week or the month, and get them scanned and uploaded to your account.

Accurate mileage tracking that can be included in expense reports.

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Add multiple users to a single account for FREE.

Store digital copies of important documents, such as invoices and warranties.

Integrate with other accounting software, such as QuickBooks, for tax reporting and accounting purposes.

Used and trusted by realtors.

Price

Plans that include the Magic Envelope start at $18/month.

30-day free trial.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started TodayWhat else can Shoeboxed do?

A quick overview of Shoeboxed's award-winning features:

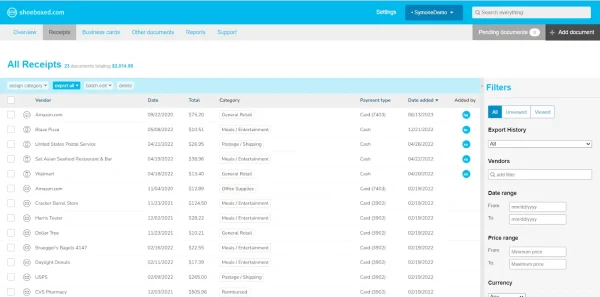

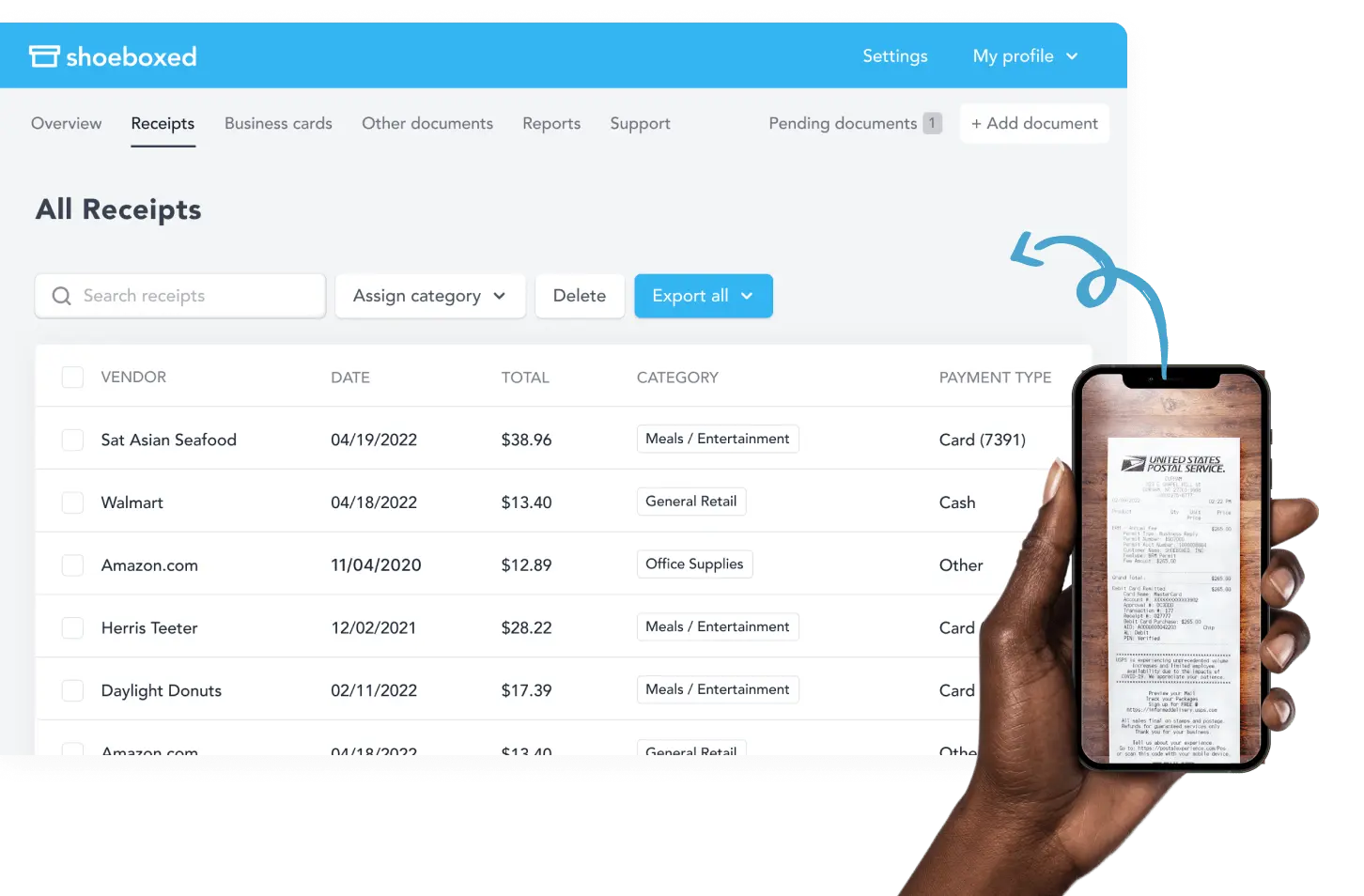

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

The Magic Envelope service is Shoeboxed's most popular feature, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to set up a real estate expense-tracking spreadsheet

This section will guide you through the key components needed to set up an Excel real estate expenses spreadsheet.

1. Know the basics of Excel for tracking

For real estate agents, mastering basic Excel functions is crucial for tracking expenses.

This includes understanding how to input data, format cells, and utilize formulas for sums and calculations.

One can use the SUM() function to total expenses and VLOOKUP() or INDEX(MATCH()) to categorize and match data efficiently.

2. Establish a worksheet structure

A well-organized worksheet structure is vital for clarity and easy data management.

A recommended approach is to have:

A Dashboard for an overview of financial status

A Monthly Expenses Tab for detailed entries

Annual Summary capturing the year's financial activity

The Monthly Expenses Tab should have columns for Date, Amount, Category, and Description for every expense incurred.

Some realtors like to include real estate agent income and business-related expenses in the same spreadsheet for a clear overview of inflow and outflow.

3. Decide on expense categories

Categorizing expenses helps identify spending patterns and manage the budget effectively.

Common expense categories in real estate include:

Advertising costs (print ads, etc.)

Social media promotion

Travel

Vehicle expenses

Home office expenses (office supplies)

Professional services and fees

Insurance premiums

Continuing education

If you're involved in real estate investment or property management, you'll also want to include any additional expenses for your rental properties, rental expenses, etc.

Customize your most common expenses according to specific business needs and regularly update the spreadsheet for accurate tracking.

4. Record transactions

Achieving accuracy in data entry is crucial. This ensures reliable tracking of income and expenses, which can help you save time when doing taxes.

Typically, a real estate agent expenses spreadsheet provides distinct columns for the type of expense, amount, vendor, and payment method.

This structured approach allows for efficient categorization and retrieval of financial information.

Expense Type |

Amount |

Vendor |

Payment Method |

Marketing |

$150 |

ABC Inc. |

Credit Card |

License Renewal |

$85 |

State Board |

Debit Card |

Date and time stamps are vital for chronological tracking and aid in identifying transaction patterns over time.

Each entry should include a precise date and, if necessary, the time of the transaction.

This information facilitates accurate reporting and can be particularly useful during tax season or when analyzing monthly cash flow.

Date |

Time |

Transaction Details |

Amount |

03/23/2024 |

2:00 PM |

Client meeting coffee |

$6 |

03/24/2024 |

9:30 AM |

Office Supplies Purchase |

$45 |

5. Create expense reports

An expense tracker can also be used as an expense report if you operate a real estate brokerage or are part of a team. The expense report would then be turned in to the accounting team, bookkeeper, or tax professional you work with.

In Excel, one typically starts by creating a ledger-style format for logging every monetary event.

For instance, for an expense report spreadsheet, one lays out columns for date, expense category, description, and amount. Here is a simple example:

Date |

Category |

Description |

Amount ($) |

03/24/2024 |

Travel |

Mileage to property visit |

45.00 |

03/25/2024 |

Advertising |

Online ad for listing |

75.00 |

03/26/2024 |

Office Supplies |

Printer ink purchase |

39.99 |

To tailor such reports, agents often incorporate formulas that automatically tally expenses per category. This provides a clear view of where funds are most directed. They might also adjust categories specific to their needs.

By customizing reports, the agent ensures they reflect the unique aspects of their business. For example, adding a column for Client may be beneficial for tracking who is associated with each expense:

Date |

Category |

Description |

Amount ($) |

Client |

03/24/2024 |

Travel |

Mileage to property visit |

45.00 |

J. Doe |

03/25/2024 |

Advertising |

Online ad for listing |

75.00 |

S. Smith |

03/26/2024 |

Office Supplies |

Printer ink purchase |

39.99 |

General |

By applying filters or conditional formatting, the spreadsheet acts as a static record and an interactive tool to assess financial status.

Alternatively, realtors who want an efficient way of keeping track of expenses with as little fuss as possible choose Shoeboxed.

In a recent survey of Shoeboxed customers, realtors accounted for Shoeboxed's second-largest user group! Reviews from Shoeboxed's realtor customer base show that they love the ability to keep a Magic Envelope on their car dashboard, stuff receipts into it as they pay for gas, have meals with clients, and show listings.

Then, at the end of the month, they ship their receipts in to get scanned and processed into their online dashboard.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayBest practices for tracking expenses for realtors

Tracking monthly expenses and income with an Excel spreadsheet clearly shows a business's financial health. Realtors can quickly assess performance data and adjust strategies accordingly.

1. Run a monthly financial overview

A Financial Overview section consolidates all critical financial data in a table format, displaying categories such as Monthly Rental Income, Operating Expenses, Mortgage Payments, and Net Cash Flow.

Category |

Amount |

Rental Income |

$X,XXX |

Operating Expenses |

($XXX) |

Mortgage Payments |

($X,XXX) |

Net Cash Flow |

$XXX |

This setup enables a quick assessment of the property’s profitability each month and helps detect any immediate financial issues that need attention.

2. Analyze trends and patterns

Within the Trends and Patterns subsection, realtors can use graphs or charts to visualize the rise and fall of real estate agent expenses and income over time.

Spotting these trends ensures investors can make informed decisions to capitalize on positive patterns or course-correct negative ones.

3. Learn formulas and functions

Automation in real estate expense tracker Excel spreadsheets enhances efficiency by minimizing manual entry and reducing errors. It enables agents and investors to handle their financial data effectively.

Excel's formulas and functions are pivotal in automating calculations within a real estate expense tracker. They allow one to automate complex calculations like summing totals, calculating tax deductions, or forecasting future expenses.

For instance, using =SUM(range) sums up a column of expenses, while =AVERAGE(range) calculates the mean. The VLOOKUP function can match and retrieve data across different tables, making expense categorization seamless.

4. Use conditional formatting

Conditional formatting in Excel enhances automation by visually highlighting key data points, such as overdue payments or budget variances. Users might set rules to change the cell's background color when expenses exceed a certain threshold or to flag potential errors.

This visual aid assists in quickly identifying trends and areas needing attention. Rental property performance can be tracked monthly by applying conditional formatting that reflects income and expense status.

Frequently asked questions

What is a real estate expense tracker Excel spreadsheet?

A real estate expense tracker Excel spreadsheet is a digital tool realtors use to record all expenses related to their business operations. This includes marketing costs, travel expenses, office supplies, and any other expenditures that occur during real estate activities.

Why do real estate agents need an expense tracker?

Real estate agents utilize expense trackers to monitor financial outflows, optimize budgeting, and simplify tax preparation. Effective tracking helps agents identify potential areas for cost savings and ensures accurate reporting of business expenses for tax deduction purposes.

Can the spreadsheet template be customized?

Yes, most spreadsheet templates are designed to be customizable. Agents can modify categories to track income, add new formulas, and adjust the layout to fit their unique needs and preferences.

How does an expense tracker help during tax season?

An expense tracker usually aligns with the tax deduction worksheet requirements, simplifying the claim process. Accurate and organized records of expenses throughout the year help agents are better prepared for tax filing.

Are there any free templates available?

Some free templates are available online, which we have mentioned in this article. These can serve as a starting point for agents developing their expense-tracking systems. Alternatively, realtors can outsource expense management to services like Shoeboxed’s receipt scanning service.

In closing

An expense tracker Excel spreadsheet ensures real estate agents have detailed records of income and major expenses, simplifying tax preparation and financial analysis.

Incorporating a way to track expenses helps real estate professionals remain diligent about their finances and equips them with valuable insights necessary for informed decision-making about their business finances.

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!