Discover a mammoth round-up of receipt organization tips and learn best practices for how to save hard copies of paper receipts, scan receipts, and organize receipts for better receipt management.

Why is receipt management important for business owners?

The following are some of the primary benefits of organizing receipts.

For monitoring supply costs

How long should you keep your business receipts?

The time you must keep supporting documentation for your tax return depends on your business type and tax requirements. The IRS mandates simple record keeping until the period of limitations—the period you can adjust your return to claim a refund or a credit—has expired.

Practically speaking, the IRS provides the following key takeaways:

Retain business receipts for 3 years unless circumstances (4), (5), and (6) below apply.

Retain receipts for 3 years beginning from when you filed your original return or when you pay your taxes, whichever is later, to file a claim for a credit or refund.

Retain business receipts for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

If you don’t report the income you’re supposed to, you must keep track of all the receipts for 6 years, and if the unreported amount is higher than 25% of your gross income on your tax return.

Retain your receipts forever if you do not submit a tax return form.

Retain your receipts forever if you submit a fraudulent return.

Retain receipts related to employment tax for a minimum of 4 years after the day on which the tax will expire or be paid, whichever is later.

Even after you no longer need to keep receipts and records for tax purposes, don’t throw them away until you double-check whether you might wish to hold on to them for other reasons. Other organizations, such as creditors or insurance companies, may require your records for other purposes.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat receipts should you keep for taxes?

There are several expense receipts you should keep as supporting tax documentation, which we list below.

Sales receipts for product inventory and raw material

Business assets

Other expenses used to operate your business

Vehicle expenses

Educational expenses

Advertising fees

Client entertainment costs

Professional services

Networking

See also:

What to Keep Track of as an Independent Contractor: 7 Document Types

Shoeboxed vs. Expensify Email Receipts: Which One is Better?

How to Organize Invoices and Receipts for Maximum Efficiency

What are the requirements for scans of receipts to be accepted by the IRS?

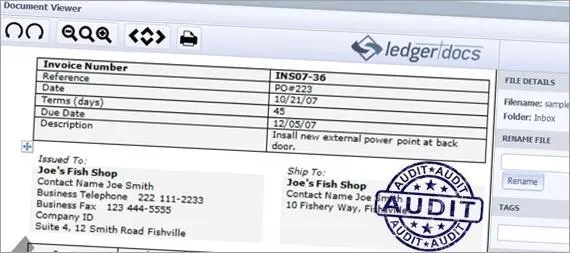

According to the IRS, digital or scanned receipts are accepted but must meet the following requirements:

Scans are completely identical to their original versions.

Each scan must exhibit a high degree of legibility and readability.

You must be able to produce hard copies of the scanned receipts (print outs) in the event of an IRS audit.

Scanned documents must be stored in a secure place.

Example of a scanned receipt accepted by the IRS from Ledgerdocs.

If you can ensure your scanned receipts are properly stored and backed up, and you can reproduce hard copies from them in a legible, readable format, you may dispose of the original receipts.

See “Rev. Proc. 97-22 (Recordkeeping – Electronic Storage System),” IRS.gov.

9 best receipt organization ideas for paper and digital receipts

We started blogging about receipt management as far back as 2008! During the 14 years we’ve been in the receipt-scanning business, these are the receipt storage ideas and tips that have risen to the top:

9 best receipt organization ideas for paper and digital receipts

1. Use a file folder or a binder for paper receipts

Stationery files make great organizers for small business owners or for your home file organization system. For example, think binders with clear pockets to store your receipts.

Paper receipt organizer for small business use: accordion file organizer, available on Amazon.

2. Create categories by expense type for paper receipts

Use tabs, labels, pockets, or filing boxes to categorize spending by expense type when filing receipts away. This will save you time when claiming deductibles for an expense category during tax season.

3. Process your receipts daily

Receipts can be easy to lose track of—so we recommend scheduling a moment in your daily routine to process all the receipts you collected throughout the day. Whether you use an app to scan them into your phone, you opt to receive them digitally, or you have some other organization method, the key to receipt management is not to let them pile up. A receipt app that you keep on your phone’s home screen can serve as a daily receipt organizer that can help kick this habit into gear!

4. Use the Magic Envelope to vanish receipt clutter instantly

Shoeboxed’s Magic EnvelopeTM service is an envelope (with pre-paid postage within the US) that users fill with physical receipts and mail to Shoeboxed’s office. The receipts are then scanned and auto-organized on your behalf, human-verified, logged into users’ accounts, and safely stored.

Watch this video on how to use Shoeboxed’s Magic Envelope service to effortlessly turn your receipts into data and deductibles!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today5. Make it a habit to ask for email receipts

Aside from the no-clutter aspect, digital receipts are eco-friendly! No more dealing with physical receipt storage. Instead, you can organize receipts electronically with receipt software like Shoeboxed, and a digital copy means your office or house stays paper-clutter-free.

6. Annotate physical receipts for better business expensing

Write notes on the backs of physical receipts describing the business expense. Some purchases might be obvious, e.g., a work laptop. But a restaurant bill might be less obvious. Add a note about who you’re with and why it is a business expense.

7. Place paper receipts in a folder chronologically

Want to establish an organizing system? Store receipts in the order in which you get them. Arranging receipts in chronological order is useful when trying to locate one out of a 100. Place the latest receipts in the front of the receipt folder. At the start of a new year, get a new folder to prepare for storing that year’s receipts.

8. Use a scanning app for speedy receipt scans and cloud-based retrieval

Refuse to let paper clutter accumulate. Save receipts to your phone by using an app like Shoeboxed, which allows you to organize receipts electronically and store everything in the cloud for easy tracking and reporting of business expenses.

Turn your receipts into data and deductibles with Shoeboxed!

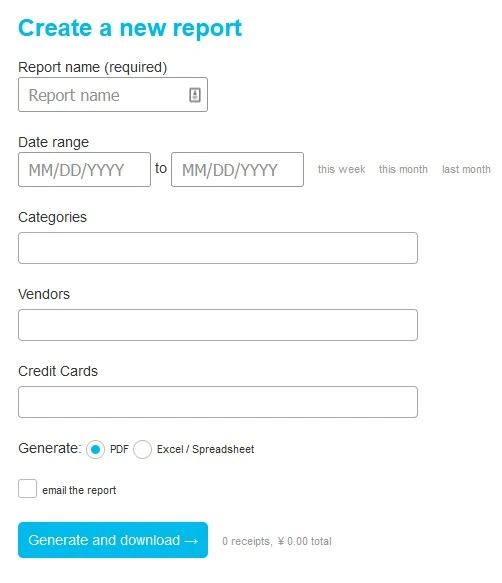

9. Export all your receipts for the year into 1 file

For those who are storing receipts electronically, you can organize your receipts simply and quickly by exporting each year’s receipts into 1 file. If you’re a Shoeboxed user, go to the “Reports” tab and select a date range spanning a full year. Include any categories you want to keep track of, and then click the “Generate and download” button.

A Shoeboxed software feature that allows you to export all your receipts into 1 pdf

Frequently asked questions

How do I keep receipts from fading?

Thermal paper, commonly used for receipts, has a chemical that changes color when sunlight or heat comes in contact with it, causing the print on the receipt to fade. Keeping your receipts in a temperature-controlled location with no direct sunlight might help to slow the fade. At best, however, this only delays the fading process and doesn’t prevent receipts from fading entirely. We have found that the surest way to preserve receipts is to scan them.

How are US businesses managing receipts?

Here are the 4 common methods small business owners in the US use to manage receipts.

They use binders, cabinetry

They use a hybrid photo/scan DIY solution (E.g., your phone, computer files, Google Drive)

They organize receipts electronically with scanning apps that include receipt management software technology (E.g., Shoeboxed, Expensify)

They use an accounting app that also allows you to organize your receipts (QuickBooks, Dext Prepare)

What’s the easiest way to scan and organize receipts for taxes?

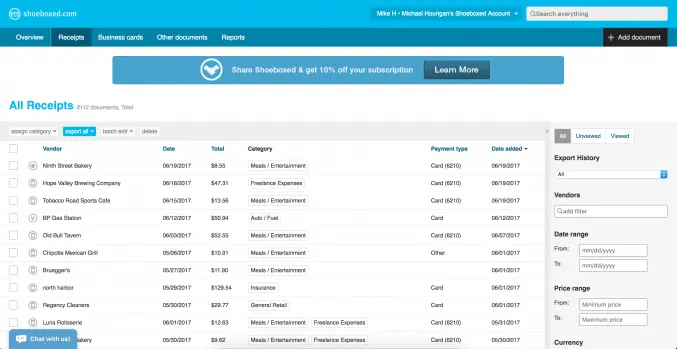

The easiest way to scan and organize receipts for taxes is to use a scanning service that also automatically sorts receipts into tax categories. For example, Shoeboxed scans receipts for you and then stores receipts electronically in your Shoeboxed account. Shoeboxed’s algorithm then goes on to assign them a common tax category.

Shoeboxed dashboard

You can also set up custom categories and category rules to help assign categories that are specific to your business. During tax season, you can use Shoeboxed’s expense report feature to export category totals and relevant receipts for each category.

What are the top 5 scanning apps with software that will organize your receipts for small businesses?

A document scanning machine may be handy, but they are often big-ticket items that require dedicated real estate on your desk. If you’re aiming to reduce paper clutter and you want a web-based app for keeping receipts digitally, check out the options below!

What is OCR and receipt data extraction?

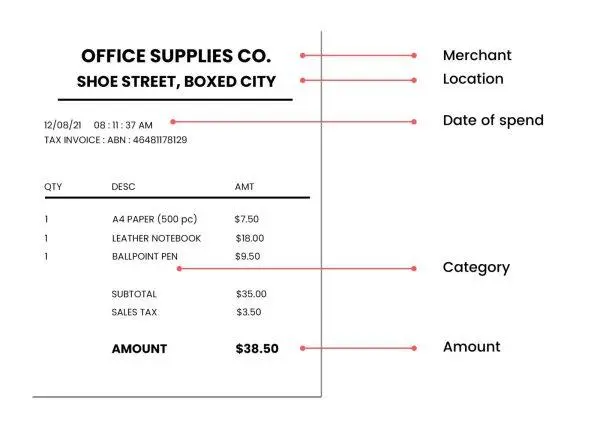

A receipt shows relevant details of a given financial transaction. Data extraction for smart receipts is an automated process of extracting and organizing critical data such as the date of purchase, vendor or merchant, and total payment from a receipt for further use.

Example of the type of data collected during the data extraction process.

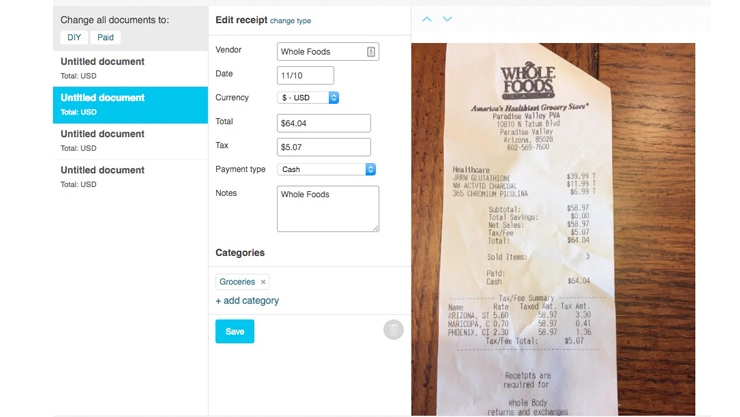

OCR (Optical Character Recognition) technology reads your receipts almost perfectly, converting printed data into digital text so that the data can be stored and analyzed.

User example of Shoeboxed’s data extraction process from Esther Schindler, PCMag.com.

For instance, with Shoeboxed’s receipt data extraction software, all essential info—including date, currency, total amount, tax, etc.—can be extracted and saved to the user’s Shoeboxed account on the cloud.

Turn your receipts into data and deductibles!

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service and receipt organizer for small business owners that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!