Are you tired of chasing down receipts and managing messy expense reports?

Managing employee expenses is crucial to running a business, and having a streamlined reimbursement process ensures efficiency and employee satisfaction.

A well-organized reimbursement form is the key to streamlining your expense claims and getting paid faster!

What is an expense reimbursement form?

A reimbursement form is a document that allows employees to claim back money spent on behalf of the company for business expenses. Most companies use a form to reimburse employees for general expenses.

Reimbursement forms help by providing a template for employees to request reimbursement. Usually, the form will include the employee’s expenses, date incurred, end date, amount, and supporting documentation (receipts).

What are some common uses of expense reimbursement forms?

A standard form is used across many industries and organizations to request reimbursement for business expenses.

Here are some common uses of forms for reimbursements:

1. Requesting reimbursement for office supplies and general admin expenses

Employees can use expense forms to request repayment for supplies and other general admin expenditures so all costs are documented.

2. Requesting reimbursement for travel expenses

Travel expenses include transport, accommodation, and food incurred during business trips.

The General Services Administration (GSA) is critical in setting guidelines for reimbursements, especially for federal employees. It establishes standard per diem rates for travel expenses such as lodging, meals, and incidentals.

These GSA rates help businesses and organizations develop fair, consistent policies aligned with federal standards.

3. Requesting reimbursement for mileage

Employees who use their vehicles for business can request mileage reimbursements. The form will have fields for date, purpose of trip, and number of miles.

4. Requesting reimbursement for training fees and professional development

Employees can use these forms to request repayment for training fees and other professional development expenditures so all costs are documented.

5. Requesting reimbursement for company events and activities

Employees can request repayment for conferences, trade shows, and other company event expenses.

By using reimbursement forms, businesses can ensure that all expenditures are documented, approved, and reimbursed.

How do you create an effective expense form?

Forms are easy to use and make the employee reimbursement process much easier.

Here are the key components to include in the form:

1. Expense categories

Include categories for expenditures like travel, supplies, meals, etc., so employees can report the individual expenses separately. This will make it much easier at tax time to claim these as deductions.

2. 'Attach receipts' section

Please always include a section where an employee can attach receipts or proof of payment.

3. Description request field

Add a space for employees to describe their expenditures, dates, and amounts.

4. Use a template

Use a template with a clean layout and fields for the specific information to minimize errors.

Are there any free downloadable reimbursement expense templates?

Suppose you're looking for a quick and easy way to streamline your process for reimbursements. In that case, there are plenty of free downloadable templates available online that can be customized to fit your business needs.

Here are just a few:

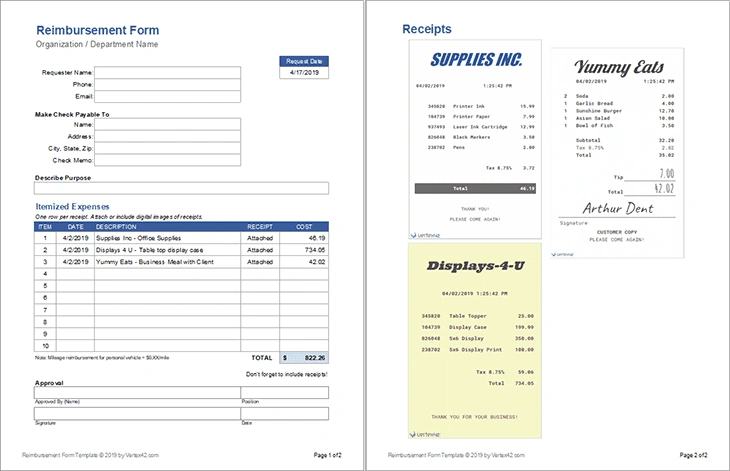

1. Reimbursement Form with Receipts by Vertex42

With this template, you can embed receipt images directly into the form. This allows you to print the form and receipts as a single PDF file for a streamlined submission process.

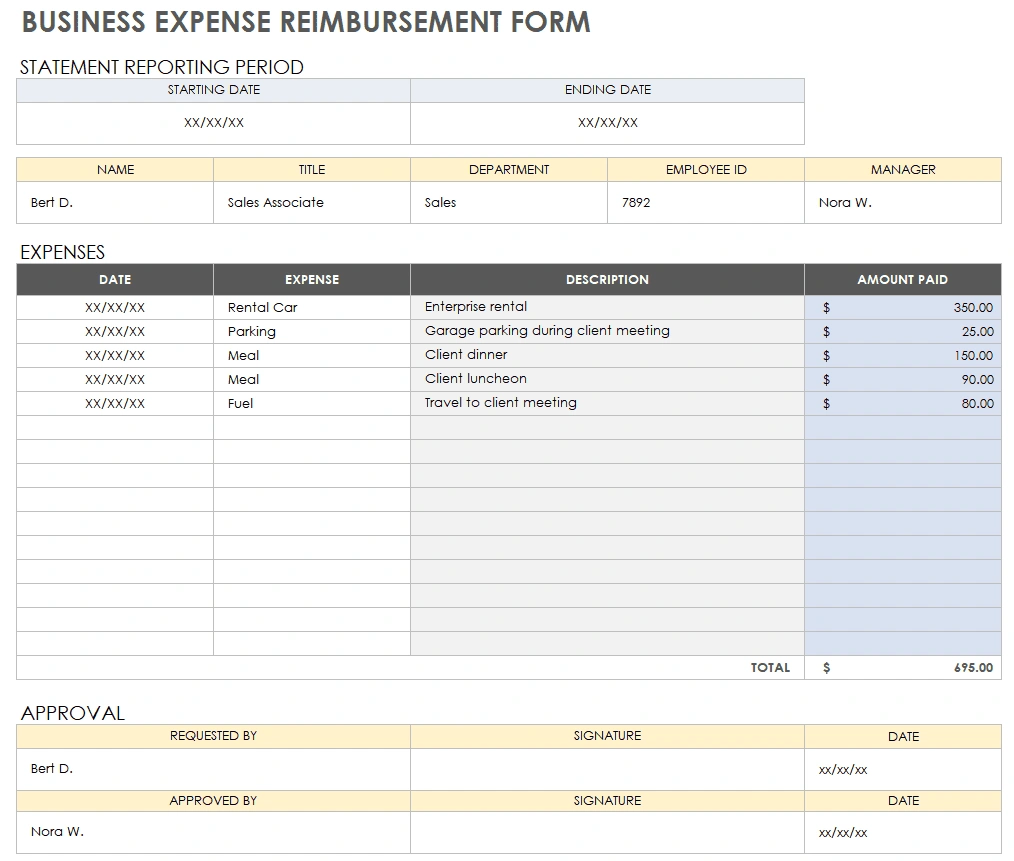

2. Business Expense Reimbursement Form by Smartsheet

This is a simple template that you can print detailing descriptions, listing amounts, and recording transaction dates. The template can also be easily customized to add more columns or information.

How can you simplify the process of requesting reimbursements?

The easiest way to simplify reimbursements is to automate as much of the process as possible.

Shoeboxed - ideal for businesses that want to automate expense management and reimbursements

Tools like Shoeboxed digitize receipts, categorize expenses, generate expense reports, and streamline the process so reimbursements are faster and more organized.

Here’s how Shoeboxed can help employees and employers efficiently manage expenses:

1. Conveniently tracks receipts

On the go, employees can scan and digitize their receipts via the mobile app by using their smartphone's camera to snap a picture of the receipt. The app then automatically uploads the receipt to your designated Shoeboxed account where it will be automatically processed.

In the office on a laptop or desktop, receipts are digitized by using the drag-and-drop method so that you can submit multiple receipts at one time.

You can forward receipts directly to your Shoeboxed account or use their Gmail plugin that will automatically find e-receipts in your inbox and automatically send them to your Shoeboxed account.

Or, if you don't want to deal with the receipts at all, you can stuff them in Shoeboxed's prepaid postage free Magic Envelope and send them to their processing center where their team will scan, human-verify, and upload receipts into your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Physical receipts method—Give your team a Magic Envelope per month and simply have them send in their receipts for scanning and data validation and extraction. Physical + Digital plans start from $18 per month for 600 digital document scans + 300 physical document scans.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Organizes data

The app’s OCR technology converts the printed text into searchable data, making any receipt quick to track down and report for reimbursement.

3. Categorizes expenses

Shoeboxed automatically categorizes expenses for reimbursement into 15 custom or tax categories so employees and employers can easily keep track of how much has been spent on what.

4. Automates expense reporting

Shoeboxed also automatically generates expense reports with just a click of a button, making reimbursements an extremely straightforward process.

5. Cloud storage

All receipts and documents are stored in the cloud so employees and managers can access, retrieve, and review expenses anywhere.

6. Export for reimbursement forms

Employees can quickly transfer organized expenses and receipts into custom expense reports or forms to submit to their manager for approval.

7. Accounting software integration

Shoeboxed integrates with QuickBooks and Xero so businesses can manage employee expenses and comply with company policies.

8. Free sub-users

With Shoeboxed, you can add an unlimited number of sub-users such as bookkeeper, accountant, and employees and grant them specified access to the account so that all company receipts and expenses are located in one place.

Digital method—Sign up to Shoeboxed.com, and create free users for each team member. Each team member then downloads the Shoeboxed app for tracking receipts on the go. Digital plans start from $18 for 600 digital document scans.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat are the best practices for expense reimbursement?

To make the expense reimbursement process as smooth as possible, follow these best practices:

Define categories for business expenses so employees know what can be reimbursed.

Set per diem rates for meals and lodging to make travel reimbursements easy.

Require receipts so employees attach proof of purchase to their reimbursements form.

Consider providing a company credit card. This can significantly reduce the need for reimbursements, simplify expense tracking, and ensure that employees have the necessary funds for their business-related activities.

Designate someone or a department to handle reimbursement requests.

Establish clear company policy guidelines for reimbursements.

Set up an efficient system to track and manage requests.

Reimburse employees on time.

Implement a digital system to make it easier.

Review and update policies regularly to keep up with company changes and regulations.

Frequently asked questions

How should employees submit their reimbursement requests?

Submit your reimbursement request using the company form and attach all receipts to support your claim. Submit on time – usually within 30 days of incurring the expense so it can process quickly.

What are the best practices for managing reimbursement requests?

To manage reimbursement requests:

Designate a department or person to handle reimbursements.

Have clear guidelines on what is eligible and submission deadlines.

Use Shoeboxed to track and manage requests.

Make sure to process and pay reimbursements on time to keep employees happy.

In conclusion

In most businesses, employees must pay out of pocket for expenses, especially travel to conferences, meetings, or offsite work. An expense form ensures they get reimbursed quickly and are not left to bear the cost themselves.

More importantly, these forms provide documentation of accounting records and help prevent fraud. In case of discrepancies between the reimbursed amount and actual expenses, the form is a reference to verify what was claimed and what was paid.

Expense forms are part of any reimbursement policy to prevent underpayment or overpayment of employees for business expenses.

Shoeboxed makes it even easier, from auto-organizing receipts to categorizing expenses to generating reports.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!