Tired of chasing down receipts and waiting weeks for reimbursement?

Managing employee expenses and getting them reimbursed in a timely manner is part of any business’s financial process. An employee expense report is the tool companies use to track and reimburse employees for business expenses.

When employees incur expenses like travel, meals, and office supplies on behalf of the company, these costs are documented, reviewed, and reimbursed through the expense report process.

A streamlined expense report process could be the game-changer your business needs to save time and money.

What is an expense report?

An expense report is a document that tracks and records the costs employees incur while doing their jobs. This allows companies to reimburse employees for the money they use from their personal funds for business expenses. Tracking actual expenses is key to accurate financial reporting and IRS compliance.

Expense reports ensure transactions are accounted for, and employees are paid back for out-of-pocket expenses. Travel, meals, office supplies, and other job-related purchases are common reimbursable expenses.

An expense report is a detailed breakdown of an employee’s business expenses. It’s submitted to the employer for reimbursement, and the costs incurred by the employee while working for the company are recorded.

It includes each expense's date, amount, purpose, and receipts or other supporting documents. By documenting these expenses properly, companies can ensure accurate reimbursement and a clear audit trail for tax purposes.

Key points

An expense report is a document that tracks and records employee expenses incurred while performing job-related duties.

It’s a way for companies to reimburse employees for the money they use from their personal funds for work-related expenses.

The expense report process gets companies to reimburse employees for expenses incurred on behalf of their employer with their funds.

What is an expense policy?

An expense policy is essential to guide employees in managing and documenting business expenses.

It should cover:

1. Eligible expenses

What are the reimbursable categories? (travel, office supplies, meals, conference fees)

2. Business vs personal expenses

It’s important to separate personal and business expenses to stay compliant and avoid misuse of company funds. Employees should know that personal expenses are not eligible for reimbursement, and using business resources for personal purchases may require them to reimburse the company.

3. Documentation requirements

What documentation is required for reimbursement? (receipts, notes on purpose of expense, proof of payment)

4. Spending limits and categories

Limit spending on specific categories (meals, lodging), so employees stay within the company budget.

5. Reimbursement process

What steps do employees need to follow to submit expenses? What is the review and approval process? How long until reimbursement?

A company expense policy should include what expenses are covered or allowed, how to document costs, and the reimbursement process.

Why is an employee expense report essential?

Expense reporting offers more than just a way to track employee spending—it provides businesses with essential insights into financial health, helps control costs, and ensures compliance with internal policies and tax regulations.

1. Reimburse employees

Expense reports are the key to getting employees reimbursed for work-related expenses on time.

2. Track business transactions

They help track business transactions so every dollar spent aligns with company policies and budgets.

3. Expense control and compliance

Expense reports help companies control costs, comply with internal policies, and avoid overspending.

4. Tax preparation and deductions

Accurate expense reports are required for tax filing to ensure businesses qualify for expenses that can be deducted from their taxable income.

What is the expense reporting process?

The expense reporting process typically involves the following steps:

1. Expense incurrence

Employees incur business-related expenses, such as travel, meals, or office supplies.

2. Expense documentation

Employees gather receipts and other supporting documentation for each expense.

3. Expense report creation

Employees create an expense report manually or using expense reporting software, detailing each expense and attaching supporting documentation.

4. Expense report submission

Employees submit expense reports to their manager or finance team for review and approval.

5. Expense report approval

The manager or finance team reviews and approves the expense report, ensuring the expenses are legitimate and comply with company policies.

6. Reimbursement

The company reimburses the employee for the approved expenses.

This structured process ensures that all business expenses are properly documented, reviewed, and reimbursed, maintaining financial integrity and compliance.

Manual vs. automated expense reporting

You can choose manual or automated expense reporting. Manual expense reporting means employees submit paper reports, which are then reviewed and approved by managers and finance teams. This process can be slow and error-prone.

I have found expense reporting that uses expense reporting software to streamline the reimbursement process is more efficient and reduces manual errors. Computerized systems can capture and categorize expenses, integrate with accounting software, and give real-time tracking, so it’s faster and more accurate.

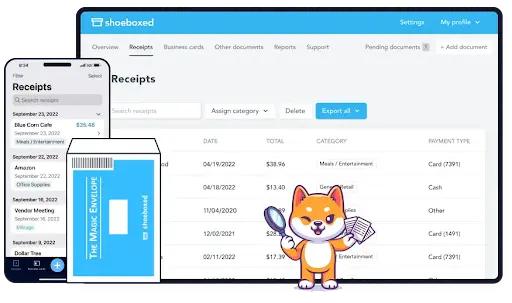

How can Shoeboxed help with reimbursement expense reports?

Shoeboxed simplifies, automates, and manages the expense reimbursement process by changing how receipts, invoices, and expenses are handled so businesses can process reimbursements faster and more accurately.

Here’s how Shoeboxed helps with the reimbursement process:

1. Simplification through receipt digitization

Shoeboxed allows employees to digitize paper receipts for expense reimbursement by scanning them with their smartphone's camera and uploading the digital receipt with their mobile app to a designated Shoeboxed account. That way, employees can scan their receipts as the expense occurs while on to the go.

You can also outsource the scanning by sending your receipts to Shoeboxed's processing center using their pre-paid Magic Envelope. There, they will be scanned, human-verified, and uploaded into your Shoeboxed account for you.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started TodayEmployees no longer have to manually enter receipt info into spreadsheets or reimbursement systems. The receipts are stored in an organized, searchable digital format so employees and employers can easily retrieve and reference them.

2. Automation of data entry and categorization

Once scanned, the app extracts the receipt’s key details, such as date, amount, and vendor.

Shoeboxed uses Optical Character Recognition (OCR) to extract and categorize receipt data automatically. This automation reduces human error and eliminates manual data entry, saving time and ensuring accuracy in expense reporting.

The platform automatically categorizes expenses based on pre-set tax or custom business categories (e.g., meals, travel, office supplies), so the data is consistent, tailored to your business's needs, and reduces the workload for employees and accounting teams.

3. Automated reimbursement workflows

Shoeboxed integrates with accounting software like QuickBooks, Xero, and FreshBooks so data can flow seamlessly between platforms and remain consistent. This means expense data captured in Shoeboxed can automatically go into accounting and reimbursement systems without manual intervention.

It also supports automated approval workflows, making the expense review and approval process more transparent. Managers can review and approve expenses digitally, making the reimbursement cycle faster.

4. Expense report generation

Shoeboxed compiles all scanned receipts and expense data into detailed expense reports. Reports can be customized to business needs and submitted to management or accounting teams for final approval.

The platform ensures all necessary receipts are attached so the report submission process is thorough and complies with company policies.

5. Compliance and tax readiness

Shoeboxed stores digital copies of IRS-accepted receipts so you can comply with tax regulations. This is especially useful during tax season or audits, providing detailed, organized records of all reimbursed expenses.

The app’s automated system ensures all required info (receipt details and expense explanations) is there, so there are no disputes or complications with the tax authorities.

6. Time-saving and real-time access

Employees can submit expenses on the go from their smartphones. The app gives managers and accounting teams real-time access to receipts and expense data, allowing them to review and approve reimbursements faster.

Shoeboxed simplifies, automates, and manages the reimbursement process by digitizing receipts, automating data entry and categorization, creating automated expense reports for approval, and ensuring tax compliance. It makes expense reimbursement a smoother and quicker process with fewer human errors.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the benefits of automated expense reporting?

Automating expense reporting gives you the following benefits:

1. More efficiency

Automated expense reporting reduces the time spent on manual data entry and processing, allowing finance teams to focus on more strategic tasks.

2. More accuracy

Automated systems reduce the risk of human error, so expense reports are accurate and compliant with company policies.

3. More transparency

Automated expense reporting gives real-time visibility into company spending so finance teams can track expenses and see where they can save.

4. Better employee experience

Automated expense reporting makes the reimbursement process more manageable for employees, resulting in less administrative tasks.

By leveraging automated expense reporting tools, companies can enhance their expense management practices and ensure a smoother and more efficient reimbursement process.

What are the best practices for expense reimbursement?

To ensure a smooth and efficient expense reimbursement process, implementing clear guidelines, setting spending limits, and utilizing digital tools are essential best practices that help streamline workflows and reduce errors.

1. Define eligible expenses and set limits

Establish a clear policy outlining what expenses are eligible for reimbursement and set reasonable spending limits for travel, meals, and office supplies.

2. Encourage timely submission

Ensure employees understand the importance of submitting expense reports promptly, ideally within a set timeframe, to avoid reimbursement delays or complications.

3. Use digital tools for efficiency

Use expense management software like Shoeboxed to automate receipt collection, organization, and submission. This reduces administrative workload and ensures accuracy in the reimbursement process.

4. Keep clear records and documentation

Ensure that all expense reports accompany valid receipts and clearly explain the business purpose. Keep these records organized for future reference, audits, or tax filings.

What are some expense report software tips?

Expense management software can save time for everyone involved in the reimbursement process.

Here are some things to remember when automating the expense report process.

1. Prioritize tasks

Automate the most time-consuming aspects of the expense management process, such as data entry and approval workflows.

2. Implement expense management software

Consider using tools like Shoeboxed to revolutionize your expense reimbursement process.

What are some common alternatives to expense reimbursement?

Instead of traditional expense reimbursements, businesses often turn to alternatives like corporate credit cards, cash advances, or per diem allowances to simplify the process and reduce the need for employees to use personal funds for work-related expenses.

1. Corporate credit cards

Corporate credit cards eliminate the employees' need to use personal funds for business expenses.

2. Cash advances

Cash advances are helpful in specific situations where employees need funds upfront.

3. Per diem allowances

Per diem allowances simplify expense reporting for business travel expenses by providing a fixed daily meal allowance and incidental expenses.

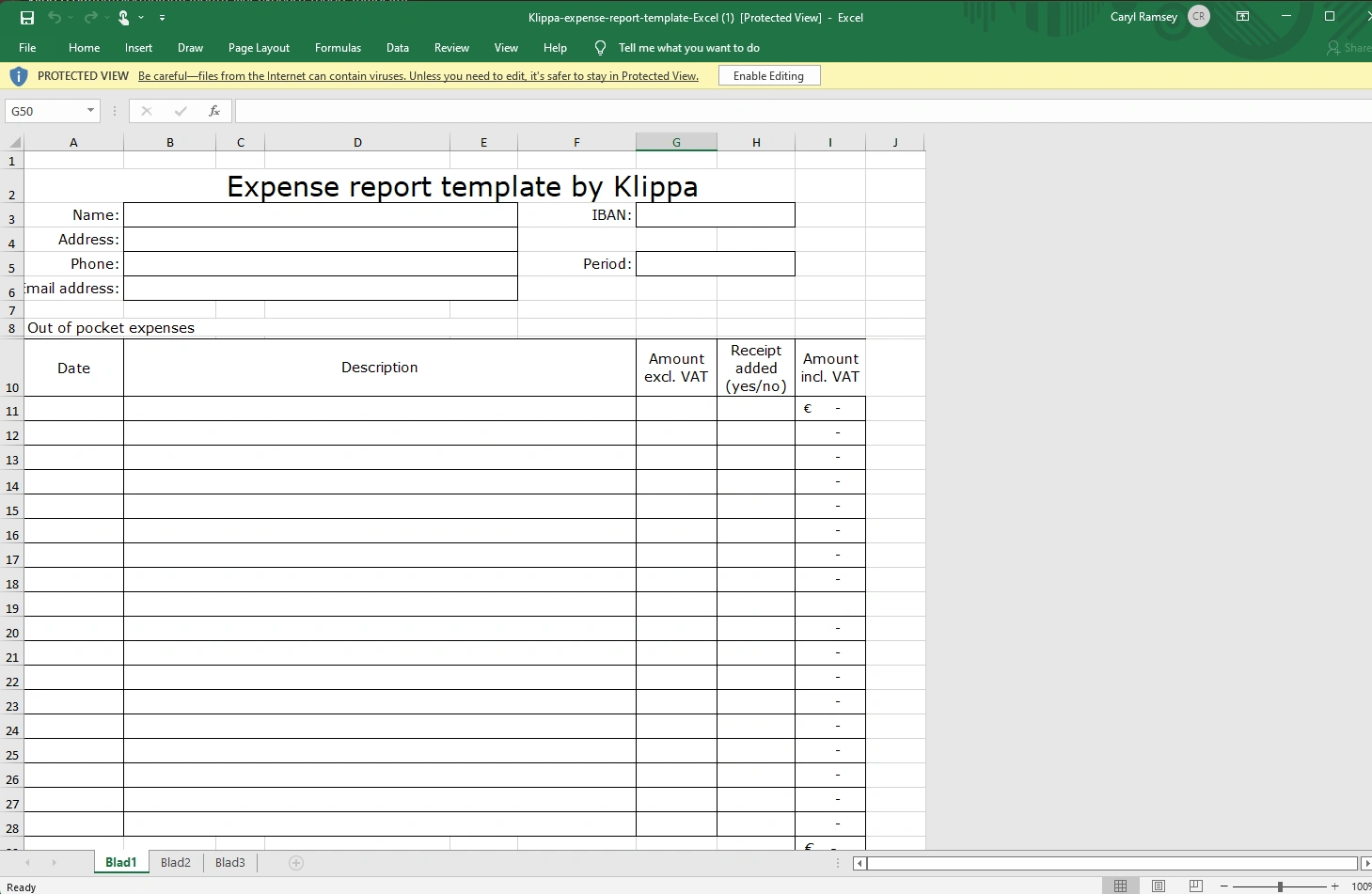

Bonus: Free expense report templates for reimbursement

Here are some free expense report templates for reimbursements:

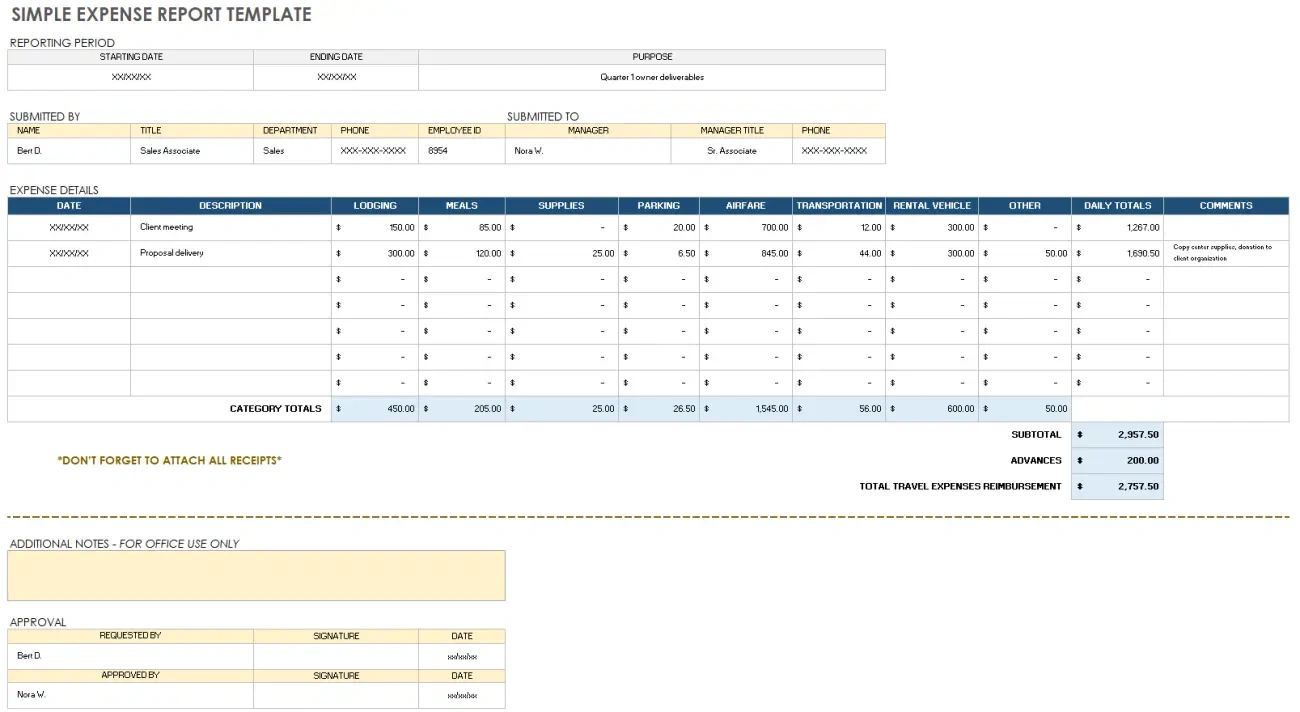

1. Simple Expense Report Template by Smartsheet

This simple expense report template documents date, type of expense, and total for each expense. The template can be customized by adding new columns or changing the headings of the columns.

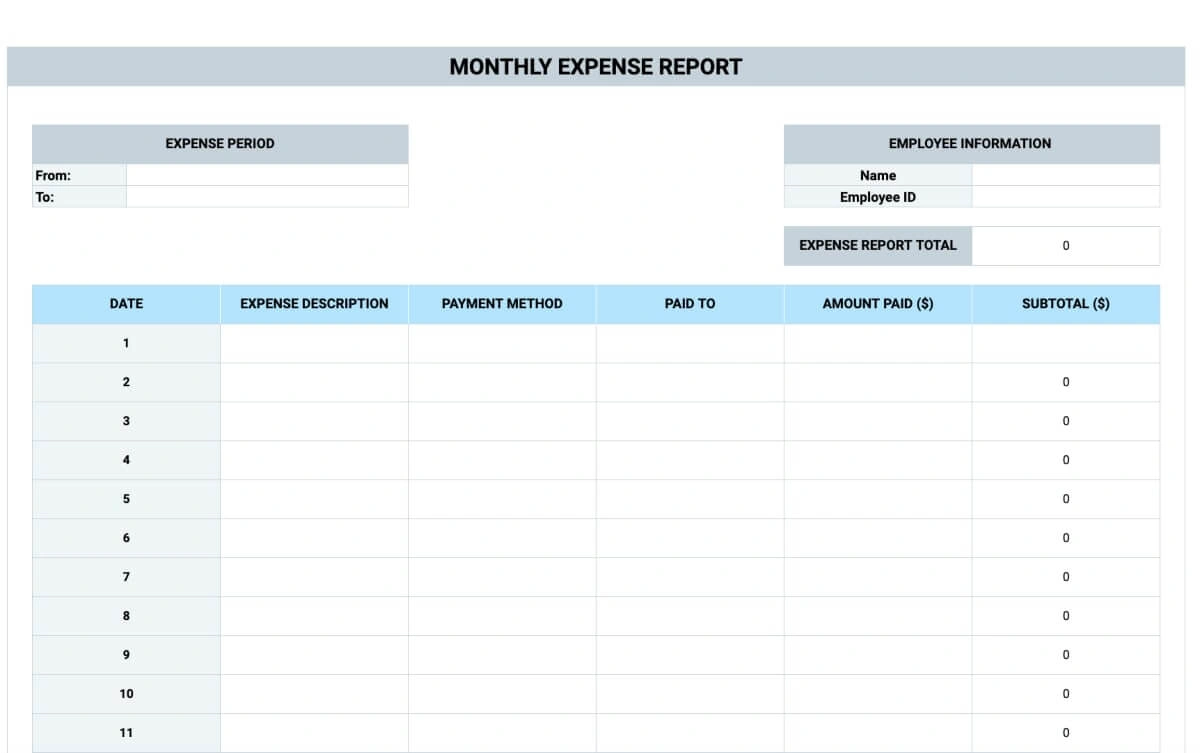

2. Monthly Expense Report Template by Clockify

This monthly expense report template includes columns for date, description of expense, payment method, who was paid, amount, and subtotal. The subtotals for each date are calculated automatically.

3. Travel Expense Report by Klippa

A travel expense report is an overview of costs incurred while traveling for business. These costs typically include travel transportation, overnight accommodations, and meals.

Frequently asked questions

How long do I keep my receipts for expense reports?

You should keep your receipts until the reimbursement process is complete and the company has approved your expense report. Some companies require receipts to be kept for a certain period for tax or audit purposes, usually 2-7 years.

What happens if I submit an expense report late?

Many companies have a policy to submit expense reports within a certain timeframe, usually 30-45 days. If you submit an expense report late, it may delay reimbursement, and in some cases, late expenses may be considered taxable income.

In conclusion

Expense reports are the backbone of any business. They help reimburse employees for business and travel expenses and track financial transactions. A good expense policy and using digital tools like Shoeboxed can make the entire reimbursement process faster, more accurate, and more employee—and employer-friendly.

By digitizing receipts, automating workflows, and integrating with accounting systems, Shoeboxed makes expense reports hassle-free and businesses compliant with internal and tax policies. With a solid reimbursement system, companies can focus on growth while keeping a tight grip on their finances.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!