Ever wondered what secrets your restaurant receipt holds?

Discover why this little slip of paper is more than just proof of payment—it's a powerful tool for tracking expenses, maximizing tax deductions, and managing your financial health!

What is a receipt?

A receipt is a document the restaurant gives you that lists the food and beverages ordered, plus other important order details like the date, payment method, and total bill amount.

The layout of a receipt can vary depending on the restaurant's style and POS system, but all receipts serve the same purpose: to be a clear and concise transaction record of your dining experience.

What information is included on a restaurant receipt?

A standard receipt will have:

Receipt number: A receipt number is a unique number for the transaction, tracking, and record keeping.

Date and time: The date and time of the transaction for record keeping and expense purposes.

Order details: To ensure your order is correct, this is an itemized list of the ordered items, including quantity, price per item, and total.

Subtotal and tax: The subtotal before tax, tax, and total amount after tax.

Tip and service charge: Any gratuities, fees, or service charges added to the bill and final total.

Payment method: How you made your payment (e.g., cash, credit card).

Additional info: Table number, server’s name, restaurant contact info, etc.

Why do you need a signed receipt at restaurants?

A signed receipt is for:

Proof of transaction: It proves the customer was at the restaurant and agreed to the total, including the tip.

Dispute prevention: A signed receipt helps resolve disputes over incorrect charges, especially tip amounts or unauthorized payments.

Tax and reimbursement: A signed receipt for a business meal is required for tax deductions or reimbursement claims.

A restaurant receipt usually comes in two copies: the merchant copy and the customer copy. The restaurant keeps the merchant's copy and proof of the transaction, including the total amount paid and any tip the server or customer added. The customer signs this copy to confirm the payment so the tip is processed correctly and to prevent disputes over charges.

The customer copy is for the diner’s records. It’s a copy of the merchant copy but without a signature. You should keep the customer copy for personal expense tracking, business reimbursement, or tax deduction purposes. It’s also a reference in case of disputes over the final bill.

Customers get two receipts, a merchant copy, and a customer copy, and it’s important to sign the right one to avoid disputes.

Just make sure you don't accidentally take home the signed merchant copy of the restaurant receipt.

How should you manage restaurant paper receipts?

The need for paper receipts is decreasing as many places focus on having a digital transaction record rather than keeping a physical copy.

I have found these steps to be an effective way to manage restaurant receipts.

1. Always ask for a receipt

Make it a habit to ask for a receipt regardless of the payment method. Even if the transaction is small, a receipt is a record that can be useful for personal or business purposes.

2. Check your receipt

Before you leave the restaurant, take a look at your receipt. Check that all items ordered and the total are correct and that the applicable tip or service charge has been applied as intended.

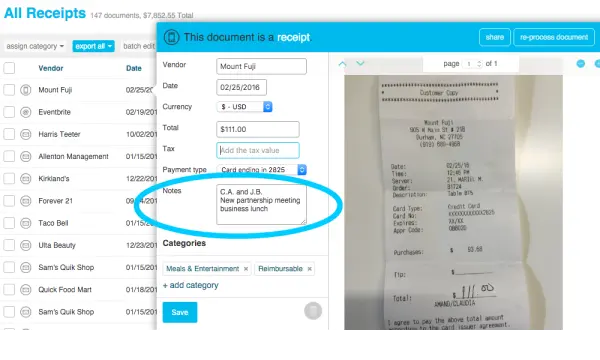

3. Digitize your receipts

Use a digital receipt management system like Shoeboxed to scan and store your restaurant receipts. Digital copies are easier to organize, retrieve, and submit for tax or reimbursement purposes. Shoeboxed lets you capture, categorize, and store receipts in the cloud to access them anytime, anywhere.

4. Date and category

Organize your receipts by date and category (e.g., personal, business). This way, you can easily find specific receipts when needed, like during tax season or financial reviews.

5. Store originals securely

By securely storing these receipts and creating digital backups, you can have peace of mind knowing you have a reliable record of your expenses in case of an audit.

What's the best way to digitize and store your restaurant receipts for expense tracking?

Do you want to simplify tracking expenses, organizing documents, and keeping all the necessary records for reimbursements and tax purposes? Try Shoeboxed.

Shoeboxed - ideal for businesses that want to digitize, organize, and store restaurant receipts for reimbursements and tax deductions

Here’s how Shoeboxed can help:

1. Automated receipt capture and data extraction

Shoeboxed lets you capture your restaurant receipts quickly using the mobile app or by outsourcing the scanning to Shoeboxed.

Take a photo of the receipt with your smartphone’s camera. Shoeboxed will use its app with Optical Character Recognition (OCR) technology to extract the date, total amount, tip, and restaurant name and upload the data to your account.

This process saves time and reduces errors from manual data entry.

Or, if you prefer, you can put your restaurant receipts in a prepaid postage-free Magic Envelope and mail them to Shoeboxed. They'll scan, human-verify, and upload them into your account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Detailed documentation

IRS compliance requires detailed documentation for business meals, including date, location, purpose, and attendees. Shoeboxed lets you add notes to each receipt so you have all the information you need for tax compliance. This comes in handy during audits when you need a complete record of your business meal expenses.

3. Categorization and organization

Shoeboxed categorizes your restaurant receipts for you, grouping them under categories like “Meals & Entertainment” for business expenses. You can also create custom categories to organize your receipts as needed.

This makes tracking and managing dining expenses a breeze and makes tax time or expense report preparation a snap.

4. Digital storage and accessibility

Shoeboxed stores all your restaurant receipts in the cloud, so they’re always available anywhere, anytime. There will be no more lost receipts; they will be easy to retrieve when you need them for audits, tax time, or reimbursement claims.

Shoeboxed can generate detailed expense reports from your restaurant receipts. These reports can be exported in PDF form or Excel format and shared with your accountant or finance team.

6. Integrates with accounting software

Shoeboxed also integrates with popular accounting software, such as QuickBooks and Xero so that you can sync your restaurant expenses with your financial records.

7. Compliance and audit readiness

Shoeboxed stores receipts in a format accepted by the IRS so tax prep is more accessible and audit-proof.

It generates tax-friendly reports of deductible expenses to help with accurate tax filing.

By leveraging these features, Shoeboxed can significantly reduce the time and effort required for essential bookkeeping processes. It allows business owners and their employees to focus more on the dining experience and less on managing their restaurant receipts and expenses.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are the IRS business meal guidelines?

The IRS has specific rules for deducting business meals. Follow these rules to be compliant and get the most deductions.

Business purpose: The meal must be directly related to or associated with the active conduct of your business. This means you must have a business discussion before, during, or after the meal.

Documentation requirements: The IRS requires detailed records of the meal, date, time, location, business purpose, attendees, and itemized receipt. A credit card statement alone is not enough proof.

Deduction limits: You can deduct 50% of the total meal cost, including tax and tip, for most business meals. However, some meals employers provide to employees (e.g., holiday parties) can be 100% deductible.

You need to keep detailed and accurate restaurant receipts to support these deductions in case of an audit.

Why are restaurant receipts important?

Restaurant receipts serve many purposes, so they are important in personal and business finance.

1. Expense management

Restaurant receipts help individuals and businesses track their dining expenses. They clearly record what was spent, where, and for what so you can monitor and manage your spending.

2. Tax documentation

Restaurant receipts are required for tax deductions for business meals. The IRS requires detailed documentation, including date, establishment location, business purpose, and attendees. Without a proper receipt, businesses can lose valuable deductions or get audited.

3. Reimbursements

Employees use restaurant receipts to claim reimbursements for business meals. A clear and itemized receipt makes it easy to submit expense reports and get reimbursed correctly.

4. Dispute resolution

Receipts show what was ordered and paid for. Having the original receipt helps resolve billing disputes or errors quickly.

How do you get old receipts from restaurants?

Yes, you can get old restaurant receipts, but it all depends on the restaurant’s policy and how long ago you purchased the meal.

Here are the general guidelines:

1. Contact the restaurant

Call the restaurant where you made the purchase. Give them as much info as you can, such as the date of visit, time of visit, total amount, and mode of payment. This will help them find and match your receipt in their records.

2. Credit card statements

If you use a credit or debit card, your bank statement can be a backup record. This is not a replacement for an itemized receipt but can validate the purchase and may be accepted for some purposes, like expense reports.

3. Point of sale systems

Many restaurants use point-of-sale (POS) systems that store digital copies of receipts for a certain period, usually a few months to a year. If your request falls within this time frame, the restaurant may be able to provide you with a duplicate receipt.

4. Restaurant loyalty programs

If you are a member of the restaurant’s loyalty program some restaurants store purchase history linked to your account so it’s easier to get old receipts.

5. Limitations

Not all restaurants keep old receipts, especially smaller restaurants or those that don’t use advanced POS systems. Also, company privacy policies may limit their ability to access and share transaction records.

So, yes, you can get old restaurant receipts, but it all depends on the restaurant’s record keeping and how long ago you purchased the meal.

What are some common mistakes to avoid?

Taking the only signed receipt home by accident can cause problems for the restaurant.

Leaving behind a blank customer copy can cause tip disputes.

Not keeping receipts can make tracking expenses or disputing incorrect charges hard.

What are some best practices for restaurant receipts?

Always ask for a receipt when you pay the bill, regardless of how you pay.

Sign the merchant copy, not the customer copy.

Keep your receipts organized and easily accessible for expense tracking or reimbursement purposes.

Consider using a digital receipt management system to make receipt tracking easy.

Please look over your receipts carefully to catch errors and discrepancies.

Frequently asked questions

How long should I keep restaurant receipts for tax purposes?

The IRS recommends keeping all business-related receipts, including restaurant receipts, for at least three years from filing your tax return. This is the statute of limitations for the IRS to audit your tax return. These receipts will support your deductions in case of errors or discrepancies.

What if I lose a restaurant receipt?

If you lose a restaurant receipt, try to get a duplicate from the restaurant. If that’s impossible, use your credit card statement as a backup. The meal includes the date, location, attendees, and business purpose.

While a credit card statement alone may not be enough for IRS purposes, having this extra information will help substantiate your deduction.

In conclusion

Restaurant receipt management is critical to accurate business reimbursement and tax deductions. Knowing what to look for on a restaurant receipt and following IRS business meal rules will save you time and headaches come tax season.

Use Shoeboxed to capture, organize, and store your restaurant receipts easily. That way, all your business meal expenses will be accounted for and easily accessible when needed. Whether you’re dining out for business or pleasure, tracking your receipts is a smart financial habit that pays off.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!