To run a business, you need to keep accurate records.

These records need to track what you sell, advertising, inventory, market research, customers, pricing, suppliers, expenses, income, taxes, cash flow, payroll, and product merchandising. Retail accounting software is essential for both brick-and-mortar and online businesses, as online operations have specific accounting and sales tax needs.

You can’t do all that by hand so you need to find the best accounting software to track all the things that can make or break your retail business.

What is retail accounting software?

The retail business is no different from any other business; it has its own needs and practices.

These practices include the following:

inventory tracking

time tracking

expense tracking

time and expense tracking

tax compliance

sales performance

managing payments

custom pricing

financial planning

Retail accounting software automates, integrates and streamlines the financial operations with the business operations so your retail business can run more smoothly.

Who uses retail accounting software?

Retail is the sale of goods for consumption or use.

These transactions occur at shops, markets, door-to-door salespeople, internet retailers, supermarkets and department stores.

Retail business owners benefit significantly from using retail accounting software. Features like ease of use and automation of financial processes help them manage their accounting and financial tasks efficiently. These retail businesses fall into two categories: brick-and-mortar and e-commerce.

How can accounting software help retailers?

Accounting software helps retail businesses in many ways.

Some of these are:

Manage inventory

Track sales taxes

Sync sales across multiple channels

Manage payroll

Automate accounting processes

Accept online payments

Provide key metrics to measure sales performance

Tax management

Financial planning

Financial reporting

Provide sales data

Create professional invoices

Manage bills

Manage vendor payments

How to choose retail accounting software

When looking for accounting software, there are several features specifically for retailers that you will want to look for.

The accounting software should have these features or be able to integrate with associated business systems.

1. Inventory management

Inventory management controls the number of products in stock so you can reduce overhead and increase profit.

2. Supply chain management

Supply chain manages orders by fulfilling orders and processing returns.

3. Point of sale

Point of sale scans barcodes, processes payments, generates reports and manages special orders.

4. Reporting

Reports are used to track sales performance, purchasing trends and financial status.

5. Multichannel

Multichannel monitors and updates sales across multiple channels.

6. CRM

CRM links transactions to marketing and sales activities.

What are the top picks for retail accounting software in 2024?

Some accounting software solutions are tailored more for retail businesses than others.

Below we’ve reviewed the top picks to help you filter by your retail business needs.

1. Shoeboxed - Best app for scanning and organizing receipts

Shoeboxed can simplify retail accounting by automating receipt management, organizing expenses and integrating with accounting software.

Here’s how Shoeboxed can help:

Automated receipt management

Retailers have a high volume of receipts from sales, inventory purchases and operating expenses.

Shoeboxed allows retailers to digitize receipts by taking photos with their mobile device's camera and Shoeboxed's app, which automatically uploads the essential data from each receipt directly into your designated Shoeboxed account. No more manual data entry.

If you want to outsource the scanning, Shoeboxed has a mail-in service for physical receipts. Retailers can send batches of receipts in a pre-paid envelope or the Magic Envelope and Shoeboxed will scan, digitize, human-verify and upload them into your account where the receipts are stored in the cloud.

Retailers can also forward receipts from their email inbox directly to their Shoeboxed account, use a custom Gmail plug-in to auto-import e-receipts in their inbox and send them to their Shoeboxed account or drag and drop receipts into the cloud using a desktop or laptop.

Expense organization and categorization

Shoeboxed extracts key information from receipts using OCR data extraction such as vendor name, date, amount and payment method and categorizes these expenses automatically into 15 tax or customized categories. This keeps financial records organized which is crucial for tracking retail expenses.

Retailers can create custom tags to categorize expenses by department, product or supplier so cost tracking and reporting is more straightforward.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayIntegration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks, Xero and Wave. This ensures all digitized receipts and categorized expenses are synced with the accounting software so there’s no room for errors and financial data is always consistent and up-to-date.

Financial reporting

Shoeboxed generates expense reports with receipts attached that can be customized to fit retail businesses needs. These reports show spending patterns so retailers can manage budgets and plan finances.

Shoeboxed stores receipts in an IRS-accepted format so tax preparation and compliance is simplified. This is crucial for retail businesses that need to track deductible expenses accurately to minimize tax liabilities.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayTime and cost savings

By automating receipt management and expense tracking, Shoeboxed saves time for retail bookkeepers.

Automation reduces the chance of errors in financial records so financial reporting is more accurate and results in better decision making.

Mobile access

The Shoeboxed mobile app allows retailers to capture receipts and track expenses from the store or on-the-go. This ensures all costs are recorded so there are no lost receipts and unaccounted expenses.

A great feature for retailers is they can log expenses on-the-go from anywhere and use their phone’s built-in GPS for business mileage tracking.

Shoeboxed will create a trip summary that includes date, editable mileage, trip name, tax-deductible and rate information and add it to the categorized expenses.

Shoeboxed helps retail accounting by automating and simplifying receipt management, organizing expenses and integrating with accounting software. These features help retail businesses maintain accurate financial records, stay compliant with tax regulations and save time and resources.

Shoeboxed is a must-have for managing the financial side of retail. Shoeboxed is great for scanning and organizing receipts. It turns receipts into data for expense reporting, tax preparation and audits.

Pros:

Digital receipt capture: Retailers can take photos of receipts with their mobile device or email digital receipts to their Shoeboxed account. The app also supports scanning paper receipts with pre-paid envelopes sent to Shoeboxed for processing.

Auto categorization: Receipts are auto-categorized into expense categories so expenses are easy to organize and track.

Data extraction: Shoeboxed extracts key information from receipts such as vendor name, date, amount and payment method so you don’t have to enter data manually.

Expense reports: Generates detailed expense reports that can be customized and exported for retail accounting purposes.

IRS-accepted: Receipts are stored in an IRS-accepted format so tax time is smoother and audit-proof.

Deductible tracking: Tracks deductible expenses so retailers can claim all eligible deductions.

Seamless syncing: Integrates with popular accounting software like QuickBooks, Xero and Wave to transfer and sync data.

Collaboration: Multiple users can access and manage the account so team members can work on bookkeeping tasks.

Permissions: Different levels of access and permissions can be set for each user to protect sensitive financial data.

Cons:

Mileage tracking: Mileage tracking is not automatic. You will need to start and stop the tracker manually, but this just makes it easier to keep business and personal miles separate.

Pricing:

Shoeboxed has plans to fit your needs:

Startup plan: $18/month (billed annually)

Professional plan: $36/month (billed annually)

Business plan: $54/month (billed annually)

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today2. NetSuite ERP - Best scalable software for retail business

NetSuite ERP is a cloud-based ERP solution for fast-growing mid- to large-sized businesses.

The platform features financial management, fixed assets, revenue management, billing, order management and inventory management tools, so it’s a full-featured software.

Thanks to the order management feature the software beats its competitors in the order-to-cash process where sales and fulfillment are tied to pricing.

Inventory management is another area where NetSuite ERP shines because it calculates the cost to minimize overhead and maximizes profit when stock is moved in and out.

The big advantage here is retailers have complete visibility of their supply chain.

The pricing plans are tailored to your retail business so they increase as your business grows. NetSuite ERP has all the applications and tools you need to support growing businesses.

NetSuite ERP was designed to support business growth by building a system that can add and customize more functions without the need for third-party apps.

Pros:

Full suite: NetSuite ERP has a full suite of tools for financial management, CRM, e-commerce, inventory management and more. This integration allows businesses to manage all their core processes in one platform, no need for multiple systems.

Scalability: Designed to grow with your business, NetSuite ERP can scale from small business to large enterprise, handling increasing complexity and transaction volume.

Real-time data and reporting: It has real-time dashboards and reporting so businesses can have instant access to key performance metrics and operational data. This helps decision-making and gives retailers an edge.

Customizable reports: Retailers can create custom reports and dashboards to their specific needs, to monitor and analyze business performance.

Global business management: NetSuite ERP supports multiple currencies, languages and tax regulations, so it’s suitable for global operations and multinational companies.

International compliance: Compliant with international accounting standards and regulations.

Integration: Integrates well with other software solutions, including third-party apps to add more functionality and streamline workflows.

API: Has robust APIs for custom integrations so businesses can tailor the system to their needs.

Cloud-based: As a cloud-based solution, NetSuite ERP allows users to access the system anywhere, remote work and collaboration across different locations.

Cons:

Cost: NetSuite ERP can be costly especially for small to medium-sized businesses. The cost includes licensing fees, implementation fees and potential customization costs.

Ongoing fees: Additional costs for support, upgrades and maintenance can add up over time and become a big investment.

Complex implementation: Implementation can be complex and time-consuming, requires careful planning and potentially external consultancy services.

Customization challenges: Extensive customization may be needed to tailor the system to your business needs which can further extend the implementation timeline and cost.

Learning curve: NetSuite ERP has a steep learning curve due to its many features. Users may need extensive training to use the system effectively.

Complex interface: Some users find the interface complex and not as intuitive as other ERP systems, so it potentially hinders user adoption and efficiency.

Performance issues: Some users experience performance issues, slow loading times and occasional system crashes, especially during peak hours.

Pricing:

NetSuite ERP doesn’t disclose pricing as it offers customized solutions based on each business’s specific needs and size.

NetSuite ERP is a full-fledged solution for businesses of all sizes, with robust features and scalability. While it has integration, real-time data and global business management benefits, the cost, complex implementation and steep learning curve are things to consider. Businesses should weigh their needs, budget and growth plans to see if NetSuite ERP is for them.

3. FreshBooks - Best software for eCommerce businesses

FreshBooks is a great choice for retail accounting and also the best for eCommerce businesses.

FreshBooks is good for e-commerce retail businesses because it can integrate with some of the top e-commerce services such as Squarespace, Big Commerce, Magento and Shopify.

Other features include online invoicing, expense tracking, time tracking, project management, online payments, accounting reports and tax compliance.

Retailers can access FreshBooks anywhere, anytime with its cloud-based accounting software and mobile app.

Pros:

Ease of use: Simple and user-friendly for real estate professionals to manage finances.

Invoicing and time tracking: Good for client invoices and billable hours.

Cons:

Limited features: May not have as many features as other options.

Scalability: Better for smaller businesses and may not scale as well for larger real estate companies.

Pricing:

Lite: $7.60/month

Plus: $13.20/month

Premium: $24.00/month

Select: Contact FreshBooks

4. QuickBooks Online - Best software for app integrations

There are many third-party integrations that work with QuickBooks.

In fact, QuickBooks Online integrates with over 750 business apps including ones for retail businesses such as customer order management, eCommerce management, inventory management, purchase order management, sales and shipping apps. There are also apps for workforce management, business management and tax compliance.

QuickBooks Online connects with apps like PayPal, Shopify, Shoeboxed and Square.

All the retail business processes such as sales, expenses and transactions are in one place.

In addition to the best app integrations, QuickBooks Online also has some cool features such as inventory management, extensive reporting, sales tax tracking, eCommerce accounting and a mobile app.

Pros:

Full-featured: Invoicing, expense tracking, payroll and financial reporting.

Shoeboxed integration: Integrates with Shoeboxed to import and categorize receipts.

Customizable: Customizable invoices, reports and documents.

Cons:

Cost: Can be expensive for small retail businesses.

Complexity: Some users find it complex and may require training.

Pricing:

Simple Start: $15/month

Essential: $30/month (allows up to three users, making it suitable for small retail teams)

Plus: $45/month

Advanced: $100/month

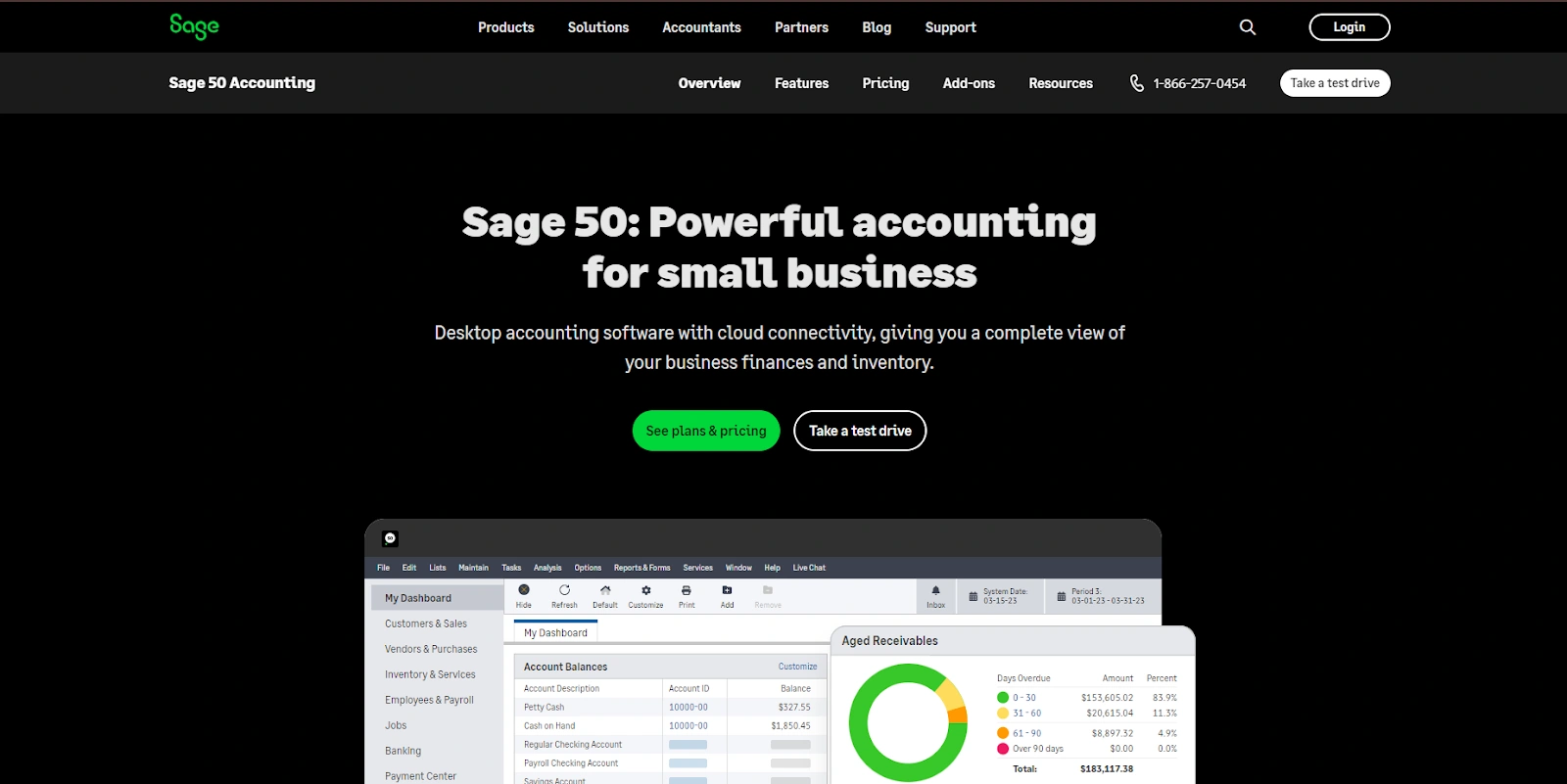

5. Sage 50 Cloud - Best software for inventory tracking

Sage 50 Cloud Accounting is a full-featured, customizable accounting software for retail businesses that need inventory tracking.

Inventory is set up in real-time and cash flow is monitored with an automated dashboard. Invoices can also be created, sent and tracked in real-time.

Their accounting software also includes payroll which auto calculates payroll tax deductions.

Pros:

Full-featured accounting: Sage 50 Cloud has a full suite of accounting tools including accounts payable and receivable, inventory management, job costing, payroll and financial reporting. It’s a great solution for small to medium-sized businesses.

Advanced inventory management: It has advanced inventory management features like stock tracking, reordering and detailed inventory reports, which are important for businesses with high inventory needs.

Microsoft 365 integration: Sage 50 Cloud integrates with Microsoft 365 so you can use Office apps and cloud storage. This integration increases productivity and ensures data is synced across platforms.

Security and compliance: Sage 50 Cloud has robust security features like role-based access control and secure data backups. These features protect sensitive financial information and ensure compliance with industry standards.

Customization and scalability: The software is highly customizable so businesses can tailor it to their needs. It also scales with the business, so it’s good for small businesses and larger organizations.

Customer support: Sage has multiple customer support options including phone support, live chat and an extensive online knowledge base, so you can get help when you need it.

Cons:

Cost: Sage 50 Cloud can be expensive compared to other accounting software, especially for small businesses with limited budget. The price includes subscription fees and additional charges for premium support and add-ons.

Extra fees: Advanced features and integrations may have extra cost which can add up to the total expense.

Complexity for new users: The software has a lot of features which can be overwhelming for new users and requires a lot of time and effort to learn and implement.

Initial setup: Setting up the software can be complex and may require technical assistance, especially for businesses with customization needs.

Limited mobile access: Sage 50 Cloud has mobile access but the mobile app is limited compared to the desktop version. This can be a drawback for users who need to manage their finances on the go.

Performance issues: Some users experience performance issues like slow loading and system crashes.

Pricing:

Sage 50 Cloud has different pricing plans based on the number of users and business needs. As of the latest update:

Pro Accounting: $15/month

Premium Accounting: $30/month

Quantum Accounting: $100/month

Sage 50 Cloud is a full-featured accounting software solution for small to medium-sized businesses. It’s a great financial tool but the cost and complexity may not be suitable for small businesses or those with limited budgets.

6. Xero - Best for brick-and-mortar stores and unlimited users

Xero’s integrations and features make it the best retail accounting software for brick-and-mortar stores.

Inventory management is available on the lowest tier which is very rare and it integrates with EPOS systems like Revel, Square and Vend.

For retail businesses that need to give multiple employees access to accounting software, Xero is the way to go.

Xero allows unlimited users on every tier which is unique among its competitors since most of the other software allows fewer users on lower tier and increases the number of users on higher tiers. Shoeboxed is the exception.

Permission levels can be set for each user and Xero logs every action made by every user.

If you have multiple employees who need access to the accounting software, Xero can save you a lot of money and time.

Xero has a simple layout, easy to use and has customizable reports and dashboards.

Pros:

User-friendly: Known for its easy navigation.

Shoeboxed integration: Integrates with Shoeboxed to manage receipts and expenses for retailers.

Mobile app: Has a powerful mobile app.

Cons:

Learning curve: Initial setup and learning can be tough for some users.

Cost: Pricing can be high especially for small businesses that need advanced features.

Pricing:

Early: $3.75/month

Growing: $10.50/month

Established: $19.50/month

7. Zoho - Best software with mobile accounting features

That’s saying a lot when the apps are as good as the browser version.

That’s why Zoho is the best accounting software with mobile app features.

Android and iOS versions have the same tools but different navigation.

The apps have a very long list of features:

Invoices

Expenses

Cash flow

Income & expense tracking

Contacts

Accounts receivable

Accounts payable

Payments

Data storage

Transactions

Time tracking

Bill-pay

Reports

Projects

Pros:

Integrated ecosystem: Zoho has many applications that are seamlessly integrated like CRM, project management, email hosting, accounting etc. so businesses can manage multiple functions in one platform.

Customization: High degree of customization across applications so companies can tailor the software to their needs.

Affordable: Compared to other enterprise solutions, Zoho is affordable, perfect for small—to medium-sized businesses.

Free versions: Many Zoho applications have free versions with limited features that are good for startups and small businesses.

User-friendly: Zoho applications are known for its easy-to -use interface so users can navigate and use the software without extensive training.

Mobile access: Most Zoho applications have a mobile version so users can access them on-the-go.

CRM: Zoho CRM has many features for sales automation, lead management, contact management and analytics.

Data security: Zoho takes data security seriously through two-factor authentication, encryption and regular security audits.

Compliance: Zoho complies with international standards and regulations including GDPR so it’s perfect for businesses that are concerned about data privacy.

Cons:

Third-party integrations: While Zoho’s internal integrations are seamless, integrating with some third-party apps can be tricky and require additional tools or technical expertise.

Support: Some users find customer support slow and unresponsive, especially with the lower tier plans.

Self-service resources: While there are extensive online resources and forums, some users may need more direct support options.

Learning curve: Although the basic features are user-friendly, some advanced features and customizations can be complex and takes time to learn and implement.

Speed and reliability: Some users have reported occasional performance issues that affect productivity like slow loading times or downtime.

Limited features in basic plans: The lower tier plans may not have all the advanced features that growing businesses need, so they may need to upgrade to higher plans.

Pricing:

Zoho has different pricing plans for its applications. Here’s an overview of some of the leading products:

Standard: $14/user/month (billed annually)

Professional: $23/user/month (billed annually)

Enterprise: $40/user/month (billed annually)

Ultimate: $52/user/month (billed annually)

8. Wave - Best free software for retailers

Wave is the best free accounting software for retailers.

It's an excellent choice for micro-businesses and retailers with less than 10 employees.

Wave is a financial management system that handles invoicing, accounting and bookkeeping all in one platform.

They have unlimited invoicing, customizable payment terms and templates and is a dedicated invoicing mobile app.

Wave accepts credit cards and bank payments online and tracks income and expenses.

You will only run into fees if you use their payroll application or Wave Payments.

Pros:

Free basic plan: The free plan includes invoicing, expense tracking and financial reporting.

Shoeboxed integration: Integrates with Shoeboxed to manage receipts and expenses.

Ease of use: Simple interface for small businesses and independent contractors.

Cons:

Limited features: Not all features of paid accounting software.

Support: Limited support options compared to premium accounting solutions.

Pricing:

Free for basic features: payroll and payment processing extra.

9. Gusto - Best software for payroll

Gusto is an HR platform that simplifies the complex payroll, benefits and financial management process.

With Gusto, you get features for nationwide workers’ compensation insurance, payroll and 401ks.

The platform automates payroll and the payment, calculation and submission of your retail business’s payroll taxes, ensures ACA compliance and handles year-end forms.

Gusto also has detailed payroll reports, multiple pay schedules, multiple PTO options, digital paystubs, employee self-enrollment, contractor payments, unlimited payroll, flexible spending accounts, commuter benefits, health savings accounts, reimbursements, time-off tracking and hourly and salary computations.

It simplifies payroll and benefits for administration and HR.

The automation process saves time and makes payroll management error-free.

Pros:

Streamlines onboarding with digital document signing, new hire checklists and welcome emails.

Integrated time tracking and PTO management features makes attendance and leave management easy.

Helps businesses comply with labor laws and regulations with alerts and notifications.

Cons:

While Gusto has a lot of features, it can be more expensive for small businesses or startups than other payroll solutions.

Setup can be complicated for businesses moving from another payroll system, requires data entry and configuration.

Pricing: $40-custom pricing/month

Frequently asked questions

Can retail businesses use QuickBooks Online as their accounting software?

QuickBooks Online is good for retailers since it integrates with many business apps.

Why use accounting software for your retail business?

Retail accounting software automates, integrates and streamlines financial and business operations to save time running a retail business.

What makes up accounting software for retail businesses?

Retail business accounting software and core accounting features that focus on the financial side of the business.

In conclusion:

Retail accounting software helps you manage your bottom line. Since the numbers are at your disposal, you can see how your retail business is doing at any time. Retail accounting software makes you more productive, efficient and profitable.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!