A sales receipt is an important document that proves money has changed hands in a business transaction. It’s useful for both the buyer and the seller because it is a transaction record. For the buyer, it’s proof of purchase, and for the seller, it’s for accounting, inventory management, and tax purposes, including sales tax calculation.

What are the different types of sales receipts?

There are three different types of sales receipts.

1. Cash register receipts

Cash register receipts are used in retail and food services, cash register receipts are a quick record of sales and payment and are printed immediately at purchase.

2. Handwritten sales receipt

A handwritten sales receipt serves traveling sales associates or small businesses and is flexible when electronic means are unavailable. Handwritten receipts are used to record sales and payment details on the go.

3. Packing slips

Packing slips are used by online businesses. Packing slips record sales and shipping information, including items purchased and shipped to the customer. They also include transaction details and information about returns inside the box when the order is shipped.

How do you create sales receipts?

Here’s a step-by-step guide to creating a sales receipt:

1. Choose a template or create your own

Use a sales receipt template from a word processing program like Microsoft Word or Google Docs, or design your own to fit your business needs.

2. What to include

Business information: Name, address, contact details.

Client information: Name, address, contact details.

Transaction date: The date of the transaction. The transaction date is part of the sales receipt; it’s beneficial for both the buyer and the seller as proof of the transaction.

Items purchased: List of items, quantity, description, price—

Total amount paid: Sum of all items, including taxes and discounts.

Optional:

Payment method: Specify payment options (cash, credit card, etc.).

Thank you message: Adding a personalized note can enhance customer experience.

What are the benefits of sales receipts?

The benefits of sales receipts include the following.

1. Transaction record

A documented history for both parties for future reference.

2. Accounting and taxes

Sales receipts track income and expenses so businesses can manage inventory and file taxes accurately. They also help companies reconcile their financial statements by providing details to track sales and revenue.

3. Proof of payment

They are proof of the transaction and protect the buyer and seller from disputes.

Sales receipt vs. invoice

What's the difference between a sales receipt and an invoice?

Sales receipt: Issued when payment is made at the time of sale; it’s proof of the transaction.

Invoice: A request for payment to be made later detailing the amount the customer owes.

How to create a sales receipt online

Creating sales receipts online is becoming increasingly convenient and popular. Tools like QuickBooks Online or Acrobat Sign make it easy to manage receipts.

These online tools offer:

Ease of use: Simplified process for creating professional receipts.

Accessibility: Access and manage receipts anywhere with an internet connection.

These online tools are cost-effective and often cheaper for small businesses.

Best practices for sales receipts

Follow these practices to make your sales receipts practical and professional.

1. Use a template

A well-designed template ensures consistency and clarity.

2. Include all details

Include comprehensive transaction details to avoid confusion and disputes.

3. Keep copies

Record all receipts for financial and legal purposes.

4. Customization

You can customize your sales receipts to fit your business needs by adding a company logo or specific payment terms. For example, a retail business can add a return policy on its receipts, and a service-based business can add the terms of its service. This customization can make your receipts look more professional and provide additional information to your customers.

5. Business transactions

Record all business transactions for tax, legal, and inventory management.

How can you simplify and streamline sales receipt management?

Shoeboxed

Shoeboxed is a great tool for managing sales receipts, especially for small businesses. It helps to digitize and organize receipts to track expenses and prepare for tax season.

By using Shoeboxed, you can:

Scan and digitize receipts with the app

With Shoeboxed, you can convert paper receipts into digital format for easy storage and retrieval. One way to do this is to use your mobile phone or device and Shoeboxed’s app. Photograph the receipt with your smartphone’s camera and upload the data to your Shoeboxed account.

Outsource your scanning

Or, you can outsource the scanning to Shoeboxed by sending your receipts to their processing center in the Magic Envelope provided by Shoeboxed, and their team will scan, human-verify, and upload the data to your Shoeboxed account.

With the receipt scanning service, you sign up, send in your receipts, and access your account to view your data.

Email receipts from your inbox to your Shoeboxed account

You can also forward receipts from your email inbox to your Shoeboxed account. Shoeboxed’s Gmail plugin will auto-import receipts from your Gmail inbox to your Shoeboxed account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

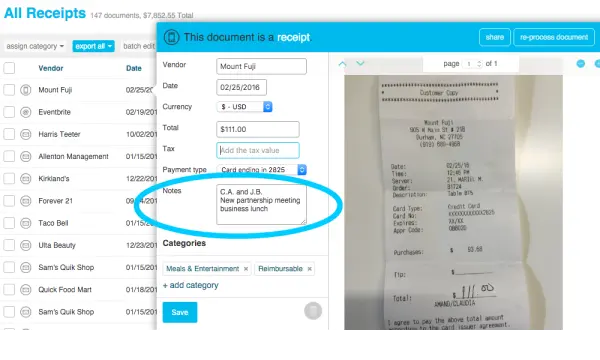

Add details to sales receipt

In the Shoeboxed app, you can add sales receipt information like client information or a more detailed description under the “notes” section to manage receipts better.

Organize financial records

Once the receipts are uploaded, Shoeboxed will categorize them into 15 tax or customized categories to make accounting easier and tax deductions more accessible.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayTurn receipts into expense reports

Your receipts are turned into extracted, human-verified data that is categorized, organized, searchable, editable, and available anytime, anywhere.

With just a few clicks, you can create custom expense reports for reimbursements from the web and your mobile device. You can also send expense reports with images of receipts from anywhere.

Integrate with accounting software

Shoeboxed works with the tools you already use. Shoeboxed integrates with Wave, Xero, and QuickBooks. No more manual entry, no more missing receipts, and no more headaches.

Prepare for taxes

Shoeboxed makes tax season a breeze by keeping all the necessary documents in one place for hassle-free tax preparation. Shoeboxed’s digital images of your receipts are accepted by the Internal Revenue Service and the Canada Revenue Service in the event of an audit.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Add free sub-users

With a Shoeboxed account, you can add a bookkeeper or accountant as a sub-user for tax reports and grant sub-users access to your team.

Adding Shoeboxed to your receipt management process can save you time, reduce the risk of losing important documents, and improve your business’s financials.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFree sales receipt templates

Here are free templates to create sales receipts without starting from scratch every time.

Sales receipt template by eForms

Sales receipt template by Invoice Home

Sales receipt template by Invoice Simple

Sales receipt template by Coefficient

Frequently asked questions

What are the three types of receipts?

The three types of receipts include the following:

1. Cash register receipts

2. Handwritten receipts

3. Packing slip

What if I lose a sales receipt?

If you lose a sales receipt, contact the business where the purchase was made. Many businesses can provide a duplicate receipt if you provide the transaction details, such as the date of purchase and the items purchased. For digital receipts, check your email or account history with the business.

Can I use a sales receipt for returns and exchanges?

A sales receipt is usually required for returns and exchanges as proof of purchase. Most businesses will ask for the receipt to verify the transaction and ensure the returned or exchanged item was purchased from their store.

In conclusion

Sales receipts are the foundation of business, proof of transactions, financial management, and record keeping. Whether you create receipts manually or use online tools or services like Shoeboxed, having organized and detailed sales receipts is key to your business running smoothly. Follow the best practices and use the resources above; your sales receipts will do their job and support your business.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!