Being your own boss is awesome. One of the best things about it? You can deduct business expenses and save a bunch as a self-employed individual.

This cheat sheet will give you an overview of the most common self-employed tax deductions to save more and stay tax-compliant.

What are the different types of business expenses?

Business expenses are costs incurred to make money and run and maintain your business. Knowing the different types of business expenses will help you identify deductible expenses and save more.

Here are the main categories:

1. Operating expenses

These are the everyday business costs, such as rent, utilities, and employee salaries. These expenses are necessary for the ongoing operation of your business and are 100% tax deductible.

2. Capital expenses

These are costs associated with acquiring or improving long-term assets like equipment, property, or vehicles. These expenses are not deductible but can be depreciated over the asset's life.

3. Travel expenses

You can deduct transportation, lodging, and meals if you travel for business. Remember to keep records of your travel to support your claims.

4. Entertainment expenses

The Tax Cuts and Jobs Act of 2017 limited the deductibility of entertainment expenses, but some costs related to entertaining clients, customers, or employees, like business meals, may still be deductible.

5. Advertising expenses

Advertising, marketing, and public relations are key to growing your business. These expenses are 100% tax deductible as business expenses.

6. Insurance expenses

Insuring your business is essential for risk management. Premiums for liability, property, and workers’ compensation insurance are tax-deductible business expenses.

By categorizing and tracking your business expenses, you can ensure that you are taking full advantage of all available tax deductions.

What are tax deductions?

Deductions are expenses you can subtract from your income to lower your tax bill. They are a must for self-employed individuals to reduce their taxes.

Understanding deductions will help you navigate the tax filing process.

How do deductions work?

Deductions work by reducing your income, which in turn reduces your tax.

There are two types of deductions: standard and itemized.

The self-employed can choose which one benefits them the most.

What is the self-employment tax?

Before we get into deductions, you need to understand that self-employed people pay both the employer and employee portion of Social Security and Medicare taxes, also known as self-employment tax.

For the 2024 tax year, the self-employment tax is 15.3%. However, you can deduct the employer portion (half of self-employment tax) when calculating your adjusted gross income.

Self-employed deduction cheat sheet

As tax season approaches, you need to know what deductions are available as self-employed.

Here is your self-employed tax deduction cheat sheet:

1. Home office

If you use a portion of your home exclusively and regularly for business, you may be able to deduct the home office by choosing either the simplified or regular method.

Simplified method: $5 per square foot of your home used for business, up to 300 square feet (max $1,500).

Regular method: Calculate actual expenses based on the percentage of your home used for business, including mortgage interest or rent, utilities, insurance, and maintenance.

Requirements:

The space must be used exclusively for business.

It must be your principal place of business.

2. Vehicle expenses

If you use your car for business, you can deduct related expenses using either the standard mileage rate or the actual expense method.

Standard mileage rate: 67 cents per mile driven for business in 2024.

Actual expense method: Deduct actual costs, including gas, repairs, insurance, and depreciation, prorated for business use.

Tip: Keep a mileage log or use a mileage tracking app to support your claims.

3. Office supplies and expenses

You can deduct business-related supplies and expenses such as:

Pens, paper, and postage

Computers and software

Office furniture (may need to be depreciated over time)

Internet and phone expenses (business use only)

4. Professional services

Fees paid to lawyers, accountants, consultants, and other professionals related to your business are deductible.

5. Marketing and advertising

Expenses to promote your business can be deducted, including:

Website design and hosting fees

Business cards and brochures

Online and print advertising

Social media marketing costs

6. Travel expenses

Business travel away from your tax home can be deducted, including:

Airfare, train, or bus tickets

Lodging

Meals (usually 50% deductible)

Taxi or rideshare fares

Tips and gratuities

Note: Personal expenses during business travel are not deductible.

7. Meals and entertainment

Business meals: You can deduct 50% of qualifying business meal expenses.

Entertainment expenses: Not deductible under the Tax Cuts and Jobs Act 2017.

Requirements:

The meal must be directly related to or associated with the active conduct of your business.

Keep detailed records, including the amount, time, place, business purpose, and attendees.

8. Health insurance premiums

If you pay for your health insurance, you can deduct premiums for yourself, your spouse, and your dependents, including:

Medical and dental insurance

Long-term care insurance (subject to age-based limits)

Conditions:

You were not eligible for employer-sponsored health coverage.

The deduction cannot exceed your net self-employment income.

9. Retirement contributions

Contributions to certain retirement plans reduce your taxable income.

Simplified Employee Pension (SEP) IRA: The lesser of $69,000 or up to 25% of net self-employment or compensation.

Solo 401(k): Contribution limit of $69,000, plus $7,500 in catch-up or 100% of earned income, whichever is less.

10. Self-employment tax deduction

You can deduct half of your self-employment tax when calculating your adjusted gross income.

11. Insurance premiums

Premiums for business-related insurance policies are deductible

General liability insurance

Professional liability (errors and omissions)

Business interruption insurance

Cyber liability insurance

12. Education and training

Expenses for education that maintain or improve your skills in your current business are deductible, including:

Workshops and seminars

Online courses

Industry-specific certifications

13. Interest on business loans

Interest paid on loans used for business purposes is deductible.

This includes credit card interest if the charges are for business expenses.

14. Depreciation

Deduct the cost of business assets over their useful life or use Section 179 expense to deduct the total cost in the year of purchase (subject to limits).

Eligible assets: Equipment, machinery, computers, office furniture, and vehicles.

15. Startup costs

You can deduct up to $5,000 in startup costs and $5,000 in organizational expenses in your first year of business.

Startup costs: Market research, advertising, training, and professional fees.

Organizational costs: Legal fees, state filing fees, and expenses for setting up your business structure.

16. Taxes and licenses

Deduct business taxes and licenses, including:

Business-related taxes (not federal income taxes)

Business licenses and permits

Real estate taxes on business property

17. Rent and utilities

If you rent office space or equipment, the rental expenses are deductible.

This includes utilities, maintenance, and other operational expenses.

18. Bad debts

If you have included an amount in your income but can’t collect it, you may be able to deduct it as bad debt.

Employee benefits and taxes

Offering employee benefits is a great way to attract and retain talent and has big tax benefits for your business.

Here are some common employee benefits that are tax deductible:

1. Health insurance

Your employees' health insurance costs are 100% deductible. This includes medical, dental, and vision insurance.

2. Retirement plans

Contributions to retirement plans like 401(k) or SEP-IRA are deductible. These plans also help your employees save for their future, which is a significant benefit.

3. Life insurance

Premiums for life insurance policies for your employees are deductible as a business expense.

4. Disability insurance

The cost of disability insurance for your employees is deductible to protect them in case of illness or injury.

5. Education assistance

If you offer education assistance to your employees, such as tuition reimbursement, the costs are also deductible.

In addition to these deductions, employee benefits can reduce your business’s taxable income and qualify you for tax credits. For example, small businesses can get health care tax credit, which is available for companies that offer health insurance to their employees.

Talk to a tax pro to ensure you get the most tax benefit from employee benefits. They can help you through the tax laws and ensure you comply while taking advantage of all the deductions and credits.

By knowing and using these tax-deductible employee benefits, you can reduce your taxes and invest in your employees.

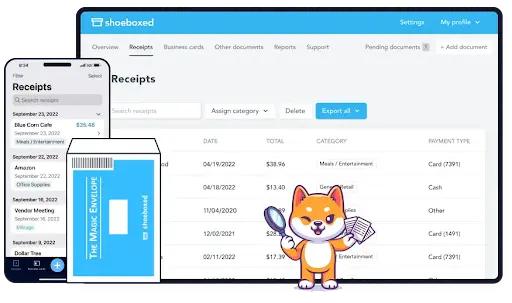

How can Shoeboxed help maximize your self-employed tax deductions?

As a self-employed individual, you must track your expenses to maximize tax deductions and comply with tax laws.

Shoeboxed is a powerful tool that simplifies expense management by digitizing and organizing your receipts and financial documents.

With Shoeboxed, you can streamline the process of tracking deductible expenses, keep accurate records, and make tax time less painful.

1. Easy receipt digitization

Use the Shoeboxed mobile app to take photos of your receipts on the go. Snap a picture of your receipt with your smartphone, and the app will upload it to your designated account so your receipts are all in one place and easy to locate.

Or, forward receipts to your designated Shoeboxed email address provided when you sign up. You can also install Shoeboxed's custom Gmail plugin to auto-import digital receipts to the Shoeboxed dashboard.

If you want to outsource your scanning, you can send physical receipts to Shoeboxed using their pre-paid Magic Envelope. Their team will scan, human-verify, and upload them into your account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

2. Automatic data extraction and categorization

With OCR technology, Shoeboxed extracts date, vendor, amount, and payment method from receipts. Receipts are then categorized into IRS-recognized or custom expense categories (e.g., meals, travel, office supplies).

Add custom tags to expenses for easy searchability.

3. Organization of deductible expenses

See all your business expenses in one place and find deductible costs.

Search for specific expenses by date, category, or vendor.

Store all documents in the cloud and reduce clutter and lost receipts.

4. Tax-ready reports

Generate expense reports with receipts attached summarizing your deductible expenses for a period.

Download reports in tax software-compatible formats or share them with your accountant.

5. Mileage tracker

Use Shoeboxed’s mileage tracker and your phone's GPS to log business travel, a common deduction for self-employed individuals.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today6. Compliance and audit support

Shoeboxed’s digital receipts are IRS-compliant so that you can use them for tax filings and audits.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

7. Time and cost savings

Shoeboxed automates tasks like data entry and categorization and frees up time to focus on your business.

Organized records make your accountant’s job easier and potentially lower professional fees.

Accurate tracking ensures you get all eligible deductions, reducing your tax liability.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to maximize tax savings

You can further maximize tax savings by taking advantage of the Qualified Business Income Deduction and business tax credits.

1. Qualified Business Income Deduction (QBI)

The Qualified Business Income Deduction (QBI) allows self-employed individuals to deduct up to 20% of their qualified business income. This deduction can help reduce taxable income and lower tax liability.

The QBI deduction is available to sole proprietorships, partnerships, and S corporations.

2. Business tax credits

Business tax credits can help reduce tax liability.

These credits include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

Business tax credits can be claimed in addition to tax deductions.

Tax planning and preparation

Tax preparation can be time-consuming unless you plan ahead, such as documenting business expenses year-round.

Documenting business expenses

Documenting business expenses is essential for tax preparation.

This includes keeping receipts, invoices, and bank statements.

Accurate documentation can help ensure that all business expenses are deducted.

What are some common tax mistakes to avoid?

Tax mistakes can cost you a lot of money.

Common tax mistakes to avoid include the following:

Failing to keep accurate records

Failing to report all income

Failing to claim deductions

These mistakes can result in penalties and fines.

Avoiding common tax mistakes can help ensure a smooth tax filing process and ensure you maximize your tax savings.

How can you simplify tax preparation?

Simplifying tax preparation can help reduce stress and save time. This includes using tax software, hiring a tax professional, and keeping accurate records.

Simplifying tax preparation can also help ensure a smooth tax filing process.

Frequently asked questions

What are some common self-employed deductions?

Self-employed people can deduct business expenses such as home office, internet and phone bills, business travel, office supplies, and professional services like accounting or legal advice. Remember to include health insurance premiums, mileage for work-related travel, and retirement contributions.

How do I make sure I’m getting all my deductions?

To get all your deductions, make sure to keep records of all business expenses throughout the year. Use expense tracking apps, keep receipts, and organize your finances in categories related to your business. Consulting a tax pro or using good tax software can also help you find deductions you might have missed.

In conclusion

Having a tax deduction cheat sheet and using Shoeboxed makes managing deductible expenses for the self-employed much more manageable.

By digitizing receipts, automating data extraction, and organizing expenses into tax-ready reports, Shoeboxed helps you get more deductions and stay compliant.

And by integrating Shoeboxed into your financial routine, you’ll save time and have peace of mind knowing your records are accurate and audit-ready.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!