Looking for a way to manage your business expenses? Consider using an expense tracking app.

Business expenses management can be tedious and time-consuming without the right tools. But with so many business expense tracker apps available in the market today, expense reports and managing employee spending is now easier than ever.

This blog post looks at how expense tracker apps help small business owners and accounting teams stay on top of their budgets and safeguard business bank accounts—plus we list the top 5 apps to consider if you are a small business owner.

See also: The Total Receipt Organization Guide

How to Start an Uber Business: The Ultimate 10-Step Guide

8 reasons to start using business expense tracker apps

1. A business expense tracker app can help you save money on taxes

Whether you are managing expenses, mileage, or purchases, utilizing the right expense tracking app is crucial for effective budget management and maximizing tax deductions in business then and now. These apps leverage expense tracking software to provide detailed insights into spending per category, empowering businesses to adjust their budgeting strategies accordingly. By leveraging such technology, businesses can stay organized, make informed financial decisions, and optimize their funds.

2. Tracking expenses with an app is much easier than using a paper journal

For small businesses, tracking expenses with a paper journal is tedious, time-consuming, and can lead to errors. Expense-tracking apps have improved over the years by offering robust capabilities that allow businesses to keep tabs on how much they’re spending and where their money goes. A business expense tracker can help prevent lost receipts and other important tax records.

3. An expense tracker app is more intuitive than tracking on spreadsheets

With an app that helps you track expenses, you won’t have to worry about formulas or remembering which cell is for what because the app comes preloaded with such functions.

For instance, Excel lacks the ease of use and intuitiveness of expense tracking software. But the majority of business expense tracker apps make it easy to categorize your expenses into sub-categories (e.g., food, hotel) to organize the data better and see where all funds are being spent.

4. The best expense-tracking apps will make it easy to categorize the different types of expenses

By using business expense trackers, your receipts are about to get a whole lot easier on the eyes. As soon as your receipt has been scanned, the app’s software categorizes the accounting information by the amount spent, date, etc., so that you can see all of this information with one glance—no more scrolling left-to-right through an endless spreadsheet. The data is searchable and editable whenever users need to make changes or add additional details after scanning their documents in real-time.

5. The best expense tracker apps also track mileage

Looking for a corporate expenses app that will automatically track mileage? For frequent travelers, it can be hard to track your work-related trips and ensure you’re receiving the correct reimbursement for your time. The best expense trackers will include a mileage tracking feature for tax purposes.

6. Expense tracking apps allow you to easily export tax data or send reports to your accountant if needed

Exporting and importing data for expense reports or to submit expenses for expense approval is simple with expense tracker apps. Most expense tracker apps allow you to export your expenses in various formats, including .pdf and .csv files, which can be used for tax purposes or sent directly to your accountant! This will significantly improve your mood and reduce stress during tax season every year. For larger companies, accounting teams can easily track expenses from employees and manage cash flow, all from one dashboard.

7. With an expense tracker app, you can create an image archive of your receipts

Digitally archived receipts are safe from being lost in the depths of your shoebox. The best expense tracking apps will let you upload receipts straight from your phone. The IRS and CRA will accept digital images, so you don’t have to worry about losing any crucial documents in case of an audit.

Top 6 best business expense tracker apps

1. Shoeboxed

Price: Starting at $4.99/month

Shoeboxed is an expense and receipt tracker app that makes it easy for you to create expense reports directly from your phone. You can then add your bookkeeper or accountant to your account at no extra charge, and your tax professional can then get those records quickly and efficiently without needing to type anything in or scan anything out.

Outsource tedious receipt scanning to Shoeboxed!

Shoeboxed’s most loved feature is its receipt scanning service. Users can send a backlog of paper receipts to Shoeboxed’s processing center in Durham, NC. And Shoeboxed’s data verification team will scan, process, and verify all receipt data, automatically assigning it 1 of 15 common tax categories.

How does Shoeboxed compare to other receipt scanner apps?

Shoeboxed |

Expensify |

Dext |

Rydoo |

Neat |

Wave |

Quickbooks |

|

|---|---|---|---|---|---|---|---|

Capterra rating |

4.4 |

4.5 |

4.2 |

4.4 |

4 |

4.4 |

4.3 |

Physical receipts |

✔️ |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ |

Digital receipts |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Document storage |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Unlimited free users |

✔️ |

❌ |

✔️ |

❌ |

❌ |

❌ |

❌ |

Mileage tracker |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

❌ |

✔️ |

Expense reports |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

❌ |

Human verification |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

❌ |

Automatic categorization |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Business contacts organizer |

✔️ |

❌ |

❌ |

❌ |

❌ |

✔️ |

✔️ |

iOS app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Android app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Free version |

✔️ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

Free trial |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Credit card reconciliation |

❌ |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

✔️ |

Starting price per month |

$18 |

$5 |

$30 |

$9 |

$200 |

$16 |

$18 |

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

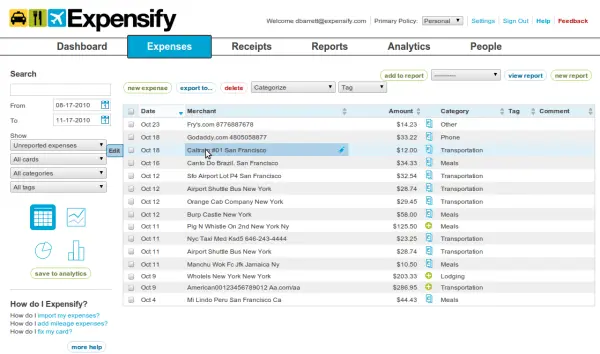

Get Started Today2. Expensify

Price: From $5/month

Expensify automates expense management and receipt tracking, streamlining the entire pre-accounting process by syncing with both Xero and QuickBooks. Their mobile app is available in the Apple Store and Google Play Store.

The Expensify app offers expense tracking features, such as splitting expenses with ExpensePoint, sending and receiving money via Venmo, connecting to Uber and Lyft to import travel receipts, and using the mileage tracker to track reimbursable travel or mileage.

See also: Budget Battles: Expensify vs. Concur

Venmo Receipt, Expense Report, and Tax Deduction: All in One

Concur Alternatives: Top 4 for Efficient Expense Management

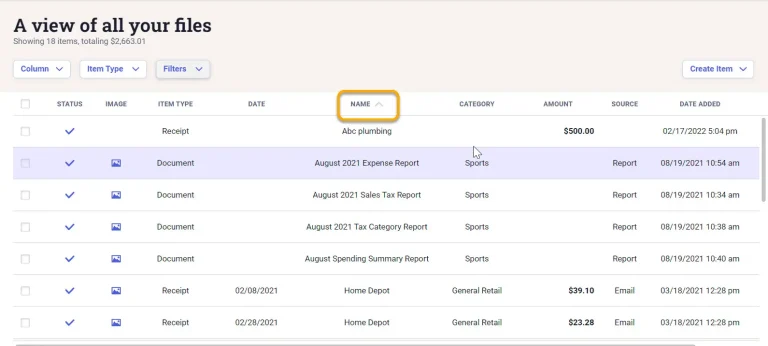

3. Neat

Price: From $25/month

Neat is a cloud-based expense tracking system that helps businesses track their expenses. It allows users to scan, upload, and organize their documents, categorize them, create reports, and send them to different platforms. Neat also provides bank-level security encryption for its users’ documents.

Neat’s online expense dashboard

Tracking business expenses is important as it helps businesses create a budget, manage cash flow, and make more informed decisions. Neat is a good choice for small businesses and entrepreneurs who deal with a lot of business expenses and receipts. It lets users upload receipts, extract the data from them, and store the original file in a secured database. This makes it easier to track business expenses and maximize tax deductions.

4. Wellybox

Price: From $9 per month

Wellybox is an online expense tracking web-based app that helps businesses track and manage their expenses. It can scan all of a company’s emails to track digital receipts, making it easy to keep track of business expenses. It also integrates with popular accounting software such as QuickBooks and Xero, allowing for easy sharing of receipts and reports.

WellyBox’s homepage

Additionally, Wellybox offers features such as automated expense report processes for quickly scanning unlimited email accounts to track bills, invoices, and other expenses. Finally, Wellybox provides tools and benefits that make it easier to keep track of all business expenses in one place. If you are not fully on board with Wellybox, there are many Wellybox alternatives for you to try.

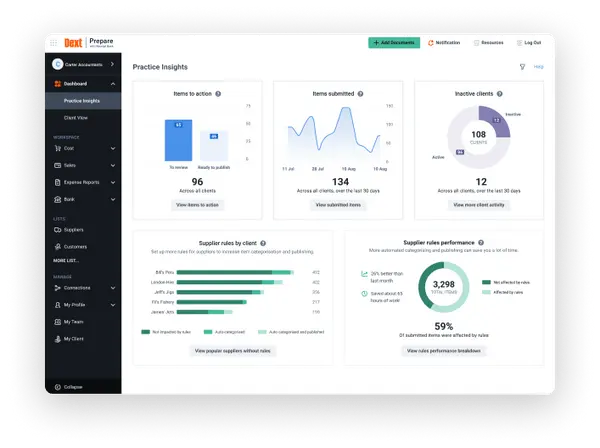

5. Dext Prepare

Price: Business Plus plan starts at $22 per month; accounting or bookkeeping firm plans start at $189.99 a month.

Dext Prepare is an expense tracking software that helps businesses and accountants manage their books conveniently. It features expense reporting, receipt scanning, and other tools helpful for bookkeeping. Dext Prepare’s mobile expense management app allows users to snap expenses and submit them in just a few clicks, automatically organizing them into an expense report. This helps eliminate the daunting task of data entry and prevents the “shoebox” accounting mentality where receipts are collected for a long period of time without being organized.

Dext Prepare’s online expense dashboard

The app also has a plan specifically targeting accounting or bookkeeping firms managing clients, which lets them automate document collection for their clients. Their software is similar to Expensify, another expense & receipt tracking app that helps users get reimbursed and maximize tax deductions.

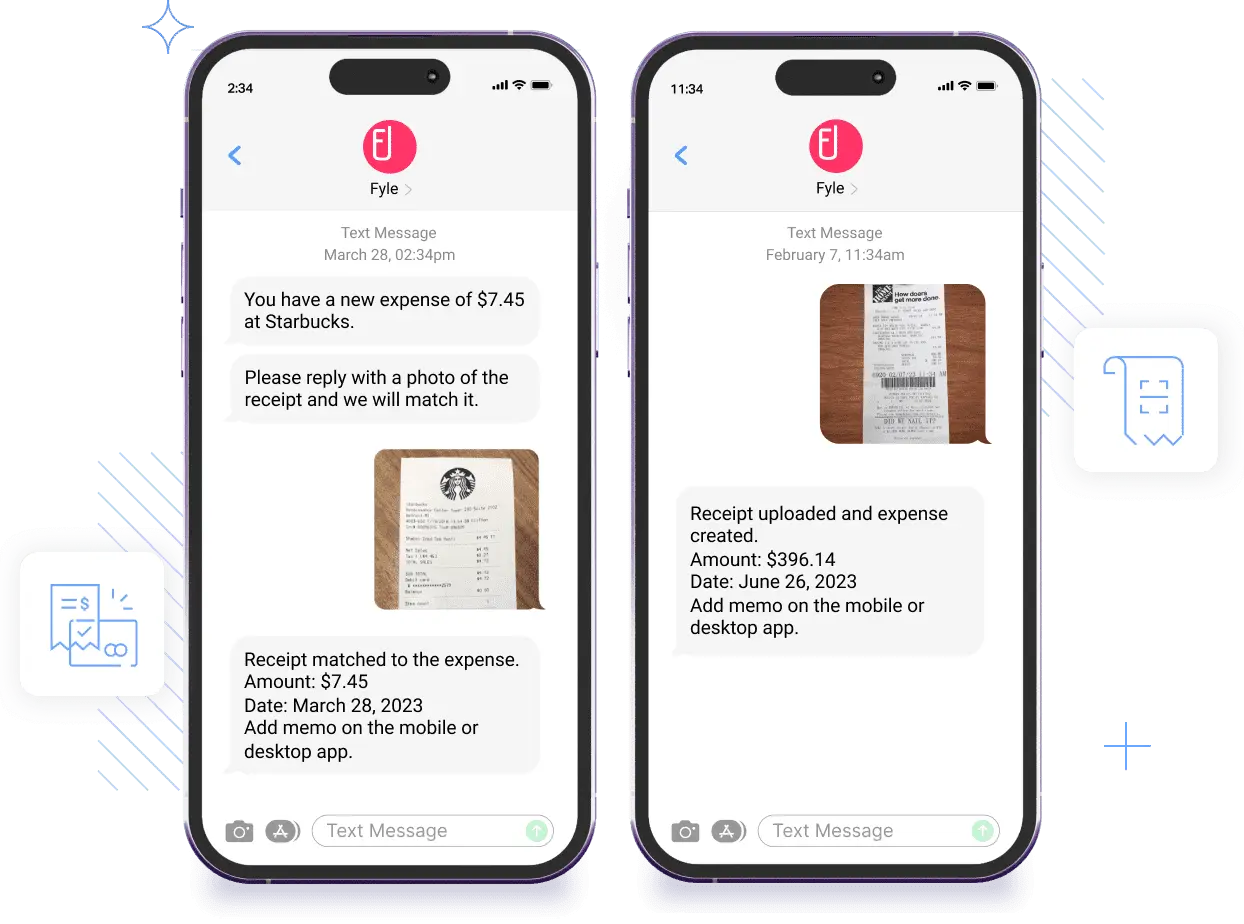

6. Fyle

Price: From $6.99/month

Fyle is the first expense management software to offer real-time feeds on your existing credit cards. It directly integrates with Visa, Mastercard, and American Express to give you real-time text notifications for all credit card spend.

With Fyle’s conversational AI, employees can text receipts, for out-of-pocket or card expenses to Fyle on the go. Receipts will be matched to the right card transaction automatically so accounting teams don't have to spend hours following up with employees, or force them to deal with apps.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

Why does a business owner need to select the best app for tracking business expenses and mileage?

A business expense tracker can help keep your finances in order if you have a large or small business. Some apps can help you manage receipts, categorize expenses, and work seamlessly with popular accounting software. A good business expense tracking system simplifies administrative tasks, from paying employees and vendors to maximizing tax deductions.

What is the best business expense tracker apps for small businesses?

1. Best for paper receipts and tax season—Shoeboxed‘s team will scan, digitize, and verify all of your paper receipts with its Magic Envelope service. All receipts are logged into your account and then sorted into 1 of 15 common tax categories.

2. Best for travelers—Expensify is a great option for individuals who travel a lot for business. The app integrates with Uber and Lyft, allowing you to submit expenses for your business travel.

3. Best for enterprises—Dext Prepare has professional and enterprise plans for bookkeeping and accounting firms. This is a great option for large businesses with multiple locations.

How do small businesses keep track of transactions?

Follow these 8 steps to efficiently keep track and organize your business expenses:

Step 1. Create a separate business bank account.

Step 2. Have a business credit card for business use only.

Step 3. Select a suitable accounting system for your business.

Step 4. Subscribe to the right accounting software to automate all record-keeping and tracking tasks.

Step 5. Use a receipt scanner for business expenses.

Step 6. Link your business bank account to your selected accounting software to document all transactions.

Step 7. Place the expenses in the right category.

Step 8. Review all the transactions and due payments regularly. Know what documents you need to keep track of here: What to Keep Track of as an Independent Contractor: 7 Document Types

How do I create a spreadsheet for my business expenses?

Here are 6 simple steps to create a business expense spreadsheet:

Step 1. Select a spreadsheet template in your excel software or a specialized expense-tracking app.

Step 2. Customize your spreadsheet with the columns and categories required for your business.

Step 3. Insert itemized receipt expenses with the related costs.

Step 4. Calculate the total costs with excel formula features.

Step 5. Attach a link to the digital scan of your receipts in the sheet.

Step 6. Save the sheet as a printable PDF file or email the report to your team.

In conclusion

The best expense-tracking app for small businesses will keep track of business receipts, mileage logs, purchase and receipt history, and other categories like food/drinks or hotel stay to provide users with a complete picture of their expenses.

You can step up your game with a document scanner to digitize all your documents and organize them in a digital filing solution.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!