Every transaction in business gives rise to a receipt, you know that little piece of paper that can become a big headache if not handled correctly. Knowing how to organize and properly store receipts can make all the difference as an individual or in running your business.

Why store receipts?

Receipts are to be kept for a myriad of reasons: from maintaining proper financial data, ensuring compliance with tax laws, to allowing budgeting and controlling expenses. They help prove transactions, some of which will count during audits.

In addition, the organized storage of receipts helps you visualize spending patterns where money is being spent or wasted so you can reverse the outcome. Whether you store receipts digitally or physically, proper organization helps a person stay in line with financial responsibility.

Regarding auditing and financial management

Receipts are very important to small businesses. These little paper slips are the center of expense management, essential to keeping a small business up and running. Organized receipt-keeping helps companies find possible ways to save, such as tax deductions or spending patterns, assisting in carrying out more strategic financial plans and distributing resources more accurately.

To reduce clutter and increase productivity

In my experience, productivity levels are typically lower in cluttered workspaces. With receipt organization, you can declutter your office or business environment, simplify tax preparation, and make sound decisions regarding financial matters. Efficient organization makes receipts easily accessible during audits or financial reviews.

What are the various types of receipts?

There are two main types of receipts: paper and digital.

1. Paper receipts

Some businesses still rely heavily on paper receipts. While this is an acceptable practice, these receipts may easily become disorganized, faded, or damaged, resulting in the loss of essential data. Storing paper receipts can be challenging, but creating a routine for receipt storage can help you stay organized. Use files and folders to keep paper clutter and create a paper filing system for physical receipts.

2. Digital receipts

Digital receipts are easier to manage, less likely to get lost or damaged, and can be accessed and sorted quickly. Electronic receipt organization is efficient and easy to use. Use digital methods to keep track of and organize your receipts easily.

How should you store receipts?

Business receipts are essential for tracking purchases, sales, and expenses, and organizing them can help you manage your finances. You can store receipts physically in a filing cabinet or cabinets or electronically in online accounting software.

Organizing receipts helps keep your important financial documents in order, making preparing for taxes and audits easier.

Declutter and organize receipts

For each receipt, determine whether it is an older or a newer one, and try to keep only those that are necessary to keep or needed for a specific period, such as receipts for returns, big-ticket items, and receipts for tax purposes. Dispose of all others. Declutter and organize receipts regularly.

Use paper receipts with a binder/folder

If you are more of a paper receipts person, keeping a binder or folder to insert your paper receipts neatly is a good idea. Just keep them in a cool, dry place to prevent the thermal paper from fading.

Use cloud storage for e-receipts

A digital receipt system saves trees, and with cloud solutions, receipts can be categorized and retrieved from anywhere and at any time. Scanning or digitizing the paper files of receipts saves a great deal of physical space and enhances access and security.

Using technology for receipt management

Using technology for receipt management has changed the game for businesses and individuals tracking business expenses.

Why Shoeboxed?

Shoeboxed is the #1 receipt management software to store and manage receipts, and it has features to track and document expenses for businesses and individuals.

Here’s why Shoeboxed is the best:

1. Ease of use

Mobile app

Shoeboxed has a super easy interface for scanning and storing receipts. Users can snap a photo of their receipt with their mobile device, and Shoeboxed will digitize the receipt and upload the data to your Shoeboxed account. The app will convert paper receipts to digital receipts.

The Magic Envelope

You can also mail your receipts to Shoeboxed using their Magic Envelope service. Just send your receipts or documents in a pre-paid envelope to Shoeboxed, and they’ll scan, digitize, human-verify, upload, and store them in your Shoeboxed account.

Shoeboxed is the only receipt scanner app to handle paper and digital receipts, saving customers up to 9.2 hours a week in manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today2. Automation through OCR technology

Shoeboxed’s OCR technology extracts receipt data such as date, total amount, taxes paid, vendor, and payment method.

3. Organization and accessibility

Organization and categorization are automatic with Shoeboxed. Receipts are categorized into 15 tax or custom categories.

Storage is cloud-based, so users can access their electronic receipts from anywhere in the world, which is perfect for businesses with travel expenses or remote teams.

4. Integration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks and Xero, so all financial records are up-to-date and accurate across the board.

5. Compliance and security

Shoeboxed ensures stored electronic receipts are IRS compliant and uses encryption and secure servers to protect user data and financial info.

6. Expense reports

Shoeboxed also has options to auto-generate expense reports. Expense reports help track spending habits, prepare for tax season, and monitor budgets more efficiently.

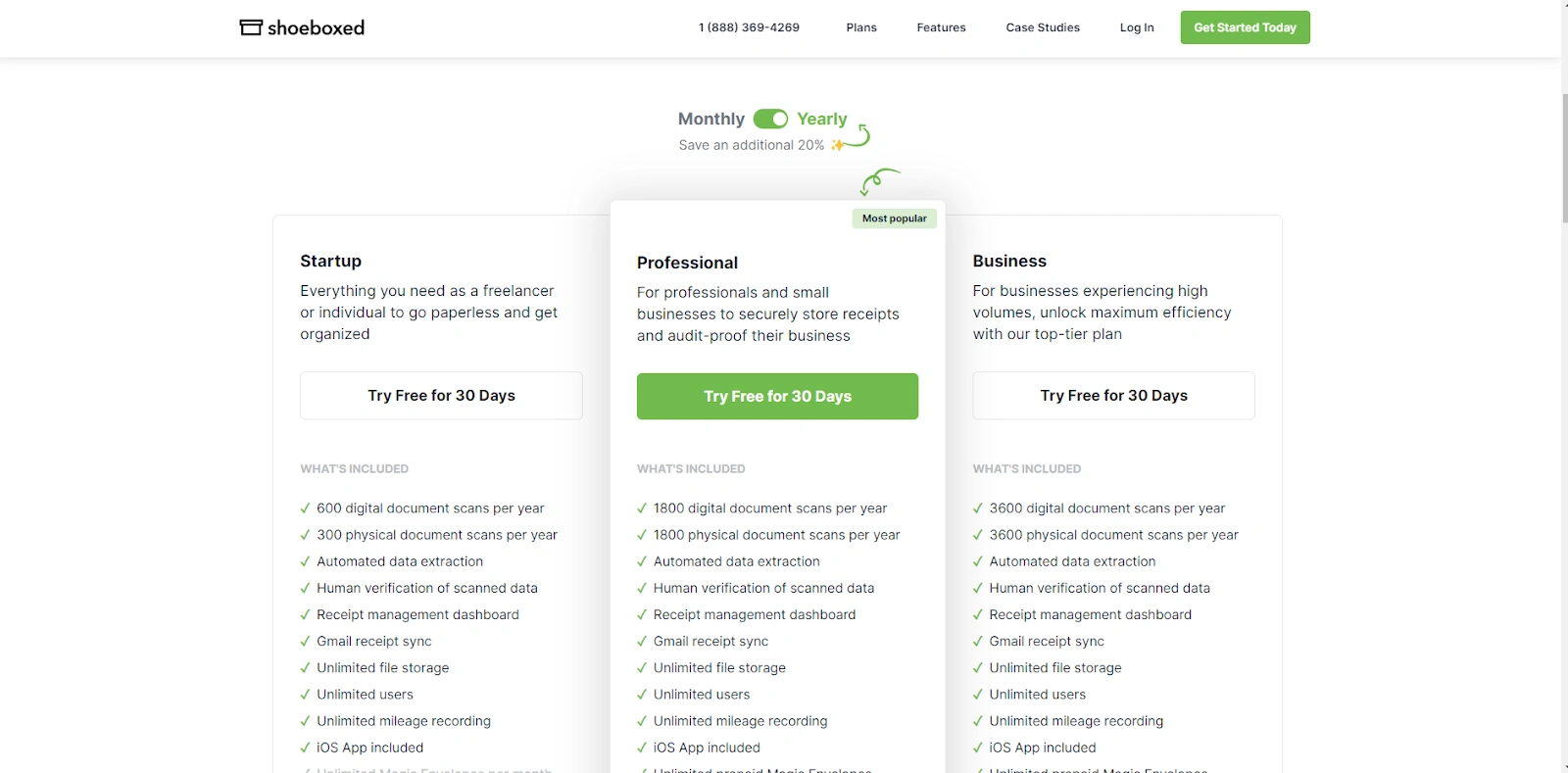

7. Cost

With many pricing tiers, Shoeboxed is affordable for individuals and businesses.

Shoeboxed is for anyone who wants maximum efficiency in receipt management, optimal financial organization, or more productivity.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat are the IRS guidelines for business receipts?

The IRS says:

Retention period: Keep business receipts for three years from the date you file your tax return or two years from the date you paid the tax, whichever is later. On average, taxpayers typically keep their tax data for 3 to 7 years.

Requirements: The IRS will accept electronic receipts as long as they are legible and can be accessed reliably.

What are some common mistakes to avoid?

Here are some common mistakes to avoid so that you don't run into issues with the IRS:

1. Not saving receipts long enough

Keep receipts for three years from the date you file your tax return or two years from the date you paid the tax, whichever is later.

Exceptions include receipts for returns, big-ticket items, and tax purposes.

2. Not organizing business receipts regularly

Set aside 15 minutes to tackle old business receipts.

Break down the project into smaller chunks to declutter receipts.

3. Not using technology to streamline receipt storage

Use accounting software or receipt scanner apps to upload and store receipts electronically.

Shoeboxed accounting software has receipt reading technology and organizational tools.

Frequently asked questions

1. How secure is Shoeboxed for storing digital receipts?

Shoeboxed uses encryption and security protocols to store all data securely and make it accessible to authorized users only.

2. Can Shoeboxed integrate with other financial software?

Shoeboxed does integrate with accounting software solutions. The synchronization of financial data across platforms makes financial management very easy.

In conclusion

Storing receipts is crucial to financial management because it affects a business's operational efficiency and compliance. With Shoeboxed to organize and store all receipts, businesses will save time and gain insight into their financial practices, making each receipt an asset instead of a nuisance.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!