What do you do when traditional budgeting methods fail? That's where strategic budgeting comes in.

While not a new budgeting model, it takes ideas and concepts of specific methods and rolls them into one.

Let's learn more about strategic budgeting and how it can help you achieve your goals in the long term.

What is strategic budgeting?

Strategic budgeting is a type of planning that aligns your organization's long-term goals and strategies with your finances.

It's different from traditional budgeting methods as it doesn't solely focus on operational costs and previous data. It also prioritizes businesses’s objectives and revenue growth by adapting to your changing environment.

3 key components of strategic budgeting

1. Goal alignment.

One of the major components of strategic budgeting is aligning financial planning with your organization's vision and mission, as it will ensure that the allocated amount is used for the long term.

Additionally, this alignment helps create a clear connection between finances and strategic outcomes to create a more focused decision-making process at all levels of the organization.

2. Flexibility.

Strategic budgeting incorporates responding to changing markets. This flexibility allows organizations to make adjustments and reallocate resources based on new trends or unforeseen circumstances, allowing you to make alternative financial decisions.

3. Collaboration.

With cross-functional teamwork and stakeholder engagement, it will foster open communication for knowing what is the shared goal across all departments.

A collaborative approach gives key financial decision-makers different perspectives on how the budget should be used.

Strategic budgeting methods

There are different approaches for strategic budgeting. A combination of these go beyond the traditional budgeting method.

Program-based budgeting: The budget is built from program proposals, so different departments have to coordinate together for the budget proposal.

Priority-based budgeting: Allocates the budget based on a predetermined list of priorities and criteria, making sure high-priority initiatives are considered.

Performance-based budgeting: Incorporated performance data to evaluate the return on investment for budget proposals.

Outcome-based budgeting: Link budget proposals with strategic goals to allocate resources to the desired outcome.

Participatory budgeting: The community is included in the budgeting process. This budgeting is always paired with other methods to help get their input on the goals.

Evidence-based budgeting: Uses current and previous data to review budget proposals to track investment outcomes and adjust the budget accordingly. You'll have to monitor actively to see your intended investments yield results.

These methods can be used individually or in combination, depending on your organization's goals and priorities.

Why is strategic budgeting important?

Strategic budgeting allows the organization to align its financial resources with long-term goals so that its funds go toward its vision and mission.

One of the major components of strategic budgeting is being flexible when the market channels or any new opportunities occur. These types of scenarios allow for quick adjustment and can drive informed decision-making.

How to implement strategic budgeting in your business

1. Assess organizational goals and priorities.

Start by identifying your company's long-term objectives. You'll need input from your stakeholders, department leaders, senior leadership, and key employees to determine that.

Meetings, surveys, and workshops can help you gather feedback about strategic initiatives rather than immediate operational needs.

2. Analyze financial data and trends.

Use any historical data to make informed decisions about your future budget allocations.

So, you'll need to review your previous budget's performance to understand past effective strategies. Look for areas where any amount was over- and underutilized.

3. Set realistic budgets for initiatives.

Based on the goals and financial analysis, allocate resources to prioritized initiatives to align with strategic priorities.

Develop detailed cost estimates for each goal, including direct and indirect expenses, to ensure financial stability for the desired outcome.

4. Monitor and revise budgets regularly with Shoeboxed

Implement a system for ongoing budget review. Regular spending reviews against the budgeted amount allow you to assess the progress.

To help you view everything in one place, try Shoeboxed.

a. Digitize expenses.

Shoeboxed is a receipt scanning tool for paper and digital receipts software that allows you to digitize and store all receipts, including tax-related documents.

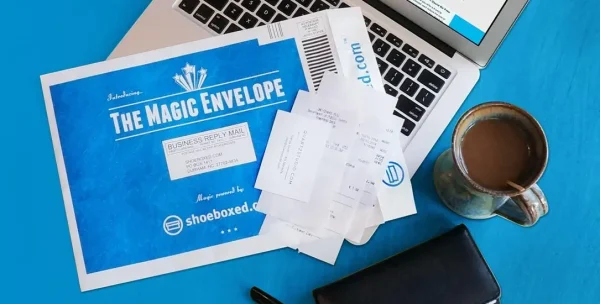

Got too many receipts to scan? No worries. You can mail your receipts and documents to Shoeboxed with their free pre-paid Magic Envelope, and they will scan and upload them for you.

For those with a large team, your team members can email their receipts to the provided Shoeboxed email address, which will automatically be added to your Shoeboxed account.

b. Track spending.

You can view everything on your dashboard once your receipts and tax-related documents are uploaded.

The dashboard gives you a snapshot of your expenses, such as business expenses, donations, etc.

Shoeboxed uses OCR (Optical Character Recognition) to extract key information from invoices and receipts, which will then be categorized in different tax categories, saving you time.

This feature will help you make a financially informed decision about the rest of your budget.

Plus, if you have multiple finance team members, you can add them as users to your account, making it easier for everyone to access these expenses easily.

3. Be audit ready

Auditing your expenses is one of the best ways to gather precise financial data to help with financial management, cash flow, cost control, and resource allocations.

Even for tax audit preparations, Shoeboxed provides IRS and Canada's Revenue Service-accepted receipt scans, so your digital copies meet regulatory standards for audits.

So, you can watch for red flags and revise your strategic initiatives with ease.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayStrategic budgeting example

A simplified example would be looking at school districts.

The most common budgeting methods, such as incremental budgeting, would have the school district rely on last year's budget as a baseline to help plan for the upcoming year.

In contrast, strategic budgeting distracts leaders' priorities to help create a new, more long-term budget plan.

So, instead of an overall blank budget increase of 1%, the school district allocates funds based on the board's and each district's properties.

Frequently asked questions

What is dynamic strategic planning and budgeting?

It is a flexible approach that aligns an organization's budget with long-term goals while allowing for regular adjustments based on market changes. Since it's dynamic, not static, it allows for greater responsiveness in financial decision-making.

In closing

Adopting strategic budgeting isn't just about balancing the books—it's about empowering your organization in an ever-changing business landscape. Take the first step toward a more flexible budget to achieve your long-term objectives.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!