Understanding the audit process is an effective way of alleviating some of those fears associated with being selected. Don’t be scared—be prepared.

An audit is one of those dreaded phrases in many people’s vocabulary, but it doesn’t have to be.

Even the most upstanding and honest taxpayer can be selected for an audit.

An audit refers to the process where the Internal Revenue Service (IRS) reviews the financial information on a taxpayer’s tax return, such as income and deductions, for accuracy. In many cases, they only need more information to back up or clarify the numbers on your return.

Understanding the process is an effective way of alleviating some of those fears associated with being selected. Here’s a comprehensive guide for a painless tax season and how to understand and prepare for this process should you ever be selected.

What triggers an IRS audit?

There are certain red flags that trigger an audit. The two items that trigger audits the most are unreported revenue and reporting an excessive amount of deductions.

Here are the most common triggers explained:

Infographic on 11 of the most common IRS audit triggers

1. Unreported earnings

Since the IRS gets copies of your Form W-2s and 1099s, they can do a crosscheck to ensure that all of your taxable revenue reported on these forms matches the information reported on your tax return. A red flag can be triggered if there is a mismatch.

2. Taking the home office deduction

This deduction can be taken by those who are self-employed. However, the IRS examines this deduction closely. In order to claim this deduction, you must use the area that you are claiming exclusively for your business, and your home must be your principal place of business. You can deduct expenses such as homeowners insurance, mortgage interest, renters insurance, and utilities based on the area used as your business office, or you can deduct $5 per square foot for up to a maximum of 300 square feet. Be sure to keep records of all of these expenses and be prepared to prove that this space is used exclusively for business purposes.

3. Reporting several years of business losses

It’s fairly typical for many businesses to have more expenses than revenue, especially when first getting started, but if your business never makes a profit or barely breaks even for a significant number of years, then the IRS begins to get suspicious. For example, in many industries, if you don’t have a profit in three out of the last five years, then the IRS begins to view the activities as more of a hobby than an actual business. Be sure your business activities support a for-profit motive, have a business plan, and maintain records of revenue and expenses to prove it’s an actual business.

4. Unusually large business expenses

The IRS looks for inconsistencies in expenses and deductions compared to other businesses in the same industry. Separate your business and personal expenses by having separate bank accounts and credit cards for personal and business transactions. Keep detailed records of your business expenses to prove their business purpose.

5. Claiming your car is used 100% for business

You’re less likely to get flagged if you allocate the use of your car between personal and business use. Keeping a mileage log will prove to the IRS how much time the car is actually used for business.

6. Unreported or changes in capital gain

Stock is taxable when you sell shares, unless they are in a tax-deferred retirement account or you are below certain financial levels. The gains and losses are reported to you and the IRS on Form 1099-B and should be reported on Schedule D on your tax return. Be sure to include information from all 1099-Bs.

7. Unreported cryptocurrency

Cryptocurrency has recently become a hot topic, and a check box indicating the presence of cryptocurrency trading is even placed at the top of Form 1040 so it can’t be missed or overlooked. Cryptocurrency needs to be reported if you received any or if you had a gain or loss from selling it. Virtual currency is treated like property for tax purposes. Be sure to report all Form 1099-Bs and Form 1099-Ks, if provided, because the IRS will have those on file as well.

8. Large charitable contributions

Charitable contributions are tax deductible if you itemize. You need to be sure to have supporting documentation to substantiate large noncash donations because this will catch the IRS’s eye for potential tax fraud.

9. A higher income bracket

Earning more money is not always a good thing when it comes to your taxes and tax brackets. The more you earn, the more likely you are to be audited.

10. Claiming the Earned Income Tax Credit (EITC)

There is one exception to the IRS’s tendency to target the taxpayers with higher earnings. These are taxpayers with lower earnings claiming the EITC. This is a refundable credit for taxpayers with low and modest earnings. If you claim this credit, your return will be subject to more scrutiny.

11. Errors

The IRS is also more likely to do a double take if there are returns with mistakes such as mathematical errors, estimates versus actual numbers, or incorrect social security numbers.

Checkout our article Filing Duplicate Tax Returns? Here’s What to Know and Do if you’ve accidentally filed your taxes twice as it can also trigger an audit.

See also: The Essential Guide to Your Financial Statement Audit

How long do tax audits take?

The statute of limitations states that you can be audited up to three years after you file your tax return. According to the IRS manual, the tax audit timeline is either 26 months after the return was filed or the due date of the return, whichever is later. The average time period to complete a tax audit is five to six months. Some can be resolved even faster. The four things that will hold up an audit are if the IRS finds a lot of adjustments on your return, if you own a small business, if there are IRS audit penalties, or if you disagree with the auditor’s adjustments.

After getting an IRS audit letter, how long do you have before the actual audit interview?

For IRS correspondence audits, taxpayers are generally notified within 7 months of filing. Once the letter is received, you generally have 30 days to respond, and the audit usually wraps up within three to six months. Office audits are usually initiated within a year of filing your tax return and are wrapped up in three to six months. Field audits are usually started within a year from when you file your return and often last about a year.

What happens after an IRS audit?

If you have substantiated all of the items in question, the audit will be closed, and there will be no change to your tax return. If the IRS proposes a change to your tax return, you can agree, sign the examination report, and pay the additional tax. If you disagree, you can appeal the IRS’s decision either before the IRS or the tax courts.

What types of audits are there?

When the IRS conducts audits due to requests for more information regarding your tax filing, they can request it in one of the following ways.

1. Correspondence

The correspondence audit is where a taxpayer receives a letter requesting more information to back up your tax data. A simple audit letter may be issued due to a math error, omission of revenue, or request documentation supporting the deductions on your return. These matters are dealt with by replying to the correspondence as instructed by the letter, which typically means mailing in additional documentation to support the item in question by the due date on the letter.

2. Office

With the office audit, the initial audit notification comes by mail, but the taxpayer must go to the IRS office and meet face-to-face with an agent. This letter may be received due to any number of issues with business revenue, itemized deductions, or rental expenses and earnings. The letter will indicate the supporting documents that you will need to bring with you to the IRS office. The office audit is more in-depth than a correspondence audit.

3. Field

A field audit involves an in-person meeting with revenue agents at the company’s place of business, the accountant’s office, or the taxpayer’s residence. These audits are quite detailed and are mainly for reviewing financial records, inventory, interviewing employees, and touring the facility to get a better understanding of the business.

4. TCMP

Taxpayer Compliance Measurement Program audits are also conducted to ensure taxpayers are complying with all tax laws and updating their DIF scores. Unlike other audits, the TCMP audit requires full documentation for every detail of the taxpayer’s return including contracts, bank transaction statements, receipts, and invoices to substantiate the amounts claimed.

What happens during an audit?

There are several different types of audits, so there are also different procedures depending on the type. However, there is an overall general procedure followed for all tax audits.

To begin, there is a tax return filtering process. All tax returns are processed by a computer screening that assigns two scores. A DIF or discriminant function score assesses the potential changes on a return, and a UDIF score assesses the potential for unreported revenue.

If a return receives a high score, it is then sent to a reviewer who manually goes over the return. The reviewer then selects the returns that have the greatest potential for error or the greatest potential for additional revenue and sends them to local field offices where an agent will conduct the detailed work.

Once the selection process is complete, a notice is sent out to the taxpayer. An individual taxpayer’s selection for an audit typically takes place within a year from when the return was filed. The process is then carried out by mail correspondence, office, or field interviews.

Once the type is determined, the taxpayer must gather all supporting documents for the item(s) in question and either mail these items to the IRS or be prepared to meet with an agent to answer questions directly.

The auditor reviews the additional financial information the taxpayer provided and ensures all tax laws are being followed. A report is then issued to the taxpayer based on the auditor’s findings. The taxpayer can either agree with the report, submit payment, if required, or the taxpayer can disagree with the report and work with the auditor to resolve the dispute or take the dispute to the Independent Office of Appeals.

Remember, as the taxpayer, you can choose a certified public accountant (CPA) or enrolled agent (EA) to represent you when dealing with the IRS. Deferring to their expertise can also help to alleviate a lot of stress.

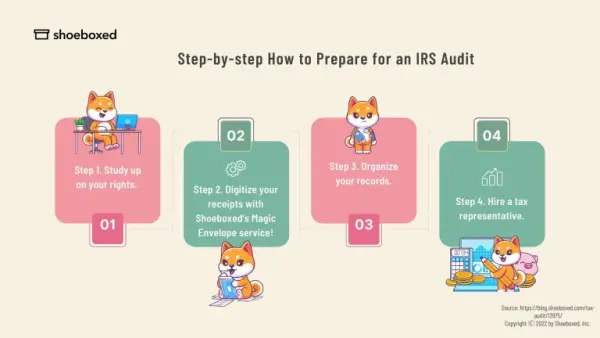

Step-by-step on how to prepare

There are several steps you can take to better prepare yourself for this process. The better prepared you are for the audit process, the smoother it will go.

Infographic on steps for how to prepare for an IRS audit

Step 1. Study up on your rights.

Do the research. Familiarize yourself with the type of audit that has been requested, the process involved, and your options after the final report has been issued.

It’s also important to know your rights as a taxpayer during the process itself. You have the right to professional and courteous treatment, as well as confidentiality and privacy regarding tax matters. You have the right to know why the information is being requested, how the information will be used, and what the consequences will be if the information isn’t provided. You also have the right to representation and to appeal disagreements before the IRS and the courts.

Step 2. Digitize your receipts.

People often wonder, “Does the IRS verify receipts during audit?” The answer is Yes, they do. Digitizing your receipts makes this process run much more smoothly. Otherwise, you’re going to be frantically flipping through a pile of paper receipts, some of which you may not even be able to read due to fading, crumpling, or water damage, just to find that one receipt that backs up the information on your return.

A receipt scanning service with receipt software such as Shoeboxed.com is a huge benefit when facing an audit prep. Shoeboxed provides an envelope with prepaid postage, if within the U.S., for users to fill with their paper receipts and mail to Shoeboxed’s office. The receipts are then scanned, verified by humans, logged into the user’s Shoeboxed account, and stored.

During an audit, if asked about a certain transaction, you can use the search feature and quickly pull it up on Shoeboxed.com instead of having to flip through hundreds of physical receipts. Shoeboxed’s service will digitize all of your receipts in preparation for an audit.

Find out how Brooklynn Chandler Willy, CEO of Texas Financial Advisory, verified all her receipts during her audit—with Shoeboxed!

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayStep 3. Organize your records.

Keeping your records organized is essential when preparing for this process. It can get overwhelming when you need to keep all pertinent tax records and supporting documents such as receipts, receipt books, and cash receipt journals, in one place so they’re easy to find.

If you’re missing a document, request a duplicate from the vendor or financial institution. You should have all monthly statements regarding the balance of your bank accounts, tax returns from the last three years, receipts, and all financial statements if you own a business. Be sure to have all documents sorted by year and type of revenue or expense, with the year being audited closest at hand. Also, include a summary of all transactions by year. Having your records organized will speed up the process.

Step 4. Hire a tax representative.

Instead of handling this process yourself, you can hire a tax representative, such as a someone in the virtual bookkeeping field, to take care of it for you. If you do hire a tax representative, you will need to sign Form 2848 or power of attorney form, which gives the representative authority to represent you before the IRS. Hiring a tax attorney is a good idea when the issues are technical in nature or require someone to interpret tax law. While hiring a tax representative can be a bit pricey, it may save you money in the long run.

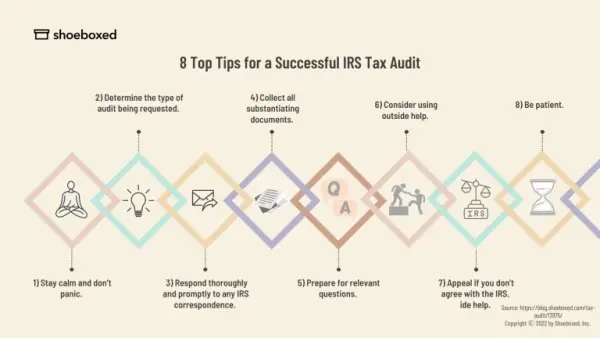

Top tips for a successful audit

While the initial thought of an audit can seem intimidating, taking the time to prepare can save time and make the process less stressful.

Here are our top tips for a successful audit:

Infographic on top tips for a successful IRS tax audit

Tip #1. Stay calm and don’t panic.

The IRS is not out to judge or get you. They simply want to make sure you reported your earnings correctly, complied with all tax laws, and paid the amount of tax you owe. By staying calm, you are more likely to get through the process in a more organized, clear-headed, and focused manner, which will save you and the auditor a lot of time. See also: When Uncle Sam Screws Up: What to Do If the IRS Lost Your Tax Return

Tip #2. Determine the type of audit being requested.

Determine the type of process you will be subject to and take the time to research and understand the process for that specific type. Knowing what to expect can alleviate some of the stress and leave you better prepared.

Tip #3. Respond thoroughly and promptly to any IRS correspondence.

Ignoring correspondence will only cause more trouble and you may have to pay increased penalties and fines. Be sure to comply with all of the IRS’s requests by providing the specific information requested and ensure it is submitted in a timely manner. Document requests will have the deadline clearly indicated on the correspondence. See also: What If I Miss the Tax Deadline for My Tax Return?

Tip #4. Collect all substantiating documents.

The IRS just wants to make sure that both of you have the same financial information and documentation. Be sure to collect all relevant information you have to back up the figures on your return. You will need all forms documenting your earnings and receipts to back up your claimed expenses. The more relevant documentation you have, the smoother the process will go.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodaySee also: 7 Useful Documents Every Independent Contractor Should Keep

Tip #5. Prepare for relevant questions.

If you’re subject to an in-person field audit, you will be answering questions directly from the auditor. You will be asked follow-up questions so that the auditor can get a clearer picture of your revenue and expenses. It’s best to have all relevant information with you at the meeting so you can quickly pull up any substantiating documentation to immediately nip questions in the bud. Be sure to only respond to the specific question asked because if you go off on a tangent or offer up too much information, you may open another can of worms that can lead to additional work.

Tip #6. Consider using outside help.

There’s nothing wrong with getting outside help if you’re feeling intimidated or overwhelmed. Your CPA or other tax attorney is the ideal person to help get you through the process. While using outside help can be a little pricey, their expertise just might save you money in the long run.

Tip #7. Appeal if you don’t agree with the IRS.

If you don’t agree with the IRS’s findings, you generally have 30 days from the date of the letter to appeal the results. So the initial report issued isn’t the final say. You do have recourse to have your return reevaluated.

Tip #8. Be patient.

You may be exchanging information for weeks and months, so remain diligent, respectful, and patient.

Frequently asked questions

Does prep work for a tax audit differ for businesses?

The only prep work that differs for businesses is the type of documents that you will collect. For businesses, you need to keep detailed records of all revenue and expenses with dates and amounts and document the purpose behind your travel and entertainment expenses. Documents you will want to have on hand for a business audit include all receipts organized by date with a note of what was purchased, bills with the type of service and date, canceled checks, any legal papers, loan agreements, logs or diaries, travel ticket stubs, medical & dental records, theft or loss records, employment records, and Schedule K-1’s, along with bank and financial statements. Keeping records of your tax-related documents for two to six years is usually long enough to satisfy small business tax requirements.

Does the IRS verify receipts during a tax audit?

Yes, they do verify receipts during an audit to make sure that a receipt exists and to make sure that it is not a fake receipt. If they are questioning a specific expense, they want proof that the expense occurred. Be sure to have all receipts on hand during the interview.

How long after being audited will I get my refund?

Typically, after being audited, it takes around 6 to 8 weeks to receive a refund check.Note: Want to hone your bookkeeping skills so you can accurately monitor the financial health of your company? Check out our mammoth list of 45+ bookkeeping resources!

In closing

An audit doesn’t have to be an unpleasant experience. If you are always ready for the possibility, whether you’re being audited or not, the process can be relatively painless. Always keep detailed, organized records of all business transactions so you have a clear paper trail for everything.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

This article was fact-checked and verified by Katherine Varraveto, CPA.

Shoeboxed does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

About Shoeboxed!

Shoeboxed is a receipt scanning service that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!