If you’re a small business owner and want to know how to minimize your tax liability, then you’ve come to the right place.

There are several ways you can legitimately reduce what you owe in taxes so that you can keep more of your profits.

One way to shave off your tax liability is through tax deductions.

Many business owners don’t take full advantage of deductions because they simply aren’t aware of all the tax deductions that are available to them.

With the tax strategies on this tax deduction cheat sheet for small business owners, you won’t miss out on any tax write-offs during tax season.

What are tax deductions?

According to the Internal Revenue Service, tax deductions are any business expenses that are ordinary and necessary.

“Ordinary” refers to any business expense that is typical for that particular type of industry.

“Necessary” refers to any business expense needed to maintain the business’s operations.

Tax deductions are business expenses that you can deduct from your taxable income when filing a tax return for your small business.

These tax deductions lower taxable income, which in turn, lessens the amount of taxes you owe to the government.

By lowering the amount you owe to Uncle Sam, you will be able to keep more of your profits.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow do tax deductions work?

There are two deduction methods when filing taxes: the standard deduction method and the itemized deduction method.

When filing your taxes, you can either use the standard deduction method or itemized deductions.

1. Standard deductions

The standard method is when the government determines a specific amount of deduction based on filing status.

The standard deduction is adjusted each year.

2. Itemized deductions

Itemized deductions involve keeping track of every single business expense, along with their associated receipt, document, or record.

In other words, you need to provide proof of each expense.

How to choose the best deduction for you

At tax time, you will add up all of the deductions that are itemized to see if the total is greater than or less than the standard deduction.

If the total of all the itemized deductions is less than the standard deduction, then you will want to go with the standard method.

On the other hand, if the total of all the itemized deductions is greater than the standard deduction, then you will want to itemize your deductions.

The goal is to deduct as much as possible from your taxable income so you can pay the least amount in taxes.

What are the deductions for small business owners?

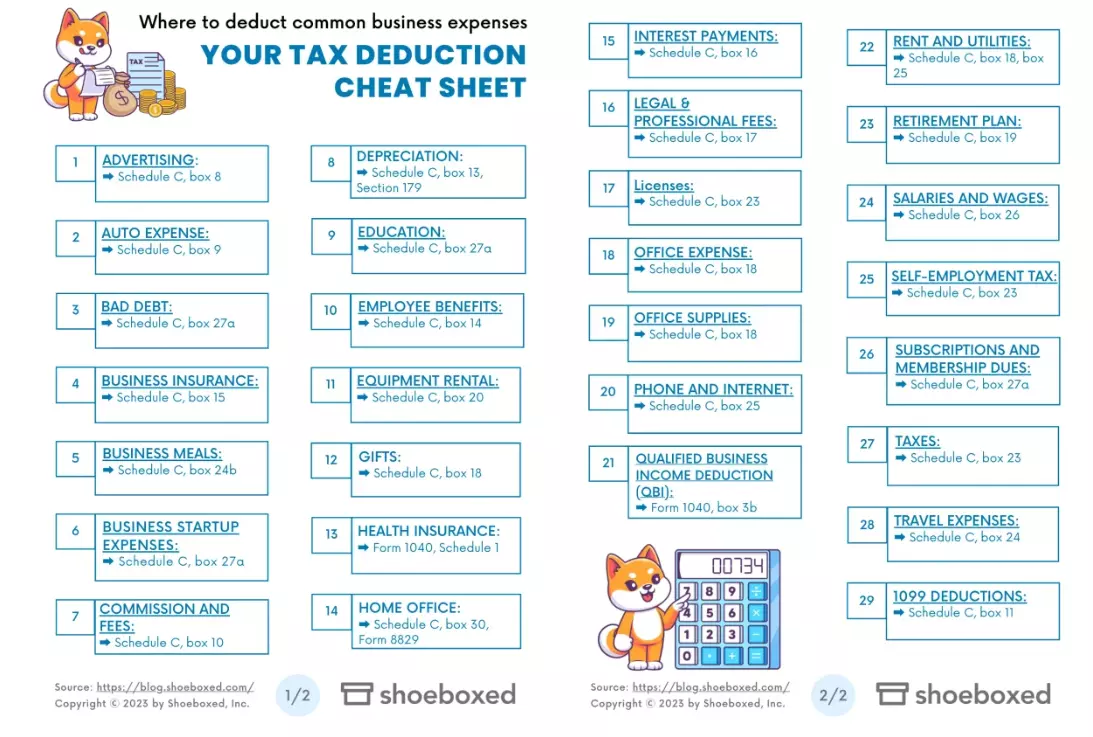

Below is your tax deduction cheat sheet for 2024.

Don’t forget to grab your downloadable and printable tax deduction cheat sheet here:

Your Tax Deduction Cheat Sheet - Shoeboxed1. Advertising

—> Deduct it using: Schedule C, box 8

Advertising and marketing costs are 100% deductible.

Advertising costs include the following:

Business cards

Brochures

Newspaper ads

TV and radio ads

Social media ads

Launching a promotion

Sponsoring events

These are all tax-deductible since they involve the cost of advertising goods or services.

2. Auto expense

—> Deduct it using: Schedule C, box 9

Auto expenses are 100% deductible or the percentage of business use.

If the vehicle is just used for business, then all costs are deductible.

If the car is used both for personal and business use, then you can use the actual expense method or standard mileage rate for the deduction.

With standard mileage, track the miles driven for business and multiply by the mileage rate of 65.5 cents per mile.

With the actual expense method, track all auto-related expenses and business miles driven.

The deduction will be the total of all auto expenses multiplied by the business mile percentage.

Auto expenses include the following:

Purchasing a company car

Gas, repairs, and other vehicle expenses (such as insurance)

Mileage deductions

Commuting from home to work does not qualify as business miles.

3. Bad debt

—> Deduct it using: Schedule C, box 27a

Bad debt is 100% deductible.

This must be a business debt and includes uncollectible accounts receivable and loans to customers, suppliers, and employees.

4. Business insurance

—> Deduct it using: Schedule C, box 15

Business insurance is 100% deductible.

Some types of business insurance that would be deductible include the following:

Property

Auto

Workers’ Compensation

Liability insurance

5. Business meals

Business meals can be 100% or 50% deductible, depending on the event.

—> Deduct it using: Schedule C, box 24b

Business meals are either 50% or 100% deductible.

Meals that are 100% deductible are meals for employees and company social events, such as food for holiday parties.

Business meals for clients and prospects are 50% deductible.

While entertainment expenses aren’t tax deductible anymore, if bought separately, meals at entertainment events are deductible.

Just be sure to hang on to your receipts for all business meals.

6. Business startup expenses

—> Deduct it using: Schedule C, box 27a

During the first business year, new business owners can take up to a $5,000 deduction if startup costs are $50,000 or less.

If costs for startups are over $50,000, then you can take a lower deduction.

If startup costs run over $55,000, then you can’t take any deduction at all.

Startup costs include things like market research and employee training.

7. Commission and fees

—> Deduct it using: Schedule C, box 10

Commission and fees are 100% deductible.

“Commission” refers to the money that’s paid out to others who bring you business.

Fees can include bank fees, e-commerce fees, and merchant processing fees.

8. Depreciation

—> Deduct it using: Schedule C, box 13, Section 179

Depreciation allows businesses to write off the cost of most assets over time.

Yearly depreciation is fully deductible.

Assets include property, vehicles, and equipment.

9. Education

—> Deduct it using: Schedule C, box 27a

Education is 100% deductible.

To qualify, the educational experience must add to the success of the business or improve necessary skills through books, publication subscriptions, seminars, workshops, and classes.

10. Employee benefits

—> Deduct it using: Schedule C, box 14

Money paid by employers on behalf of employees for benefits fall under this tax deduction category.

11. Equipment rental

If you rent office equipment or machinery, you can write it off on your taxes.

—> Deduct it using: Schedule C, box 20

You can deduct 100% of the rental cost of equipment and machinery.

12. Gifts

—> Deduct it using: Schedule C, box 18

Gifts for employees, customers, and clients are tax deductible up to $25 a person.

13. Health insurance

—> Deduct it using: Form 1040, Schedule 1

Self-employed individuals can deduct 100% of the health insurance premium that they pay for themselves and their families.

If employers pay 50% or more of their employees’ health insurance premiums, then business owners can deduct the full cost as a business expense.

14. Home office

—> Schedule C, box 30, Form 8829

Business owners who have an office in their home can take the home office deduction.

There are a couple of methods to choose from when taking this deduction for your office at home.

With the simplified method, $5 per sq. ft. of your office space can be deducted, up to $1,500.

With the standard method, you can track all of your home expenses such as utilities and rent.

With the standard method, you then take a deduction based on the percentage of these expenses in relation to the size of your office vs home.

Just be sure to keep all of your receipts associated with your business from working in your home office.

15. Interest payments

—> Deduct it using: Schedule C, box 16

If you’ve taken out a loan on your business or used credit to make business purchases, the interest charges are deductible expenses.

For businesses with a $27 million revenue or under, 100% of the cost of interest can be deducted.

For all other businesses, the deduction can’t be over 30% of the taxable income.

Any interest above the limit can be carried forward.

16. Legal & professional fees

—> Deduct it using: Schedule C, box 17

Business-related legal fees are 100% tax deductible.

Legal fees include the following:

Business sales

Discrimination claims

Tax issues

17. Licenses

—> Deduct it using: Schedule C, box 23

Licenses, permits, and certificates are 100% deductible.

18. Office expense

—> Deduct it using: Schedule C, box 18

Office expenses are 100% deductible and include cleaning services and repairs to office equipment.

19. Office supplies

Office supplies such as stationery can be used as tax write-offs.

—> Deduct it using: Schedule C, box 18

Supplies, equipment, and tools used to run your business are 100% deductible.

These include the following expenses:

Computer

Computer programs

Printer

Ink cartridges

Printer paper

Office furniture

Cleaning supplies

Postage

20. Phone and internet

—> Deduct it using: Schedule C, box 25

Internet and phone expenses are 100% deductible.

All phones and internet used strictly for business purposes are tax deductible.

If your internet and phone are used for both business and personal use, only the business use percentage is deductible.

21. Qualified Business Income deduction (QBI)

—> Deduct it using: Form 1040, box 3b

The Qualified Business Income deduction is one that partnerships, S-corporations, sole proprietorships, and most LLCs can benefit from if the business is a pass-through entity where the company's profits or losses pass through to the owner's individual tax return.

The QBI is 20% of your net income.

22. Rent and utilities

—> Deduct it using: Schedule C, box 18, box 20b, or box 25

Rent and utilities are 100% deductible.

This includes rent payments for business property such as warehouse space, storage, and office space.

23. Retirement plan

—> Deduct it using: Schedule C, box 19

Even retirement plan contributions are business deductions.

The amount of deduction will depend on your plan.

Below are the 2024 limits:

401(k) plan: $23,000 or $30,500 if 50 or above

Simple IRA: $16,000 or $19,500 if 50 or above

Traditional IRA: $7,000 or $8,000 if 50 or above

24. Salaries and wages

Employee salaries can be deducted from business taxes.

—> Deduct it using: Schedule C, box 26

Salaries and wages are 100% deductible.

Business owners can deduct benefits, bonuses, wages, and salaries from business taxes.

25. Self-employment tax

—> Deduct it using: Schedule C, box 23

Self-employed individuals, such as sole proprietors or LLCs with one owner, can deduct half of their self-employment tax, which would be 7.65% from income that’s taxable.

26. Subscriptions and membership dues

—> Deduct it using: Schedule C, box 27a

Subscriptions are 100% deductible.

Subscriptions include the following:

Software services

Trade publications

Online resources

Cloud storage

27. Taxes

—> Deduct it using: Schedule C, box 23

Business-related taxes are 100% deductible.

The following are some examples of business-related taxes:

Social security

Medicare

State income tax

Local taxes

Sales tax for business-related purchases

Business property taxes

28. Travel expenses

—> Deduct it using: Schedule C, box 24

Business travel is 100% deductible.

Travel deductions include the following:

Plane tickets or the cost of going to and from your destination

Hotels or lodging

Rental cars

Parking fees

Taxis or ride-sharing

Keep in mind meals are 50% deductible.

Be sure to hang on to all tax receipts to write off these travel expenses.

29. 1099 Deductions

—> Deduct it using: Schedule C, box 11

1099s are 100% deductible for self-employed individuals and small business owners.

You can deduct the total cost of hiring a freelancer or contractor.

What’s the difference between tax deductions and tax write-offs?

Tax write-offs and tax deductions are two terms used to describe the process of lowering your taxable income.

A tax write-off and a tax deduction both refer to the same thing.

A tax write-off or tax deduction lowers your taxable income and therefore, your tax liability.

A deduction is a qualified expense that business owners incur during the tax year to deduct, or subtract, from gross income to calculate adjusted gross income.

What’s the difference between tax deductions and tax credits?

Both tax deductions and tax credits give you a break on income taxes, but they do it in different ways.

A tax deduction lowers a person’s tax liability by reducing the taxable income.

Deductions lower the income that’s taxable, which in turn, lowers the amount of tax you owe.

A tax credit is a dollar-for-dollar reduction taken directly from the income tax owed.

The Earned Income Tax Credit and Child Tax Credit are both examples of a tax credit.

Therefore, deductions are deducted from your taxable income, while tax credits are deducted directly from the income tax owed on your tax return.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayFrequently asked questions

Do I need receipts for tax deductions?

You should save receipts for all of your tax deductions. This will be especially helpful if you are ever audited.

What is the purpose of this small business tax deduction cheat sheet?

This tax deduction cheat sheet will help business owners maximize their deductions and minimize their taxable income to lower their tax bill.

Should I take the standard deduction or itemize?

Ultimately, you want to choose the method that saves you the most money. If the total of your itemized deductions exceeds the limit of the standard deduction, you’re better off itemizing.

In conclusion

This tax deduction cheat sheet will help business owners save money on their tax bill by maximizing deductions and minimizing taxable income.

Since small businesses spend 2.5 billion hours prepping for and answering questions about their tax return each year, hopefully, it will also be a helpful reference during the tax filing process.

Shoeboxed is another way of keeping track of tax deductions. Shoeboxed automatically extracts important information from your receipts, categorizes them into 15 tax categories, and allows you to add a bookkeeper or accountant to create tax reports on your behalf.

While this cheat sheet is a great place to start, always consult a tax professional for any advice or questions regarding tax deductions.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!