Maintaining organized records of tax-related expenses is integral to individuals and businesses when navigating tax season.

A tax expense spreadsheet simplifies this process, allowing for efficient categorization, tracking, and reporting of deductible expenses. Its benefits go beyond mere record-keeping; it is a crucial tool to optimize tax deductions, ensure compliance with tax regulations, and ultimately contribute to more accurate and potentially lower tax liabilities.

Many online resources provide templates or guidance for setting up a tax expense spreadsheet, and we've gathered our favorites in this article. Enjoy!

Best 5 free tax expense spreadsheets

The following expense spreadsheets range from basic layouts suitable for freelancers and independent contractors to more complex frameworks designed for businesses with multifaceted expense and business income streams.

Customizing a spreadsheet to fit specific needs can further enhance its effectiveness, making it a crucial component in managing fiscal responsibilities (e.g., you can create a spreadsheet tailored to farms by including farm-related expense categories, etc.).

1. Mod Boutique Agency's monthly expense tracker

This expense spreadsheet offered by Mod Boutique Agency can be used as an independent contractor expenses spreadsheet and is a convenient and user-friendly tool for managing personal or business expenses.

There are tabs for monthly expenses that will automatically calculate the totals that will appear in the Overview tab. The totals can then be used for tax time when reporting tax deductions.

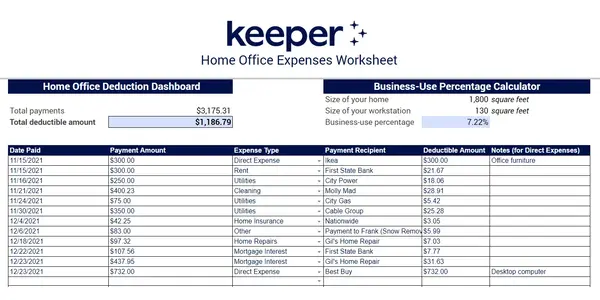

2. Keeper Tax Office Deduction Template

Keeper Tax provides a home office deduction worksheet for Excel or Google Sheets. This template makes it easy to track business-related expenses for the home office to maximize deductions.

It includes a business-use percentage calculator where you input the size of your home and the size of your workstation to find out how much you can write off as business costs.

To use this expense sheet, you will be asked to make a copy.

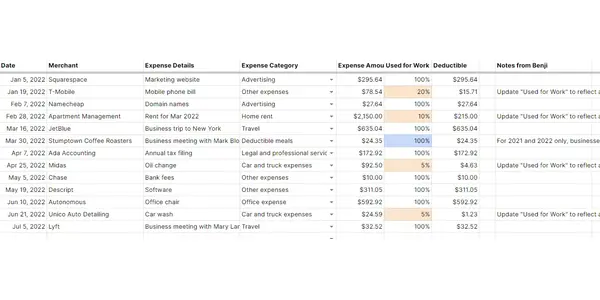

3. Benji's free business expense tracking spreadsheet

Benji has created a business expense spreadsheet that sole proprietors in the US can use to report business income and expenses when filing the Schedule C (Form 1040).

Using Schedule C tax categories, this free template helps business owners and freelancers track business expenses and enjoy a less stressful tax season.

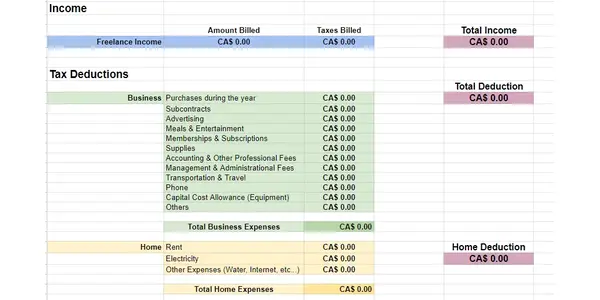

4. Google's Canadian tax deductions template

Google Sheets has prepared a tax deductions expense tracking template for those filing Canadian taxes.

Tabs include Freelance Income, Business Expenses, Home Expenses, and an Income and Deductions overview summary tab.

To use this sheet, go to File --> Make a Copy.

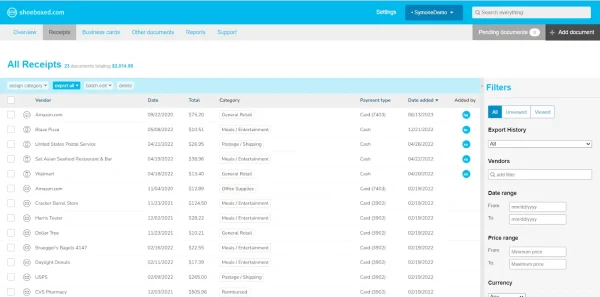

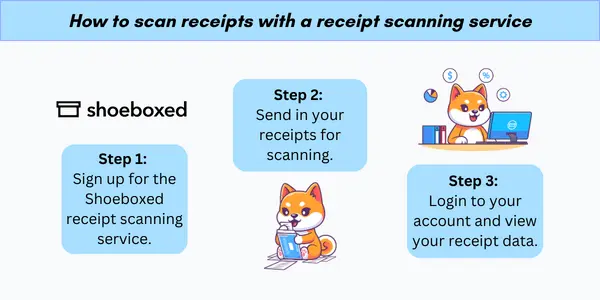

5. Shoeboxed's receipt scanning service

Small business owners and independent contractors who want the simplest way to organize receipts and expenses for tax purposes may want to consider Shoeboxed.

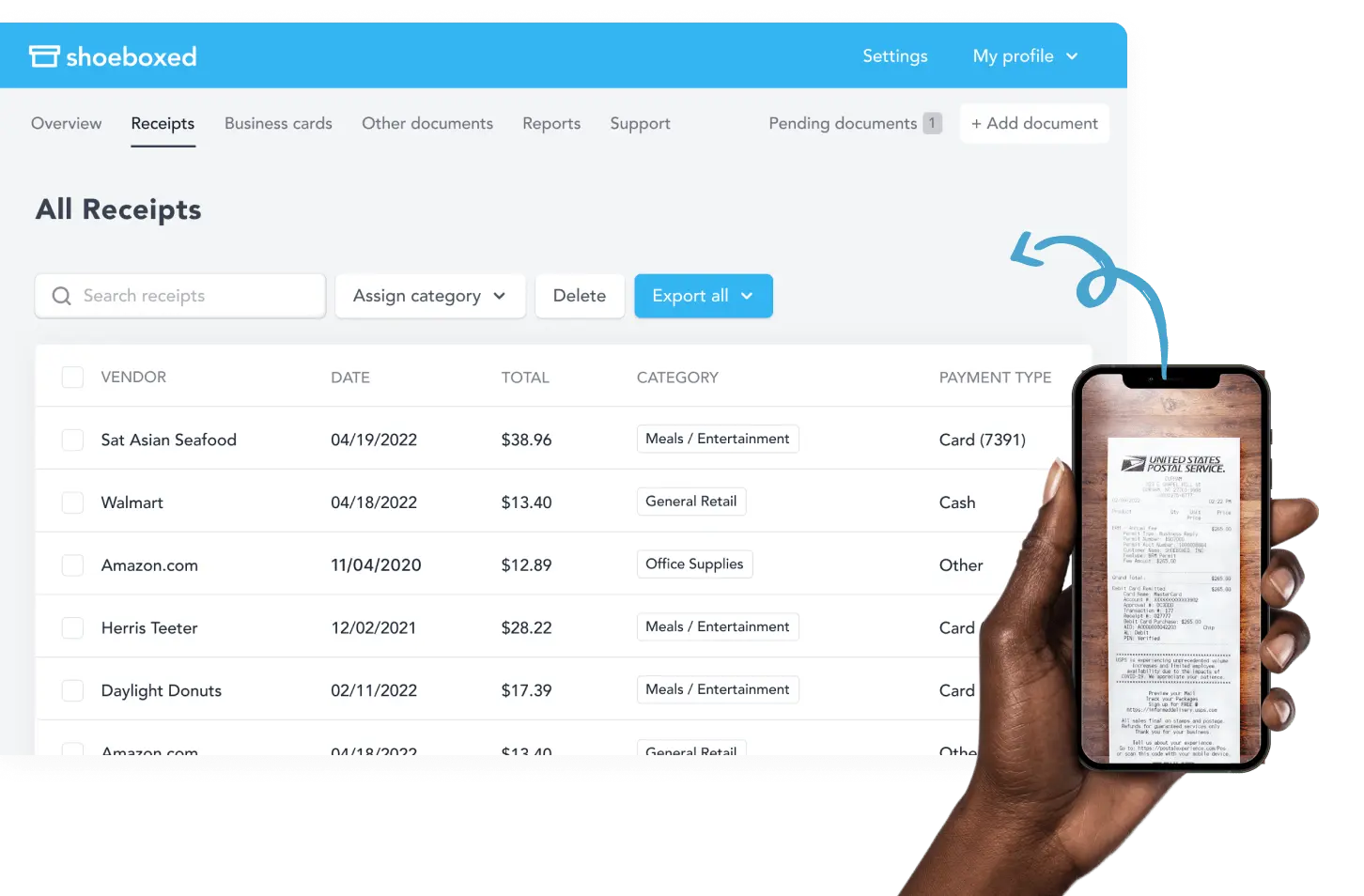

Shoeboxed's receipt scanner app extracts key information from scanned receipts. The extracted data is then verified by Shoeboxed's data verification team, then categorized, tagged, and stored securely in the cloud.

Shoeboxed also offers a receipt scanning service that allows business owners to outsource data entry of paper receipts.

Starting from $18 per month, individuals receive a postage-prepaid Magic Envelope that you stuff receipts into.

At the end of the month, simply send the Magic Envelope in, and the Shoeboxed team will scan all your data and categorize it into 15 common tax categories. Easy peasy.

Shoeboxed is the only receipt scanner app that will handle both your paper and digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

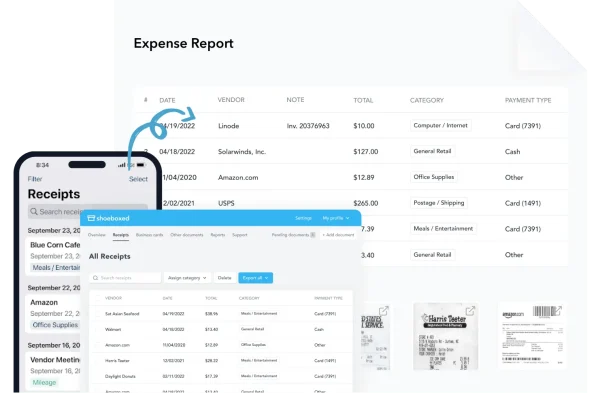

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is one of Shoeboxed's most popular features, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow to create a tax expense spreadsheet from scratch

If you're after a more manual solution to managing tax expenses, here's how to create one from scratch:

1. Select spreadsheet software

You can opt for Microsoft Excel, known for its advanced features and customization capabilities, particularly useful for complex tax scenarios. For those seeking a free alternative, Google Sheets provides collaborative features and sufficient functionality for basic to moderately intricate tax preparations.

3. Set up the spreadsheet template

A well-structured business expense template should have clear categories, such as Income, Expenses, Deductions, and Credits.

The user should structure expense categories to mirror those used in tax filing, which will help make tax preparation more straightforward. They can utilize a premade home office deduction worksheet for freelancers or customize their categories per IRS guidelines to ensure nothing is overlooked.

By customizing your expense categories, you can tailor your expense spreadsheets to your specific industry. For example, check out the following spreadsheets for truckers, Airbnb hosts, lawn care specialists, real estate agents, etc.

Make sure the following categories are accounted for in your Excel spreadsheet or Google template:

a. Income sources

Income sources must be methodically documented. They typically include wages, dividends, and interest, as well as profits from business operations or rental properties.

Precise categorization of income ensures proper tax treatment and lays the foundation for accurate tax calculations.

b. Deductible expenses

Deductible expenses are classified to decrease taxable income. These include operational costs, home office expenditures, and travel expenses. If you're wondering what tax deduction you might be eligible for, read The Definitive Guide to Commonly Missed Small Business Tax Write-offs.

c. Tax credits

Tax credits, a direct reduction of one's tax liability, cover a range of items from education to energy efficiency.

Familiarity with various tax-deductible expenses and credits is crucial for maximizing the amount that can be legally subtracted from one's tax due.

Each financial transaction should also be logged with a date and description to maintain chronological integrity and clear references for potential audits or reviews.

4. Enter and track data

All potential deductible expenses should be logged in detail. These expenses can include business expenses, educational expenses, health care costs, and charitable donations among others.

Recording these expenses aids in determining eligibility for deductions and can significantly impact one's tax liability.

For those who want a low-effort way to keep track of expenses, Shoeboxed can help maximize tax deductions with minimal effort and save money on tax payments by automatically placing expenses into 1 of 15 common tax categories.

You can export the data to popular accounting software or as an expense report.

With features built to handle the specific needs of tax season, Shoeboxed earns its reputation as an award-winning alternative to conventional expense spreadsheets.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today5. Calculate taxes

Calculating taxes in a spreadsheet allows for precise control over one's financial data, enabling accurate tax liability estimations and strategic tax planning.

For instance, one might structure the spreadsheet to automatically apply a 10% rate to the first $25,000 of income, 20% to the next $25,000, and so on.

This method ensures that each portion of income is taxed according to the current tax brackets, providing a detailed view of one's tax obligations and upcoming tax bill.

See also:

Frequently asked questions

How do I make an expense spreadsheet for taxes?

To create an expense spreadsheet for taxes, one must choose a spreadsheet builder, set up the spreadsheet template with Income, Expenses, Deductions, and an Overview Summary tab, enter and track data, and separate expenses into tax categories.

How do I track personal expenses for taxes?

First, make sure that the expenses you wish to track qualify as business expenses. Then, begin tracking your expenses using a spreadsheet or a receipt management service like Shoeboxed.

In closing

By systematically using a spreadsheet to monitor yearly expenses, taxpayers are better equipped when it's time to file taxes.

The use of a spreadsheet enables taxpayers to better understand their total expenses and maintain accurate records, thus facilitating better-informed business decisions.

Tomoko Matsuoka is the managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!