Always remember, you can't believe everything you hear. There are a lot of tax myths floating around out there that are misleading and can leave you in a lot of hot water if you aren't careful. We've compiled a list of the most costly tax myths to help you stay informed and avoid getting in trouble with the IRS.

Here are some of the most costly tax myths we've encountered along our tax journey:

Myth #1: Filing taxes is optional

Fact: Filing taxes is not optional for most people; it is a legal requirement in the United States and many other countries. Whether you need to file a tax return depends on various factors, including your income level, filing status, age, and the type of income you received during the year.

Here are some general guidelines:

Income thresholds: You must file a tax return if your income exceeds certain thresholds. These thresholds vary based on your filing status (e.g., single, married filing jointly, head of household, etc.), age, and the type of income you receive. For example, in the U.S., for the 2023 tax year, a single individual under 65 must file a tax return if their gross income was at least $13,850.

Dependents: Dependent minors won't owe taxes if their earned income doesn't exceed the standard deduction. However, they may receive a refund if they earn less than the deductible. If dependents collect more than $1,250 in unearned income, such as interest and dividends, they must report this to the IRS. Parents can typically report their child's unearned income on their return if that's the only income.

Self-employment: If you are self-employed and have net earnings of $400 or more, you must file a tax return.

Other situations: There are different situations in which you must file a tax return, such as if you owe any special taxes (e.g., alternative minimum tax, additional tax on a qualified plan) or if you received distributions from a health savings account,

Additionally, filing a tax return is necessary to claim any refunds you are owed, to report and pay taxes on income not subject to withholding, and to qualify for tax credits and benefits.

Myth #2: The deadline for filing individual income tax returns is always April 15th

Fact: While April 15th is traditionally recognized as the deadline for filing individual income tax returns in the United States, this is not always true.

There are several exceptions:

Weekend or holiday: Tax Day is moved to the next business day if April 15th falls on a weekend or a legal holiday. For example, if April 15th is on a Saturday, the deadline would typically be moved to the following Monday unless that Monday is a legal holiday.

Emancipation Day in Washington D.C.: This holiday is observed in Washington D.C. If April 16th falls on a weekend, it is observed on the closest weekday. The tax deadline is then pushed to the following day.

Disasters and extensions: The IRS may extend the filing deadline for taxpayers affected by natural disasters like hurricanes, floods, or wildfires. The IRS announces these extensions, which can vary depending on the severity and location of the disaster.

State deadlines: While federal tax returns are typically due on April 15th (with the above exceptions), state tax return deadlines may vary. It's essential to check the deadline for your state if you must file a state income tax return.

Extensions: Taxpayers can request an extension to file their federal income tax returns, which typically extends the filing deadline by six months, making the extended due date October 15th. However, it's important to note that an extension to file is not an extension to pay any taxes owed. If you owe taxes, you must estimate and pay the amount by the original deadline to avoid penalties and interest.

Therefore, while April 15th is the standard Tax Day, various factors can result in a different filing deadline for a given year. It's always a good idea to verify the current year's tax filing deadline, especially if April 15th is approaching and falls under one of the exceptions mentioned.

Myth #3: All income is taxed the same way

Fact: Not all income is taxed the same way; different types of income are subject to different tax rates and rules.

Here are some of the key distinctions:

Ordinary income: This includes wages, salaries, commissions, and income from businesses in which you are actively involved. It also encompasses interest from non-municipal bonds and rent from properties. Ordinary income is taxed at progressive tax rates that range from 10% to 37% in the United States, depending on your total taxable income and filing status.

Capital gains: Income from the sale of an investment, like stocks, bonds, or real estate, held for more than one year are considered long-term capital gains and are taxed at lower rates than ordinary income. As of the last update, long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income and filing status. Short-term capital gains from the sale of assets held for a year or less are taxed as ordinary income.

Dividend income: Qualified dividends, which U.S. corporations pay, and certain foreign companies are taxed at favorable long-term capital gains tax rates. Non-qualified dividends are taxed as ordinary income.

Interest income: Most interest income, such as that received from savings accounts, is taxed as ordinary income. However, interest from municipal bonds is usually exempt from federal income tax and, in certain instances, state and local taxes, depending on where you live and where the bond was issued.

Retirement income: Distributions from retirement accounts, such as traditional IRAs and 401(k)s, are typically taxed as ordinary income. However, distributions from Roth IRAs and Roth 401(k)s are generally tax-free if certain conditions are met. Social Security benefits are taxed based on your combined income but may not be fully taxable; a portion of your benefits may be tax-free, depending on your income level.

Passive income includes earnings from activities you are not actively involved in, such as certain rental property income or income from limited partnerships. While often taxed as ordinary income, passive activities have their own set of rules, particularly regarding deductions and losses.

Self-employment income: If you are self-employed, your net income from your business is taxed as ordinary income. However, you must also pay self-employment taxes covering Social Security and Medicare taxes. Calculating your adjusted gross income, you can deduct the employer-equivalent portion of your self-employment tax.

Gifts and inheritances: Generally, receiving a gift or inheritance is not taxable. However, there can be tax implications for the giver, and inherited assets may incur taxes upon their sale or if they generate income.

Because of these differences, it's important to understand the types of income you receive and how each is taxed. Proper planning and knowledge can help minimize your overall tax liability.

Myth #4: Married couples should always file taxes jointly

Fact: While many married couples benefit from filing their taxes jointly, there are better options for some. Whether you should file jointly or separately depends on your financial situation.

Here are some points to consider:

Joint filing benefits: Generally, married couples that file jointly can qualify for multiple tax benefits, such as a higher standard deduction, income thresholds for tax benefits, and eligibility for various credits such as the Earned Income Tax Credit, American Opportunity and Lifetime Learning Education Tax Credits, and others. Joint filing often results in lower tax liability compared to filing separately.

Separate filing considerations: There are situations where filing separately may be more advantageous. For example, if one spouse has significant medical expenses, miscellaneous itemized deductions, or casualty losses, and the couple's combined income is high, filing separately might result in lower overall taxes due to how these deductions are calculated. Additionally, if one spouse has significant debt, back taxes, or child support obligations, filing separately can protect the other spouse's refund from being applied to these obligations.

Student loans: If either spouse is on an Income-Driven Repayment (IDR) plan for student loans, filing separately might result in lower monthly payments because the payments will be calculated based on the individual's income, not the combined household income.

Trust and transparency issues: If there are trust issues or if one spouse does not want to be responsible for the other's tax liabilities due to potential inaccuracies or undisclosed income, they might choose to file separately.

Residency and legal considerations: In some states, especially community property states, filing separately can have different implications, and the division of income and deductions might not be straightforward. Additionally, nonresident aliens married to U.S. citizens or residents might also find different rules applying to them.

Before deciding whether to file jointly or separately, it's essential to calculate your taxes to determine which filing status results in lower overall taxes. Remember that once you file jointly, you cannot change to "Married Filing Separately" after the tax return's due date. However, if you file separately, you may be able to amend your returns to file jointly within the allowed time frame.

Myth #5: If you work from home, you can always claim a home office deduction

Fact: The ability to claim a home office deduction is subject to specific IRS rules, and not all employees who work from home qualify for it.

Here's a breakdown of the tax code and requirements:

-

Self-employed individuals: The home office deduction is primarily available to self-employed individuals or independent contractors. They can claim this deduction if they use part of their home regularly and exclusively for business activities. If you are self-employed and work from home, you need to meet the following criteria:

Regular and exclusive use: You must regularly use part of your home exclusively for conducting business. For example, you may not meet the exclusive use test if you work in a spare room for guests.

Principal place of business: Your home must be your principal place of business. This means you use your home office for administrative or management activities of your business, and there is no other location where you perform these substantial activities.

Employees: Due to changes in the tax law from the Tax Cuts and Jobs Act of 2017, employees who receive a W-2 and work from home cannot claim the home office deduction for tax years 2018 through 2025, even if they are working from home for the convenience of their employer. This is a significant change from previous years.

It's also important to note that even for those who qualify for the home office deduction, the space must be used regularly and exclusively for business.

The deduction includes direct expenses related to the home office (like repairs in the office itself) and a portion of the home's overall expenses (like utilities and mortgage interest) based on the percentage of the home's square footage used for business.

Myth #6: You do not need to keep receipts for expenses that you write off as deductions

Fact: You should keep receipts and records for any expenses you claim as deductions on your tax return.

Here's why:

Record-keeping requirements:

Proof of expenses: Receipts provide evidence of the expenses you claim as deductions. In the event of an IRS audit, you will need to provide documentation to support the deductions claimed on your tax return.

Details for deductions: Receipts typically contain all the necessary information for tax deductions, including the transaction date, the amount paid, and the nature of the expense.

Determining the correct deduction: Detailed records help you calculate the correct amount for your deductions, which can prevent errors on your tax return and potential penalties.

Statute of limitations: The IRS can audit your tax returns up to three years after filing. However, this period can extend to six years if income is substantially understated. Keeping receipts ensures you have the necessary documentation if your return is selected for audit.

Peace of mind: Maintaining good records and keeping receipts can give you peace of mind, knowing you can substantiate your deductions if questioned by the IRS.

Tip for keeping receipts:

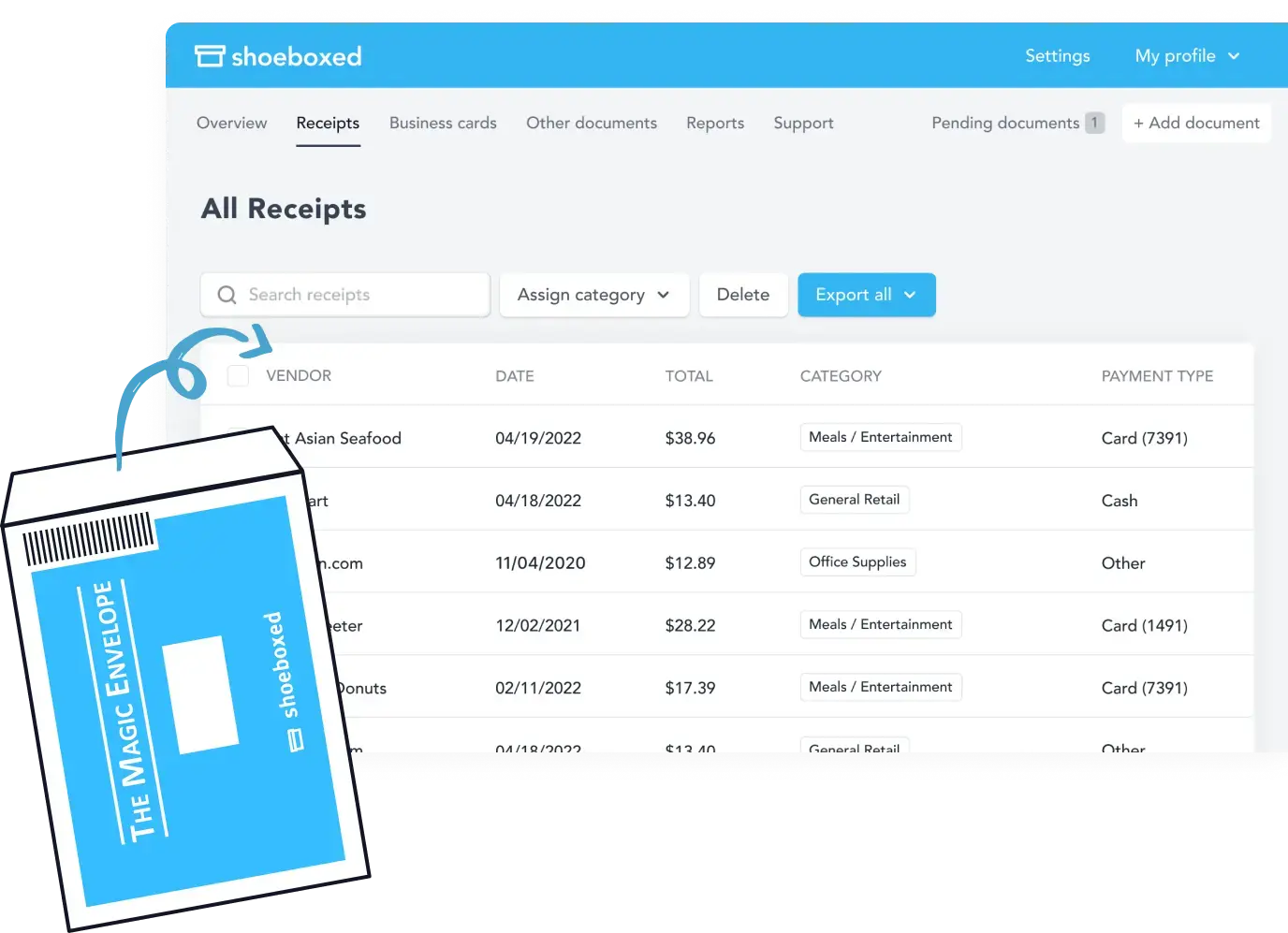

Consider digitizing all receipts with a receipt scanning app or service like Shoeboxed. That way, you can clean the paper clutter off your desk and store it as digital data.

Over one million businesses use Shoeboxed to scan and organize receipts as proof for their tax deductions.

Shoeboxed can be used as a receipt scanning service or a receipt scanning app.

The Magic Envelope is unique only to Shoeboxed. Stuff your receipts or any other paper clutter into a pre-paid Magic Envelope and drop it in the mail, and Shoeboxed will scan, human-verify, and load each receipt into your account.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today

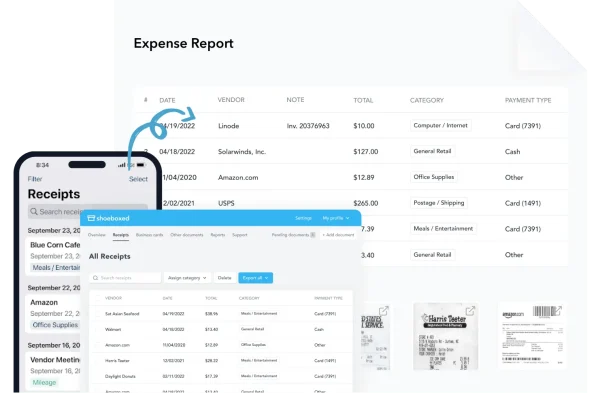

Capture your expenses on the go.

Or you can instantly capture images of your receipts from anywhere using Shoeboxed's app on your mobile phone. Take a picture of the receipt using your phone's camera, which will automatically upload into your Shoeboxed account.

Shoeboxed offers a systematic approach to receipt categories for tax time.

Receipt information is OCR-extracted, and the data is automatically categorized into 15 tax categories. That way, your receipts are organized by category (e.g., home office expenses, travel expenses incurred, charitable donations). This makes filing taxes easier and allows for responding to any IRS issues and inquiries, especially during audits.

Brooklynn Chandler Willy, CEO and President of Texas Financial Advisory, had this to say about Shoeboxed:

“[Shoeboxed] actually saved me during my IRS audit because they would look at the bank statements and then see a transaction and then ask me for the receipt. And I could go and type in the amount or whatever it was, and it would pull up on Shoeboxed.”

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayMyth #7: Filing an extension means I have a longer time to pay my federal income taxes

Fact: Filing an extension for your taxes gives you additional time to file your tax return, but it does not grant you more time to pay any taxes you owe. The extension typically gives you until October 15th to file your return without incurring penalties for late filing. However, any taxes owed are due by the original filing deadline for tax season, typically April 15th.

If you file an extension but do not pay the estimated taxes you owe by the tax day of the original deadline, you will likely incur interest and possibly penalties on the amount owed. The IRS expects taxpayers to pay their taxes by the original due date, even if they need more time to complete and submit their tax forms.

Therefore, if you plan to file an extension, it's a good idea to estimate how much you owe and pay your taxes by the original tax deadline to avoid additional charges. If you need clarification on how much you owe, you can use previous years' returns or IRS estimation tools to make an educated guess.

If you overpay, you will receive a refund once you file your return. You must pay the remaining amount owed plus any accrued interest or penalties if you underpay.

Myth #8: If you filed your taxes a month ago and are still waiting for your refund, you should try filing again

Fact: This is another common tax myth. If you've already filed your taxes and are waiting for your refund, you should not file your taxes again. Filing your taxes more than once can lead to confusion, delays, and potential processing issues with the IRS.

Instead, you should check the status of your refund. The IRS provides several tools for taxpayers to track the status of their refunds:

IRS2Go App: The IRS offers a mobile app, IRS2Go, which you can use to check your refund status.

Where’s My Refund?: This is an online tool available on the IRS website. You can check the status of your refund 24 hours after e-filing or four weeks after mailing your paper return. You must provide your Social Security number, filing status, and expected refund amount.

Call the IRS: If it has been more than 21 days since you e-filed or more than six weeks since you mailed your paper return, you may call the IRS for assistance. However, expect high call volumes and potentially long wait times.

If you check your refund status and find that it is still being processed, it usually means the IRS is reviewing your return. This can take time, especially during peak periods or circumstances where the IRS operates with reduced staff or increased security measures.

If there is a problem with your return, the IRS will contact you by mail. They will provide instructions on if and how you need to respond. It's essential to ensure your contact information is accurate and to regularly check your mail if you expect communication from the IRS.

If you're waiting for your refund, do not refile your taxes. Instead, you can use the available tools to check your refund status and wait for the IRS to process your return. Refiling can complicate the process and result in further delays.

Myth #9: The person preparing your taxes is liable for any mistakes in your tax return

Fact: Ultimately, you, the taxpayer, are responsible for all the information on your tax return, regardless of who prepares it. If there are any mistakes, you are liable for any additional taxes, penalties, or interest that may result from those errors.

However, tax preparers do have a level of responsibility:

Due diligence: Tax preparers must exercise due diligence in preparing tax returns. They should ask you for all necessary information to complete your return accurately and should not knowingly enter false information.

Preparer penalties: If a tax preparer engages in fraudulent activities or shows reckless disregard for the rules, they can face significant penalties, including fines and criminal charges. They are also subject to preparer penalties for understatements due to unrealistic positions or lack of due diligence.

Preparer responsibility: If the error on the tax return was due to a mistake by the tax preparer and not due to incorrect information provided by the taxpayer, the preparer might be morally or contractually obligated to pay the penalties and interest resulting from that error. However, this does not absolve taxpayers of their liability for the additional taxes owed.

Indemnification: Some tax preparers might have an indemnification clause in their contract with you, which could require them to compensate you for errors they make. However, these clauses vary and may not cover all additional taxes owed due to errors.

Choosing a reputable preparer: Choosing a reputable tax preparer is essential. Look for someone with proper credentials (CPA, Enrolled Agent, or Tax Attorney), and check their history with the Better Business Bureau or the IRS Office of Enrollment (for enrolled agents).

Remember, while a tax preparer can help you with tax questions, navigate complex tax laws, and minimize your tax liability, providing them with complete and accurate information is essential. Review your return carefully before signing, and ask questions if something needs clarification.

By staying involved in the preparation process, you can help ensure your tax return is accurate and minimize the risk of errors.

Frequently asked questions

If I don't earn much, do I still need to file a tax return?

It depends on your income level, age, filing status, and other factors. Even if you earned below a certain amount, you might need to file a return to reclaim any withheld income tax or to claim eligible credits.

Can I claim more deductions if I file separately from my spouse?

While filing separately may benefit individuals in certain situations, married couples often receive more tax benefits from filing jointly. Calculating taxes both ways is essential to see which filing status is more beneficial.

In conclusion

Understanding these myths and tax laws can help you navigate your responsibilities more effectively and avoid the pitfall of following misleading advice, which can result in penalties, interest on unpaid taxes, and potentially more severe legal consequences. If you need clarification on your situation, consulting with a tax professional can provide guidance tailored to your circumstances.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!