Having trouble keeping all your tax documents in order?

Tax season can be overwhelming but a tax organizer template in Excel can make all the difference. With its ability to store all your financial info, an Excel tax organizer will help you get your records in order and ensure you don’t miss out on any deductions, saving you money.

We show you 3 free templates plus a bonus alternative for those looking to streamline tax organization!

What is a tax organizer?

An organizer is a document that helps individuals collect and organize their information for tax preparation. It’s a tool used by tax pros and clients to ensure that all tax return information is collected, accurate, and in one place.

Why use a tax organizer template in Excel?

An Excel tax organizer template is great for both individuals and businesses.

You can track income, expenses, deductions, and other tax-related information. With customizable columns and formulas, you can customize it to fit your specific financial situation.

Whether itemizing deductions, tracking business expenses, or preparing for a meeting with your accountant, this template makes it easier and less stressful during tax season.

What features are included in Excel template tax organizers?

A tax organizer template includes:

Income: Wages, freelance, rental income, etc.

Expense categories: Office supplies, travel, medical bills, etc.

Calculations: Formulas to add up totals and estimate taxes owed.

Customization: Add your own categories or details.

Ease of use: Excel template with instructions and labels.

Compatibility: Works with Adobe Acrobat Reader and Microsoft Excel.

How do you create a tax organizer in Excel?

Here's how to create a tax organizer in Excel:

Open a new Excel file.

Create columns for categories like “Date,” “Income Source,” “Amount,” “Expense Type,” and “Tax Deduction.”

Use formulas to add up totals for each category, like =SUM(range)

Add filters to sort by date, type, or amount to make navigating easier.

Add columns for mileage or home office deductions.

You can also download and customize pre-made templates.

What are some pre-made templates?

A tax organizer can be a PDF or Excel template, making it easy to download, fill out, and submit.

Here are some free downloadable tax organizer templates in Excel:

1. Individual Tax Organizer by Knight Accounting

An individual tax organizer is designed to help taxpayers collect and organize an individual's personal information, dependents, income, expenses, taxes, charitable contributions, and miscellaneous deductions.

2. Rental Property Tax Organizer by Knight Accounting

A rental property tax organizer is designed to help owners track income and expenses related to the property they rent out to others.

3. Small Business and Home Office Tax Organizer by Knight Accounting

A small business and home office tax organizer helps business owners track, organize, and categorize their business income and expenses, including their home office.

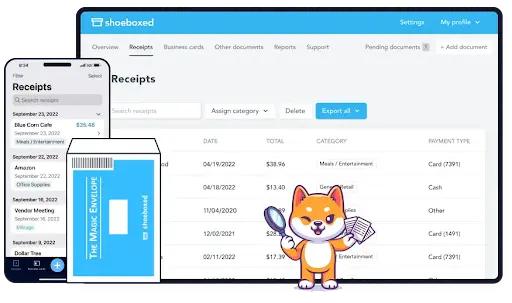

Why is Shoeboxed a better alternative to an Excel tax organizer template?

While an Excel tax organizer template gives you a structured way to manage your tax info, Shoeboxed is a more efficient and comprehensive solution for several reasons:

Automated data entry

Turn your receipts and documents into digital data so that it's always accessible and data is never lost.

Use your smartphone to snap a picture of your receipt, note, or document, and Shoeboxed's app will automatically upload a copy to your designated Shoeboxed account.

This automation eliminates manual data entry, reduces errors, and saves a lot of time compared to inputting data into an Excel template.

You can even outsource your scanning by mailing your receipts or documents to Shoeboxed using their free pre-paid Magic Envelope. Their team will scan, human-verify, and upload them into your account for you.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAutomatic organization

With OCR technology, Shoeboxed extracts date, vendor, amount, and payment method from receipts. Receipts are then categorized into 15 tax or custom categories.

Add custom tags to receipts for easy searchability.

The platform automatically organizes your receipts to make it easy to find deductible expenses.

Generates detailed reports

Shoeboxed generates complete expense reports summarizing your categorized expenses, including all receipt images and details.

Tax-ready reports can be exported in various formats (PDF, Excel, CSV) to share with your accountant or tax professional.

This makes tax time a breeze as you have all the information about your expenses in one place.

Mobile accessibility and on-the-go tracking

With the Shoeboxed mobile app, you can snap and upload receipts instantly using your smartphone. Since the data is stored in the cloud, it's accessible anywhere, anytime. This is especially convenient for business travelers or those frequently on the go.

IRS-approved digital storage

Shoeboxed offers secure, IRS-accepted digital storage for your receipts and documents, so you’re compliant and audit-ready. Self-managed Excel files can’t guarantee that.

Beyond receipt management, Shoeboxed has features like mileage tracking using your phone’s GPS and business card management. These features give your business a more complete expense and document management solution.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

How do I make a tax organizer in Excel?

Follow these steps:

Open a new Excel file.

Create columns for categories like “Date,” “Income Source,” “Amount,” “Expense Type,” and “Tax Deduction.”

Use formulas to sum up each category, like =SUM(range) for total amounts.

Add filters to sort by date, type, or amount to make navigating easier.

You can customize this to your needs, like adding columns for mileage or home office deductions.

Why is Shoeboxed better than using a template in Excel?

Shoeboxed digitizes data, so there is no manual data entry, fewer errors, and a lot of time saved vs entering data into an Excel template.

See also: W2 vs W4: Key Differences You Need to Know for Better Filing

In conclusion

A completed tax organizer is a quick way to track deductible expenses. An Excel tax organizer is useful, but Shoeboxed is a more automated and comprehensive tax and expense information solution.

Shoeboxed eliminates manual data entry, reduces errors, and saves a lot of time compared to entering data into an Excel template.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!