Ever lost a taxi receipt just when you needed it for reimbursement, taxes, or to settle a dispute?

Whether you’re a frequent traveler or just an occasional rider, keeping your taxi receipts can be helpful for personal reasons or while on a business trip.

Discover why keeping track of these small slips of paper can save you time, money, and headaches.

What is a taxi receipt?

Taxi drivers sell their services to transport passengers. A taxi receipt is a document given to customers by taxi drivers when they purchase their services to take them from point A to point B. It includes fare, payment method, date, and route. Usually given upon request, it is proof of purchase for their services.

Business travelers need them for reimbursement or tax purposes, and passengers can use them to resolve disputes or issues with taxi companies, such as overcharging or poor service.

What are the types and formats of taxi receipts?

Taxi receipts come in various formats, catering to passengers' diverse needs.

The most common types are paper-based and digital. Paper-based receipts are typically issued using a receipt book or a thermal printer and handed directly to the passenger at the end of the ride.

On the other hand, digital receipts are becoming increasingly popular. These are sent directly to the passenger's email or mobile device, often through the taxi company’s mobile app.

Digital receipts are convenient as they reduce the risk of losing paper-based taxi receipts and make it easier to organize and store them for future reference.

What information do you find on taxi receipts?

Regardless of the format, taxi receipts generally include essential information such as:

Date and time: When the ride started and ended.

Pickup and drop-off locations: Specifics about where the ride began and ended.

Fare amount: The total cost of transporting the passenger.

Tip amount: If a tip was given, it is often included.

Form of payment: Most taxi companies accept cash, credit cards, and mobile payments such as apps or digital wallets.

Taxicab information: The name and contact information of the taxicab.

Driver’s information: Sometimes, the driver’s name and license number are also included.

Receipts may include information about the passenger’s luggage, reservation, or special requests, such as child safety seats or service animals.

Some taxi companies may go a step further by including a menu of services offered or a request for customer feedback on their receipts. This additional information and feedback can help improve customer service and provide passengers with a comprehensive overview of their rides.

What's the best way to manage your taxi receipts?

Managing taxi receipts can be a hassle, especially for frequent travelers or business professionals who must keep records for reimbursement or tax purposes. Thankfully, there's a solution that can lighten this load.

I’ve found the best way to manage receipts is to digitize them so you can store them electronically. This reduces the risk of losing receipts and makes it easier to find when needed.

So, how do you store your receipts electronically?

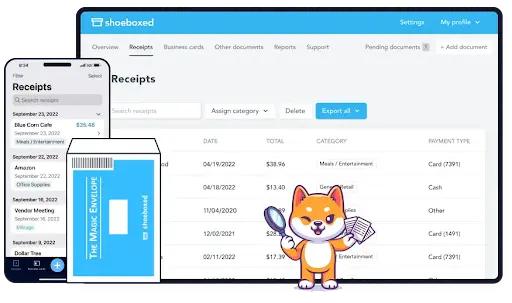

Shoeboxed - ideal for businesses looking for an efficient way to manage receipts

Shoeboxed turns your receipts into data with automatic data extraction for expense reporting, tax prep, and more.

Their platform offers a streamlined solution by easily digitizing and organizing your receipts, eliminating the need to manually sort and file paper copies. This not only saves you time and effort but also ensures that your records are accurate and easily accessible.

Digitizes receipts

With Shoeboxed, you no longer need to keep track of paper receipts. Just take a photo of your taxi receipts with your smartphone and Shoeboxed’s mobile app, and the scanned copies will be uploaded to the platform.

Or, if you want to outsource the scanning to Shoeboxed, you can mail your receipts in their pre-paid postage-free Magic Envelope to their processing center, and they will scan, human verify, and upload them into your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today

If the taxi company sends digital receipts directly to your email or mobile device, you can forward them to your Shoeboxed account, which will be processed automatically.

If you have a Gmail account, Shoeboxed’s Gmail plugin will search your inbox for receipts and send them directly to your Shoeboxed account for you.

Automatically organizes receipts

Once uploaded, Shoeboxed uses OCR technology to extract essential info like date, fare, and taxi company and categorize receipts for you.

This automation makes it easy to search for and find specific receipts later, saves time, and ensures all details are recorded accurately.

Expenses are sorted into up to 15 tax or custom categories.

Generates expense reports

With just a click, Shoeboxed creates detailed expense reports for business travelers who must submit receipts for reimbursement or tax purposes.

Ensures compliance and tax-readiness

Shoeboxed stores IRS-accepted digital receipts so you can comply with tax regulations. Perfect for tax season or audits since you’ll have detailed, organized records of all travel expenses.

Provides cloud storage

Shoeboxed’s cloud-based system stores all your taxi receipts, which you can access anywhere and anytime. This secure storage ensures that you won't have to worry about losing physical receipts or misplacing vital documents, giving you peace of mind about the safety of your records.

By using Shoeboxed to manage your taxi receipts, you gain convenience and peace of mind, knowing that your records are securely stored, easily accessible, and ready whenever needed.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

Why do I need to keep taxi receipts?

It would be best to keep taxi receipts for expense tracking, proof of payments in case of disputes, reimbursement requests, budgeting, and tax filings. Keeping receipts to provide feedback on the driver is also essential for companies who want to improve their services.

How do I store my taxi receipts so I don’t lose them?

Use a digital receipt management tool like Shoeboxed to scan and store your receipts in the cloud so you don’t lose them. Later, you can easily find them for reimbursements, tax filings, or audits.

In conclusion

Taxi receipts are more than just a piece of paper; they are your travel expenses and payment history.

Whether dealing with disputes, business expense claims, or personal expenses, you need a system to manage your taxi receipts conveniently. Use Shoeboxed to digitize, organize, and manage your receipts so you always have them when needed.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!