Travel nursing is a dynamic and rewarding profession that allows nurses to work in various healthcare settings across the country, often with the benefit of higher pay rates and the excitement of exploring new places. However, higher pay can mean higher taxes. That's why it's essential to look for ways to minimize travel nurse taxes.

Here, we offer some travel nurse tax tips by breaking down the typical costs faced by travel nurses, how these costs can be used as tax deductions to reduce taxable income, and how to keep track of these expenses so that more money goes back into their pockets.

Which travel nurse expenses can be written off as tax deductions?

A travel nurse can write off work-related expenses on their taxes, assuming their employer does not reimburse them. Tax deductions can significantly lower the taxable income and reduce the taxes owed on state and federal income taxes. When claiming deductions, it's extremely important to keep thorough records and receipts to prove and demonstrate eligible expenses for your tax filing.

Here are some of the most common deductions we've encountered to help travel nurses save money on their tax bill.

1. Travel expenses

Travel expenses related to getting to and from assignments can be written off as tax deductions. These include airfare, mileage for personal vehicle use (at the IRS mileage rate), car rentals, parking fees, and tolls. The critical requirement is that these expenses directly relate to the travel nursing job.

To deduct travel expenses from your taxable income, keep detailed logs of all business travel expenses, including:

Dates of travel for each assignment.

If you are using your vehicle for travel, mileage logs show the odometer readings at the start and end of each trip, the date, the trip purpose, and the total miles driven.

Receipts for airfare, bus, or train tickets; fuel receipts; tolls; and parking fees.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today2. Lodging and meals

Lodging expenses can be deducted when a travel nurse is away from their primary residence or tax home (the area where they typically live and work) on assignment. This is considered a living expense. Living expenses include transportation, meals, housing, and lodging expenses. The IRS allows the deduction of reasonable costs for hotels or temporary housing.

Save all lodging receipts from hotels or temporary housing expenses to prove expenses when away from your tax home. Ensure these receipts clearly show the date, location, and amount paid.

Additionally, meal expenses during the assignment may be partially deductible, usually at a standard meal allowance rate, unless actual costs are tracked and justified.

Although you might opt for the standard meal deduction, keeping receipts can be helpful, especially if your meal expenses exceed the IRS’s standard meal allowance. Records should include the date, location, and amount of each meal expense.

3. Licensing and certification fees

Costs associated with membership fees and obtaining and maintaining nursing licenses and certifications required by different states or employers are deductible.

Keep receipts or invoices for any costs associated with maintaining or obtaining professional licenses and certifications required for your assignments.

4. Uniforms and medical supplies

The costs for purchasing and maintaining uniforms (including specialized footwear) that are required for work and unsuitable for everyday use can be deducted. Similarly, expenses for medical supplies not reimbursed by the employer, such as equipment costs such as stethoscopes or medical scissors, are also deductible.

Keep receipts for the following:

Uniforms: Receipts used to purchase uniforms and any unique clothing required for work that is unsuitable for everyday use.

Supplies: Receipts for medical supplies, tools, and equipment purchased for work purposes.

5. Continuing education and professional development

Expenses for continuing education courses, seminars, and workshops required to maintain a nurse’s professional license or enhance job skills are tax-deductible. This includes tuition, books, and related supplies.

Document expenses related to maintaining your professional skills or required educational credits, including:

Tuition and fees for relevant courses or seminars.

Receipts for educational materials such as textbooks and supplies.

6. Agency fees and job-related expenses

If a travel nurse pays any fees directly to the travel nursing industry or a staffing agency that are not reimbursed, these may be deductible. Additionally, costs related to job searching, including phone calls, postage, and travel to interviews for new travel nurse assignments, can be reimbursed expenses or deducted.

If you have expenses related to job searches or communications with your agency that are not reimbursed, such as:

Phone bills: Highlight calls related to job arrangements.

Internet bills: If part of your internet usage is dedicated to professional activities, keep these bills.

7. Home office expenses

If a travel nurse maintains a home office in their permanent residence exclusively for work-related activities, such as organizing assignments or managing contracts for a travel nursing agency, a portion of travel nurse tax home-related expenses (like internet fees, utilities, and rent) can be deducted based on the percentage of the home used for business purposes.

If you claim a home office deduction, maintain records of:

Square footage used exclusively for business purposes.

Utility bills, rent, or mortgage interest statements to allocate the proportion used for business.

What are some other things to consider when dealing with travel nurse taxes?

There are several other aspects to consider when dealing with travel nurse tax deductions.

These include the following:

Tax home or primary residence: Travel nurses must maintain a tax home to claim most travel-related deductions. This is generally the city or area where they regularly live and work when not on assignment. If they do not maintain a permanent tax home, their travel expenses may be considered personal commuting expenses, which are not deductible.

Record keeping: Travel nurses must keep detailed and organized records of all expenses, including receipts, invoices, and logs, especially if they itemize their deductions.

Consult a tax professional: A tax professional familiar with travel nursing or a certified public accountant (CPA) can provide personalized tax advice and ensure that all eligible expenses and deductions are correctly claimed, optimizing tax benefits and compliance.

How can you track expenses for travel nurse tax deductions?

Shoeboxed is a service that can be particularly beneficial for travel nurses who file and pay income tax due to its ability to streamline the management of receipts and track expenses efficiently. This is crucial for travel nurses, who incur various expenses while on assignment.

There are many other ways Shoeboxed can benefit travel nurses.

Simplified expense tracking

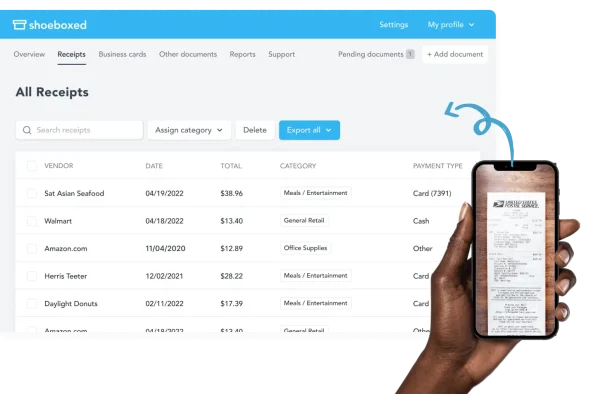

For a travel nurse, expense tracking doesn't get any simpler than with Shoeboxed.

Shoeboxed makes tracking their expenses simple for a travel nurse.

Travel nurses frequently incur various living expenses, such as travel, accommodations, and meals. With Shoeboxed's receipt scanning service, nurses can track their expenses in three steps. These include signing up for a Shoeboxed account, sending receipts in for scanning, and logging into your account to view your receipt data.

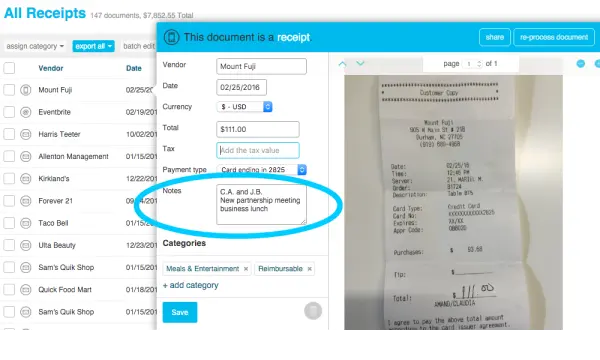

Magic Envelope

Shoeboxed is the only receipt scanning service that offers a Magic Envelope.

One of the best things about Shoeboxed is its Magic Envelope. Shoeboxed is the only receipt-scanning service that provides this feature. With the Magic Envelope, travel nurses can stuff this prepaid postage envelope full of receipts or other documents and mail it to Shoeboxed. Shoeboxed will then scan, human-verify, and upload receipts into your account.

With a travel nurse's busy schedule, what could be better than only having to mail receipts in and having Shoeboxed take care of the rest? The Magic Envelope makes it easy and convenient for travel nurses to keep up with receipts so they don't get misplaced or damaged.

The Magic Envelope can easily be kept in a briefcase, purse, or on top of your car's dashboard, which makes it easily accessible, especially when purchasing gas.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

Get Started TodayMobile phone app

What's better for travel nurses than a mobile phone app?

Nurses who want to scan receipts themselves can use Shoeboxed's mobile phone app and their mobile phone camera. Once scanned, the receipts are automatically uploaded to their account and separated into 15 different tax categories.

The mobile phone app allows users to digitize and organize receipts. Again, this simplifies tracking expenses for travel nurses who are always on the go because they can scan the receipt as the expense is incurred.

Easy reimbursement process

With Shoeboxed, travel nurses can easily categorize and store receipts in an IRS-accepted format.

Shoeboxed makes the reimbursement process quick and easy.

Shoeboxed makes it simple for travel nurses to file for travel reimbursements from their agency. They can quickly provide organized, digital copies of receipts when needed. Comprehensive expense reports with receipt images can also be created from the web or mobile phone. This streamlined process saves time and reduces the hassle of managing paper receipts.

Tax preparation

Travel nurses may need to file taxes in multiple states and handle complex tax situations due to their travel schedules.

Shoeboxed automatically separates expenses into 15 tax or custom categories.

Shoeboxed makes filing taxes much more straightforward for travel nurses, especially since business-related expenses are automatically placed in tax categories. Shoeboxed also ensures that all deductions are accounted for accurately, potentially reducing tax liabilities.

Shoeboxed also helps by keeping all tax and expense-related documentation in one place, making tax preparation easier during tax season.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayBudget management

By using Shoeboxed, travel nurses can closely monitor their spending patterns.

Shoeboxed helps travel nurses manage their budgets.

Shoeboxed's detailed reports on where money is spent help nurses adjust their budgets accordingly and save money where possible.

Security and accessibility

All documents and receipts stored in Shoeboxed are secure and can be accessed anywhere with the internet.

Shoeboxed can be accessed anywhere on the internet for travel nurses on the go.

The accessibility from anywhere is particularly beneficial for travel nurses who may need to access their financial documents while away from home or when planning for future assignments.

Shoeboxed can help travel nurses manage their expenses more efficiently, ensure they are reimbursed correctly, prepare their taxes easily, and maintain better control over their financial health while on the move.

Frequently asked questions

How can I reduce my taxable income as a travel nurse?

Travel nurses can reduce their taxable income by deducting expenses as tax write-offs. Some common tax deductions for these expenses include travel and lodging expenses, meals, licensing and certification fees, uniforms, medical supplies, continuing education and professional development, agency fees, professional expenses, and other business-related expenses. Keeping track of all work-related expenses is essential when claiming tax deductions.

How is income tax handled if I work in multiple states?

If you work in multiple states during the tax year, you must file and pay taxes for various states. You must file and pay taxes in every state you have worked.

If you work in a state with no income tax, then you don't owe income tax for that state. However, you may still owe income tax to your home state. Regarding travel nurse taxes and multiple states' tax implications, it's always best to consult a tax professional.

In conclusion

Travel nursing can be financially rewarding, but it comes with its own set of challenges, particularly related to managing various expenses. By understanding which costs are deductible and how to track expenses efficiently, travel nurses can make the most of their careers as traveling healthcare professionals while maintaining financial stability.

Consulting with a certified tax professional experienced with travel nurse expenses and taxes can provide additional support and insights to navigate tax obligations.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!