Navigating the maze of taxes for truckers can feel like a bumpy ride.

As an owner-operator, managing taxes can be a real challenge, especially when you’re responsible for tracking income, tax deductions, and compliance with tax laws. Unlike company drivers, who have taxes taken from their paychecks, owner-operators have to do it themselves.

You can steer your finances toward smoother roads and bigger savings with the right tools and tips.

What taxes are required for owner-operators?

One of the biggest parts of this tax burden is federal taxes, which you must manage along with state and local taxes.

Here’s a breakdown of the taxes you need to manage as an owner-operator:

1. Self-employment tax

As an owner-operator, you’re self-employed, so you must pay self-employment tax. This tax covers Social Security and Medicare, 15.3% of your net income (12.4% for Social Security and 2.9% for Medicare).

You’ll report and pay this tax when you file your federal income taxes using Schedule SE.

2. Federal income tax

Owner-operators pay federal income tax on their earnings. Since taxes aren’t withheld from your paychecks like they are for company drivers, you’ll need to estimate and pay quarterly. You’ll use IRS Form 1040-ES to estimate and submit these payments to avoid penalties and interest for underpayment.

3. State income tax

Depending on where you live, you may also need to pay state income tax. Each state has its own tax rates and rules, so you’ll need to check the specific requirements for each state. Some states, like Texas and Florida, don’t have state income tax, while others, like California, have higher rates.

4. Heavy vehicle use tax (HVUT)

The IRS requires owner-operators to pay the Heavy Vehicle Use Tax (HVUT) if their truck has a gross weight of 55,000 pounds or more. The tax is $100 to $550 annually, depending on the vehicle's weight. HVUT is reported on IRS Form 2290 and is due by the end of August each year.

5. Fuel taxes (IFTA)

Owner-operators who operate in multiple states must pay fuel taxes under the International Fuel Tax Agreement (IFTA). You’ll need to file quarterly IFTA reports that calculate the fuel taxes owed to each state based on the miles driven and fuel consumed. These taxes fund road maintenance and infrastructure.

6. Highway vehicle use tax

Some states have additional highway use taxes on trucks that travel within their borders. These taxes are based on weight and mileage driven in each state. Check the specific requirements for each state where you operate.

7. Sales tax

You may need to pay state and local sales tax when you buy equipment, parts, or other taxable items for your trucking business. The rate and applicability of sales tax varies by location and item. Some trucking-related items may be exempt in some states, so check with your state’s tax department.

8. Federal excise tax (FET)

Owner-operators buying new trucks or trailers may be subject to the Federal Excise Tax (FET), which applies to heavy-duty trucks and trailers at 12%. This tax is paid at the time of purchase and is a big deal for those buying new equipment.

9. Employment taxes (if applicable)

If you hire other drivers or employees, you’ll be responsible for employment taxes, including Social Security, Medicare, and federal unemployment taxes (FUTA). You must withhold these taxes from employee wages and make employer contributions.

Why is recordkeeping and expense tracking essential?

Recordkeeping and expense tracking are crucial to reducing your tax liability. As an owner-operator, you can write off many work-related expenses, but you need proof of those expenses through receipts and documentation.

Save all your receipts and categorize them. Organize your receipts and keep precise records, and you’ll be ready to claim tax deductions and avoid issues during tax season and audits.

Working with a tax professional or using tools like Shoeboxed can help you manage these responsibilities and maximize your deductions and tax credits.

What is the best way for truckers to track expenses?

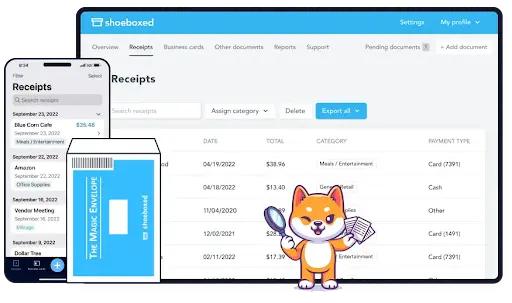

Keeping track of receipts, actual expenses, and deductions can be a headache for owner-operators, but Shoeboxed, a simple document, receipt, and expense management software, can ease the burden.

With Shoeboxed, you can easily digitize and organize your receipts, making it a convenient tool for tracking and categorizing your yearly expenses.

Here’s how Shoeboxed can help truckers manage their tax finances:

1. Receipt scanning

Truckers collect various receipts for fuel, lodging, meals, and maintenance on the road. Shoeboxed allows you to scan those receipts using the mobile app. Then, they digitize and store those receipts in the cloud so you don’t have to deal with paper receipts that can get lost or damaged on the road.

Simply scan the receipt with your smartphone's camera and the app will automatically upload the digital receipt to your designated Shoeboxed account.

Truckers can also outsource the scanning by sending their receipts to Shoeboxed's processing center using their prepaid Magic Envelope. There, team members scan, human-verify, and upload them to your Shoeboxed account for you.

Just keep this envelope on the dashboard of your truck and stuff receipts into it as you pay for gas, maintenance, meals, etc. This reduces receipt loss while on the go.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today2. Auto extraction

Once a receipt is scanned, Shoeboxed uses Optical Character Recognition (OCR) to automatically extract the essential details: amount, date, merchant, and expense category.

The extracted data is uploaded into a Shoeboxed account, verified by their data verification team against the original receipt, and categorized.

This saves time and reduces errors as you don’t have to manually enter each receipt, which is helpful when dealing with hundreds of expenses.

3. Expense categorization

For tax purposes, Shoeboxed allows truckers to automatically sort their expenses into tax categories: fuel, food, maintenance, lodging, repairs, and tolls. Categorizing expenses makes it easier to claim deductions specific to the trucking industry.

You can also create custom categories to fit your business needs and track all deductible expenses throughout the year.

4. Detailed expense reports

Shoeboxed generates expense reports summarizing your categorized expenses, including all receipt images and details. Tax-ready reports can be exported in various formats (PDF, Excel, CSV) to share with your accountant or tax professional.

This makes tax time a breeze as you have all your expenses in one place.

5. Compliance and tax readiness

Shoeboxed stores digital copies of IRS-accepted receipts so you can comply with tax regulations. This is especially useful during tax season or audits, providing detailed, organized records of all actual expenses.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

6. Cloud storage

Shoeboxed stores all your receipts and expense records in the cloud so truckers can access their financial data anywhere. Since truckers are always on the road, accessing expenses and receipts digitally means you don’t have to carry physical receipts.

All receipts are stored safely, so you have everything you need for tax time or audits.

7. Per diem tracking

Truckers can claim per diem deductions for meals while on the road. For example, truck drivers can deduct either 80% of their meal expenses or the per diem rate of $69 per day.

Shoeboxed can track those expenses so you can claim the 80% or per diem allowance, which benefits truckers away from home for extended periods.

Shoeboxed will ensure you claim the maximum allowable deduction by keeping a digital log of your meal expenses.

9. Audit protection and compliance

Shoeboxed protects truckers during IRS audits by having organized and detailed expense records. All receipts are stored with date, merchant, and amount, so you have the documentation ready if your deductions are questioned.

This organized system reduces the stress of an audit and prevents penalties.

10. Integration with accounting software

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and Wave to easily transfer expense data to your accounting platform.

This integration makes bookkeeping a breeze, so your expenses are recorded accurately without manual data entry, making tax time much easier for you or your accountant.

11. Multi-user access

Shoeboxed has no limits to the number of free users you can add!

Shoeboxed’s multi-user feature makes collaboration easy by allowing multiple users to access and manage a single account. This feature is perfect for truckers who work with accountants, bookkeepers, or financial assistants.

Whether on the road or at home, you can give your team access to digitize receipts, track expenses, and generate reports in real time. This ensures your financial records are always up-to-date and ready for tax season.

Multi-user access provides seamless teamwork and keeps everyone on the same page, even when you're miles apart.

Shoeboxed has everything truckers need to manage and track expenses for tax purposes. With features like receipt scanning, automatic data extraction, and expense categorization, Shoeboxed makes it easy to stay organized, maximize deductions, and minimize tax burden.

By digitizing receipts and keeping records in real-time, truckers can focus on the road while knowing their financial records are safe, accurate, and ready for tax time.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayWhat are estimated tax payments, and how do you stay on top of quarterly taxes?

Owner-operators are required to make quarterly estimated tax payments. The Internal Revenue Service (IRS) enforces these quarterly payment requirements to ensure compliance with tax obligations. If you fail to make these payments, you may be subject to penalties and interest.

The self-employment tax rate is 15.3%, split into 12.4% for Social Security and 2.9% for Medicare. To avoid these penalties and interest, you should set aside 25% to 30% of your weekly net income to cover your quarterly tax obligations.

Filing your quarterly taxes on time using Form 1040-ES will help you avoid underpayment fees and comply with IRS regulations.

How can you maximize your refund with truck driver tax deductions?

Maximizing your tax refund as a truck driver, especially if you’re an owner-operator, means taking advantage of all the deductions and tax credits available. The general rule of thumb is that if an expense is necessary to run your business, it’s a write-off on owner-operator taxes.

Here are some key tips to help you reduce your taxable income and get more back:

1. Track and deduct all business expenses

As an owner-operator or independent trucker, you can deduct many business expenses necessary for your job. Truck driver tax deductions can reduce your tax burden by lowering your taxable income and moving you into a lower tax bracket.

Some ordinary business expenses include:

Fuel

Truck maintenance and repairs

Hotel and food while on the road

Tolls and parking fees

Truck insurance premiums

Licensing and permit fees

Office supplies

Accounting or tax preparation fees

Keep records of these expenses, including receipts and invoices, to claim deductions.

Using Shoeboxed can make tracking expenses and not missing any deductible items easier.

2. Claim per diem for meals

Per diem is a tax deduction for ordinary and necessary business meals incurred while traveling away from home. Truck drivers away from home for extended periods can claim the per diem for meals.

The IRS allows a daily allowance to cover meals while traveling for work. Per diem can reduce taxable income if you’re on the road for long periods.

3. Depreciate your truck

If you own your truck, you can claim depreciation as a tax deduction. Depreciation allows you to deduct the cost of your truck over several years for the wear and tear.

The IRS has different methods for calculating depreciation, including the Section 179 deduction, which allows you to deduct the total cost of your truck in the year you purchase it up to a specific limit.

Section 179 is good if you purchased expensive equipment like a new truck or trailer, as you can deduct the full amount in the year you purchased it instead of spreading it out over several years.

4. Interest on loans

If you financed your truck or any other equipment, truck drivers can deduct the interest paid on the loan as a business expense. This applies to loans for trucks, trailers, or other equipment used in your trucking business.

5. Use the home office deduction

You may qualify for the home office deduction if you run your trucking business from home, such as paperwork, scheduling, or maintenance planning.

To claim this deduction, you must have a dedicated space in your home that is used regularly and exclusively for business purposes. You can deduct a portion of your home expenses, such as mortgage interest, rent, utilities, and insurance, based on the size of your office.

6. Claim health insurance premiums

If you’re self-employed and pay for your own health insurance, you may be able to deduct the cost of health insurance premiums. This applies to yourself, your spouse, and dependents. Even if you don’t itemize your deductions, you can claim this, so it’s a great tax savings opportunity.

7. Don’t miss miscellaneous deductions

Truck drivers can also claim other deductions that might not be obvious:

Cell phone and internet expenses used for business purposes (e.g., contacting dispatchers or clients).

Work-related clothing and uniforms required for the job and are not suitable for everyday wear.

Subscriptions or fees for trucking associations or industry publications to stay current on regulations and industry trends.

Expenses for continuing education or training, such as certifications for your trucking business.

8. Contribute to retirement

Contribute to a retirement account like a SEP IRA (Simplified Employee Pension) or a Solo 401(k) to reduce your taxable income and save for the future. Contributions to these accounts are tax-deductible, lowering your current tax liability and securing your financial future.

9. Pay quarterly estimated taxes to avoid penalties

It is not directly related to getting a refund, but paying quarterly estimated taxes will avoid underpayment penalties and interest. Paying on time will keep you from getting hit with extra charges and keep more money in your pocket.

10. Hire a tax professional

Tax laws for owner-operators can be complicated. Working with a certified tax pro who knows the trucking industry will help you claim all the deductions and credits you’re eligible for, reduce your tax liability, and get a bigger refund. A tax pro will also help you avoid mistakes that can trigger audits or penalties.

Working with a trusted accountant or tax preparer helps ensure your tax return is completed accurately and on time.

Frequently asked questions

How much should I set aside for estimated owner-operator taxes in the trucking industry?

Set aside 25-30% of your weekly net income to cover quarterly estimated taxes. This way, you’ll have enough saved to pay your quarterly taxes without falling behind or getting hit with penalties.

What is the best way to track expenses for trucking business taxes?

I have found that the best way to track expenses is to use Shoeboxed for digitizing, organizing, categorizing, and storing receipts. That way, expenses are automatically sorted into tax categories and ready to be turned into tax deductions. The data is also securely stored in case of an audit.

In conclusion

As an owner-operator, staying on top of your taxes is critical to a successful business. From tracking expenses to maximizing deductions, understanding trucking taxes will help reduce your tax burden and be IRS-compliant.

Shoeboxed has everything truckers need to manage and track expenses for tax purposes. With features like receipt scanning, automatic data extraction, and expense categorization, Shoeboxed makes it easy to stay organized, maximize deductions, and minimize tax burden.

By digitizing receipts and keeping records in real time, truck drivers can focus on the road while knowing their financial records are safe, accurate, and ready for tax time.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!