The humble receipt is a long-standing tradition in the world of goods and services.

For thousands of years, people have been buying, selling, and jotting (or chiseling) down written receipts to prove an exchange of merchandise or money was made.

Since then, receipts have evolved into the paper and digital receipts we know today, and there are more types of receipts than you may think.

In this guide, we’ll be discussing 13 types of receipts and what they’re used for!

What is a receipt?

While paper receipts are still used, digital receipts are becoming more commonplace with the advancement and implementation of technology in businesses.

What are the different types of receipts?

There are endless ways that receipts can be used, but in this section, we’ll be covering the receipts that are the most inquired about.

Below is a list of 13 different types of receipts:

Bank transaction receipts

Transaction receipts

E-receipts and digital receipts

Purchase receipts

Reimbursement receipts

Paper receipts

Cash receipts

Handwritten receipts

Carbon copy receipts

Invoices

Gross receipts

Without further ado, let’s dive into the types of receipts and their purposes!

1. Bank transaction receipts

Bank transaction receipts are receipts that detail transactions with a bank.

Whether you’re an individual or a business, bank transactions such as deposits, loan payments, or credit card transactions are recorded digitally or on paper.

Bank transaction receipts help banks and customers accurately track the money going in and coming out of the bank.

2. Transaction receipts

Transaction receipts are any receipts that indicate an exchange of money for merchandise was made. These receipts can be digital or printed and act as proof of purchase for customers, businesses, or employees.

Should a customer want to return the item they bought, a transaction receipt is needed to show the item that was purchased, when, and for how much.

Businesses keep transaction receipts for deductible business expenses, and employees can use transaction receipts to prove any business-related expenses were made.

3. E-receipts and digital receipts

Never lose a receipt again! E-receipts and digital receipts are sometimes used interchangeably, but these electronic receipts have slight differences.

E-receipts, or electronic receipts, are receipts that originate on a computer. Say you buy a piece of furniture online. Once the purchase is complete, you’ll be sent an e-receipt by email.

Digital receipts are also receipts that are sent electronically to your email, but they represent paper receipts.

For example, if you visit a clothing store and finish checking out, you’ll be given the option of a paper and digital receipt or just one or the other.

4. Purchase receipts

Purchase receipts are business-related and given when you pay for goods or services. For example, a carpenter would receive a purchase receipt from suppliers when he or she orders wood for a contract.

Purchase receipts typically include the date of the transaction, a description of the purchase, the payment method, and charges.

5. Reimbursement receipts

Reimbursement receipts are receipts used by employees as proof of purchasing business-related expenses out of pocket.

An employee can use a receipt to show their employer what was bought and how it was purchased in order to be reimbursed for what they spent of their personal money. One may make use of an expense reimbursement software to report and track reimbursements easily.

6. Paper receipts

Cash register tape receipts, or paper receipts, are printed directly at the register when you check out at a store.

Cash register receipts are old-school receipts and are great for those who cannot receive digital receipts.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started Today7. Business receipts

Business receipts are receipts that show a business transaction was made.

These receipts can prove business-to-business dealings or business expenses such as office supplies, maintenance, and any other necessary business purchases.

Business receipts can also be used for acceptable tax write-offs and prove where your money went if you’re ever subject to an audit.

8. Credit card receipts

A credit card receipt is a receipt that details a transaction that was made using a credit card. If you check out at a store using a credit card, you’ll receive a credit card receipt either by email or print.

9. Cash receipts

Whenever cash is used in a purchase, a cash receipt is printed as proof of payment.

Cash receipts will have a statement of the amount of cash received, the date of the purchase, and signatures to authenticate the transaction.

10. Handwritten receipts

A handwritten receipt is a receipt from a receipt book that is often given by service providers such as electricians or plumbers detailing the work done, on what day, and for how much.

Handwritten receipts will include the company name and contact information, the services and supplies used (and their cost), the subtotal, taxes, the grand total, and the payment method of the customer.

11. Carbon copy receipts

Carbon copy receipts were receipts that had carbon paper on the back side. When you wrote on the receipt, the pen impressed your handwriting onto the carbon paper, creating a copy of the original receipt.

While they were commonly used in the hundred-year span of 1870 to 1980, carbon copy receipts are a rare sight in the modern world.

12. Invoices

Invoices, though given to a customer before they receive a receipt, are considered the most common receipt type.

They detail the type of work or product purchased, the date of the purchase, the terms of payment, and the names of the buyer and seller.

Invoices are a type of receipt that can be used as a record of purchases for businesses and customers. One may make efficient use of an invoicing software to keep active track of all invoices of business.

13. Gross receipts

According to the IRS, “Gross receipts are the total amounts the organization received from all sources during for an annual revenue, without subtracting any costs or expenses.”

Essentially, gross receipts (also known as tax receipts) are an important part of reporting your income accurately to the Internal Revenue Service.

Your business’s gross receipts also determine whether or not your company is considered a small business under the law’s stipulations.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayWhat's a good receipt management software or system?

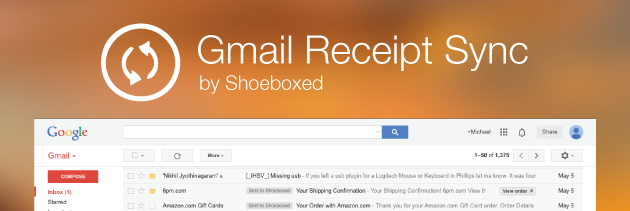

Importing receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing!

Purchases are categorized under a tax category for effortless expense management and tax preparation.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

What else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

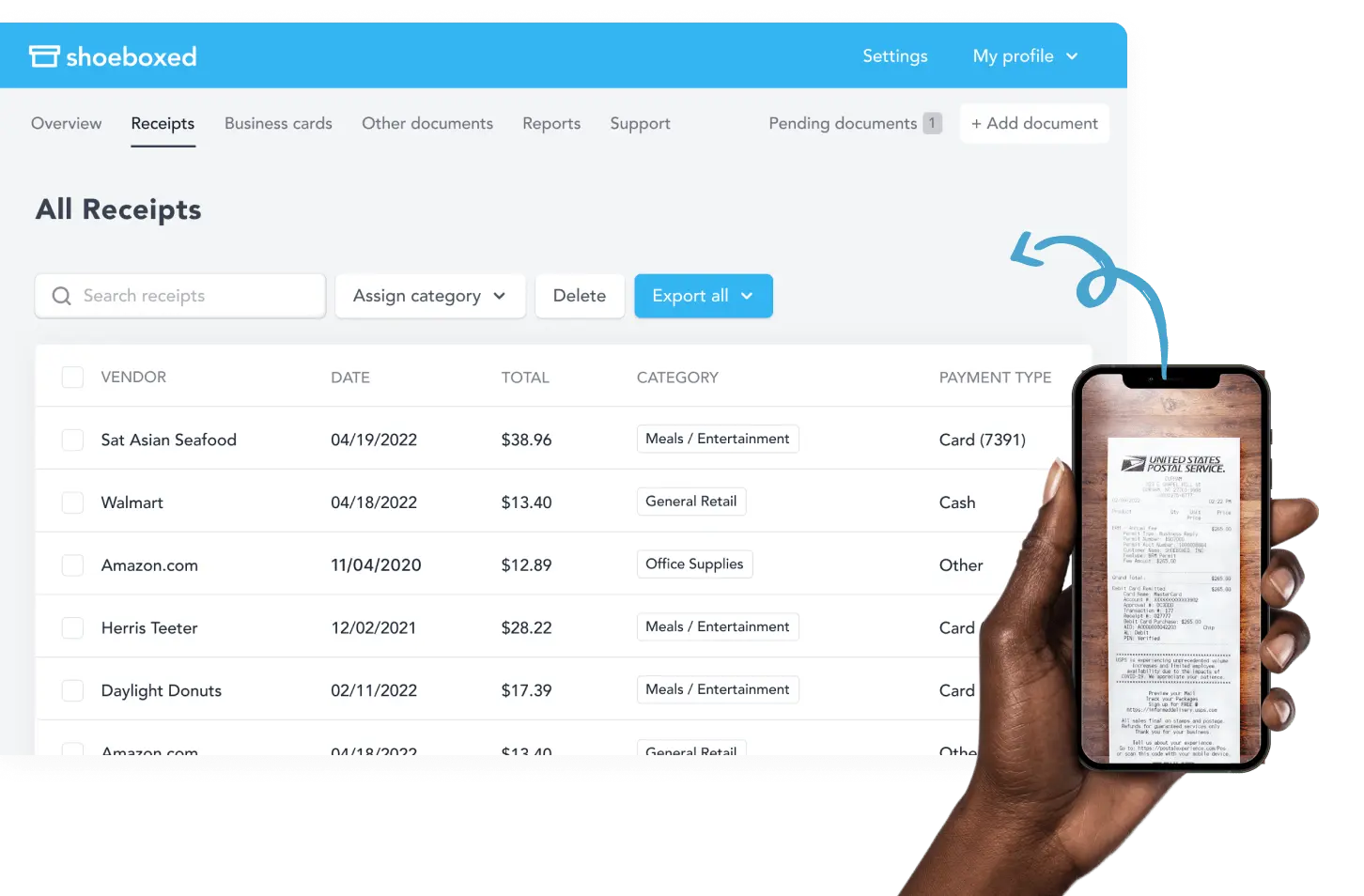

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

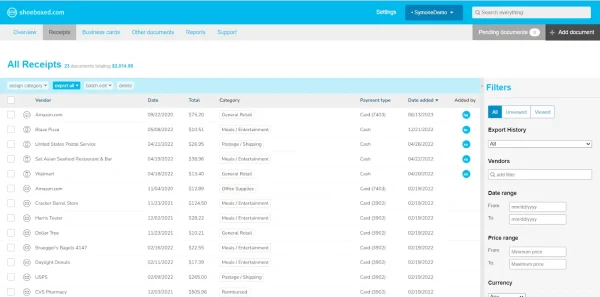

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayFrequently asked questions

What are the 3 copies of a receipt?

The white copy, yellow copy, and blue copy. The white copy is the receipt given to the customer. The yellow receipt copy is given to the business office (such as the sales or finance department). The blue copy is meant to be kept in the business’s receipt book.

What is the most common type of receipt?

Invoices are the most common type of receipt and are written to acknowledge the request for goods or services provided. Invoices prove that an exchange of work or merchandise was made.

How do you categorize receipts?

Receipts should be categorized in chronological order with the oldest receipts in the back of your receipt organizer and the newest near the front. Some categories include the following:

Medical

Home and assets

Business

Income

Business receipt categories may include the categories below:

Advertising

Company vehicles

Supplies

Employee expenses/payroll

Office/workplace expenses

Keeping and storing your receipts in an organized way can help you maintain a record of transactions should they ever be called into question.

See also: Receipt Storage: The Best Ideas for a Clutter-Free Life

What kind of receipts can I use for taxes?

If you run a small business, there are a few receipts you can keep for tax write-offs.

Acceptable receipts for tax deductions include the following:

Travel expenses

Business supplies

Home office expenses

Meal deductions

Educational expenses

Remember that anything you plan to write off for your business should only be business-related or else they will be classified as nondeductible expenses.

Travel expenses are acceptable tax deductions, but not if they were for a weekend getaway with the family.

Visit the Credits and Deductions page of the IRS for more information on acceptable write-offs.

Final thoughts

Receipts serve an important purpose of recording business transactions, cash and credit sales, stock market transactions, the purchase and sale of raw materials, charitable contributions, and more.

While paper receipts may soon phase out, digital receipts will carry on the legacy of a millennia-old practice when buying and selling products.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!