Uber Eats is a popular side hustle that allows people to earn extra money on their terms and at their pace.

But when you drive for Uber Eats, you’re not an employee, which means you’re responsible for keeping up with the miles and expenses you generate while making deliveries.

These miles and expenses are vital to minimizing the money you owe to the IRS.

In this guide, we review the best mileage tracker apps for drivers, cover what to do if you forgot to track your mileage, answer common questions about reducing your tax liability, and more.

How we chose the top mileage tracking apps for Uber Eats

We used the following criterion to narrow down our list of the best mileage tracker apps for Uber Eats delivery drivers.

User-friendliness: We looked for apps that were easy to use with intuitive and navigatable interfaces. This lets drivers be as hands-off as possible so they can focus on deliveries.

Automatic and manual tracking options: We chose trackers that offered automatic and manual tracking options to put the control in drivers’ hands.

Integration with delivery apps: We learned that many Uber drivers also deliver for other platforms. So, we chose mileage trackers that work with Uber and other apps, like DoorDash and Instacart.

Reporting features: Features that allow you to export your data take the hassle out of paying taxes for your hustle.

Easy on the wallet: We compared the cost to the apps’ features to determine their cost efficiency.

Now that you know how we created our round-up, let’s dive into the reviews!

7 best mileage tracker apps for Uber Eats in 2024

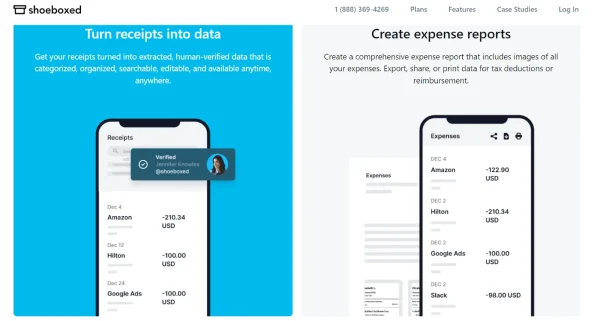

1. Shoeboxed – Best for expense tracking and tax prep

Log your miles, manage expenses, and prepare for tax time with Shoeboxed

Shoeboxed is our favorite option for full-time Uber Eats drivers and lets users track their miles, scan receipts, and prepare for tax season in one comprehensive app.

How does Shoeboxed’s free mileage tracker work?

Shoeboxed’s mileage tracker

When you sign up for Shoeboxed, tracking miles is as easy as:

Opening the Shoeboxed app.

Tapping the “Mileage” icon.

Clicking the “Start Mileage Tracking” button.

And driving!

Shoeboxed will then track your location and miles and save your route as you drive.

When you make stops and have to pay for parking or tolls, just snap a photo and upload the receipt to your Shoeboxed account. The mileage tracker will continue to log your trip as you record expenses along the way.

At the end of a trip, tap the “End Mileage Tracking” button, and Shoeboxed will create a summary of your trip with the date, editable mileage and trip name, and your tax deductible and rate info.

If everything looks correct, click “Done” to generate a receipt with the information from your drive. Each trip is saved with a photo of your route on the map.

Shoeboxed will automatically categorize your drive under the mileage category so it’s easy to find.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayReceipt management, search features, and tax prep

With Shoeboxed’s smart receipt capture, you can snap photos of the receipts you receive from parking, tolls, insulated bags, car maintenance, and any other expenses related to Uber.

Shoeboxed will automatically pull the data from your receipts and categorize them under 15 editable expense categories for tax season.

If you need to find an old receipt from a specific delivery, you can call it up in seconds with Shoeboxed’s advanced search function and filters.

Example of a CSV expense report from Shoeboxed demo account.

Tax season is also a breeze with Shoeboxed’s expense reporting feature. With Shoeboxed, you can transform business receipts into an organized expense report for your accountant.

Because expense reports come with receipts attached, they can also protect your interests in the event of an audit.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayThe Magic Envelope and how it benefits delivery drivers

Outsource your receipt-scanning with the Magic Envelope

Shoeboxed offers a service called the Magic Envelope that allows Uber drivers to outsource their receipt scanning.

This service is unique only to Shoeboxed, so you won’t find it offered by any of the other mileage trackers on our list (or any other expense tracking app, for that matter).

The Magic Envelope is a helpful tool for long-term Uber drivers who generate lots of business receipts.

When you buy a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month for you to mail your receipts in.

As soon as your receipts reach the scanning facility, the team at Shoeboxed will scan and upload the information to your account under the appropriate tax categories.

And if you want your receipts categorized in a particular way, just leave a note!

Send Shoeboxed your receipts so we can do the scanning for you.Software integrations

If you use QuickBooks, Xero, or Wave Accounting, you can integrate Shoeboxed with your software for more organized receipt and expense management.

Pros:

Mileage tracker is easy to use.

Drives are editable with notes and details.

Miles are turned into receipts for expense reporting and automatically categorized under mileage.

Advanced search and filter options for tax reporting.

Track mileage and digitize business receipts simultaneously.

Expense reports come with receipts attached.

Integrates with accounting software for simplified expense management.

Magic Envelope can be an excellent option for city-dwelling delivery drivers that often get receipts for parking, tolls, and other fees.

Unlimited number of free sub-users. Add your accountant to Shoeboxed for free.

Cons:

The mileage tracker is manual only. Though, this gives you more control over which trips are logged.

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope service.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope service.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope service.

Starter Plan – $4.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (Digital Only plan. Doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

NOTE: The Start Up, Professional, and Business plans are only available on desktop. The Starter, Light, and Pro plans are available on the Shoeboxed mobile app only.

2. Hurdlr – Best for preserving battery

Hurdlr app, Apple App Store

Hurdlr solved a problem that many trackers overlook—battery drainage.

This app was designed to preserve your phone’s battery life while tracking your miles, “even with heavy usage.”

But Hurdlr isn’t just good for saving battery.

Automatically record miles across all your delivery apps

Not only does Hurdlr track the miles you drive for Uber, but it can also track miles for DoorDash, Lyft, Amazon Flex, Instacart, and other apps.

Track your miles automatically and access drive reports

Tracking with Hurdlr is automatic, which means it runs in the background and records your trip while you drive.

If you’re thinking, “That sounds great!” don’t jump the gun.

The downside to Hurdlr running in the background is that it also records your personal drives, which you’ll have to differentiate in-app.

Don’t like the sound of that? Hurdlr also offers a manual miles-tracking option.

You can access reports of your trips from the mileage tab and filter your drives by the year, month, week, or custom date ranges—which will come in handy during tax time.

Manage income and business expenses and get tax estimates

You can get access to expense, tax, and income tracking, though these additional features are only offered if you buy the Premium version of Hurdlr.

Hurdlr lets you connect your bank and payment methods with your account to track your Uber income and manage expenses.

This mileage tracker app also offers a receipt-scanning feature so you can take pictures of your receipts or manually record the amount of the expense or income you receive.

As for taxes, just complete your Hurdlr tax profile to view estimated tax calculations.

Pros:

Track miles automatically or manually.

Designed to preserve battery life.

Filter your drives.

Link your accounts to track income or business expenses automatically.

Create reports for the miles you drive.

Integrate your Hurdlr account with FreshBooks and other software.

Attach pictures of receipts to expenses or income statements.

Cons:

Expense tracking, income tracking, and tax estimations are only available on the Premium version.

Receipt capture isn’t as comprehensive as other apps, like Shoeboxed.

Pricing:

Free.

Premium for $100/year.

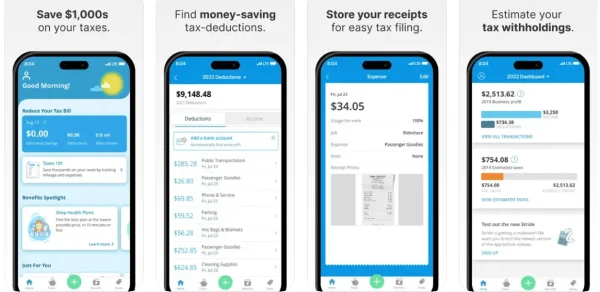

3. Stride – Best free option

Stride App, Apple App Store

Stride is a free mileage tracker app that offers users an impressive range of features at no cost.

Tracking mileage with Stride

Stride is an easy-to-use manual mileage tracker app that lets drivers begin and end their trips with one click.

Drives automatically have their approximate tax deduction calculated for the miles covered. Stride also keeps tabs on the time you spent driving.

Insurance and tax help

Since Uber drivers are considered independent contractors, finding health plans for full-time drivers and learning to navigate taxes can be challenging.

We really like the resources for insurance plans and tax prep help that Stride offers users.

Scan receipts for expense tracking

Stride understands the importance of receipts for expense management and tax filing, so you can actually snap photos of business receipts with the app.

Under each receipt, you’re given the option to edit the job and expense fields and leave notes about the purchase.

That said, the expense management feature lacks on the customization front compared to other receipt scanners, like Shoeboxed.

Pros:

Unlimited mileage tracking.

Insurance and tax resources.

Estimated tax deductions.

Link your bank account and be matched to applicable deductions.

The app is easy (and free) to use.

Though tracking is only manual, it’s easy to start and stop trips.

Cons:

No way to automatically track your business miles.

The receipt scanning feature doesn’t have many options for customization.

Pricing: Free.

4. Gridwise – Best for drivers with multiple side hustles

Gridwise app, Apple App Store

Gridwise is the best mileage tracker app for drivers that work with multiple meal delivery services.

Plus, it’s free (until you want more out of the app).

Gridwise works for drivers by tracking miles, expenses, and earnings from:

DoorDash

Uber Eats

Grubhub

+ a dozen more delivery apps.

Delivery insights for Uber drivers

The best part about Gridwise is its insights into income and popular areas and times for deliveries so you can maximize your earnings.

Gridwise also lets drivers compare how they’re performing with drivers nearby to see where they can improve and increase their profits.

Features you get with the paid version

With Gridwise Premium, you would get access to:

Tax prep help.

Gas-saving and rewards.

Advanced insights.

Pros:

The free version is promising and gives drivers what they need to log their miles and manage income.

Unlimited mileage tracking.

Tracking is automatic.

Get insights into your income and business expenses.

Find hot spots for deliveries.

A good option for logging multiple side gigs.

Cons:

The paid subscription probably wouldn’t benefit Uber Eats delivery drivers much (better for rideshare drivers).

Only works with specific food delivery apps, so you can’t track the miles you drive for other businesses.

Pricing:

Free app.

Get more features for $9.99/month or $95.99/year (it’s tax-deductible!)

5. TripLog – Best for multiple tracking options

TripLog app, Apple App Store

TripLog is another tracker for business miles and expenses. Our favorite thing about this one is its handful of tracking options.

Customizable automatic mileage tracking

Though you can choose to track miles manually, TripLog mainly uses Google Maps to record miles automatically.

What makes TripLog unique is that it offers a few auto-start options:

MagicTrip – Runs in the background and begins tracking 1-2 minutes after you start driving. Stops after 5 minutes if no motion is detected.

Car Bluetooth – Connects via Bluetooth and begins tracking once you drive faster than 5 MPH. Disconnect from Bluetooth to end tracking.

Plug-N-Go – Tracks once you plug your phone into the charger and drive faster than 5 MPH. Tracking ends when you unplug your phone.

Income and expense tracking

TripLog also lets users record fuel, expenses, and income with its receipt-scanning function.

The biggest letdown

The free version of TripLog was a bit disappointing, and only the paid plan offers advanced features like unlimited receipt uploads and trips, bank and card integrations, and OCR scanning for receipts (which means you’ll have to manually input receipt data).

You get 40 trips per month with the free version, which is only enough for part-time deliveries.

Pros:

Choose how you want to auto-track your miles.

Offers a manual tracking option.

Capture receipts for expense management.

Drive reports.

Web-based platform with the Premium version.

Cons:

Only 40 expense uploads and trips per month with the free plan.

Bank and credit card integration not included in the free plan.

Receipt uploads don’t automatically pull information in the free version.

Leaves much to be desired in the receipt-scanning department compared to other options, like Shoeboxed.

Dated app.

Pricing:

Free mileage app.

Premium features for $4.99/month (billed annually).

6. QuickBooks Self-Employed – Best for all-in-one accounting

QuickBooks Self-Employed app, Apple App Store

QuickBooks Self-Employed is an all-in-one accounting software for full-time delivery drivers.

If you need a comprehensive solution for all of your business needs, this one’s for you.

What QuickBooks Self-Employed offers delivery drivers

QuickBooks Self-Employed has features to address your needs as an independent contractor, including:

Expense and receipt management.

Tax write-offs.

Payments and bank transfers.

Mileage tracking.

You’re here for mileage tracking apps, so how does QuickBooks’ tracker work?

QuickBooks’ mileage tracking app

QuickBooks offers an automatic mileage tracking app that starts tracking when you drive and ends when you’re idle.

This app also estimates the potential deductions you earned during your trips.

In QuickBooks’ own words, “QuickBooks Self-Employed users have found billions in potential tax deductions by using this automatic mileage tracker.”

Pros:

Automatic tracking.

Calculates potential tax deductions.

Capture receipts for expense management.

A complete solution for self-employed bookkeeping.

Cons:

Not recommended for a part-time gig.

May have more features than you need.

Pricing:

Self-Employed: $15/month.*

Self-Employed Tax Bundle: $25/month.*

Self-Employed Live Tax Bundle: $35/month.*

*Save 50% on your first 3 months when you sign up.

See also: 3 Quick Ways to View Your Apple Card Statement

Does Uber Eats track your miles?

While Uber Eats used to only track the miles you drove on trips, today the app is designed to track your online miles (or the miles you drive with the app open).

The mileage Uber tracks and where to find it

Online miles include all of the ground you cover to pick up deliveries and drop them off, or while waiting for your next delivery.

Uber prepares a tax summary annually for its drivers, which you can find under the Tax Information tab of your Uber Driver Dashboard.

Deducting mileage Uber doesn’t track

While it has certainly improved over the last few years, Uber Eats still may end up missing the miles you spend offline.

These offline miles could come in the form of a bad connection, canceled deliveries, or accidental app closures.

If you want to get the most out of your miles, you’ll need to record the miles you deliver for Uber using a separate mileage tracker.

The importance of using mileage tracker apps

Rideshare and Uber Eats delivery drivers are independent contractors in the eyes of the IRS, and with that comes special responsibilities regarding taxes and write-offs.

If you’re wondering if tracking the miles you spend on Uber deliveries is worth it, here’s why you should:

1. You’ll save money on your taxes

If you don’t track your miles, you’ll miss out on the mileage deduction, which means you’ll owe more money to the government.

By tracking the miles you drive for Uber, you can lower your tax bill by claiming deductions using the standard mileage rate.

2. Tracked miles and expenses cover your tail

The IRS requires delivery drivers to keep a record of their trips and business-related expenses to validate their tax deductions.

Having up-to-date, accurate records is the proof you need to protect yourself should the IRS call you into question.

What to do if you forgot to track your miles

If you didn’t track your Uber Eats miles, there’s still light at the end of the tax tunnel.

In order to claim the business mileage deduction, you’ll have to do a bit of detective work to find the miles you drove for Uber (and the evidence to support it).

Here are the steps we recommend you take:

Step 1. Find the days you drove for Uber Eats

Uber Eats records the days you made deliveries and the income you earned. Log the days you delivered and how much money you made.

Step 2. Calculate the miles you drove for the year

The next step is to find the starting and ending points of your drives. If you use Google Maps, it’s probably the first place you want to look.

When you find the starting and ending points, calculate the miles between those locations.

Step 3. Gather evidence for the IRS

Evidence includes:

Invoices for deliveries.

Logged routes from mileage trackers.

Bank statements.

Drive records and income from the Uber Eats app.

Step 4. Create a mileage log

The final step is to create a mileage log with the days you drove for Uber.

Be sure to include:

The dates you drove

Total miles

Purpose for driving

Locations

By following these steps, you can claim the mileage deduction and provide the necessary proof to the IRS for your write-offs.*

*For informational purposes only. Consult a tax professional for advice specific to your situation.

How do you deduct the miles you drive for Uber Eats?

You can use the standard mileage deduction or actual expenses to write off vehicle costs on your taxes.

The standard mileage deduction

The standard mileage deduction is used by most delivery drivers to write off their vehicle expenses for business.

To deduct the miles you drive for Uber Eats using the standard mileage deduction, simply multiply your business mileage for the tax year by the current IRS standard mileage rate.

The actual expenses deduction

You can also deduct your miles using actual expenses.

Actual expenses refer to the money you spend on your car over the previous year for business, such as:

Gas

Car insurance

Car maintenance

Delivery drivers can also deduct things like car washes, parking, and tolls. However, these expenses will replace your miles.

To deduct your mileage using actual expenses, multiply your total vehicle spend by the percentage of time you drove for Uber Eats.

Deductions and Tips for Uber taxes | ClearValue TaxWhat expenses can be deducted besides mileage?

Besides mileage, you may also be able to deduct the following expenses from your taxes:

Gas.

Vehicle maintenance and depreciation.

Parking and tolls.

Car insurance and registration.

Phone bill and phone accessories you use for work.

Uniforms or visibility vests.

Courier bags.

Any fees charged by Uber Eats.

If you use a bike for your Uber Eats deliveries, you can also write off any accessories you bought for delivery purposes.

Frequently asked questions

Can I track mileage on Uber Eats?

The Uber driver app tracks the miles you spend online, or the miles you drive with the app open. However, Uber Eats does not track the miles you spend offline. For that, you’ll want to use a separate mileage tracking app.

What is the best mileage app for Uber Eats?

Gridwise, Shoeboxed, and Stride are among the best mileage tracker apps for Uber Eats. By using a mileage tracking app over Google Sheets, drivers can keep a log of their deliveries, track their expenses, and prep for tax season.

Final thoughts

After reviewing the top trackers for business miles, our favorites fall down to Stride, Gridwise, and Shoeboxed.

Stride is the best free app for the delivery driver on a budget, Gridwise is our go-to for multiple side gigs, and Shoeboxed is our pick for expense management and tax purposes.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!