Tired of losing track of your weekly spending?

A budgeting process is an essential practice for anyone looking to manage their finances effectively. Google Sheets offers a variety of free and customizable budget spreadsheet templates to help you track your income and expenses every week.

Using a weekly budget template in Google Sheets allows you to take control of your business or personal finances, plan your spending, and achieve your financial goals more efficiently.

Discover how a completely free Google Sheets budget template can help you take control of your finances, one week at a time

What are the benefits of using Google Sheets for budgeting?

Google Sheets is a versatile and powerful tool for budgeting, offering numerous advantages for personal and business money management.

1. Wide range of free templates

Google Sheets provides a variety of free budgeting templates that can save you time and effort when creating a budget from scratch. Whether you need a simple budget template for weekly monitoring, a monthly budget template, or a comprehensive annual budget template, there’s a template available to suit your needs.

2. Customization

One of the main benefits of using Google Sheets for budgeting is its flexibility. You can easily customize any template to include additional categories, change the layout, or integrate it with other tools to suit your unique financial needs.

3. Collaboration

Google Sheets enables seamless collaboration, idealizing shared finances or business budgeting. Multiple users can access and edit the budget in real-time, making it easy to track shared expenses or financial goals with partners or team members.

4. Data visualization of financial data

A good budget template in Google Sheets includes charts and graphs visually representing your financial data. This makes it easier to understand your spending habits and identify areas where you can save money.

What are the key features of a good budget template?

A good budget template should have these features to help you manage your finances efficiently. A good template will also help you keep a business or personal budget to track your income and expenses.

1. Customizable

A good template should be easy to edit, add, or remove categories, formulas, and layout according to your needs.

2. Data visualization

Incorporating charts and graphs into your budget template can help you visualize your income and expenses more clearly, making it easier to spot trends and make informed decisions.

3. Sharing and collaboration

Sharing and commenting on the same document is a must for joint budgeting. A Google Sheets budget template should have real-time collaboration and space for notes.

4. Integration with other tools

Integrating your budget template with other tools like financial apps or accounting software will help you streamline your financial tracking, reporting, business goals, and financial forecasts.

See also: Travel Baseball Team Budget Spreadsheet for 2024 Planning

Free weekly budget Google Sheets templates

Here are the top free budget templates in Google Sheets to help you manage your money on a weekly basis:

1. Detailed Weekly Budget Template by Clockify

The Weekly Budget Template by Clockify is a full-on tool to track your income and expenses weekly. It has a structured format for fixed costs, variable expenses and savings so you can see your financial habits clearly.

It’s perfect for individuals and businesses to get a full picture of their weekly cash flow, make informed decisions, and stay on top of their budget goals.

2. Weekly Budget and Template Tracker by Weekly Budgeting

The Weekly Budget and Tracker by Weekly Budgeting is a simple tool to plan, monitor, and control your weekly spend. It has a straightforward layout to track income and expenses across different categories like groceries, transport, and entertainment.

With clear visuals and built in formulas, this template makes it easy to see where your money is going each week so you can stay within budget and achieve your financial goals.

This template is perfect for anyone who wants to stay disciplined and get a better picture of their weekly cash flow.

3. Weekly Budget Worksheet Template Google Spreadsheet by Smartsheet

Weekly Budget Worksheet Template Google Spreadsheet by Smartsheet is a simple tool to help you manage your finances weekly. It has a format to track income, expenses, and savings with built in formulas to calculate totals and balances.

It has customizable categories and data visualization to see your financial situation at a glance.

This template is for individuals and businesses to get control of their weekly budget and make smart financial decisions.

4. Bi-Weekly Budget Worksheet Template Google Spreadsheet by Smartsheet

Bi-Weekly Budget Worksheet Template Google Spreadsheet by Smartsheet is a flexible tool to plan and track your finances bi-weekly. For those who get bi-weekly paychecks, this template helps you manage income, expenses, and savings.

It has customizable categories and automatic calculations to see your financial situation, so you can stay on top of your budget and reach your financial goals.

This template is for individuals and families to get control of their spending between pay periods.

When to use annual budget templates

Annual budget templates are great for planning and managing your finances long-term. They give you a snapshot of your income, expenses, and savings goals over a longer period of time.

An Annual Business Budget Template is a must for businesses. It allows you to track your revenue streams, operating costs, and projected profits so you can allocate your resources wisely and make informed decisions.

For individuals or families, a simple annual budget template is perfect for capturing daily expenses and income in an easy-to-read format. This way, you can plan for big purchases, savings goals, or unexpected expenses throughout the year.

Both templates simplify the budgeting process, offering clarity and organization for business financial planning or personal money management.

Budgeting for specific situations

Budgeting is a part of managing your finances; different individuals or organizations have different financial needs.

This section will examine Google Sheets templates for specific needs such as household, student, wedding, and retirement savings.

1. Household Budget Spreadsheet by Smartsheet

A household budget template is a valuable tool for managing family finances. It helps track income and expenses to ensure essential expenses like rent/mortgage, utilities, and groceries are covered.

A household monthly budget template will have categories for:

Income: Salaries, investments, and other sources of income

Fixed expenses: Rent/mortgage, utilities, insurance, minimum payments on debts

Variable expenses: Groceries, entertainment, hobbies

Savings: Emergency fund, retirement, and other long-term savings goals

Using a household budget template, families can:

Cut costs

Determine between wants vs needs

Save for emergencies and long-term goals

Be smart with your money

2. Student Budget Spreadsheet by Smartsheet

A student budget simple spreadsheet template will help students effectively manage their money.

It will have sections for:

Income: Scholarships, part-time jobs, parental support

Fixed expenses: Tuition, room, board

Variable expenses: Textbooks, transportation, entertainment

Savings: Emergency fund and long-term savings goals

Using a student budget, students can:

Track expenses and stay on budget

Prioritize needs over wants

Build an emergency fund and save for long-term goals

Make informed decisions and be financially stable

3. Wedding Planner Spreadsheet

A wedding budget planner is a template to help couples plan and manage their wedding expenses.

It will have sections for:

Venue and catering

Photography and videography

Music and entertainment

Attire and accessories

Transportation and accommodations

Using a wedding budget planner, couples can:

Set a realistic budget and prioritize expenses

Track expenses and stay on budget

Make informed decisions and have their dream wedding

4. Retirement Savings Calculator Template by Smartsheet

A retirement savings template will help you save money in the long term.

It will have the following categories:

Income: Current income and expected retirement income

Expenses: Living expenses, healthcare, and other retirement costs

Savings: Current retirement savings and growth

Goals: Retirement age, desired lifestyle, and income replacement ratio

Using a retirement calculator, you can:

See how ready you are for retirement and find the gaps

Create your own retirement plan and savings strategy

Track and adjust

Get to your retirement goals and be financially free

What is a more efficient alternative to weekly budget templates?

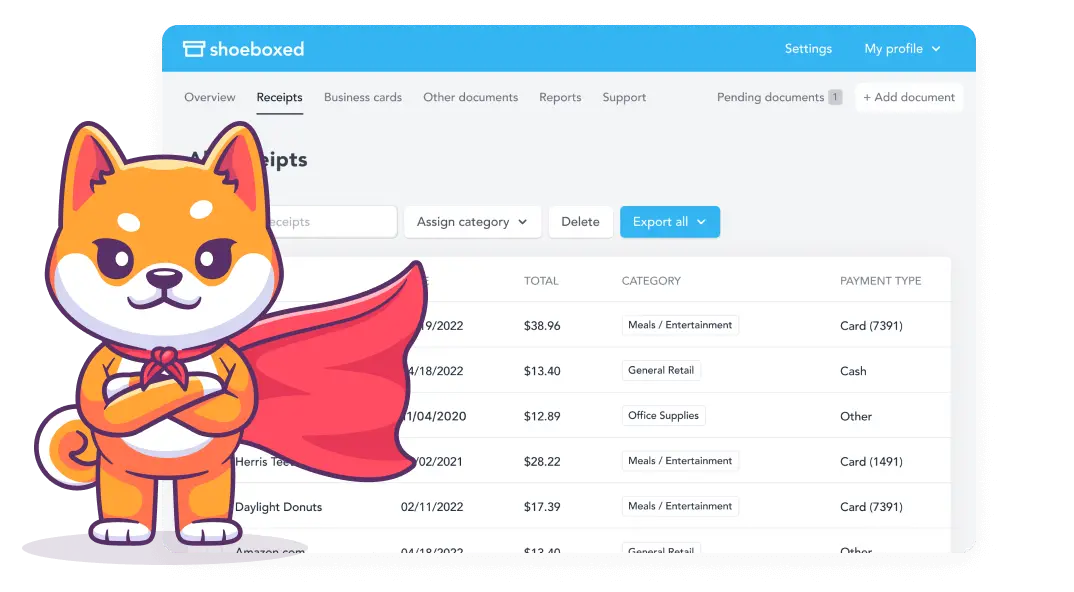

Shoeboxed is the digital alternative to expense tracking if you want a more efficient solution than spreadsheets.

Shoeboxed—ideal for businesses looking for a more efficient alternative to weekly budget templates

Shoeboxed lets you scan and digitize receipts, categorize expenses, and generate reports. It integrates with popular accounting software, so you don’t have to enter anything manually.

I have found for those looking for a more efficient and effective way to manage expenses, Shoeboxed is the best alternative to weekly budget templates.

Here’s why:

Digital receipt management

Shoeboxed transforms the way you manage receipts and expenses. It turns receipts into digital data.

Shoeboxed’s digital receipt management is way more dynamic and efficient than weekly budget templates. While weekly budget templates in tools like Google Sheets give you a framework to track income and expenses, you still have to manually enter financial data, which can be time-consuming and error-prone.

Shoeboxed automates the process of capturing and organizing expenses by digitizing receipts and pulling out the important details like date, amount, and category from the receipt itself.

Accessibility and ease with mobile app

Shoeboxed eliminates the need for manual data entry by allowing you to upload or photograph receipts with your smartphone's camera. The receipts are automatically categorized and stored in the cloud, saving time and ensuring accuracy in tracking expenses.

Shoeboxed has a mobile app that will scan receipts, extract data, and categorize expenses for you.

With Shoeboxed's receipt scanner app, simply snap a picture and the app will upload it to your Shoeboxed account,

Magic Envelope service

Shoeboxed’s Magic Envelope service makes it even easier to enter receipts into accounts.

Just stuff your receipts into Shoeboxed’s postage-paid envelopes and outsource receipt scanning to the pros.

The Shoeboxed team will scan, human-verify, and upload receipts to your account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

With digital receipts, you can access your expense data from anywhere, anytime. Shoeboxed uses secure cloud storage to ensure your financial data is safe and always accessible.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAutomatic categorization

With OCR technology, Shoeboxed then automatically organizes receipts based on 15 tax or custom categories.

Expense reports

With Shoeboxed, you can automatically generate detailed expense reports to get a summary or overview of your personal or business expenses and get an even better perspective of your personal or business budget.

Integration

Shoeboxed also integrates with accounting software and budgeting tools so you can export data into your budgeting systems without having to manually update a business budget template.

Integrate Shoeboxed with accounting software like QuickBooks, Xero, and many others so you can automatically sync your expense data for accounting and tax purposes. That way, your data is consistent and up-to-date across all platforms.

IRS compliance

Shoeboxed ensures all digital copies of receipts are legible and categorized according to IRS guidelines for tax preparation and audit protection.

An Overview of Shoeboxed

With real-time tracking and automated reporting, Shoeboxed is a more comprehensive and streamlined way to manage expenses for individuals and businesses looking to simplify their financial management and budgeting.

Shoeboxed offers a powerful and efficient alternative. It automates the expense tracking process and provides added benefits such as secure storage, easy integration, and compliance with tax regulations.

For professionals and businesses looking for a streamlined approach to finance management, Shoeboxed is undoubtedly the best choice.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

How do I edit a weekly budget template in Google Sheets?

Edit a weekly budget template in Google Sheets by opening the template and clicking on the cells you want to change. Add or remove categories and change labels and formulas. Use the “Format” menu to change the look of your budget and add charts for visualization.

How can I use Shoeboxed to make budgeting easier?

Shoeboxed makes budgeting easier by automatically capturing and categorizing your expenses. Upload your receipts to Shoeboxed, and the platform will extract the details and place them in tax or custom expense categories for you. This is much easier and more efficient than a simple budget template.

In conclusion

A weekly Google Sheets budget template is one way to manage your finances and stay on top of your spending. Whether you’re a student, a business owner, or want to get a grip on your money, these templates will help you reach your financial goals.

However, with digital management and automated categorization and reporting, Shoeboxed is a more comprehensive and streamlined way to manage expenses for individuals and businesses looking to simplify their financial management and budgeting.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!