Is your spending out of control? A weekly expense tracker is one of the best ways to regain control of your money and track spending habits. This post covers the benefits of a weekly expense tracker, practical tips for better financial management, plus 3 free weekly expense tracker templates you can download.

Why should you analyze your weekly expenses?

Analyzing expenses is critical to managing finances. Expenses are the costs incurred by an individual or business to generate income or maintain daily operations. They can be categorized into different types, such as housing, utilities, groceries, transportation, and travel.

Accurate tracking and recording of expenses is important for tax purposes, financial planning, and making informed spending decisions. By analyzing your expenses, you can identify where you can cut back, allocate your resources better, and achieve your financial goals.

Why weekly expense tracking?

Tracking expenses weekly is important because it lets you stay on top of your spending:

Financial awareness

Tracking your financial activities every week gives you instant feedback on your financial activities, so you can see where your money is going. This weekly review helps you catch expenses before they become big financial problems.

Proactive budgeting

A weekly expense tracker lets you adjust your spending habits. Creating your own categories for expenses helps with tracking and customization so you can better manage your monthly budget. Reviewing your expenses weekly lets you see when you will go over your monthly budget and adjust to avoid overspending.

Financial goals

Tracking expenses regularly helps you better achieve your financial goals. Whether saving for a big ticket item, paying off debt, or managing business cash flow, tracking expenses consistently gives you the map and feedback for successful budgeting. Achieving these goals brings a sense of accomplishment and motivates you to continue tracking your spending for better financial decisions and smarter spending.

What are the benefits of a weekly expense tracker?

Using a weekly expense tracker has many benefits for individuals and businesses.

Here are some of the main advantages.

Better financial management

A weekly expense tracker helps you track your expenses, manage your finances, and make wise spending decisions.

More savings

By tracking your expenses, you can see where you can cut back and allocate your resources better, thereby saving more.

Less stress

Tracking your expenses can be overwhelming, but a weekly expense tracker makes it easier and reduces stress and anxiety.

Better budgeting

A weekly expense tracker helps you create a realistic budget and stick to it, keeping you on track with your financial goals.

How do you track weekly expenses?

I have found that tracking your weekly expenses is key to being in control of your finances and can be done in 8 easy steps:

1. Choose your tool

Decide how you want to track your expenses. You can use a simple spreadsheet or an efficient expense management app like Shoeboxed. Digital tools have extra benefits like automatic categorization and reminders.

2. Set up your tracker

If you’re using a digital tool, most will have templates you can customize. Set up categories that match your spending habits, like groceries, transportation, dining out, and entertainment. For spreadsheets, create columns for dates, categories, descriptions, and amounts spent.

3. Record expenses in real-time

Make it a habit to record an expense as soon as it happens. This will prevent the buildup of receipts and the hassle of trying to remember expenses at the end of the week. Mobile apps are perfect for this; you can use them on the go.

4. Review and categorize

At the end of each day or week, review your expenses and make sure each is categorized correctly. This will help you see where your money is going and where you can cut back. This will help you track your goals, adjust your budget, and see patterns in your spending that need attention.

5. Use visuals

Use a digital tool and features like charts and graphs to see your spending trends visually.

6. Adjust as needed

Use your weekly reviews to adjust your spending and budget for the next week.

7. Include savings and goals

Add savings as a category in your expense tracker and treat it as a fixed amount or one to add to.

8. Integrate receipt management

For a more accurate tracking system, integrate a tool like Shoeboxed, which can digitize and categorize your receipts. This is especially useful for business expenses and tax documentation, so all paper trails are accounted for and easily accessible.

Tracking expenses helps you be mindful of how you spend money, be more aware of the results of your financial actions, and stop unnecessary spending, leading to a sense of relief and reduced stress.

How do you calculate your weekly expenses?

Here's how you do it:

1. Gather data

Collect your spending data for the week. This could include receipts, bank statements, or digital payment records.

2. Categorize your expenses

Divide expenses into categories, such as groceries, transportation, dining out, entertainment, utilities, and other recurring bills. This will help you recognize where your money is going.

3. Expense tracking

Log your expenses in a spreadsheet or financial app. Ensure all business expenses have the amount paid, the date of payment, and the category.

4. Sum the expense total

Total the expenses in each category at the end of the week and then calculate the total spent for the week. You can do this manually or use formulas if you're using a spreadsheet. For example, the SUM function in Excel will calculate your total expenses for the week.

5. Reflection and changing budget

Use your calculations to change the budget for the next week if needed. Note areas you may be overspending in and make the necessary changes so that your finances stay on course with what was planned.

With these steps, you will better understand the outflow, manage your budget more efficiently on a monthly basis, and make well-informed decisions that align with your financial goals.

How to create and edit your monthly budget

Create a realistic monthly budget by:

Forecasting future monthly expenses based on past data.

Prioritizing the essentials over the non-essentials.

Editing the budget as your financial situation changes.

How can you customize your weekly expense tracker?

Customizing your weekly expense tracker is key to making it work for your unique situation.

Here’s how:

Create custom categories: Add categories specific to your expenses, like pet expenses or home maintenance.

Set reminders: Set reminders so you don’t forget to track your expenses and budget.

Use tags: Use tags to categorize your expenses further so you can track specific expenses.

Integrate with other tools: You can integrate your tracker with financial tools, like your bank account or budgeting software.

Make it visual: Use charts and graphs to make your expenses visual so you can see trends and patterns.

How do you track expenses automatically?

Tracking expenses automatically is a great way to manage your finances without manually logging each transaction.

Using Shoeboxed can make this tedious task simpler and save time.

Here’s how you can use Shoeboxed to track expenses automatically:

1. Getting started with Shoeboxed:

First, sign up for Shoeboxed and download their app. Shoeboxed has various plans depending on the receipts and documents you need to process, so choose one that suits your business or personal needs.

2. Automate receipt capture

Mobile app

Use the Shoeboxed app to take photos of your receipts on the go. Shoeboxed’s technology will extract the key information from the photographed receipts, such as vendor, total amount, date, and payment type. This data will then be stored digitally and categorized in your Shoeboxed account.

Magic Envelope service

You can also use Shoeboxed’s Magic Envelope service to mail your receipts to them. Send your receipts, business cards, or documents to Shoeboxed in their prepaid envelope, and they will scan, digitize, human-verify, upload, and store them in your Shoeboxed account.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Email receipt handling

For online purchases or digital receipts, Shoeboxed allows you to forward email receipts to a unique Shoeboxed email address assigned to your account. Shoeboxed's Gmail plugin will automatically send receipts from your inbox directly to your Shoeboxed account, so your electronic purchases are tracked automatically.

3. Categorization and organization

Once your receipts are uploaded to Shoeboxed, they are automatically categorized by expense type into 15 tax or custom categories. You can customize these categories to match your budgeting framework or accounting requirements so you can track specific types of spending.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started Today4. Accounting software integration

Shoeboxed integrates with popular accounting software like QuickBooks, Xero, and Wave. This integration automatically sends expense data into your accounting records, allowing you to do real-time financial reporting and tax preparation.

5. Access and review

Access your Shoeboxed dashboard from any device to review and manage your stored data. You can search, sort, and filter your expenses to find specific transactions or analyze spending over time.

6. Report and export

Generate reports from Shoeboxed to see your spending habits. These reports can be used for monthly budget reviews, tax returns, or expense reports for reimbursement.

Shoeboxed also allows you to export data in various formats if you need to use it in other applications or send it to your accountant.

7. Store securely

With Shoeboxed, all your receipts and expense data are stored in the cloud. This means they’re safe from physical damage and accessible from anywhere, so you have a backup of your critical financial documents.

Tips to get the most out of Shoeboxed:

Update your categories: As your spending or business changes, update your categories in Shoeboxed, so your tracking and reporting stay accurate.

Review your account: Even with automation, checking your Shoeboxed account regularly ensures everything is correct.

Use all features: Get to know all the features Shoeboxed has, like mileage tracking and business card scanning, to get the most out of automation in your financial journey.

By automating your expense tracking with Shoeboxed, you’ll save time, ensure more accuracy, and appreciate the efficiency in your financial management, which will allow you to make more sound business decisions. This process means better financial decisions, simpler tax preparation, and peace of mind knowing your financial data is secure and organized.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayBonus: Free weekly expense trackers

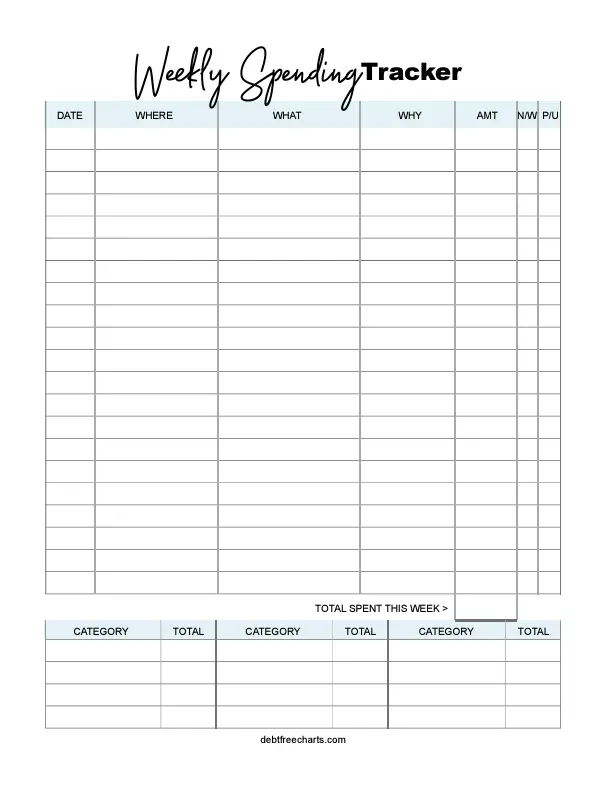

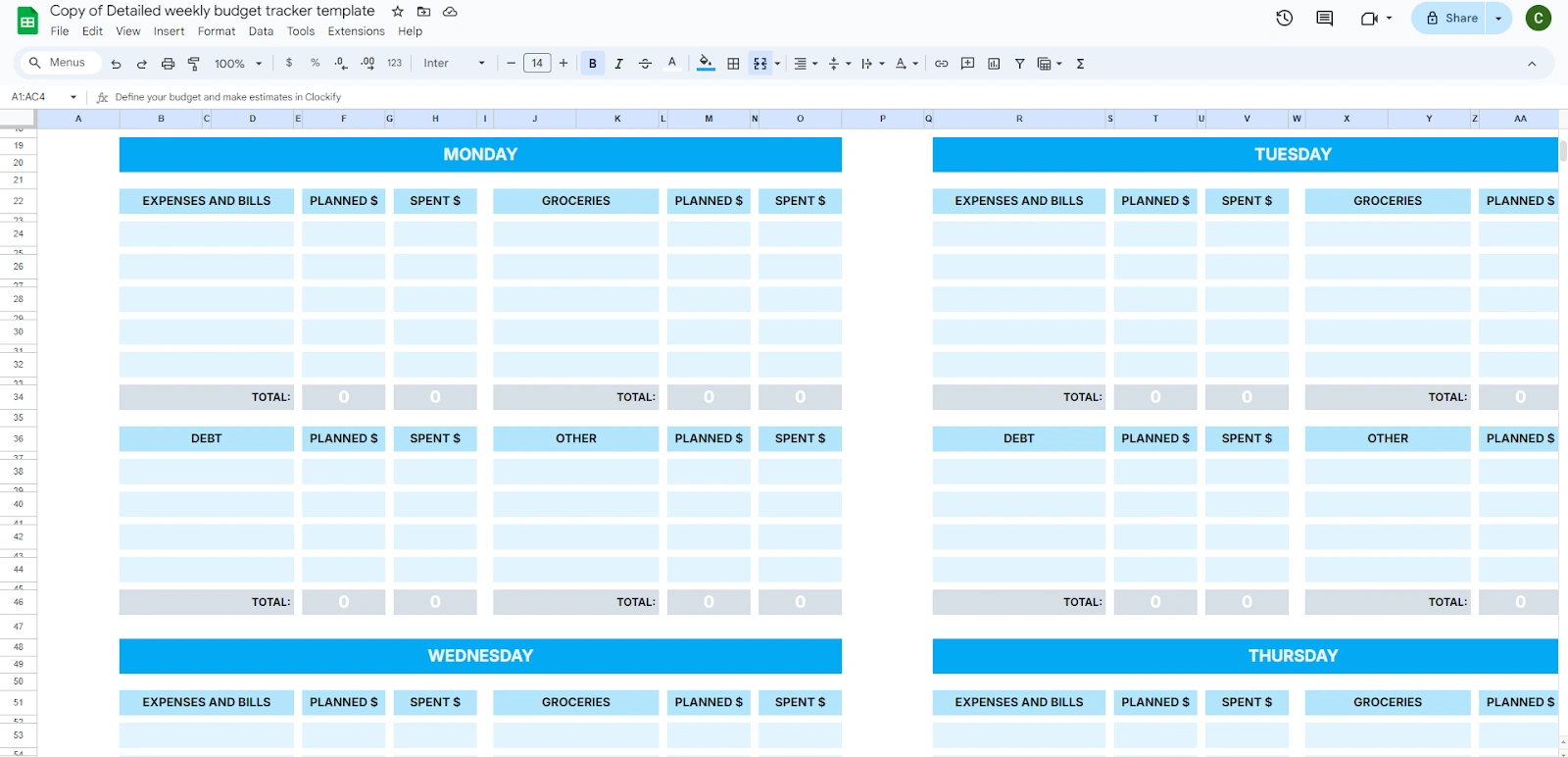

As a bonus, here are some free weekly expense trackers that you can download:

1. Weekly Spending Tracker by Debt Free Charts

2. Detailed Weekly Budget Template (Google Sheets) by Clockify

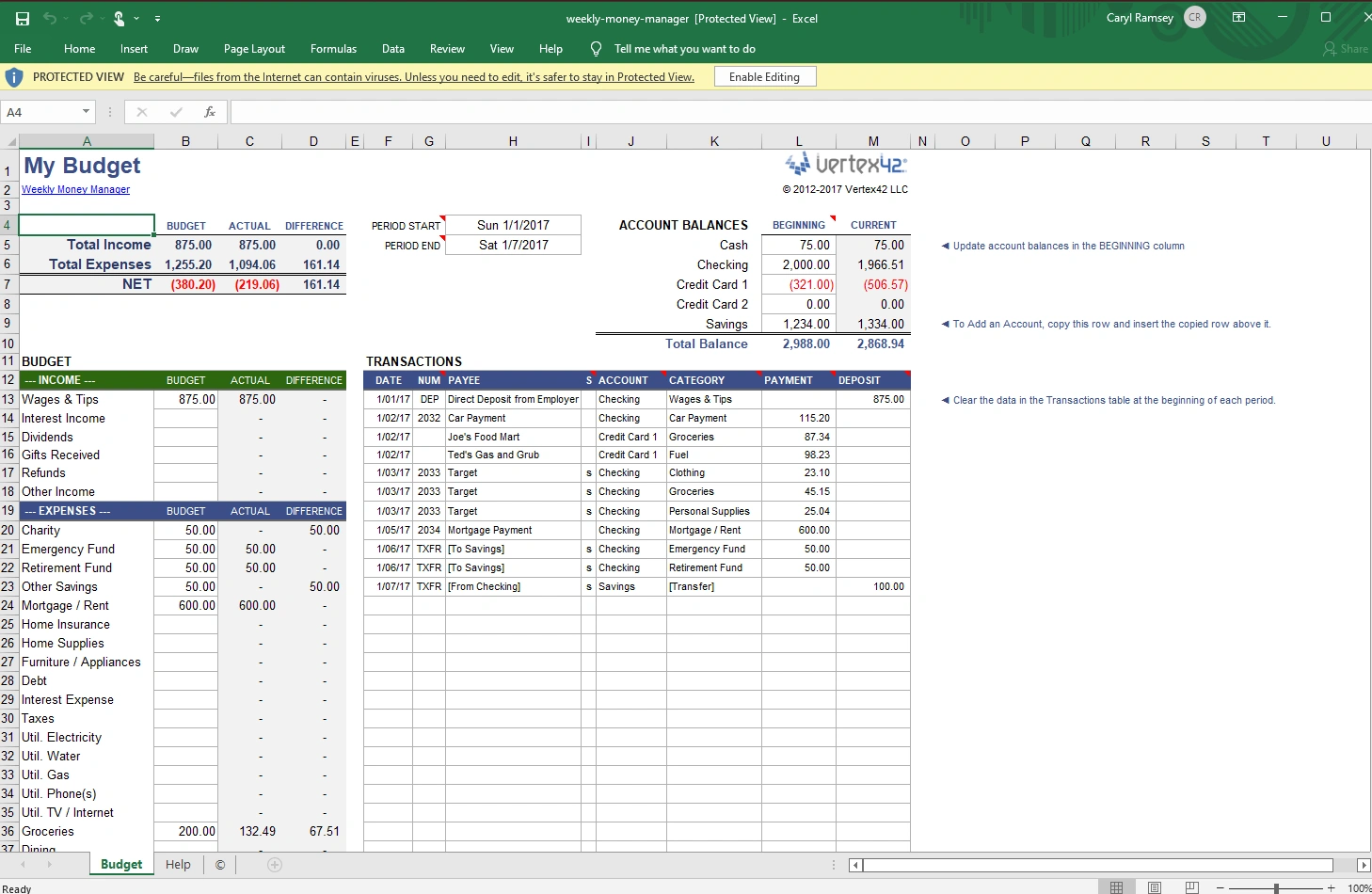

3. Weekly Money Manager by Vertex42

Frequently asked questions

1. How will Shoeboxed work with my weekly expense tracker to help with financial management?

Shoeboxed will help with financial management by automatically digitizing and categorizing your receipts and invoices. This reduces manual entry errors, saves time, and ensures all financial data is captured and easily accessible for review or audit.

2. How do I use a weekly expense tracker for personal use?

A weekly expense tracker can be used for personal use. Update the tracker with all expenses and income every week. Review the tracker weekly to edit your budget as needed. Use the data to reduce unnecessary spending and reallocate it to saving or investing.

In conclusion

A weekly expense tracker is a must for anyone who wants to take control of their money. Using this tool and Shoeboxed will make you a financial tracking ninja.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!