Tracking your spending every week doesn't have to be a chore. Tracking your weekly spending is one of the most effective ways to manage your finances and ensure you’re making informed decisions about your money.

A weekly spending tracker can provide insights into your spending habits, help you identify areas where you can cut back, and keep you accountable for your financial goals.

Whether you aim to stay within a budget, avoid overspending, or understand where your money goes, the right tracker can make all the difference. With the right tools, you can take control of your budget and watch your savings grow faster than you ever imagined!

What is a weekly spending tracker?

A weekly spending tracker is a tool or app that helps you track your spending. You record and categorize your spending, and it shows you where your money is going every week.

Using a spending tracker is critical to managing your finances. By tracking your expenses regularly, you can stay within your budget, see where you can cut back, and make informed decisions. Weekly spending trackers promote financial awareness, help with goal setting, and prevent overspending.

What are the benefits of weekly tracking?

Tracking your spending weekly has many benefits.

Here are a few reasons why it’s a good habit to get into for financial management:

1. Maintain control of your finances

By tracking your expenses regularly, you can catch spending habits early and make changes before problems arise.

2. See where your money is going

A weekly tracker shows you where your money is going so you can see where you can cut back or reallocate for more important financial goals.

3. Set and track goals

Tracking your weekly spending makes setting realistic goals easier. Whether saving for a holiday, paying off debt, or building an emergency fund, weekly tracking keeps you accountable.

4. Avoid overspending

Keeping an eye on your spending habits helps you stick to your budget and avoid impulse buys.

5. Proactive budgeting

Proactive budgeting is creating a budget plan that accounts for all your income and expenses and making necessary changes to stay on track. By being proactive with your budget, you can avoid overspending, save money, and achieve your financial goals.

What are some tips for proactive budgeting?

Here are some tips for being proactive when budgeting:

1. Track expenses

Tracking your expenses is key to creating a budget. Use a budgeting app or spreadsheet to record all your income and expenses. This will help you see your spending habits and where to cut back.

2. Set goals

What do you want to achieve with your budget, whether saving for a big purchase, paying off debt, or building an emergency fund? Clear goals give you direction and motivation.

3. Establish a realistic budget

Based on your income and expenses, make a budget that directs your money toward your financial goals. Ensure your budget is realistic and flexible enough to account for unexpected expenses.

4. Review and update regularly

Review your budget regularly to see if you’re on track to meet your financial goals. Make changes as needed to stay on course. This will help you be proactive and responsive to changes in your financial situation.

What are some free weekly spending tracker templates?

Here are some popular weekly spending tracker template options to help you control your spending:

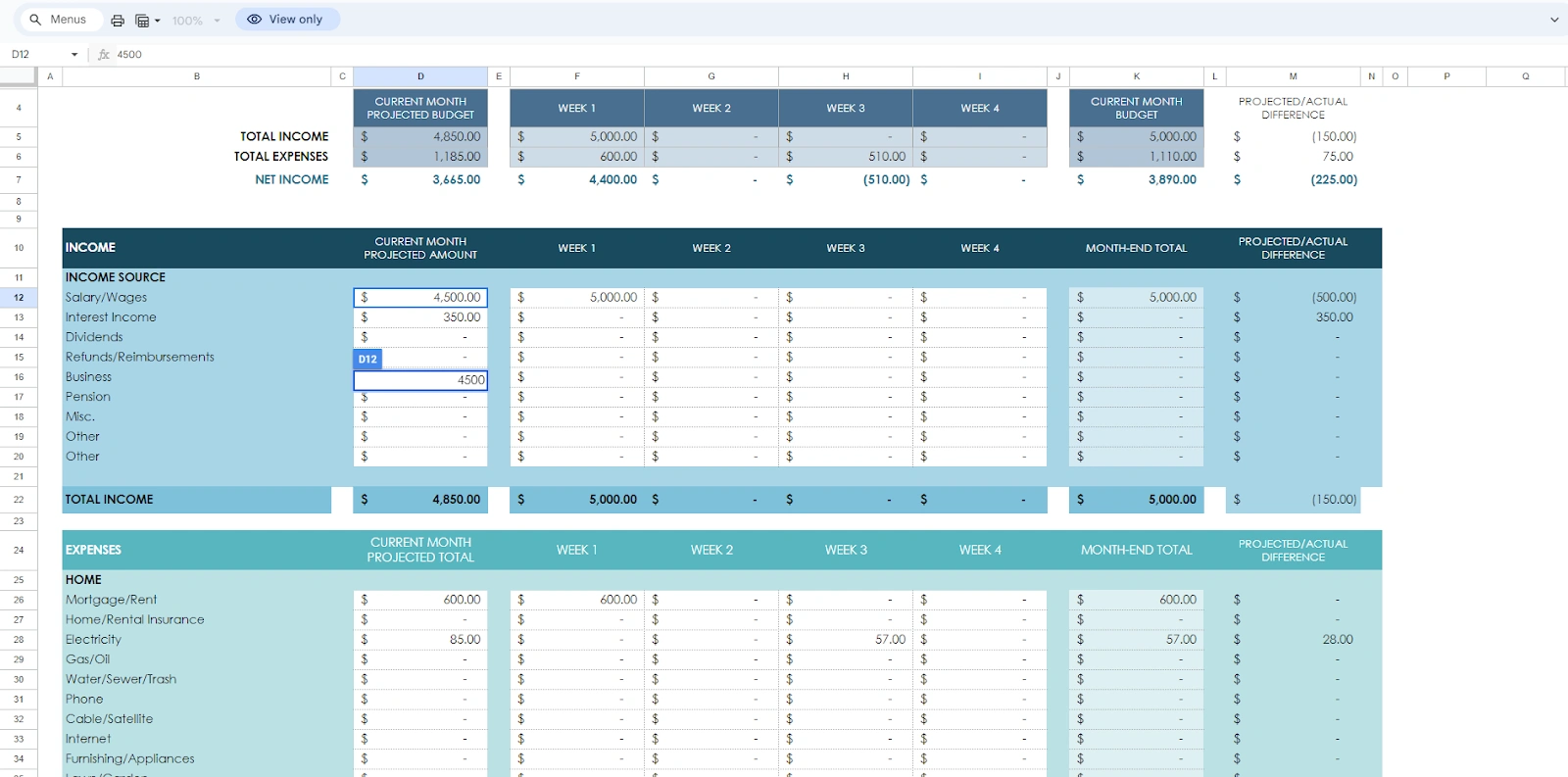

1. Google Sheets Weekly Budget Template

This customizable template allows you to track income, expenses, and savings. It includes pre-built categories for housing, groceries, transportation, and more. It is easy to update and accessible across devices.

Pros: Free, customizable, easy to share and collaborate.

Cons: Requires manual input of expenses.

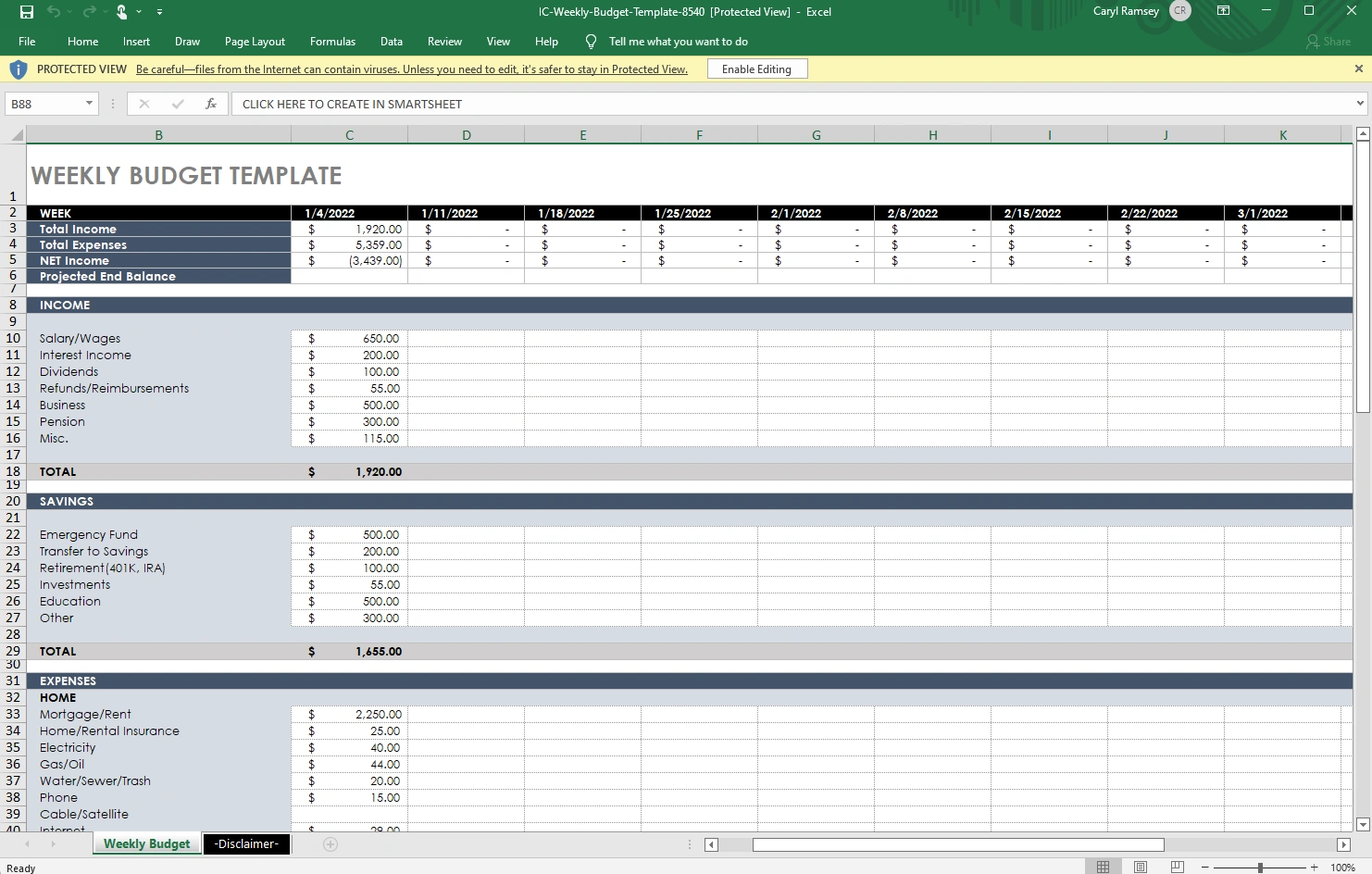

2. Excel Weekly Spending Tracker Template by Smartsheet

Microsoft Excel offers numerous templates for tracking weekly spending. These templates typically include sections for income, fixed expenses, variable expenses, and savings. You can also create custom graphs to visualize your spending trends.

Pros: Includes advanced data analysis features and customizable charts.

Cons: Requires manual input; Excel may not be easily accessible to everyone.

3. Printable Weekly Budget Planner by On Planners

A simple, printable PDF or physical tracker where you can manually enter your weekly expenses. It usually includes spaces to record spending categories, dates, and totals.

Pros: Useful for those who prefer paper tracking, easy to use offline.

Cons: No automated features or integration with financial apps.

These templates provide various ways to track your weekly spending. Choose one based on your specific needs and preferences.

What’s the best way to track weekly spending?

The best way to track weekly spending is using digital tools that automate expense tracking.

Shoeboxed

Shoeboxed is a great option for tracking weekly spending because it automates your financial data process and makes it super easy for individuals and businesses.

Here’s why Shoeboxed stands out:

1. Automates receipt scanning and data entry

You can scan receipts with your smartphone's camera, and the app will upload them to your designated Shoeboxed account. This eliminates manual data entry, which is time-consuming and error-prone.

2. Outsources receipt management

You can also outsource the scanning by sending your receipts to Shoeboxed's processing center using their prepaid Magic Envelope. There, they will be scanned, human-verified, and uploaded to your Shoeboxed account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days!✨

Get Started Today3. Automates expense categorization

Shoeboxed's OCR data extracts the amount, date, and vendor. It then categorizes your expenses into 15 tax or custom categories so you can see where your money is going. Whether it’s groceries, dining out, or transportation, you’ll have a clear breakdown of where your money is going every week.

4. Integrates with accounting software

Shoeboxed integrates with accounting software like QuickBooks and Xero to transfer your expenses seamlessly between platforms.

5. Customizable expense reports

You can generate detailed expense reports with Shoeboxed to track your weekly spending and see where you’re spending. These reports can be customized to fit your personal budgeting or business expense management needs.

6. Tax-ready and compliant

Shoeboxed scans receipts into IRS-accepted digital copies so tax time is easier. It ensures your expenses are documented and ready for tax deductions or audits. Perfect for freelancers or small business owners.

7. Data is easily accessible anywhere, anytime

With Shoeboxed's mobile app and cloud storage, you can access your weekly spending data anytime.

8. Paperless and organized system

Shoeboxed digitally stores all your receipts and financial documents, giving you an organized, clutter-free system. You can easily access your records for reference, tax time, or audits.

Shoeboxed is the best way to track weekly spending because it automates the whole process, is accurate, and gives you a clear view of your financial habits.

Whether for personal or business expenses, Shoeboxed makes tracking expenses easy so you can focus on improving your financial health.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayHow to use a weekly spending tracker app for business expenses

Freelancers, contractors, and small business owners must track business expenses for tax purposes.

Here’s how a weekly spending tracker app can help:

1. Turns receipts into digital data

Apps like Shoeboxed turn your receipts into digital data, making tracking expenses easier.

2. Automatically categorizes business expenses

A weekly spending tracker app like Shoeboxed automatically categorizes business expenses, giving you a clear picture of your weekly spending.

3. Generates detailed expense reports

Last but not least, Shoeboxed lets you generate detailed expense reports for reimbursements, to share with your accountant, or for tax purposes.

Tracking weekly means staying organized and reducing the workload at tax time when pulling together expense totals for deductions.

What are some weekly spending tips to help you stay on track?

I have found that these personal and business weekly spending tips will hold you accountable to your budget:

1. Set a weekly allowance

Break your monthly budget into weekly limits. That way, it's easier to control and adjust if you go over one week.

2. Track everything

Log every purchase, no matter how small. Use apps or tools like Google Sheets, Shoeboxed, or a weekly spending tracker to capture all transactions so you can see where your money is going.

3. Use cash for discretionary spending

Set aside cash for things like dining out or entertainment. This gives you a physical limit on what you can spend each week to stay disciplined.

4. Automate essential bills

Automate payments for recurring expenses like rent, utilities, and savings. This way, your key obligations can be handled without disrupting your budgeting flow.

5. Review your spending weekly

At the end of each week, sit down and review your spending. Compare it to your budget to see where you need to cut back or where you’re crushing it.

6. Adjust as needed

If you see a pattern of overspending in certain categories, adjust your budget or cut back in other areas. Regularly reviewing your financial habits is key to staying on track.

7. No impulse buys

Don’t buy things on a whim. Create a 24-hour rule: Wait 24 hours before making any purchases.

8. Meal planning

Plan your weekly meals and grocery list to avoid overspending on food or dining out. This will keep food costs in check and reduce waste.

9. Unsubscribe from unnecessary

Review your personal and business subscriptions (streaming services, gym memberships, etc.) annually and cancel the ones you’re not using.

10. Reward yourself

If you stick to your budget, treat yourself to a small reward, like your favorite meal or activity, to reinforce your positive spending trends.

Frequently asked questions

How often should I review my weekly tracker?

Review at least once a week. Set aside time at the end of the week to review your expenses, identify spending trends and patterns, and adjust if needed. This way, you stay on top of your budget.

Can I use Shoeboxed for personal and business expenses?

Yes! Shoeboxed lets you categorize expenses as personal use and business. You can track both types of expenses separately, which is super useful for freelancers or entrepreneurs with multiple income streams.

In conclusion

Tracking your weekly spending is key to controlling your money and padding your bank account. Use the right weekly spending tracker app, like Shoeboxed, to simplify the process, automate expense tracking, and get real-time insights into your spending habits.

With customizable categories, auto expense tracking, and easy-to-read reports, you can make better financial decisions to help you achieve your short—and long-term goals.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go, auto-import receipts from Gmail, or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!