As a business owner, you must deal with numerous receipts daily. This article will look in detail at a very common type of receipt—the purchase receipt.

Once you know the features of a purchase receipt, you’ll be able to distinguish them from other types of receipts, ensuring a smooth and orderly system of storing your receipts. On top of that, you will also find useful tips on creating a purchase receipt if you are a supplier.

What is a purchase receipt?

When you receive materials, goods, and services from a supplier, they will issue you a purchase receipt. This is normally done against a purchase order. However, some suppliers still give you purchase receipts without one. Purchase receipts can be printed directly from a cash register or handwritten.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat is the purpose of a purchase receipt?

A purchase receipt mainly serves as proof of ownership. This receipt is issued when you accept and pay for goods and services from your suppliers or customers when they buy your products.

Generally, this document includes details of a specific service or product purchase. It also clarifies the contract between you and your suppliers—what, how many, and how much you ordered.

Purchase receipts are also kept and recorded for accounting purposes, allowing you to go back to examine and double-check if the details of the transactions tally.

What information is on a purchase receipt?

Though it varies between businesses, a purchase receipt normally includes the following information:

Date and time the transaction occurred.

Customer information: company name, possibly a contact person, address, phone number, and email address.

Purchase description: date, purchase order number, quantity, and a brief description of each purchased item with prices.

Payment information: payment method.

Additional charges: shipping fee, delivery cost, and taxes.

Return policy. Detailed explanation on how the customer may return, exchange, and/or receive a refund for a purchase.

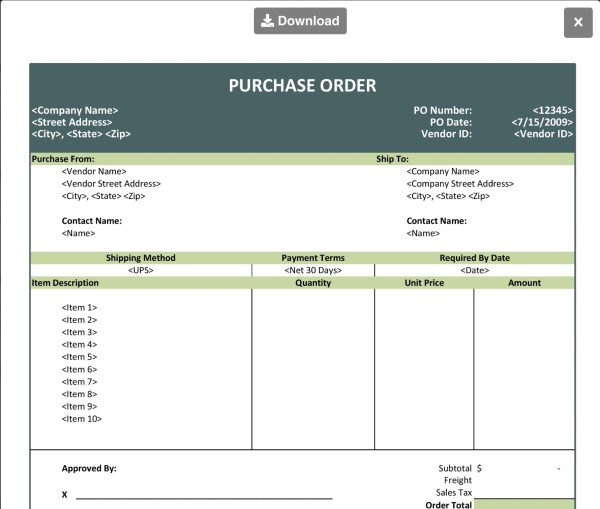

What does a purchase receipt look like?

Below is a basic template of a purchase receipt.

Image. Purchase receipt from Templatelab.

A purchase receipt is fairly straightforward, so you can easily customize a template for your business using Microsoft Excel. Many websites on the Internet also have free downloadable templates for purchase receipts. If you need a free Purchase Receipt template, check out these links below:

Another way to issue purchase receipts is to use paper receipt books. They are widely available online and easily found on Amazon.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayHow do you write a purchase receipt?

There are two main ways to create a purchase receipt: manually (by hand) and digitally.

How to write a purchase receipt by hand

Make sure you have a printed template ready or a receipt book that looks professional. It’s fairly easy to create a purchase receipt as you only need to fill in the blanks with relevant details. Keep your handwriting neat and tidy to avoid any unnecessary misunderstandings. Also, don’t forget to double-check your calculations!

How to write a purchase receipt digitally

If you already have a good template prepared, type in the transaction information whenever you get a new customer order and have the receipt printed out. A great tip is to save your regular customer’s basic information in the template, like their company’s name, address, and contact information. Then, you won’t have to spend time typing that information again the next time they buy from you.

Alternatively, you can download and use specialized accounting software like Quickbooks, Xero, etc., to create purchase receipts. It may not be easy to get the hang of it at first, but once you get used to it, you will enjoy the convenience and effectiveness it brings.

What is the difference between an invoice and a receipt?

A receipt indicates payment of the items and that the sale is complete, while an invoice serves as a payment request. They both include details of the products ordered, prices, taxing information, contact details, and credits.

Frequently asked questions

How do I provide a purchase receipt from your supplier to fulfill Paypal’s request?

Provide Paypal with as much information as possible when they require you to. For example, the documents that Paypal usually requests include:

1. Your ID photo

2. Purchase receipt from your supplier or proof of purchase fulfillment.

However, if you don’t have a purchase receipt from your supplier, you can provide a document that says you don’t have any suppliers or receipts. Save your receipts as a PDF file and attach them to the place you are supposed to upload them. This will help you fulfill Paypal’s requirements and receive a case tracking number. Paypal usually gets back to you within three working days.

Where can I get a purchase receipt template for my business?

Here are some places where you can download a purchase receipt template online.

1. For sales receipt: Eforms

2. For cash receipt: Templatelab

3. For simple sales receipts, use Microsoft word software: Templates.office

What is the difference between an ordinary invoice and a simplified invoice?

An ordinary invoice requires the customer’s full name and address and the issuance date, along with VAT (value added tax). On the other hand, a simplified invoice does not require the customer name nor the date the invoice was issued.

What is the difference between a retail invoice and a tax invoice?

A retail invoice is an invoice issued by the seller to the buyer for the amount of the goods sold. A tax invoice is an invoice that shows how much tax is owed, issued by a registered dealer to the person who purchased something.

To hone your bookkeeping skills and learn more bookkeeping terms so you can accurately monitor the financial health of your company, check out our mammoth list of 45+ bookkeeping resources!

Bonus infographic: Essential information required on a purchase receipt

In closing

While it’s important to store, keep, organize, and manage your receipts for accounting and tax purposes, many often neglect to do so or find it difficult to systemize hundreds of documents. However, you can easily get your receipts categorized with the right tools. Shoeboxed is the complete receipt tracking and receipt software solution for virtual accountants or small business owners looking for the most versatile accounting app. Shoeboxed also helps users scan paper receipts into digital data, create comprehensive reports, and prepare for tax season.

Turn receipts into data and deductibles.

You might also be interested in:

How to Track Mileage for Tax Deductions with the Shoeboxed App

How to Scan Receipts With the Shoeboxed App: A Step-By-Step Guide

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!