Keeping track of business expenses is essential for all businesses, but why is keeping track of your business expenses particularly important for freelancers?

Since freelancers often manage multiple projects simultaneously, financial organization is crucial for ensuring smooth business operations and tax compliance.

By maintaining a separate business account and an organized record of business expenses, freelancers can better control costs, make informed financial decisions, and even save money during tax season.

Why is tracking business expenses crucial for freelancers?

Freelancers can achieve financial success and stability by understanding income and expenses, maintaining accurate records, and implementing effective expense management systems.

For freelancers, keeping track of business expenses is vital to saving money and maintaining a healthy financial status.

Understanding your income and expenses

By understanding the total amount of money flowing in and out of their business account, freelancers can better control their cash flow and prevent potential financial pitfalls.

Also, recognizing the various sources of income and types of expenses involved in their work allows them to make informed decisions about managing their money.

Importance of keeping receipts

One critical aspect of tracking freelancer expenses is the necessity of keeping receipts.

These records serve as proof of business expenses, which are crucial when tax time rolls around and if ever called up for an audit.

With paper or digital receipts, freelancers provide evidence of the costs of their work.

Some of these costs can be tax deductions and significantly lower the amount they owe to the IRS.

This can save them money and benefit their overall financial well-being.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayExpense management: a vital aspect of freelancing

A solid expense management system is also essential for freelancers who want to succeed in their small businesses.

A comprehensive plan for tracking expenses not only helps freelancers stay organized but also allows them to make accurate forecasts about their financial future.

By analyzing trends in business purchases and patterns in their costs, they can identify potential issues, avoid costly mistakes, and make more informed decisions about the direction of their business.

What are some efficient ways to keep track of business expenses?

Freelancers have specific challenges regarding expense management, so we found efficient ways to track small business owners’ expenses.

We explored a few key methods: optimizing accounting software, using the cloud and apps, and using expense spreadsheets.

Optimizing accounting software

Accounting software is invaluable for freelancers looking to manage their business finances efficiently, primarily by streamlining their business expense tracking system.

Platforms like QuickBooks streamline the tracking of multiple clients’ revenue, expenses, invoices, and payments.

Furthermore, these cloud-based accounting software solutions provide real-time data, allowing freelancers to make informed financial decisions.

Leading software options like QuickBooks Online offer comprehensive financial management solutions

Freelancers should learn to optimize their chosen software, ensuring that all transactions are accurately recorded and categorized.

This will help maintain accurate records, streamline expense tracking, enhance financial decision-making, and ensure smooth tax filing.

How to use QUICKBOOKS ONLINE (2023) by Accounting stuffUsing cloud and apps to track expenses

Cloud-based apps offer additional efficiency when managing business expenses.

These apps enable freelancers to access their financial data on the go.

Essential features of these apps include:

Integration with accounting software

Mobile access for added convenience

By choosing an app like Shoeboxed, users can securely store their financial information in the cloud, quickly track expenses, and sync data with accounting software such as QuickBooks.

Over a million businesses use Shoeboxed to track business expenses automatically

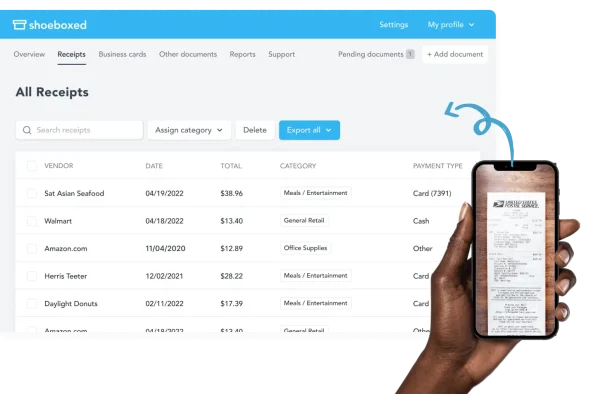

With Shoeboxed’s receipt scanner app, users can snap a photo of the receipt with their iOS or Android phone, and it will automatically upload to their Shoeboxed account.

Simply take a photo of the receipt with your phone

Once the receipt is uploaded, the data will be OCR-extracted, human-verified, and assigned a tax category.

From there, the expenses can be turned into expense reports with receipt images to be submitted for reimbursements or categorized tax deductions, where costs will be easily searchable and retrievable, even on the go.

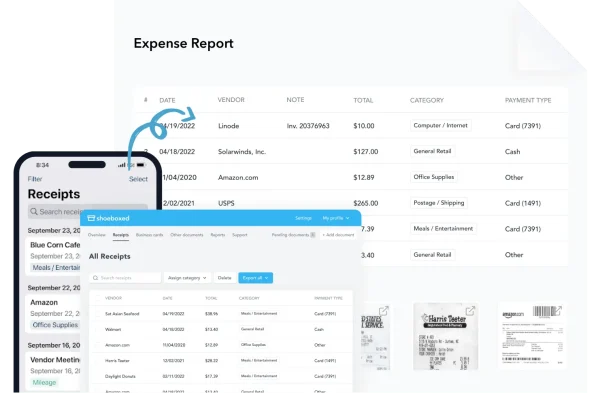

With Shoeboxed, create expense reports effortlessly

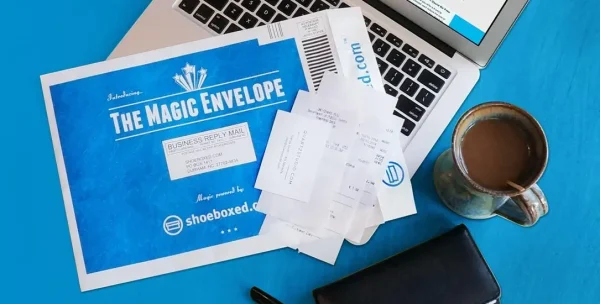

Another option is to fill a prepaid Magic Envelope provided by and unique to Shoeboxed, full of receipts, and mail them to Shoeboxed to be scanned and processed.

Use Shoeboxed’s Magic Envelope to mail your receipts in to be processed

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

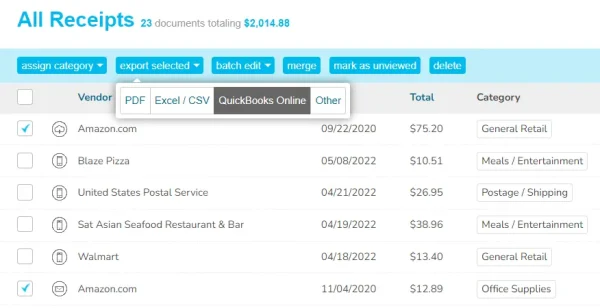

Get Started TodayShoeboxed can also be integrated with popular software such as QuickBooks to streamline the expense management process.

Shoeboxed seamlessly integrates with QuickBooks

Once receipts are scanned and uploaded into Shoeboxed, they will sync with QuickBooks and other tools, showing up as categorized expenses.

Shoeboxed not only integrates with QuickBooks but other tools as well.

Shoeboxed was even chosen by Forbes which ranked it the best business expense tracking app.

By utilizing cloud-based apps, freelancers can gain instant access to their financial data and minimize the risk of loss due to physical documents or traditional storage systems.

Shoeboxed Demo by Shoeboxed Youtube

Using expense spreadsheets

Spreadsheets are a manual way to track expenses ahead of tax season.

This option is generally free, as there are many expense spreadsheets available online to download without charge. And these spreadsheets can be specifically tailored to your industry. For example, here are some free-to-download expense spreadsheets:

However, accounting software and apps are recently bypassing spreadsheets in popularity as a more convenient and less time consuming option for staying on top of outflow.

Reporting and filing taxes as a freelancer

As a freelancer, it’s crucial to understand the significance of tax deductions to report your business expenses accurately.

Understanding tax deductions

Tax deductions help reduce your taxable income, ultimately lowering the taxes you owe to the Internal Revenue Service (IRS).

By finding an efficient method for tracking your business expenses, you can maximize your deductions to ensure you pay minimal taxes on your freelance income.

Deducting eligible business expenses allows freelancers to lower their tax burden and maximize profits.

Preparing for tax season

Properly preparing for tax season can mitigate potential tax penalties and reduce stress.

As a freelancer, keeping organized records of income and expenses is essential.

One way to do this is by maintaining a separate bank account for your freelance work, which simplifies recording and monitoring your business transactions.

Moreover, regularly monitoring your business income and expenses throughout the year can help determine if you need to make quarterly estimated income tax payments.

The tax filing process for freelancers

The tax filing process for freelancers may differ from traditional employees, as you must file a tax return if you have net earnings from self-employment of $400 or more.

Freelancers are responsible for reporting all their income, including cash payments, property, goods, or virtual currency.

Additionally, freelancers must calculate and pay the self-employment tax, which covers Social Security and Medicare taxes, amounting to 15.3% of their freelance income.

Freelancers will also want to ensure they take advantage of all tax deductions, which means carefully tracking all business expenses.

Although the process can be complex and require additional paperwork, following the IRS guidelines and staying organized will make filing much smoother.

Keeping accurate records throughout the year, such as expense tracking and understanding the tax deductions applicable to your freelance work, can help you save time, money and maintain compliance with the IRS.

Managing incomes, invoices, and payments

Efficient invoice management

For freelancers, managing income, invoices, and payments efficiently is crucial to maintaining a steady cash flow and keeping track of their earnings.

Accounting software can help streamline tracking income and expenses, the invoicing process and ensure timely payments.

Understanding payments and banking for freelancers

Freelancers should clearly understand the different payment methods available and how they can impact their finances.

Setting up a business checking account or a dedicated business bank account helps separate personal and professional expenses, making the record-keeping process much more manageable.

Additionally, online payment platforms like PayPal allow freelancers to receive payments from clients in different countries and currencies, expanding their business opportunities.

Tracking income consistently

Consistent income tracking is essential for freelancers to monitor their business’s progress and make informed financial decisions.

Regularly running reports from accounting software enables freelancers to have an overview of their total income, expenses, invoices, and payments received.

Keeping track of deductible expenses, such as business deductions and ordinary expenses, is also crucial for reducing the freelancer’s taxable income, as reported to the IRS.

By clearly understanding all income channels and staying organized with their record-keeping, freelancers can better control their cash flow and secure financial stability.

Mitigating financial risks in freelancing

As a freelancer, mitigating as many financial risks as possible is crucial.

Preparing for financial audits

Freelancers should be well-prepared for financial audits, which are crucial in maintaining their financial health and compliance with the IRS.

How to prepare for an IRS audit.

With Shoeboxed, instead of flipping through a stack of receipts to find any in question by the IRS, users can easily search for the digital receipt by category, vendor, price, or date on the app for quick retrieval.

Being organized and diligent when tracking expenses can reduce the chances of facing penalties during an audit.

Freelancers should consider separating their personal and business bank accounts, consistently organizing receipts, and using accounting software and apps to make the process easier.

Mileage tools

Freelancers should also use an efficient method to track their business miles since this is a deductible expense.

Shoeboxed’s built-in mileage tracker automates the process of logging deductible expenses such as mileage and other travel costs to optimize financial management while on the go.

Shoeboxed even has a built-in mileage tracker.

With Shoeboxed, to start tracking, simply go to ‘Trips’ on the app.

Click the ‘Start Mileage Tracking’ button.

When the destination is reached, click ‘Stop Trip.’

Once the information has been edited and approved, click ‘Done.’

Forbes also ranked Shoeboxed as the best mileage-tracking app.

By leveraging online accounting software and utilizing mileage and other expense-tracking software tools, freelancers can confidently control their financial management and ensure business success.

See also: Shoeboxed vs. QuickBooks Mileage Tracker: Navigating the Race

Frequently asked questions

What tools can freelancers use to track income and expenses?

Some of the best methods for tracking receipts in a freelance business include using digital tools such as mobile apps, scanning software, or cloud-based storage systems. These tools simplify the process by automatically categorizing and storing receipts, making them easily accessible for tax preparation and financial analysis. Freelancers may also opt for traditional methods, such as maintaining physical folders or envelopes for tickets, but these methods may be less efficient and prone to loss or damage. Various tools are available for freelancers to track income and expenses, such as accounting software like QuickBooks and expense-tracking apps like Shoeboxed. These tools often cater to the unique needs of freelancers, providing features like invoicing, expense tracking, categorization, payment tracking, and financial reports.

Why is expense organization essential for freelancers?

Expense organization is essential for freelancers as it helps them maintain a clear financial record and understand their cash flow better. Organized financial records enable freelancers to make informed decisions about their business, allocate resources effectively, and plan for future expansion. Moreover, maintaining organized financial records helps freelancers comply with tax laws, prepare their tax returns accurately, and avoid potential penalties due to errors or omissions.

How can expense tracking systems benefit freelancers?

Expense tracking systems offer numerous benefits to freelancers, including increased financial transparency, time and cost savings, better budgeting, and accurate tax reporting. These systems allow freelancers to gain insight into their income and expenditure patterns, helping them identify areas where they can save money or invest more resources to grow their business. Additionally, expense tracking systems mitigate the risk of errors in financial reporting and help freelancers avoid potential legal and tax-related issues.

Conclusion

Tracking business expenses is a crucial aspect of freelancing, allowing individuals to control their cash flow, maximize tax deductions, and make informed decisions about the future of their small business.

As a freelancer, embracing the habit of monitoring and managing expenses will ultimately contribute to continued business success and growth.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!