April 15th marks the deadline for the tax filing status for individuals in the U.S. during tax time—a time that often strikes fear in people’s hearts. The basis for this feeling is fear of the unknown. Most have heard of the 1040 tax form by the time they need to file taxes for the first time, but many find it confusing and long.

That doesn’t have to be the case. So read on for a definition of a tax return to paint a clearer picture.

The tax return definition—simplified and explained

In plain terminology, the tax document is defined as paperwork filed with a tax authority to report income and pertinent expenses during the tax season. The U.S. tax season for individuals comes around yearly, between January and April 15th. Individuals file the 1040 tax return document to calculate tax liability or request a tax refund for overpayment.

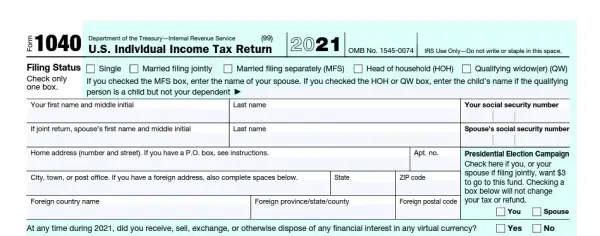

1040 tax return form example

What are the sections on a tax return?

The 1040 tax form is divided into sections spanning over two pages. These include sections such as personal information, filing status, dependents, income, and credits. When filing taxes, to report certain types of income or deductions, additional forms or schedules are also required.

For example, Schedule C is used to report self-employment income. The totals from each schedule typically get transferred to Form 1040.

Filing status

Form 1040 starts with personal information such as name, address, and social security number and then leads into the filing status options, which are:

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Qualifying Widow(er)

This information should match what the government has on file.

Digital assets

Even if you did not participate in digital assets, you still must answer this question which asks if at any time during 2023 did you receive, sell, exchange, or dispose of a digital asset.

Deduction

Below the digital assets, the form asks if someone can claim you as a dependent, your spouse as a dependent, if spouse itemizes on a separate return, or if you were a dual-status alien. Again, this only needs an answer if any of these are true.

Dependents

A spouse is listed in the filing status section, but this portion of the tax return forms asks for any other household members you or your spouse can claim. Qualifying children and relatives are good examples of who can be claimed on a tax return. Qualifying children must be under the age of 19 or if a full-time student, under the age of 24. There is no age limit if the child is permanently disabled. Dependents can have income but cannot provide more than half of their annual support.

Income

This 1040 section deals with providing income such as reported wages, salary, taxable interest, dividends, IRA distributions, pensions, capital gains & losses, Social Security benefits, and other types of income.

Deductions are also included in this section. You can opt to go with the standard deduction or an itemized deduction, whichever one is greater. Itemized deductions include expenses such as medical, mortgage interest, state & local income taxes, personal property taxes, and charitable donations.

By subtracting your deductions from your income, you will end up with your taxable income.

Tax and Credits

The next section is tax and credits. This includes items such as the Child Tax Credit and the Self-Employment Tax. This section gives you your total tax amount.

Payments

The payment section includes federal income tax withheld from your wages and salary. It also includes estimated tax payments made during 2023 and the amount applied from 2022. This section will give you your total payments.

Refund

The tax refund is one of the most looked-forward-to sections of the tax return. It will lead you to determine whether line 33 from the income section is more than line 24. If that is the case, line 24 is subtracted from 33 to determine the amount overpaid to the Internal Revenue Service and owed back to the filer. Simply put, you’ve overpaid taxes and are due that money back.

Amount you owe

A not-so-fun section is where the filer calculates taxes owed to the Internal Revenue Service. If line 33 is less than 24, the difference is the amount of tax burden the government wants to see by the deadline unless a payment plan is agreed upon.

Signing

The remainder of the form walks the filer through disclosing if someone filed on their behalf and signing the form before it gets submitted.

Who has to file a tax return?

Most individuals will need to file a tax return. The rule of thumb states that as long as your income is higher than the standard deduction, which for 2023 is $13,850 for single filers and $27,700 for married filing jointly, you must file a tax return by April 15th. Of course, pay attention to the filing status you want to claim and the deduction allowed for the year—for example, married filing jointly has a higher deduction than single.

Taxpayers should pay attention to any changes during the tax year. Older taxpayers will have different rules when it comes to reporting wages and other income. It never hurts to file a tax return regardless of your income because there may be some deductions or credits that could really benefit you. Always talk to a tax professional if there is any doubt about what to do.

Learn how to pay less to the IRS with this webinar from Bench. Sign-up to Bench using this link, and get 30% off your first 3 months!

See also: W2 vs W4: Key Differences You Need to Know for Better Filing

What happens if I make a mistake on my tax return?

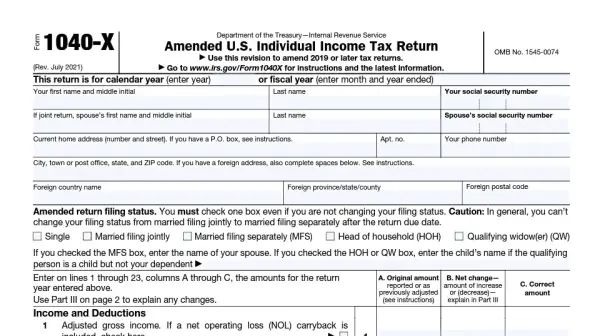

Mistakes can happen, even on tax returns. If you find a mistake, like a misrepresented number or forgotten income, you can amend or, in other words, correct your tax return using form 1040-X since tax authorities will want to know. The 1040-X allows changes to the information on the originally submitted form, such as tax filing status, income, deductions, credits, or tax liability.

1040-X form is used to amend an individual’s tax return

See also: Tax Myths vs Fact: How to Avoid the Most Costly Tax Myths

When is the deadline for filing an income tax return?

Unless the IRS extends the deadline, the expected due date of the tax return is April 15th. However, if the date falls on a weekend, the deadline is extended to the next business day. Just in case, check out What If I Miss the Tax Deadline for My Tax Return?.

How can I track my refund?

Don’t worry about losing your tax returns.

For those filers who expect to get a refund, the anticipation is high. Thankfully, the Internal Revenue Service built a refund tracker right on the IRS website. The tracker will request some personal information such as name, social security, and filing information before providing the filer with an expected date.

What does surveyed tax return mean?

A surveyed tax return is one that was reviewed internally by the IRS. In many cases, the filer is unaware of the survey, and many tax returns never undergo the rigorous process, but it is designed to find any inconsistencies in a tax form.

What is the definition of a tax return transcript?

A tax return transcript is a document filers can request from the IRS once their 1040 is processed. The tax return transcript discloses the information provided by the filer to the IRS as proof of what the government received. However, it does not provide any changes made after the original Form 1040 was submitted.

What is the definition of an amended tax return?

An amended tax return is one where changes were made after the IRS processed the original 1040. This process is completed using form 1040-X to assist the filer in fixing mistakes or providing missing data from the original Form 1040.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFrequently asked questions

What is the IRS definition of earned credit and unearned credit when filing a tax return?

The earned income tax credit, the EITC for short, is a refundable tax credit for households that are considered low to moderate-income workers. For those who fall within the strict guidelines, the tax credit is fully refundable to provide a much-needed boost to those struggling.

What is the definition of a delinquent tax return?

When an individual who met the criteria to file a tax return by April 15th failed to do so, they are considered delinquent. Significant IRS tax penalties are associated with delinquent tax returns unless a request for a tax extension is made to the IRS.

See also: A Definitive Guide to Commonly Missed Small Business Tax Write-offs

In closing

Tax season is stressful for many households, especially those who believe they might owe taxes to the government. However, throughout the past couple of years, the form itself has become easier, making simple tax returns a breeze. For those who may be worried about past tax returns, don’t hesitate to check out Tax Audit Prep: The Absolutely Non-Scary Guide.

Summing it up, the tax return definition means filing income and expense information to the IRS using Form 1040. Of course, other forms called schedules help the process in certain situations, but the basic idea is to make sure the IRS has all of your information sent in by no later than April 15th.Interested in resources that will help you monitor the financial health of your company? Check out our mammoth list of 45+ bookkeeping resources!

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!Y

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!