Struggling to make your paycheck last until the next payday?

Managing a bi-weekly schedule can be challenging when bills and expenditures don’t always match your paycheck.

Bi-weekly budget templates in Excel, designed to help you take control of your finances, can help you quickly stretch every dollar!

What is a bi-weekly budget template?

A bi-weekly budget template is a financial tool for planning and tracking income and expenditures over a two-week period. This budget template helps monitor cash flow by organizing personal expenses, bills, savings, and other financial obligations to align with a two-week income cycle.

How do you create a bi-weekly budget template?

When creating your own template, make sure it's designed with an easy-to-read layout with clear categories highlighted in green to enhance navigation.

It's also helpful to incorporate automatic calculations to calculate total income, expenditures, and savings automatically, so you don’t have to do the math.

A bi-weekly template should include the following information:

1. Income

You should include a section to record your expected and actual income, including salary, bonuses, or other income, for each pay period.

2. Expense categories

Expense categories should include fixed expenses for recurring expenditures like rent, mortgage, utilities, and loan payments and variable expenditures like groceries, gas, entertainment, or dining out.

The bill payment tracker section should include the due date for bills so you can pay on time within the bi-weekly cycle. Also, a column to track what you paid vs. what you budgeted.

4. Spending overview

This section should include spending limits where you set spending caps for each category based on your bi-weekly income using a table format. Also, a total spent vs. budgeted so you can see how much you spent compared to what you budgeted to see if you’re on track.

5. Savings goals

You should include a section for savings goals with space for target amounts and progress tracking so you can make regular contributions.

6. Debt payoff tracking

A debt overview section is where you list debts, minimum payments, and extra payments for credit cards, loans, and other debt obligations so you can better manage your debt.

See also: Travel Baseball Team Budget Spreadsheet for 2024 Planning

Free bi-weekly budget Excel templates

As a bonus, check out these free bi-weekly excel budget templates:

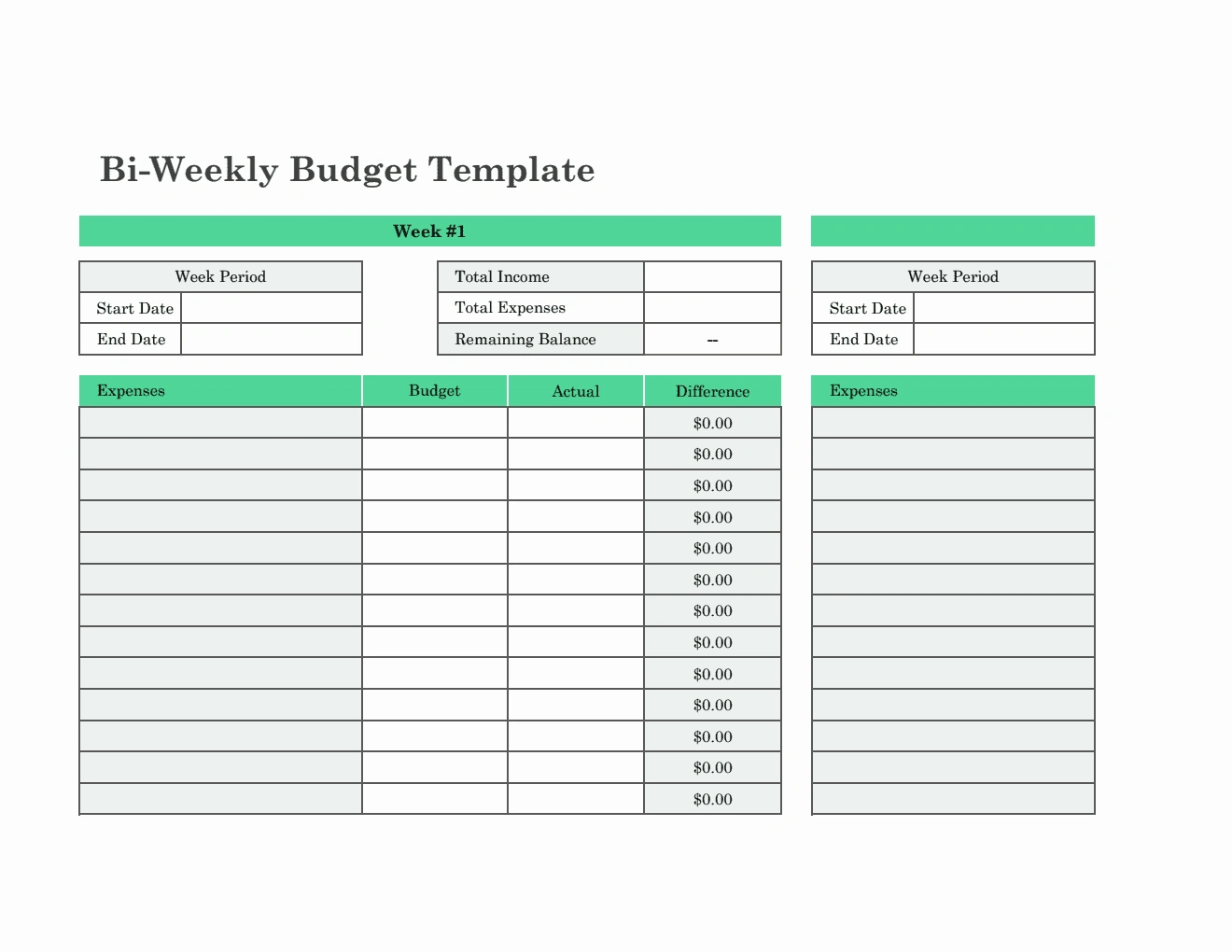

1. Bi-Weekly Excel Budget Template by General Blue

This spreadsheet includes two tables—one created for Week 1 and one for Week 2—designed to cover your monthly expenditures in two-week increments, with both tables offering the same features and functionality.

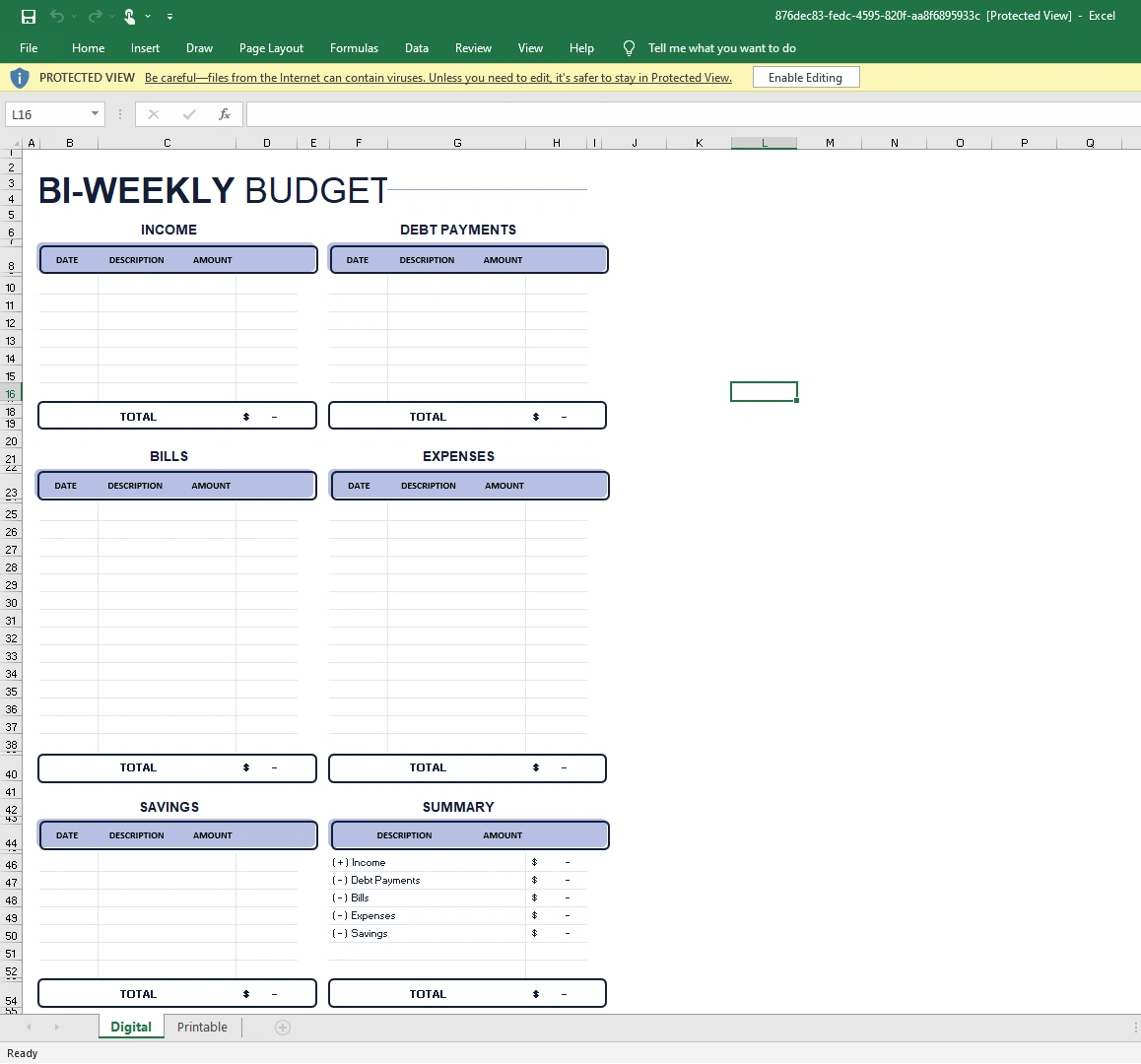

2. Bi-Weekly Excel Budget Template by Natalia Prokhorenko (GooDocs)

This Excel bi-weekly spreadsheet is easy to edit. You can change the text, images, and more. It's available in a digital and fillable format.

What is a more efficient alternative to bi-weekly budget templates?

Shoeboxed is the digital alternative to expense tracking if you want a much easier and better solution than spreadsheets.

Shoeboxed—ideal for businesses looking for a more efficient alternative to bi-weekly budget templates

Shoeboxed lets you digitize receipts, categorize expenses, and generate reports.

Here’s why Shoeboxed is better than templates:

Automates receipt and expense tracking

With Shoeboxed, users on the go can scan and upload receipts via a mobile app, no need to enter expenses manually which is required in Excel-based budget templates.

Just use your smartphone's camera to take a snapshot of the receipt as the expense is incurred and Shoeboxed will upload a copy of the receipt into your designated account.

Or, if you don't want to deal with the receipts at all, you can stuff them in Shoeboxed's prepaid postage free Magic Envelope and send them to their processing center where their team will scan, human-verify, and upload receipts into your account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started Today

Real-time organization and categorization

Shoeboxed automatically categorizes expenses into 15 custom or tax categories (e.g. travel, office supplies, meals) whereas bi-weekly and weekly budget templates require manual sorting of expenses into categories. This saves an enormous amount of time.

In just a few clicks, you can create comprehensive expense reports with receipts attached from the web or your mobile device that make tax season a breeze!

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

How can a bi-weekly budget template in Excel help me control my spending?

A biweekly budget framework helps you match your income and expenses to your pay schedule to plan for bills, savings, and variable costs over two weeks. This way, you have enough money for each pay period and don’t overspend or run out before your next pay.

Can I customize a bi-weekly budget template in Excel to fit my specific needs?

You can add, remove, or modify categories, and even add personal savings goals or debt repayment sections to fit your needs.

In conclusion

Bi-weekly Excel templates for budgeting are doable but Shoeboxed helps you stay better organized, provides a real-time perspective on finances, and leads you to make better decisions by allowing you flexibility, automation, and more control over your cash flow.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!