Kakeibo (kah-keh-bo) is a Japanese budgeting method for being mindful of money. It means “household financial ledger,” and it’s about keeping track of income, expenses, and savings in a simple and reflective way.

Kakeibo, the Japanese art of saving money, is a simple but powerful tool to help you understand your spending, make intentional financial decisions, and build savings. This post will break down the basics of Kakeibo, how to set it up, how to use it, and the long-term benefits so you can take control of your finances.

How do you spend your money?

Have you ever thought about how you spend your money? Does a lot of your money go towards unnecessary spending?

1. Analyze where to improve

The first step of Kakeibo is to identify where to improve your spending habits by recognizing patterns of overspending or unnecessary purchases. This will help you see where your money is going and where you need to make changes.

2. Draw a line between needs vs. wants

Distinguish between needs and wants in your monthly expenses. Establish your financial priorities like rent, utilities, groceries, and discretionary spending like dining out, entertainment, or luxury items. This is key to budgeting.

3. Take a mindful approach

Kakeibo is about being mindful of your money. Be intentional with your money and make conscious financial decisions to save. Before you buy something, ask yourself if you need it and how it fits into your budget and financial goals.

How do you set up a Kakeibo budget?

Setting up Kakeibo, the Japanese budgeting system, is simple.

1. Calculate monthly income and fixed expenses

First, calculate your monthly income and fixed expenses. Fixed expenses are bills that don’t change monthly, like rent, utilities, and insurance. This will give you an idea of your projected income and how much you have available for saving money and discretionary spending.

2. Set a target

Set a monthly target based on your monthly savings goals, income, and expenses. Make sure this is achievable and aligns with your financial goals. A target keeps you motivated and on track.

3. Choose a ledger or journal

Choose a household finance ledger or journal to record your spending. You can use a physical pen and paper notebook or a digital tool like Shoeboxed. Whatever you choose, make sure it’s a dedicated place to record all your financial transactions.

How do you implement Kakeibo budgeting?

You can implement the Kakeibo budgeting system in just three steps.

1. Track everything

Track every purchase, no matter how small. This will give you a clear picture of your spending and help you see patterns. Consistency is critical to budgeting.

2. Categorize into needs and wants

Use the four-category system to categorize your spending:

Needs (essentials)

Wants (non-essentials)

Culture (books, concerts, museum visits, etc.)

Unexpected (emergency expenses)

This will help you see where to improve and adjust your envelope budgeting accordingly.

3. Review often

Review expenses and your spending regularly to see how you’re tracking toward your target. Adjust your spending habits as needed to stay on track.

How can digital tools make it easier to track and organize your expenses so that you can enhance your Kakeibo experience?

Digital tools like Shoeboxed simplify your budgeting by streamlining the tracking and organization of all your purchases and expenses.

Shoeboxed

Combining Kakeibo with modern tools like Shoeboxed can enhance your budgeting efforts, making it easier to track expenses, organize receipts, and achieve financial stability.

With Shoeboxed, you can:

Digitize receipts and expenses

Digitizing receipts can make tracking expenses a much simpler and less time-consuming process. One way to do this is to use your mobile phone or device and the Shoeboxed app. Photograph the receipt with your smartphone camera, and the app will upload the data to your Shoeboxed account.

Outsource your scanning

Or, you can outsource expense scanning to Shoeboxed by sending your receipts to their processing center using their Magic Envelope. Their team will scan, human-verify, and upload the data to your Shoeboxed account for you.

Import receipts from your email

You can also forward receipts from your email inbox to your Shoeboxed account. Shoeboxed’s Gmail plugin will auto-import receipts from your Gmail inbox to your Shoeboxed account.

Shoeboxed is an easy and quick way to keep all your expenses in one place when tracking expenses with the Kakeibo method.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayAdd details to the expense

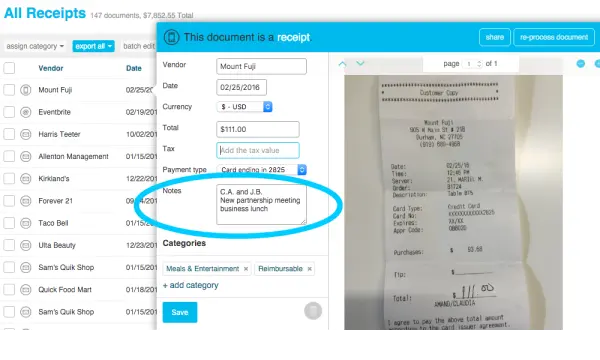

With Shoeboxed, you can add details under the notes section to manage your expenses better. For example, you could add whether the expenses are needs, wants, fixed, or unexpected expenses. On each receipt.

Organize financial records

Once the receipts and expenses are uploaded, Shoeboxed categorizes them into 15 tax or custom categories.

Shoeboxed streamlines the process of consistent tracking by automatically digitizing and categorizing your receipts, making it easier to track your expenses accurately.

Turn receipts into expense reports

Your receipts and expenses are turned into extracted, human-verified data that is categorized, organized, searchable, editable, and available anytime, anywhere.

You can create custom expense reports from the web and your mobile device to see how much money is going into each category. This breakdown helps to identify where to improve your spending habits by recognizing patterns of overspending or unnecessary purchases. Expense reports will help you see where your money is going and where you need to make changes.

Integrate with accounting software

Shoeboxed works with the tools you already use. Shoeboxed integrates with Wave, Xero, and QuickBooks. No more manual entry when tracking expenses, no more lost receipts or expenses, and no more headaches.

Shoeboxed’s integration with accounting tools and detailed reports helps monitor your Kakeibo budgeting progress.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayReflect on how you spend money

Kakeibo encourages you to consider why you're spending money the way you are.

Here are three steps to the reflection process.

1. Answer reflection questions

At the end of the month (or week), reflect on your monthly spending by answering these questions:

What did you spend?

What did you save?

What can you improve?

What are your goals?

Reflection helps you understand your spending habits and adjust if you need realistic monthly savings goals.

2. Improve

Based on your reflection, identify areas to improve and adjust your budget. Make changes to your spending habits to align with your savings goal.

3. Celebrate and learn

Celebrate your successes no matter how small, and learn from your setbacks. This positive reinforcement will keep you motivated and committed to your financial journey.

How do you overcome obstacles?

It's important not to let obstacles get in the way of your financial goals.

Here are two ways to overcome the barriers.

1. Irregular income or expenses

Adjust your budget to accommodate the fluctuations if you have irregular monthly income or expenses. Plan for unexpected costs and have a buffer in your budget.

2. Impulse purchases and emotional spending

Develop ways to avoid impulse purchases and emotional spending. Techniques like waiting 24 hours before buying or setting aside a small budget for discretionary spending can help.

How do you maintain long-term success?

It's essential when you're on track to stay on track.

Here are two ways to consistently maintain your success forward.

1. Review and adjust budget

Review and adjust your budget regularly to stay on track with your savings goals. Regular reviews will keep your budget current and relevant and will go a long way when it comes to saving money and reaching your financial goals.

2. Make Kakeibo a habit

Make Kakeibo a part of your daily financial habits. Consistency is the key to long-term success and financial stability. Shoeboxed is a valuable tool in maintaining this routine by providing easy access to digitized financial records.

What are the benefits of Kakeibo?

There are two essential benefits for Kakeibo users.

1. Saving money by mindful spending

Kakeibo helps you save money by mindful spending. By being intentional with your money, you can avoid unnecessary expenses and allocate more to savings.

2. Financial stability and security

Using the Kakeibo method, you can take control of your household finances and reach your savings goals. Integrating Shoeboxed into this process can further enhance your ability to manage receipts, track expenses, and stay organized.

Frequently asked questions

How do I start Kakeibo if I have never budgeted before?

Starting your own Kakeibo is easy, even if you’ve never budgeted. Calculate your monthly income and fixed expenses. Set a realistic savings goal and choose a ledger or journal to track your spending.

Record every purchase and categorize your spending into needs, wants, culture, and unexpected. At the end of the month, reflect on your spending and adjust as needed.

Using Shoeboxed can simplify tracking and organization, making it easier to stick to your budget.

Can I use Kakeibo with other budgeting methods or tools?

Yes, Kakeibo can be used alongside other budgeting systems, methods, or tools. Its mindfulness and reflection aspects complement traditional budgeting.

You can use Kakeibo to track and reflect on your spending and use digital tools like Shoeboxed for more detailed financial management.

Just find what works for you and helps you to achieve your financial goals.

In conclusion

Kakeibo is more than a Japanese budgeting system. It is a Japanese art and a mindful and intentional way of thinking about money. By understanding your spending habits, setting realistic goals, and reflecting on your progress, you can achieve financial stability and security.

Making the Kakeibo budget part of your daily habits will transform your financial life, helping you save more and spend wisely. Integrating tools like Shoeboxed can further enhance your budgeting process by simplifying the tracking and organization of your expenses.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!